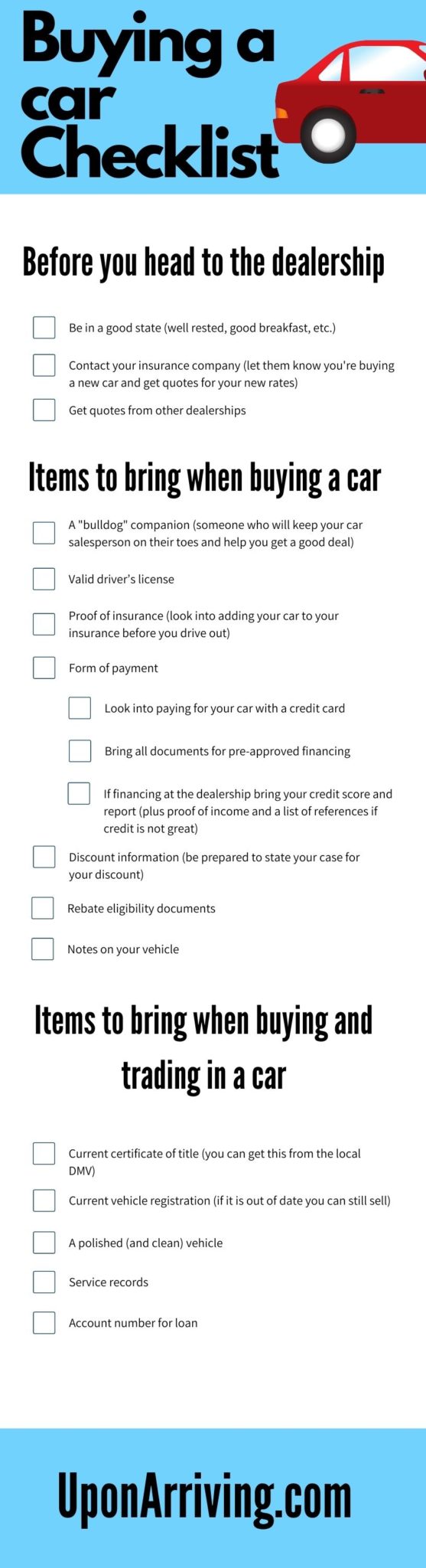

Buying a new vehicle can be an overwhelming process but you can make things a lot easier on yourself by knowing what type of items to bring and what to expect.

In this article, I will break down everything you need to bring when buying a car.

Table of Contents

Before you head to the dealership

Be in a good state

Sometimes buying a new car can be a long process that drags out for several hours. (I’ve been involved in vehicle transactions at dealerships that have taken four hours or so to complete for various reasons.)

For that reason, you want to make sure you are well-rested and well-fed before heading to a car dealership. (Think about heading to the dealership like you would about preparing to take an important exam like the SAT.)

There’s nothing worse than being tired and hungry as you deal with a bunch of bureaucratic back-and-forth and wait for endless piles of paperwork to be filled out.

So make sure you take care of yourself the morning you head out to the dealership and you might even want to bring some snacks and drinks along with you.

Tip: You can also use hunger to your advantage by scheduling an appointment a couple of hours before lunch so that the salesperson might be more willing to give in to hunger as they work to finish your deal.

Contact your insurance company

I would recommend to call up your insurance company before you head over to the dealership and notify them that you are planning on purchasing a new vehicle.

This is a good idea because they can put you on notice of any requirements that need to be taken care of such as adding the new vehicle to your current insurance (which I will talk about below).

It’s also a great idea because you can get a quote on what your new insurance rates might be.

They will likely ask for the VIN but you should be able to get that by calling the dealership or even finding it online.

Get quotes from other dealerships

If you know what type of vehicle you want to purchase, do some research and find some prices from other nearby dealerships.

This will help you negotiate your price down and give you a better idea of the range of prices that will be negotiable.

Sometimes you can use portals like the American Express Auto Purchasing Program to scan different dealerships for great deals.

One tip I have is to email a handful of salespersons with all of your details and have them essentially bid for your business.

Items to bring when buying a car

A “bulldog” companion

The number one item to bring when buying a car is a companion who can help you sniff out the BS and arrive at a good deal.

Try to find someone who is direct and confrontational. If that is already you then great but if you are not confrontational, you might get walked over by an experienced salesperson (often without even realizing it).

Your companion’s main mission is not to simply give you company during the buying process or even to ask relevant questions about car features.

Instead, you want your companion to focus on actively questioning and calling out your salesman as you try to get the best deal possible.

My rule of thumb is that if your salesperson is at ease and comfortable throughout the entire encounter, chances are you are leaving a good deal of savings on the table.

Bringing a so-called “bulldog” along with you will ensure that you don’t miss out on a good deal and fall victim to a charismatic salesperson.

Driver’s license

You should already have your driver’s license on you at pretty much all times but you especially want to bring it with you to the dealership when buying a new car.

The dealership is going to want to make sure that you are a legally licensed driver before they handover the keys to a new vehicle.

So make sure your driver’s license is active and in good standing.

Proof of insurance

You’ll also want to have proof of insurance.

No respectable car dealership should allow you to drive off with your vehicle if you do not have proof of insurance.

Remember, as soon as you sign the bill of sale, that vehicle becomes yours and you are liable for it which means that if you were to crash the vehicle on your way home you would be responsible for the loss.

The big question is should you add your new car to your insurance policy before you purchase the car or after?

If you know exactly which car you’d like to purchase, you can contact your insurance provider and add the car to your insurance before you ever leave the dealership so you’ll have insurance from the very beginning.

Basically, you can wait until the deal is going to be finalized and then contact your insurance company right at that moment and add the new vehicle.

If you have already contacted your insurance company before heading over to the dealership, they should already have things in order and should be able to send over confirmation via email or fax in a timely manner.

If you don’t plan out your insurance in advance, it is still best to get some details regarding how you can transition your current insurance over to the new vehicle.

Typically, you will have a grace period for adding the new vehicle to your insurance. This grace period might be around 2 to 4 days but some insurance providers might have a much wider window.

Be sure to contact your insurance provider to find out exactly how long you have.

Form of payment

If you are planning to purchase your vehicle with cash or making a down payment, then you will need to have the proper form of payment with you.

Some people could purchase a car with actual cash but a lot of times it is common to use something like a cashier’s check for a large purchase such as a vehicle.

You could also consider writing a check but checks can be problematic because they take so long to clear so a cashier’s check would almost always be preferred.

You might also think about purchasing the new car with a credit card. Not all dealerships will accept credit cards but there are some tips and tricks to using a card to purchase a vehicle from a dealership.

Tip: Check out the free app WalletFlo so that you can optimize your credit card spend by seeing the best card to use! You can also track credits, annual fees, and get notifications when you’re eligible for the best cards!

If you are planning on financing your vehicle then you will need to take some necessary steps to ensure that you have the proper documentation when you visit the dealership.

There are a few different routes you can take for financing and they will determine how you prepare.

Pre-approved financing

To make the transaction as clean as possible, you should consider lining up your financing before you even arrive at the dealership.

You can do this by narrowing down your vehicle options and getting a price range from the dealership (either online or by calling).

You can then contact your lender to get pre-approved so that you will have a guaranteed loan up to a certain amount with a specific interest-rate.

When going this route, always make sure that you are getting an approval for financing based on the walkout price which includes TTL (“tax, title and license”).

You can also work backwards.

With this method, you will tell the credit union the maximum amount you can afford for a monthly payment. They can then give you an amount for your entire loan and you can find cars within that range.

Pre-approved financing is definitely the way to go if you want to streamline the transaction.

Tip: Contact local credit unions for some of the most competitive interest rates.

Financing at the dealership

Allowing the dealership to finance your transaction can be advantageous sometimes as they can offer you some great rates like 0% APR.

If you choose to let the dealership take care of the financing for you, it’s a good idea to go in with the following documents.

Credit score and report

You definitely want to check all of your credit scores before you head to the dealership so that you know what type of credit you are working with.

It is also a big help if you have your credit score and report on hand for all three credit bureaus: Equifax, Experian, and TransUnion.

You can get your (non-FICO) TransUnion and Equifax score through CreditKarma and you can also get your Experian score here.

This will help you know for sure what your credit score is and you will know what credit bureau is the best bureau for the lender to pull your report from.

Just keep in mind that lenders will pull from different types of credit scores so the credit score you bring may not line up with the scores that the lenders pull for you.

But by having your credit score and report on you, you will at least have a ballpark idea of what your score should be and you can verify negative items on your report.

Most lenders use the FICO model so try to get at least one of your FICO scores.

Proof of income

If you are relying on the dealership to find you financing, some of the lenders may require you to show proof of income in order for you to get approved for your loan.

Typically, you can prove your income with the following:

- Paycheck stubs

- Bank statements

- W2

You may also have to show proof of residence which can be shown with different types of documents including recent utility bills, credit card statements, etc.

It’s best to call ahead to the dealership to find out what their lenders may require.

A list of references

If you have a questionable track record such as poor credit or a lot of negatives on your credit report, you might have to supply a list of references.

Try to have a list of individuals who do not live with you or are not related to you on hand just in case they are needed. Typically, you will need to provide a phone number, address, and explain the relation to you (e.g., co-worker).

Discount information

If you plan on taking advantage of a discount then be sure to print out the discount or have a physical copy with you.

You might also be able to pull up the discount on a mobile device but it will make things easier if you have a hardcopy that you can hand over.

Keep in mind that car dealerships are always looking for ways to get out of these discounts so be prepared to state your case as to why you are entitled to a discount.

Pay very close attention to the fine print and to any eligibility criteria such as eligible vehicles or dates. Be prepared to call corporate to sort out any disagreements over the terms and you might even want to call them beforehand to verify the validity of the discount.

Rebate eligibility documents

Many dealerships offer special rebates for folks like military members, students, etc.

In some cases, you might need to provide proof of your status such as a verification of enrollment for students or active military ID.

So be sure to call ahead to see what type of documents you will need for your proof of eligibility.

Notes on your vehicle

If you already know that type of vehicle you plan on purchasing and have a clear idea on the features, you should bring along some type of print out with all of those features listed.

It will be helpful to break them down into two categories: must-haves and wish list.

Just in case something comes up and you end up having to look at different vehicles, you will have a feature list already on hand to compare the other cars to.

Buying a Car Out of State

Purchasing a vehicle out of state is a little bit more difficult at times because there is a higher suspicion of fraud and you may have to deal with different regulatory rules.

Inspection (for used vehicles)

Before you drive out of state to purchase a used vehicle, it can be a good idea to have someone inspect the vehicle for you.

It’s not uncommon to hire a local mechanic to evaluate the condition of your potential used vehicle. They should even be able to test drive it for you.

Taxes

Some states will not charge you tax on a vehicle purchase. These include states like New Hampshire, Oregon, Delaware, Montana and Alaska.

If you purchase a car from a state with no sales tax but register it in a state with sales tax, you will likely still owe sales tax.

Title and registration

After you purchase a vehicle from out of state, you will have to pay for a new title and registration in your home state.

You should check with your home state to see about the grace period for how long you have to wait until you need to complete the title and registration.

The time allotted varies but you can expect 30 days or longer and some states.

Trading your vehicle in

If you plan on trading in your vehicle then you will need to bring some additional documentation with you.

Current certificate of title

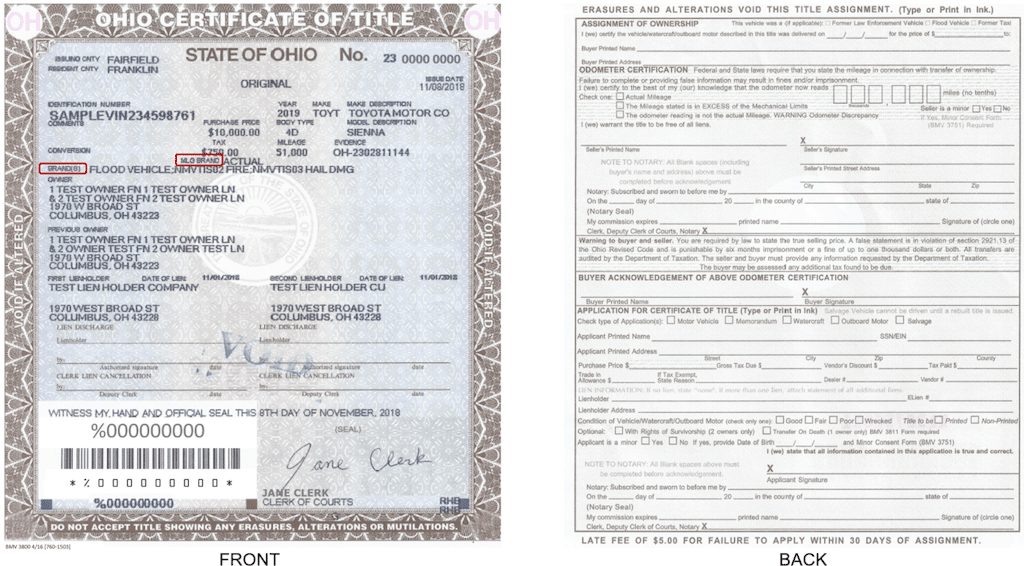

One of the most important documents you will need is the certificate of title (pink slip).

This is the document that contains information like your VIN, year, make and model, ownership, etc.

On the back of the document, you’ll see how to assign ownership to the buyer and typically a dealership can take care of these fields for you or at least walk you through it.

If you do not currently have your title just contact your local DMV and they should help you get a duplicate (for a fee usually).

Current vehicle registration

It will also help if you can provide current vehicle registration.

You should still be able to trade in your vehicle if your registration is expired but you might have to cover the cost of the registration (even if that means the buyer factoring in the price without telling you).

A polished (and clean) vehicle

If you have any scuffs or small dents on the exterior consider paying someone to rub those out or fix them because those can cost you a lot on your valuation.

It’s also not a good look if you try to trade in your vehicle with tons of trash or debris scattered in your vehicle. Many people prefer to have their car detailed before they sell it for optimal presentation.

Service records

Buyers of used vehicles are very interested in the service records and repair records. You can build a stronger case for a higher valuation if you have a detailed and accurate record of all of the services and repairs.

Account number for loan

If you still owe money on the car that you are trading in, then make sure you have all of the loan account information.

Buying a car FAQ

No, but you will need one to drive the vehicle from the dealership to your home.

Yes, your insurance provider should be able to add the new vehicle to your insurance before you drive off.

Most dealerships will require you to have insurance before they allow you to drive the vehicle off the premises.

You can pay for your vehicle in a variety of ways including cash, cashiers check, and even credit cards.

If your credit is suspect, you may have to show proof of income which you can do with the following documents:

– Paycheck stubs

– Bank statements

– W2

– Someone to help you negotiate (if needed)

– Driver’s license

– Proof of insurance

– Form of payment

– Financing documents

– Credit score and reports

– Proof of income and list of references (if needed)

– Discount information

– Rebate eligibility documents

– Notes on your vehicle

Final word

Purchasing a new car can be overwhelming but if you break down everything step-by-step you can be well prepared and the entire process will be a lot smoother than you might think.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.