The cornerstone of award travel is your credit score. Without at least a decent credit score, you’re going to get hit with denials on your credit card applications left and right and it’s going to be an uphill battle just to get approved for some of the most basic travel rewards cards. Thus, if you want to get into award travel, your first priority is making sure that you have decent credit.

Why is your credit score important?

While being able to be approved for some of the most valuable credit cards is certainly a major plus of having a good credit score, there are far more important reasons for maintaining a solid credit score.

Having a poor score can costs you thousands of dollars in interest for loans and insurance, hinder your employment prospects, make it more difficult to open utilities, cell phones, etc., and ultimately keep you held down.

I highly suggest you read my article on how your credit score can affect your daily life to begin to instill the importance of having a good credit score.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What exactly is your credit score?

If you’re not very familiar with credit scores, I suggest you read my article: Beginner’s Guide to Credit Scores and Reports.

In that article, you’ll learn about the basics regarding your credit score and also find a lot of other links that provide insight into common questions about credit scores. For your reference, those links along with a few other helpful inks are listed here:

- How does payment history affect your credit score?

- Should you pay off your credit card balance each month?

- Does closing your credit card hurt your credit score?

- How do credit inquiries (hard pulls) affect your credit score?

- Understanding the different types of credit scores

- How does becoming an authorized user affect your credit score?

If you take the time to read and understand all of the links above, you’ll have a pretty in-depth understanding of the basics of how your credit score is determined and how getting new credit cards factors into the equation.

Checking your credit score

There are a few ways that you can check your credit score for free or for a small fee. The most readily used credit scores are FICO scores, so those tend to be the most important to find out first.

There are a few ways to get your FICO credit scores…

- Freecreditreport.com offers you a $1 seven day trial where you can view your FICO Experian score. If you just want to quickly view one of your FICO scores for cheap, then I highly recommend this website. (Just know that you’ll need to call in to cancel and sometimes the reps can be annoying with their persistent retention offers.) You can re-enroll in this $1 seven day trial each week and get an update every 7 days.

Now-a-days banks and credit card companies are offering free FICO scores so if you have an account with any of the following be sure to see if you’re eligible for a free FICO score.

- American Express (Experian)

- Barcalys (Trans Union)

- Capital One

- Citi (Experian)

- Discover (Trans Union).

You can also get what’s dubbed a “FAKO” score, which is often close to being accurate to your FICO scores (though sometimes they can be off by quite a large margin).

There are several ways to get your FAKO scores:

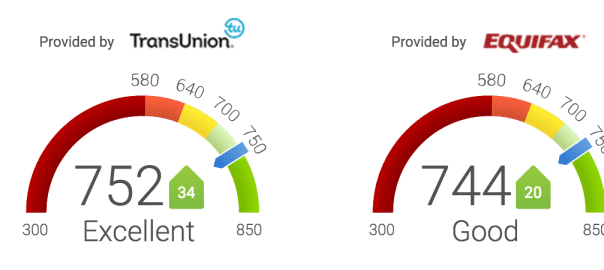

- Credit Karma provides you with both your Transunion and Equifax score

- Mint.com will provide you with your Experian

- Credit Sesame will provide you with Trans Union

- Quizzle will provide you with Equifax or Trans Union

Personally, I really like Credit Karma. It gives me weekly updates and has a nice mobile app that makes checking your credit score a breeze. Credit Karma also provides you with a full report and the means for disputing errors on your report.

I’ve personally had errors and updates made to my credit report going through Credit Karma and it’s been great. Finally, while your experience may differ, my FAKO score on Credit Karma has always been identical or nearly identical to my FICO scores (though that won’t always be the case).

What credit score do you need for award travel?

I personally think you should wait until you break the 700s before pursuing some of the premier travel rewards cards but it’s not all always solely about the credit score. For example, if you’ve got a “perfect” score of 720 but practically no credit history, you may get hit with denials for certain cards.

Below is a highly generalized (and relatively conservative) guide for credit scores needed to get into award travel. Please note, these are by no means strict thresholds for approvals but a quick read of them should help you find out where about you fall in the credit score spectrum.

If you want to take a look at some resources to research what kind of credit score got approved for different cards check out the following resources:

- Credit Karm’a Approval Odds

- Creditboards.com

- Reddit community data points

You also read my article on Chase Sapphire Preferred approval odds.

Again, keep in mind that there is a lot more than a mere score that goes into many credit card approvals so just because your odds appear to be bad or great, you will not know the outcome of your application until after you apply.

680 and below

If you’re at 680 or below, your best bet may be to seek out secured credit cards to build your score or to wait for your score to raise as you make more on time payments and lengthen your credit history.

You can look into cards like the Discover IT secured, Capital One® Secured MasterCard®, etc. and if you have trouble getting approved for those (very possible if you’re stuck in the mid to low 500s), then contact your local bank or credit union for further options, as they often have secured credit cards which are easier to get approved for. Here’s an article on some of the best secured credit cards out there right now.

Another option to consider is going for store cards or trade lines. These are cards offered at places like Wal-Mart, Macy’s, etc. Sometimes you can even get these cards without incurring a hard pull with the Shopping Cart trick.

If you’re close to 680, sometimes you can get lucky and snag a card like the Chase Freedom® Card but most of the time you’re going to struggle to get approved for those cards, so it’s generally better to be patient and wait for your score to get closer to 700.

680 to 720 — You Might Ready for award travel

Once you get into the 680 to 720 range, you might be ready to start applying for some rewards cards, just proceed with a bit of caution. The closer to 680 you are, the more established credit history you’re going to need to be approved for cards. If you’re more the conservative type, then you might want to wait until you at least break the 700s to start applying.

The cards you’d be considering at this level are those like the Chase Freedom® Card and The Amex EveryDay® Credit Card to get you started. As you get closer to 720 you can definitely take a chance on some of the better cards, especially if you have some payment history established with the bank you’re going to apply with or other lines of established credit.

720+

As long as you have a little bit of credit history (3-5 years ideally) and are above (or close to) 720 you have a good shot as some of the great cards like the Chase Sapphire Preferred® card, Citi Thankyou cards, and American Express charge cards. Once you hit this mark, you should feel good when applying for the vast majority of travel rewards cards.

Occasionally a bank will ding you for certain reasons (e.g., too many new accounts, reached credit limit, limited credit history, low income, random obscure reason, etc.), but I’ve got something like a 98% success rate on credit card applications with a score above 720. The higher up in the 700s you go, the better your odds get (you might eventually hit a point of diminishing returns near 800), but from my experience anything in the range of 720+ seems to get the job done.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Improving your credit score

I’ll eventually get around to writing in-depth articles on ways to improve your credit score but here’s some basic information that can help you if you’re just starting out.

How is your credit score determined?

The first thing you need to know is how your credit score is determined. Your credit score is determined by the following factors.

- Payment History (35%)

- Utilization (30%)

- Credit History (15%)

- New Credit (10%)

- Mixed Credit (10%)

The two biggest factors are your payment history and your utilization (credit-to-debt ratio). They amount to 65% of your score so it makes sense to attack these things first.

Pay off that credit card debt!

The first thing you need to do is try to pay off all of your credit cards or revolving credit lines. Do whatever you can possibly do to pay down your credit cards ASAP. If you’ve got high utilization you really need to put some effort into reducing it because credit card companies are going to see you as a credit risk and your score is going to suffer.

In a perfect world, you’d rely on your income to quickly pay off your cards and get your utilization as close to 0% as possible. However, in some circumstances it’s just very difficult. One solution you can always consider is opening up an installment loan.

Even if you have suspect credit, if you have a good relationship with a bank or credit union, you might be able to pull out a personal installment loan that you can use to pay off or pay down your credit card debt. Since the loan is in installment form, that means it won’t affect your utilization. Also, if you already have a personal loan with revolving debt, inquire with the bank about converting that to an installment loan. My friend lowered her revolving debt by $6,000 overnight be employing this trick and it catapulted her credit score into the 700s.

Do your research on negative marks on your report

If you have any late payments or derogatory marks you’ll now need to research how to get those removed off your credit score. Try not to get too discouraged if you’re facing a lot of late payments. When I first started, I’d slipped up big time and got hit with 6 late payments, bringing my score down to the 500s! A lot of sources said I didn’t have any hope for getting all six of these late payments removed but I got all six of these payments removed and my credit score ended up touching the 800s! So don’t give up!

Consider the secured credit card route

If you’re not able to pay down your credit cards in a reasonable amount of time and have some negative marks on your report, then consider opening up a secure credit card. Basically, you deposit money to a bank and they open you up a credit line for that amount. You use this account to make timely payments over time and eventually your score will go up! It might take some time, but I know of several people who have had pretty good success going the secured credit card route.

Just take your time, do your research, and just don’t give up!

Make sure you are mentally prepared…

You need to possess the discipline to make financially responsible decisions with your credit cards to be successful in award travel. The first time I got approved for a huge credit line it was a bit of a shock to go from having a couple of thousand dollars at my disposal to all of a sudden having access to over $20,000! For some people, being granted instant access to $20,000+ in a matter of seconds can open up room for them to make poor decisions.

The whole point of award travel is to travel at a fraction of the cost that it would require otherwise. If you run up your credit card balances and end up paying large amounts of interest every month you’re going to cut into your savings and be defeating the purpose of travel hacking in the first place.

I really think that if you want to get the most out of award travel you need to be in a place where finances are not a constant worry. Whether that be worrying about steady income, mounting medical bills, spending habits, whatever. You should feel confident in your ability to apply budgeting to your spending habits even if you’ve got the ability to buy just about anything you want or think you’ll need.

I’m not saying you have to be wealthy — I think even “broke” college students can get into award travel. I’m just saying it’s a good idea to be honest with yourself before it’s too late. For example, If I had found out about this hobby 10 years ago, I’d probably still be paying off credit cards because I just wasn’t mature enough to make good financial decisions. Now, I’ve made enough financial blunders to learn my lessons and it’s a totally different story.

So once you get your credit score in order or at least come up with a plan to get it right and do a bit of self-evaluation to make sure you’re ready for this hobby, it’s time to get informed!

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Great site!! One addition, a free account with WalletHub will give anyone basic credit monitoring and quarterly FICO scores, completely free.

Hello, my question to you is I am paying off all my credit cards though a personal loan, making this move will affect my credit so my credit score too?

Thanks

Is the card available in US, the reason i am asking that is in the application they is No my state. What can do??????