Offers contained within this article maybe expired.

Amex allows you to have a lot of control over the authorized users who you have chosen to allow to use your credit cards, which is great for reducing your exposure to unexpected credit card bills. This article will show you how to set spending limits for authorized users for your Amex cards. I’ll also discuss some of the benefits to adding authorized users and why you might want to consider doing so.

Tip: Check out the free app WalletFlo so that you can optimize your credit card spend by seeing the best card to use! You can also track credits, annual fees, and get notifications when you’re eligible for the best cards!

Table of Contents

Why set credit limits?

When you add an authorized user to your account, you are agreeing to guaranty the debt that they run up that is linked to your account. So whatever they spend on their authorized user credit card is your responsibility to pay.

The risk of being hit with a huge, unexpected bill is why many people are understandably reluctant to add authorized users to their accounts.

However, when you can control the spending limits on those credit cards and receive notifications when your authorized user approaches certain limits, the risk factor goes way down. You’ll still be responsible for whatever they put on the credit card, but you can limit that responsibility down to whatever you are 100% comfortable with.

Setting spending limits is also very quick and easy to do so if something ever comes up and you need to change or edit those limits, you can usually do so pretty quickly.

Thus setting spending limits is a great way to retain control over the spending of your authorized users and thus relieve some of the worry and risk that comes along with adding authorized users.

Setting spending limits for Amex authorized users

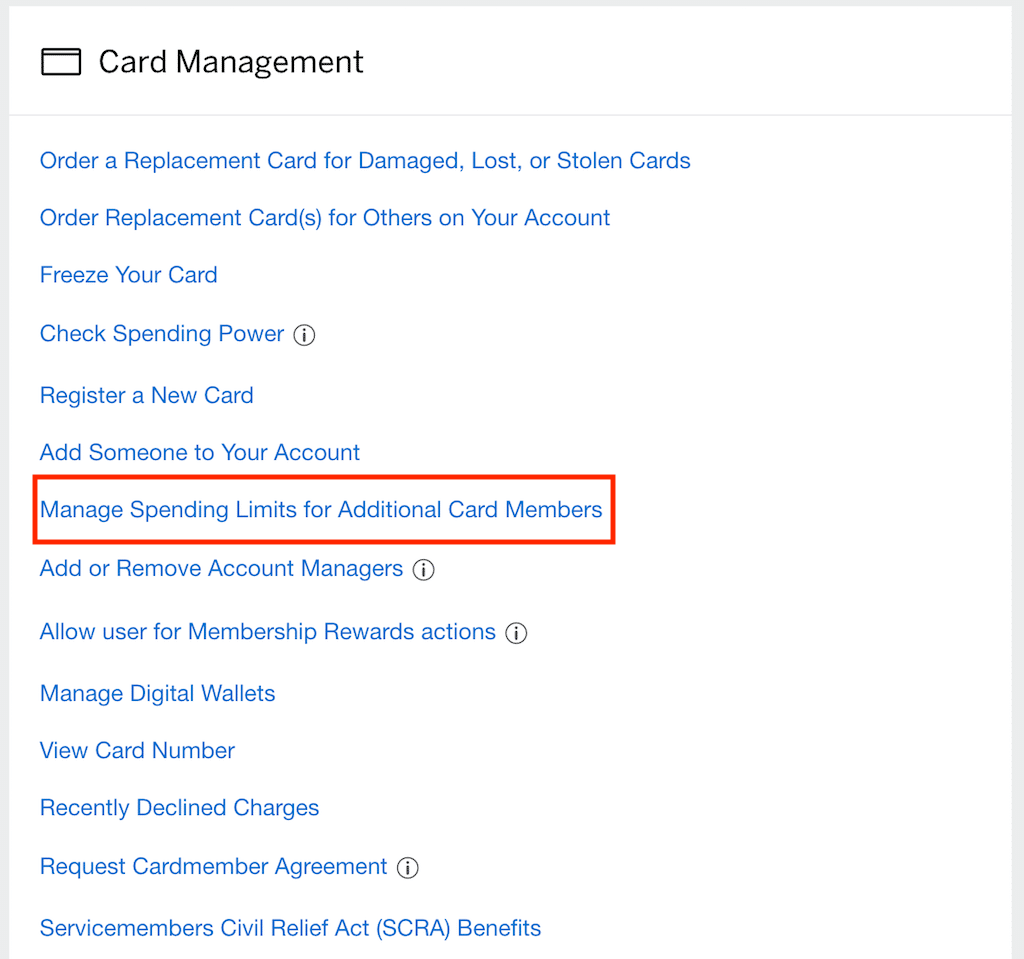

The first thing that you need to do in order to set your spending limits for your authorized user is to log-in and select the specific card that they are linked to and then click on “Account Services.” Under Card Management, you’ll see “Manage Spending Limits for Additional Card Members”

If you haven’t already added someone as an authorized user to your account, you can do that under the “Add Someone to Your Account.”

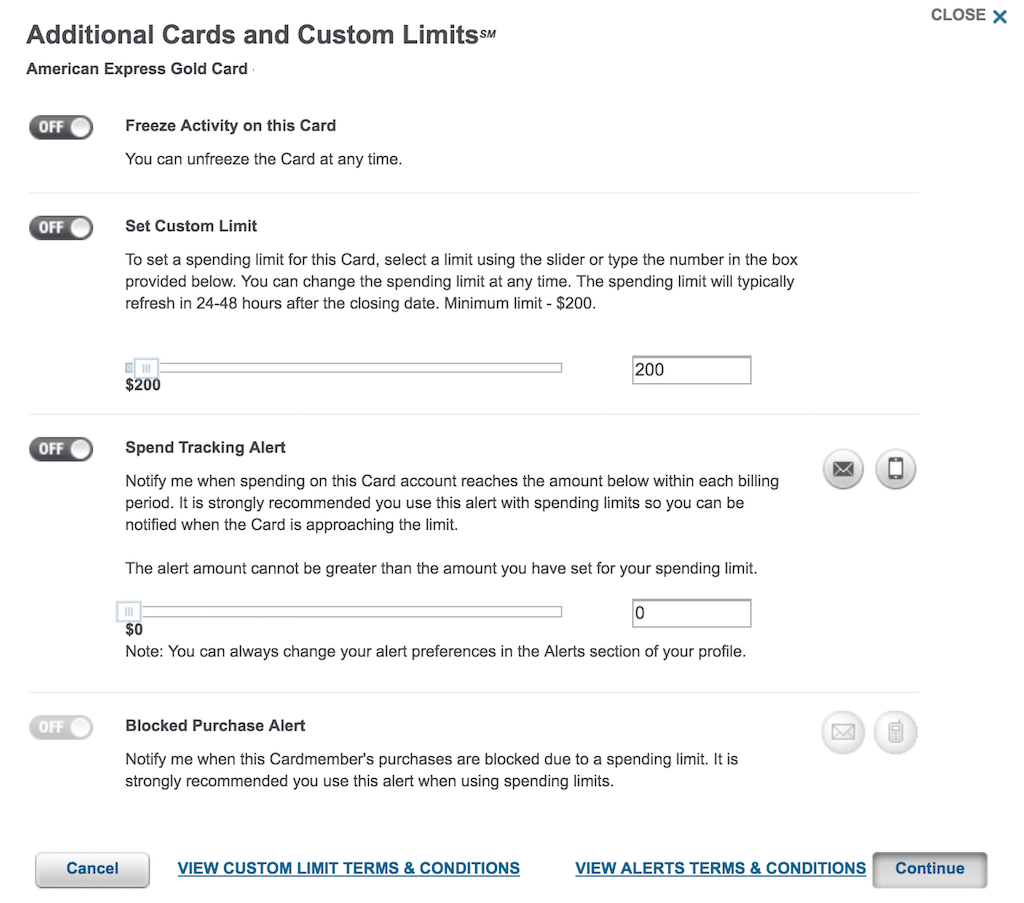

Once on that screen, you’ll see a pop-up which states “Additional Cards and Custom Limits” and you’ll see an area to click which says “edit” on the right side. Click on that to edit the spending limits.

Different limits

Here are the different spending limit features that you can apply:

- Freeze Activity on this Card

- Set Custom Limit

- Spend Tracking Alert

- Blocked Purchase Alert

Freeze Activity on this Card

This is a feature you can use to stop the authorized user from being able to use the card at all. If you need to immediately cut someone off this is the feature to use. You can unfreeze the account at any time.

Set Custom Limit

For this feature, you’ll need to select a limit using the slider or type the number in the box provided. You can change the spending limit at any time. The spending limit will typically refresh in 24-48 hours after the closing date. There is a minimum spending limit of $200 but you can crank that limit all the way up to close to $10,000,000.

If your primary purpose for adding the authorized user is for emergency purposes then you obviously want to think these limits through before putting them too low. While you will always be able to increase the limit in the event of an emergency, you might not be able to do that in real-time at the time of the emergency.

If you’re worried about setting them too low then you can always set a spending tracking alert described below. That can help you detect when the spending is getting too high for your liking but still leave the authorized user room on the spending limit for emergencies.

Spend Tracking Alert

This allows you to be notified when spending on the account reaches a certain amount within each billing period. It is strongly recommended you use this alert with spending limits so you can be notified when the Card is approaching the limit.

(The alert amount cannot be greater than the amount you have set for your spending limit.)

Blocked Purchase Alert

This will notify you when a cardmember’s purchases are blocked due to a spending limit. It is strongly recommended you use this alert when using spending limits.

This can help you to start conversations with your authorized user about their need to follow along with the required spending limit.

Notifications

You’ll need to select how you wish to be notified about these alerts. You can choose to be emailed or receive notifications via your phone (or both).

You can read more on the official terms and conditions here.

Adding authorized users

Amex may allow you to add an authorized to your card beginning at the age of 13.

You can add authorized users to virtually all of your Amex credit cards by calling, or going to the “Add Someone to Your Account” section shown above. They will eventually ask you to add that person’s social security number so be prepared to hand over that information.

You can often add authorized users for free to Amex card. Two good examples of high quality cards that don’t charge you to add authorized users are the Amex EveryDay card and the Amex Gold Card. However, other cards like the Platinum Card from American Express will force you to pay a premium for adding authorized users. While you’ll have to pay a premium for the Platinum Card, you’ll also be able to receive some valuable benefits as an authorized user so it’s often worth it.

Why add an authorized user?

Adding an authorized user can make sense in a lot of scenarios.

One of the most common situations is when you have a family member that needs to have access to a credit card. You can help them out with emergencies or just in times when they need to put purchases on a card for the moment. They will receive the added spend flexibility and you’ll receive additional points for their spend.

Adding an authorized user can benefit the authorized user in major ways. By adding an authorized user, you can help to improve the authorized user’s credit score in a few ways.

You can help decrease their utilization, increase the average age of their accounts, improve their credit credit history (by diluting negative history), and also help diversify their credit mix. How much the authorized user benefits from being added to your card will depend on which of these factors needs improvement, but I’ve seen pretty substantial leaps in credit scores of 50+ points in the past, especially when utilization is a problem.

Authorized user spending limit FAQ

Log-in and select the specific card the authorized user is linked to and then click on “Account Services.” Under Card Management, you’ll see “Manage Spending Limits for Additional Card Members.”

Once on that screen, you’ll see a pop-up which states “Additional Cards and Custom Limits” and you’ll see an area to click which says “edit” on the right side. Click on that to edit the spending limits.

The minimum spending limit is $200.

It could take between 24 and 48 hours for the spending limit to refresh.

American Express allows authorized users to be added beginning at the age of 13.

Final word

Adding authorized users to your credit cards can be a risky proposition at times that has the potential to put you in a financial bind. Luckily, Amex makes it very easy and convenient to reduce your exposure to these risks by setting limits and alerts to your authorized user’s spending. By using these features you should be able to keep the spending under control and still allow your authorized user to use their card for necessary expenses under your watch.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.