Both Southwest and JetBlue are two of the most popular low cost carriers in United States. They both offer some low fares that you can take advantage of to various locations in the country (and abroad) but they also come with some additional features that set them apart from other airlines.

In this article I will take a look at different aspects of what these two airlines have to offer and compare them to each other. I’ll cover everything from credit cards and legroom to baggage fees and flight networks.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Table of Contents

Credit cards

First, let’s take a look at the type of credit cards offered by these two airlines. We will start with Southwest.

Southwest credit cards

Southwest credit cards are issued by Chase and there are three different personal credit cards and two business credit cards. One way that Southwest immediately stands out with its credit cards is that they offer (mid-tier) premium cards (although JetBlue is rumored to be introducing some soon).

Southwest Rapid Rewards Plus Credit Card

- 2 points per $1 spent on Southwest purchases and Rapid Rewards Hotel and Car Rental Partner purchases

- 3,000 anniversary points

- $69 annual fee

Southwest Rapid Rewards Premier Credit Card

- 2 points per $1 spent on Southwest purchases and Rapid Rewards Hotel and Car Rental Partner purchases

- No foreign transaction fees

- 6,000 anniversary points

- Earn 1,500 Tier-Qualifying Points for every $10,000 in purchases, up to 15,000 Tier-Qualifying Points each calendar year

- Business version also available

- $99 annual fee

Southwest Rapid Rewards Priority Credit Card

- Bonus spending:

- 2X Rapid Rewards on Southwest purchases

- 2X Rapid Rewards on hotel and car rental partner purchases.

- 1X Rapid Rewards on all other purchases

- $75 Southwest annual travel credit

- 7,500 anniversary points each year

- Four Upgraded Boardings per year when available.

- 20% back on in-flight drinks, WiFi, messaging, and movies

- No foreign transaction fees

- Earn tier qualifying points towards A-list Status

- $149 annual fee applied to your first billing statement

Southwest Rapid Rewards Performance Business Card

- 9,000 bonus points after your Cardmember anniversary.

- 3 points per $1 spent on Southwest Airlines purchases.

- 2 points per $1 spent on social media and search engine advertising, Internet, cable and phone services and 1 point per $1 spent on all other purchases.

- 4 Upgraded Boardings per year when available

- Inflight WiFi Credits

- A-List credits

- Global Entry or TSA Pre-Check Fee Credit

- Employee cards added at no additional cost

- $199 Annual Fee

With Southwest, you can get both a personal and a business credit card and sometimes earn enough Rapid Rewards to earn the coveted Companion Pass.

The Companion Pass is special because it allows a companion to fly for free with you for up to two years. This applies even on award flights! It is one of the most valuable perks and should be considered by anybody who does a lot of flying domestically.

Related: Southwest devalues Rapid Rewards points by 6%

JetBlue credit cards

JetBlue has three credit cards issued by Barclays. The most popular airline card is probably the JetBlue Plus, which comes with the following features:

- 6X on JetBlue purchases

- 2X on Restaurants and grocery stores

- Free first checked bag

- TrueBlue Mosaic benefits for one year after you spend $50,000 or more on purchases annually with your card

- 5,000 points on account anniversary

- 10% rebate on points redemptions

- 50% savings on eligible inflight purchases including cocktails and food

- $99 annual fee

Something worth noting is that, unlike Southwest, JetBlue does have an option for a no annual fee credit card. Your earning rate on JetBlue gets cut in half at only 3X and you lose some other benefits like the free checked bag, but if you are not a fan of paying an annual fee, JetBlue might be more appealing to your wallet.

And finally, the JetBlue cards may offer 0% introductory APR on balance transfers made within 45 days of account opening.

My pick

Overall, I am a bigger fan of the Southwest credit cards because of the opportunity to earn the Southwest Companion Pass. If you time your Southwest credit card offers, you can earn the Companion Pass without ever having to fly a single flight on Southwest!

Still, the JetBlue Plus card has a lot of value to offer. I like its 5,000 points every anniversary, 10% rebate on points (which adds value to the sign-up bonus), and the ability to spend into elite status.

And while JetBlue points have not been worth quite as much as Rapid Rewards in my experience, the JetBlue Plus card offers better earnings on airline (JetBlue) travel purchases with 6X.

As far as credit scores needed for these airline cards they both require good to excellent credit. If your credit score is below 700 you probably want to focus on increasing your score and then applying for these cards at a later time.

Each bank also has its own specific rules about credit card eligibility and I would suggest you to use WalletFlo to help you navigate those rules.

Transfer partners

Both Southwest and JetBlue are transfer partners of Chase Ultimate Rewards. But JetBlue is also a transfer partner of the other programs including:

- American Express (250 Amex points for every 200 points)

- Capital One (2:1)

- Citi (1:1).

Thus, there are more opportunities to transfer your points in to JetBlue and you could build up a JetBlue points balance up quicker.

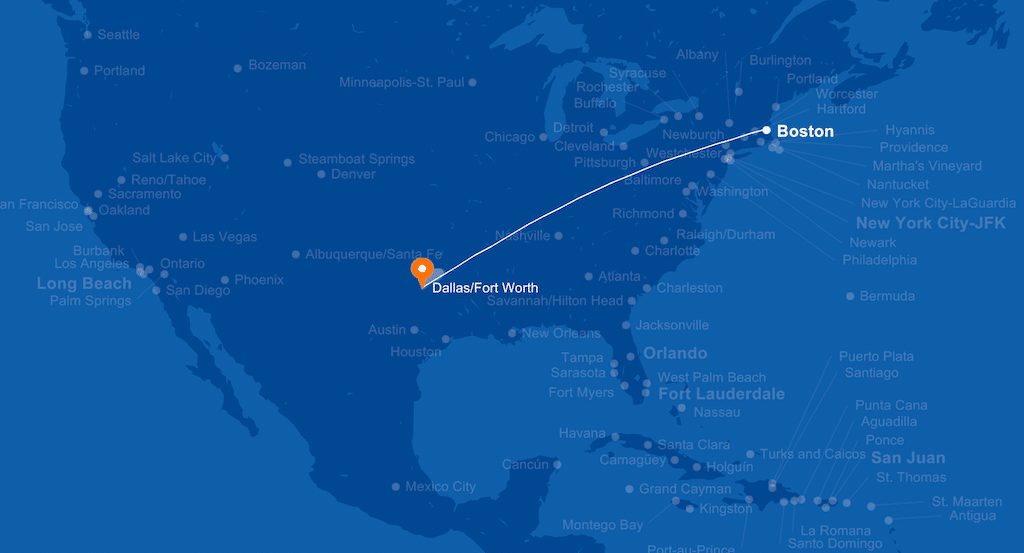

Flight network

JetBlue serves a lot of flights out of New York, Boston, and Washington but in some other parts of the country, you’ll need to connect through one of those locations. For example, if I want to fly JetBlue out of Houston it is usually a very inefficient route to places outside of the East Coast.

Meanwhile, Southwest has many flights out of Chicago, Baltimore-Washington, Denver, Las Vegas, Dallas, Phoenix, and other major cities.

I have found Southwest to be much easier to get around the country because they offer more flight options to a lot of destinations out of major cities. JetBlue will offer you a lot of options when traveling to or from the East Coast, but you can find plenty of flights just about anywhere with Southwest.

Keep this in mind, in 2017, Southwest transported 157,000,000 passengers compared to JetBlue’s 40,000,000. Thus, Southwest serves almost 4 times the amount of passengers as JetBlue, which isn’t surprising considering JetBlue’s fleet size is around 280 and Southwest’s is around 750.

When it comes to international flights, JetBlue has more destinations though both serve some very popular international destinations and you can read about Southwest international destinations here. Also, Southwest just started to fly routes to Hawaii.

Punctuality

Southwest has better punctuality than JetBlue. They also have fewer cancellations. You have to attribute a lot of the delays and cancellations to geography but because you often have to route through the Northeast with JetBlue, that data is still relevant.

Although delays and cancellations may be more common, I do like JetBlue’s no overbooking policy.

Baggage fees

Southwest will allow you to fly with two free checked bags on every flight. This is a significant potential savings for many people and should always be factored into the flight price.

With JetBlue, you will have to pay for your first checked bag and here are the prices you can expect:

- 1st checked bag: $35

- 2nd checked bag: $45

- 3rd+ checked bag: $150

You can read more about the JetBlue baggage fees here.

Change fees

Southwest allows for free changes, which is a huge factor to consider when making a booking. Meanwhile, JetBlue will charge you fees depending on how expensive your fare was.

For example, for changes in cancellations to Blue and Blue Plus fares under $100, you would have to pay $75 per person plus difference in fare and for fares between $100 and $149.99, you would have to pay $100 per person plus difference in fare. The price continues to go up the more expensive the fare.

Update: As of June 8, 2021, JetBlue eliminated change and cancel fees for most fares, except Blue Basic.

The lack of baggage fees and change fees is what really distinguishes Southwest from JetBlue in my opinion. It sort of solidifies Southwest as more of a budget airline.

Travel funds

JetBlue does have a more generous policy when it comes to its travel credits. With JetBlue you can use them for other people. So if you have three other people traveling with you, you could book their flights with funds from your Travel Bank.

This is not the same as the travel credits for Southwest, which require you to use them for the passenger who received the credit. One workaround for those travel credits for Southwest is that you can convert them into LUV vouchers which can be used for other people although there is a fee associated with that conversion. You can read more about Southwest travel credits here.

Legroom

JetBlue is known for having great legroom in its aircraft. Below, you can see just how much legroom JetBlue has:

- A320: 34″

- A320: 32″

- A321: 33″

- A321: 32″

- Embraer E-190: 32″

Now compare those results with Southwest.

- Boeing 737-700: 31″

- Boeing 737-800: 32-33″

- Boeing 737 MAX 8: 32-33″

So in some cases the legroom is actually the same. However, since JetBlue flies the A320 for most routes and Southwest flies these 737-700 on most routes, you’ll usually get an extra inch or two of legroom with JetBlue. An extra inch or two may not sound like a whole lot but it can actually go pretty far when it comes to comfort. This is especially true if you are on the taller side.

Boarding

With Southwest there is an open boarding policy. This means that you do not have assigned seats and instead you find your seat as you board. It is not as chaotic as it sounds since you are given a boarding position at check-in and the process usually goes pretty smoothly in my experience.

With JetBlue, they have more of a traditional boarding process where you can reserve your seat. Some people despise the open boarding policy with Southwest, while others like me don’t mind it all. It all depends on how much assurance you need about your seat. You can always look into Southwest EarlyBird for help with securing a better seat with Southwest, though.

Business class

Southwest has something called Business Select but this is not a “true” business-class. I say that because there are no special seats with extra leg room in Southwest planes. But that doesn’t mean that you will not get any additional perks. If you purchase a Business Select ticket you can get the following benefits:

- Guaranteed A1-A15 boarding

- Fly By lane access

- Free premium drink

- 12 Rapid Rewards per dollar spent

- Fully refundable fare

- Standby

However, JetBlue has a real business class. In fact, it is arguably one of the best products for flying around the US, especially from a value perspective. This product is known as Mint and gets fantastic reviews. There are two different versions of Mint seats and one of them includes a suite. So if you truly value luxury and comfort, Southwest can’t compete with this. (It should be noted that this type of cabin is only available on select routes.)

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Elite status

Southwest A-List

Southwest has two levels of elite status.You can earn A-List If you meet the following requirements in a calendar year:

- 25 one-way qualifying flights OR

- 35,000 tier qualifying points

Here are the Southwest A-List benefits.

- Priority boarding

- Priority security and check-in lanes

- 25% bonus earning (7.5X per dollar for Wanna Get Away fares)

- Free same day standby

- Dedicated A-List phone number

You can earn A-List Preferred if you meet the following requirements in a calendar year:

- 50 one-way qualifying flights OR

- 70,000 tier qualifying points

The benefits for A-list Preferred are extremely similar to the benefits for A-List.

- Priority boarding

- Priority security and check-in lanes

- 100% bonus earning (12X per dollar for Wanna Get Away fares)

- Free same day standby

- Dedicated A-List phone number

- Free in-flight wifi

JetBlue Mosaic

JetBlue only has one level of elite status and it is known as Mosaic. It can be earned by meeting the following requirements:

- 15,000 base flight points within a calendar year OR

- Fly 30 segments plus 12,000 base flight points within a calendar year.

You will normally earn 3 base flight points for every dollar spent, so spending $5,000 will get you Mosaic. Here are all of the Mosaic benefits.

- First and second bag free

- Change and cancellation fees waived

- 15,000 bonus points upon qualifying for Mosaic

- Expedited security line

- Early boarding

- Complimentary drinks

- 6 points per dollar if you book a Blue fare on jetblue.com

Some of the key Mosaic benefits like free baggage and no change fees are already provided by Southwest to non-elites so they don’t feel as valuable in the context of this comparison. I really like the 15K bonus for achieving Mosaic status but 7.5X per dollar for Wanna Get Away fares offers more value than 6X TrueBlue points on Blue fares.

It’s also nice that Southwest continues to reward frequent flyers with a second-tier of A-List, which allows for even higher earnings on flights of at least 12X. So to me, Southwest has the more rewarding program for frequent flyers.

In-flight entertainment

In-flight entertainment is going to be better on JetBlue. The reason is that they have built-in TV screens and planes more equipped with Wi-Fi (JetBlue is the only airline with free high-speed Wi-Fi at every seat).

With Southwest, there aren’t any TV screens and you have to bring your own device in order to stream in-flight entertainment. The internet connections are not always so great so streaming can be a frustrating experience.

Partners

JetBlue is partnered up with a lot of well-known international carriers. This gives it a distinct advantage because you can earn miles with a lot of different airlines including:

- Aer Lingus

- Aeroflot

- Air China

- Air India

- All Nippon Airways

- Asiana Airlines

- Avianca Airlines

- Azul

- British Airways

- Brussels Airlines

- Cape Air

- Cathay Pacific

Southwest does not have a long list of partners so JetBlue easily wins this.

Southwest vs JetBlue FAQ

Southwest has more credit card options than JetBlue and arguably better overall credit cards because of the opportunity to earn the Southwest Companion Pass.

These cards include the:

– Southwest Rapid Rewards Plus Credit Card

– Southwest Rapid Rewards Premier Credit Card

– Southwest Rapid Rewards Priority Credit Card

– Southwest Rapid Rewards Performance Business Card

In 2017, Southwest transported 157,000,000 passengers compared to JetBlue’s 40,000,000. Thus, Southwest serves almost 4 times the amount of passengers as JetBlue, which isn’t surprising considering JetBlue’s fleet size is around 280 and Southwest’s is around 750.

Southwest will allow you to fly with two free checked bags on every flight.

With JetBlue, you have to pay for your first checked bag and here are the prices:

1st checked bag: $35

2nd checked bag: $45

3rd+ checked bag: $150

JetBlue has more legroom than Southwest. You typically will have 1 to 3 inches more of leg room with JetBlue.

JetBlue has a true business class known as “Mint.” It’s one of the best business class cabins for a US airline and is superior to the Business Select experience offered by Southwest.

Final word

Overall, each airline has its strengths and weaknesses. I personally feel like Southwest has more value to offer for those looking to travel on a budget. With the potential savings of the Companion Pass and the two free checked bags and no change fees, there is a lot of potential to save. It is also very nice to have a much more expansive flight network which makes finding cheaper (and more convenient) flights easier.

JetBlue also has a lot of value to offer but they also have more of a premium experience with more legroom, better in-flight entertainment, and of course a true business-class product. My only major complaint is the smaller flight network which makes flying JetBlue very inconvenient out of some major cities.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.