There are a lot of purchases you wouldn’t expect to be able to pay on a credit card: lawyers, mortgages, tuition, taxes, loans, the list goes on. I’ve even heard of people paying child support with a credit card. But undoubtedly one of the most common large purchases that just about every person makes is a car.

So a lot of people wonder if they can pay for a car with a credit card?

This article will walk you through the process of paying for a car with your credit card and give you some specific tips for how to best use a credit card to pay for a car.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

Can You Pay for a Car with a Credit Card?

Yes. Some dealerships will allow you to pay for a car with a credit card. However, many dealerships place limits on credit card transactions so you might have trouble paying for an entire vehicle with your card and might have to settle for just making a down payment, usually around $5,000.

Tip: Check out the free app WalletFlo so that you can optimize your credit card spend by seeing the best card to use! You can also track credits, annual fees, and get notifications when you’re eligible for the best cards!

What dealerships take credit cards?

You’ll probably have to just ask around and call the dealerships anonymously to find out if they take credit cards.

I say anonymously because I would NOT reveal that I was using a credit card to make a purchase until it got time to close on the vehicle and the final price was already set in stone. Otherwise, you risk them manipulating the price to cover the cost of the credit card transaction fee.

So consider calling in weeks ahead of time and not revealing anything about your desired car — you might even have someone else call in for you so that they don’t recognize your voice if you want to play it really safe.

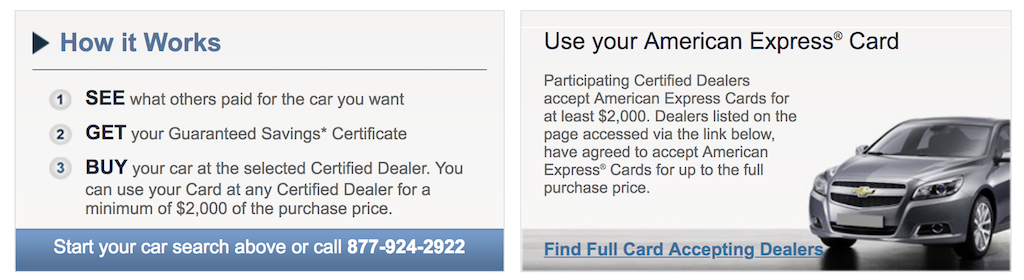

If you have an Amex card there’s a specific web portal you can use to locate dealerships that take Amex credit cards. You’ll be able to search for specific types of vehicles, sign-up to receive emails for deals, and even review prices that others paid for the car you want. The program will also show you which dealerships have credit card limits (like $5,000) and which dealerships will allow you to pay the full price for the vehicle.

And if you’re wondering about Carmax, they do not take credit cards.

Related: What to Bring When Buying a Car (Detailed Checklist)

Why car dealers deny your credit card

Many car dealerships will tell you that they can’t take credit cards or that they don’t. Sometimes they are just telling you that because they don’t want to pay the transaction fee on the purchase but there are some legitimate reasons as well.

Transaction (interchange) fees

Credit card issuers make money when merchants pay transaction fees of 2% to 4%, which is one of the ways many of these credit card companies make a lot of their money (especially Amex). So from the dealership’s eyes, they are losing out on maybe 3% of a large transaction which will affect their profits and commission. (The profit margins for car dealerships can be much lower than you probably think.)

While a dealership may refuse to take a credit card and may not be contractually obligated to take your card, you might be able to persuade them otherwise by offering to pay half or all of the transaction fee. Start with presuming you won’t pay any of the fee, then ask about paying half, then ask about covering the entire transaction fee.

Fraud and contested charges

Some dealerships are legitimately worried about fraud, especially if the purchaser is coming in from out of state and has other shady characteristics (e.g., urgent reason for needing a vehicle, etc.). If the dealership sells that car, they’re going to take a huge hit if that card was fraudulently obtained. Also, some people will contest their charges which could cause some major problems for the dealership.

Getting around limits on the purchase

Many dealerships place limits on the amount that you can put on a credit card. For example, I was once told there was a $5,000 limit on what we could pay with a card and other limits might be as low as $2,000 or $3,000. This, again, is sometimes just to avoid having to pay for the transaction fees so if you offer to cover that cost you might be able to get around these limits.

Other times it might just be company policy to limit transactions to $5,000, regardless of who is covering the transaction fee. You can ask them to run multiple purchases of $5,000 and they might be willing to work with you if that’s what is holding them back.

But some dealerships just don’t want any part of a huge transaction like that and won’t budge. If you really want to use your card you might to move on to the next dealership but I suggest trying to be reasonable. Sometimes you might need to consider it a win if you’re allowed to put any spend on a credit card at a dealership.

Is it worth it to purchase a car on a credit card?

When trying to figure out if it’s worth purchasing a card on your credit card I think there are a few major considerations. The first is who is covering the transaction fee?

Dealership paying the transaction fee

If the dealership is paying for the transaction fee then it will usually be worth it to use your credit card whether you’re just earning points on the spend or if you’re hitting a minimum spend requirement. The key to remember is not to reveal you’re using a card too early so that the price doesn’t get inflated.

Tip: If you just want to save cash you could “decide” not to use your credit card at the last minute and offer to not use your credit card if they reduce the price by the amount of the transaction fee.

Customer paying the transaction fee

If you are paying for the transaction fee, then you’re going to have do the math to see if it’s worth it.

If you’re trying to make a huge purchase like a $25,000 car then you would be paying $750 in transaction fee costs (assuming a 3% transaction fee). If you were earning 2% back on that purchase with credit card rewards then you would be losing money on the purchase.

However, if you were meeting the minimum spend requirement for a card offering a huge welcome bonus like the Chase Ink Business Preferred then you might be earning $1,200+ worth of rewards. Plus you’d get $375+ worth of rewards from the 25,000 points you’d earn on the purchase.

So in total you’d come out with over $1,500 worth of rewards and paying a $750 transaction fee would cut into your earnings but still leave you with $750 extra left in your pocket.

If you’re not earning a sign-up bonus, it could still be worth it just to earn the credit card rewards on the spend.

For example, if you were using the Amex Blue Business Plus, you will earn 2X on your purchase (up to $50,000/yr) and if you value Amex Membership Rewards at 1.8 cents per point, then you’d be earning 3.6% back. So even if you paid a 3% transaction fee, you’d still come out on top.

However, in most cases a simple 1% or 2% back card won’t earn you enough rewards to justify a transaction fee if you’re responsible for paying it.

Interest you don’t want to pay

If you’re using a credit card to purchase a car or even make a significant payment you need to have a plan to pay off that bill as soon as you can. If you have 0% APR for an intro period then carrying a balance can make sense but generally rewards credit cards are going to have high APRs (10 to 20%+) and you’d be able to get much better financing through the dealership, a bank, or a credit union, at around 2% to 5% APR. Credit cards don’t make good car loans.

Interest you might want to pay

You might also want to think about the rewards you’d earn by making the monthly payments with a credit card. There’s a service called Plastiq that allows you to use a credit card to send out checks. It comes with a 2.5% transaction fee but if you earn referral credits you can make payments for free.

If you got great financing and could minimize transaction fees using a service like Plastiq, a monthly car payment could allow you to more easily hit your minimum spend requirements for various credit cards over time and you could still come out on top with credit card rewards earnings.

Investing alternatives

If you are going to pay off your credit card in full after making the payment on the car, don’t forget to factor in alternative uses for those funds, such as investing. Let’s say you earned $750 in rewards by using a card to pay for a $25,000 car like in the example above. That’s 3% back.

But if you’re a savvy investor you might be able to put that $25,000 to use and earn much more back investing, even factoring in the interest you’d be paying on an auto loan. Everybody’s going to be different but the goal is to maximize your rewards in a way that’s most comfortable to you.

What about credit card benefits?

If you were hoping to get credit card benefits for your purchase like extended warranty coverage or something along those lines, automobiles are usually excluded from benefits like that.

For example, for the Amex extended warranty they specifically exclude:

4. Motorized vehicles (passenger cars, trucks, motorcycles, boats, airplanes) and their parts, subject to high risk, combustion, wear and tear or mileage stipulations

So don’t expect to get any special coverage from your credit cards.

What cards can you purchase a car on?

Depending on the type of car you’re after, you might need an extremely high credit limit.

Charge cards

For car purchases, a charge card will often be the best route because they have no established limit. While they have no limit, you’re generally responsible for paying off the bill the next month.

The issue with charge cards is that it can take a while to build up the upper limits of your charge card’s “unofficial limit.” For example, if you opened up an Amex Gold Card last month and that’s your only card with Amex, Amex is probably not going to “know you well enough” to allow you to throw a $20,000+ purchase on your charge card. Your card would get flagged and the chances of that transaction going through would be very small.

So the best way to use a charge card to purchase a car is to maintain a relationship with Amex for a while and try to use it for as many large purchases as possible. Then, call into Amex and inquire about the spend power of your card (or check it online). That will tell you right there whether or not you’ll have the capacity to make the purchase.

The problem with this is that if you’re trying to hit a minimum spend requirement for the charge card, that doesn’t leave you that long to show Amex your spending habits. Luckily, there is a solution for this.

Make pre-payments

Something else that you can do is to make a pre-payment on your charge card. For example, you could make a $10,000 payment on your charge card so that your balance goes to -$10,000. That would effectively increase your credit limit by $10,000 — just make sure to run this by Amex or whatever issuer you’re working with before you do it. I know Amex will allow you to do this, but I’m not sure about other issuers.

High limit credit cards

If you don’t want to go the charge card route you can look into getting cards that offer high credit limits. These are typically premium cards like the Black Card and cards like the Chase Sapphire Reserve but other issuers can also provide you with large credit limits.

If you have enough room on your credit card for the purchase, you should still contact your credit card issuer and put them on notice about the large purchase, since you don’t want the purchase to get flagged for fraud.

Use multiple cards

One of the best strategies is to simply use multiple cards to make your purchase.

As mentioned above, meeting a sign-up bonus for a credit card can easily justify the transaction fee. Well, if you end up meeting the spend requirement for multiple credit cards then you can earn multiple sign-up bonuses, which is definitely the best route for getting the most value from credit cards.

The amount of cards that you are able to use will depend on what the dealership decides but some have been able to use a half dozen to pay for their cars!

Assuming around a value of $500 per sign-up bonus, that could be a way to earn $3,000 in sign-up bonus value alone (plus you’d earn points from the spend).

Utilizing several credit limits will be necessary if you don’t have very high limits on your credit cards and it could help you stay under mandatory $5,000 limit transactions.

Note that certain issuers like Chase will allow you shift credit between your cards so you could always allocate to one credit card to maximize the limit with that card. Also, some issuers like Citi will allow you to request a credit limit increase (sometimes without a hard pull) so you could always raise your credit limit that way.

Cash advances off

Whatever card you use, it’s a good idea to bring your cash advance limit down to $1 to avoid the purchase coding as a cash advance. Sometimes bringing down your cash advance to $0 can cause processing issues, so I generally bring it down to $1 when I’m worried about something coding as a cash advance.

Pay for a Car with a Credit Card FAQs

Paying for a car with a credit card can often make sense if you are earning lucrative rewards (especially a new welcome bonus). Just make sure the car dealership is not increasing the price of the vehicle to cover the transaction fee.

American Express has a special web portal to help you find dealerships that will accept American Express cards.

Some car dealerships may not charge a fee while others will charge a 2% to 4% fee.

No, car dealerships are not legally required to accept a credit card.

Typically, motorized vehicles are excluded from the terms of conditions when it comes to extended warranties on credit cards.

Final word

Using a credit card to pay for a card isn’t always easy. You’ll often be hindered by limits but if you shop around enough and negotiate properly, you should be able to find a dealership that will work with you. You’ll need to factor in the transaction fees you might have to pay, but even if you have to pay them, it can still make sense to use your credit card to pay for a car.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I Did in fact buy a small truck for my small business using Discover they (with a phone call) agreed to give me a one year same as cash offer in which I bought the truck I owe only 500 left and will be paid next month no INTEREST so I would always call your card issuer and ask for there thoughts I can Really help remember that they are a creditor you have a repor with already

Great tip!