The Mastercard Black Card is a part of the Luxury Card collection of credit cards. The Black Card is synonymous with prestige, luxury, and high credit limits but how does it actually stack up against other rewards cards?

Here’s a full review of the Mastercard Black Card with a look at is requirements, benefits, and how they stack up against other major premium cards.

Table of Contents

Different from the Amex “black card”

Don’t get the Mastercard Black Card confused with the Amex black card formally known as the American Express Centurion Card. The Amex Centurion cards is much more exclusive and harder to obtain than the Mastercard Black Card. You can only get it by invitation and need to be spending $250K+ on your Amex to get the invite.

The Mastercard Black Card requirements are pretty much just a great credit score and decently high income and you stand a good shot of being approved.

You can read more about the Mastercard Black Card versus the Amex Centurion Card here.

Income requirements

A usual credit limit for the Black Card is usually around $20,000 to $25,000, so they’ll expect you to have an adequate income.

It’s not clear exactly what income is needed for the Mastercard Black Card. It’s definitely not as much as the Centurion Card and while some state you need to be in the six figures, I know you can get this card with income below that.

I’d say where in the $80,000s and up probably gives you a good shot but if you have a great credit score you might be able to get approved.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Credit score needed

You need a good credit score to the Mastercard Black Card.

Generally 740+ is considered a great score and should be sufficient (you don’t need a perfect credit score). But that’s not to say you couldn’t get it with a lower score.

What are the Mastercard Black Card benefits?

- High credit limit

- Earn one point for every dollar spent

- 2% back when used for airfare

- 1.5% back on all purchases

- $100 airline credit

- $100 Global Entry credit

- Priority Pass Select

- 0% introductory APR for the first fifteen billing cycles following a balance transfer

- No foreign transaction fees

- No sign-up bonus

- $495 annual fee

- Terms and conditions apply

Sign-up bonus

The Mastercard Black Card does not come with any sign-up bonus. Compare this to other premium cards that offer very valuable sign-up bonuses.

The Platinum Card from American Express offers 60,000 points after you spend $5,000 in the first 3 months. At a valuation of 1.8 cents per point, this comes out to $1,080 worth of points. And sometimes it’s even possible to get an offer of 100K!

The Chase Sapphire Reserve is another top premium card that comes with a sign-up bonus of 50,000 points after you spend $4,000 in the first three months. At a valuation of 1.8 cents per point, that’s $900 worth of points.

The Sapphire Reserve comes with a host of benefits like 3X on dining and travel, a $300 airline credit, and Priority Pass membership.

The lack of a sign-up bonus is a major drawback to the Black Card as it makes it much harder to justify its high annual fee when compared to what the other luxury cards offer, at least for upfront value. However, the Black Card does have some redeeming qualities when it comes to redemptions.

Black Card credit limit

The Mastercard Black Card is known for being one of the best high limit credit cards.

Depending on your income, you can often expect a starting Black Card credit limit of $20,000 to $25,000 or more with increases available.

Keep in mind that the Amex black card (known as the Centurion Card) is a charge card with essentially no limit.

Bonus categories/redemptions

1.5% back on all purchases

- You earn 1.5% back when you redeem your points for a statement credit. For example, you can redeem 5,000 points for a $75 statement credit.You can also receive the cash back in the form of a bank direct deposit.

Consider that the no annual fee Chase Freedom Unlimited allows you to earn 1.5% cash back on all purchases and that you can get 2% back on all purchases using a no annual fee credit card like the Citi Double Cash.

So in short, the Black Card’s 1.5% cash back is not too special. But it is nice that you don’t have to get an additional card to have a respectable earning rate for everyday purchases.

2% back when used for airfare

- The Black Card allows you to redeem your points toward airfare at a value of 2 cents per point. This means that you effectively get 2% back when your redemption goals involve air travel.

You can only get this rate when you book your flights on myluxurycard.com. This means that you won’t always be able to redeem your points at 2 cents per point for every flight because you might not have access to certain flights.

This is even made clear in the official terms and conditions:

Cardmembers may redeem points for a scheduled ticket on a participating major airline carrier, provided that the fares and schedules are found on, and the ability to generate a ticket (electronic or paper) is possible through, the Global Distribution System (GDS). GDS provides the same flights and fares available to travel agencies, but lower fares may be available elsewhere, e.g., from charters, wholesalers, consolidators and any Internet fares that are not published and/or available through GDS.

Redeem for hotel and car rentals

You can also redeem your points to book hotel and car rentals but the redemptions rates will be different. Hotel and car rental redemptions start at 100 points for $1.00. So for these bookings you’ll only get 1 cent per point — better to just redeem for a statement credit.

Gift cards

Gift certificates and merchandise redemptions minimums vary based on what you are redeeming for but you can get 1 cent per point with some gift card redemptions.

No transfer partners

Don’t get tricked by the marketing of the Black Card.

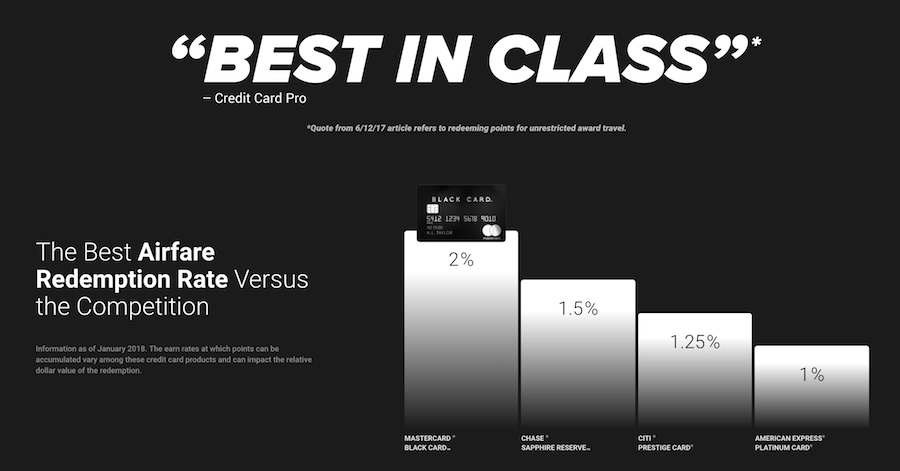

You might see images like the one below that supposedly show that the Black Card has better airfare redemptions than the Sapphire Reserve and other cards.

What this chart doesn’t mention is that you can transfer points earned by the other cards to airlines and book some amazing business class and first class products.

For example, with the Chase Sapphire you can transfer your points to a lot of fantastic travel partners like Flying Blue, United, Southwest, Singapore, British Airways, Korean Air and several others. In fact, I recently used my Chase points to fly first class on Korean Air and it was one of my favorite flights of all time.

With some of these redemptions you can get over 10 cents per point, which is value that the Black Card just can’t compete with.

It also doesn’t consider that the other cards offer bonus categories on spending, which can factor into the redemption analysis.

For example, the Sapphire Reserve earns 3X on dining and travel. So when you redeem your points toward airfare at 1.5 cents per point, it’s like getting 4.5% back towards airfare (more than double the 2% of the BlackCard).

So the take-a-way here is that getting 2% back towards airfare is a decent perk but it’s not nearly as impressive as the marketing materials would have you think.

$100 Airline credit

The primary cardmember’s qualifying airline purchases are eligible to receive a statement credit for a total amount of up to $100 each calendar year.

This credit will cover expenses, such as airfare, baggage fees, lounge access, and some in-flight purchases, as determined by the merchant category code.

It’s nice that it’s offered every calendar year and it’s also good to see that it can even cover airfare. Although this credit is very flexible it’s not competitive compared to credits like the Chase Sapphire Reserve’s $300 travel credit, the $250 Citi Prestige credit, or the $200 Amex Platinum credit.

$100 Global Entry/Pre-Check credit

The Black Card also comes with a $100 Global Entry or TSA Pre-Check credit. Global Entry of course is the program that will get you expedited access through immigration and customs when arriving back in the US.

Priority Pass

Primary Cardmembers and Authorized Users are eligible for a complimentary membership to participating airport lounges, which allows for unlimited visits for yourself as well as guests.

This perk is offered by tons of other premium cards including the Chase Sapphire Reserve, Amex Platinum, Citi Prestige, etc. However, the distinguishing factor here is that you can get access for unlimited guests. Most cards limit you to only two guests so this is a noteworthy perk.

In addition, the Priority Pass membership can be used for restaurants.

Patented Card Construction

The Black Cards are metal and are engineered with a unique stainless steel front and carbon back “for durability and distinction.”

While metal cards have almost become a commonplace, the Black Card is known for being one of the more “impressive” metal cards due to its weight of a whopping 22 grams. Luxury Card actually has 46 patents on this credit card design.

Mastercard Black Card protections and benefits

Some of the Black Card MasterCard protections have been removed but there still are some nice benefits like:

Baggage Delay Insurance

- Coverage up to $100 a day (maximum 3 days) if your checked luggage is delayed more than 12 hours from the time you arrive at your destination.

Travel Accident Insurance

- As a Luxury Card member, you and your family will be automatically insured up to $250,000 against accidental loss of life or dismemberment if you purchase your common carrier travel tickets with your eligible Luxury Card.

Trip Cancellation and Interruption

When you purchase a covered trip using your eligible card, you can be reimbursed for the cost of the non-refundable trip expenses up to $5,000 per insured person if certain unforeseen covered events cause you to cancel or interrupt your trip for a covered reason.

Travel Assistance

Service is available 24 hours a day, 365 days a year, and provides the following assistance services:

- Master Trip Travel Assistance

- Medical Assistance

- MasterLegal Referral Service.

Benefits are designed to assist you or your travel companions when you’re traveling 50 miles or more from home.

Cellular Wireless Telephone Protection (as of Nov 1, 2019)

Get $1,000 in yearly coverage ($800 max per claim, 2 claims per year) should your phone get stolen or need certain repairs. (You’ll need to pay for your mobile phone bill with your Luxury Card to activate coverage.

In addition, there are more Black Card benefits to take advantage of:

Boxed

Use your Luxury Card to earn 5% cash rewards on eligible Boxed orders for use on future purchases.

Fandango

Use your Luxury Card World Elite Mastercard to purchase movie tickets through Fandango and earn up to 500 Fandango VIP + points to be redeemed for $5 in Fandango movie tickets.

Lyft

Enroll and take five eligible rides in a month using your Luxury Card and get a $10 Lyft credit. Keep riding to earn credit month after month.

ShopRunner

Receive free two-day shipping and free return shipping on eligible purchases when you sign up for a complimentary ShopRunner membership with your Luxury Card.

onefinestay

Cardmembers get a 10% discount on all onefinestay bookings in addition to free Wi-Fi and a complimentary iPhone to use during your stay.

Luxury Card Concierge

Enjoy 24/7 access to Luxury Card Concierge—a complete and dedicated lifestyle management service tailored to your personal requirements.

Concierge Agents can assist with bookings, product searches, VIP access and much more. It’s not just for booking airfare and rental cars. In fact, you can use the service for requests that don’t include an actual purchase (reservations, research, questions, gift ideas).

Luxury Card App

With the Luxury Card App, you can browse and book unique experiences, make travel arrangements and also take advantage of exclusive offers.

Luxury Card Experiences

Book trips and tours appealing to a diverse range of passions and interests such as Culinary & Wine, Activity & Adventure, Sports & Entertainment, Family, Arts & Culture and Specialty Travel.

Luxury Card Travel

Luxury Card Travel offers competitive rates and complimentary benefits with an average total value of $500 per stay at over 3,000 properties around the world. When you book these properties, you can receive upgrades, complimentary food and beverage, and spa credits. Some perks you might enjoy:

- Enjoy a private tour of the wine cellar when you dine at the hotel’s renowned 1888 Chop Hous

- Receive free breakfast for 2 at $35 during your stay

- $100 spa credit per stay

- Discounts at the hotel’s famed golf course

- Room upgrade, when available

- Early check-in and late check-out, when available

This is a pretty standard benefit that other premium cards offer (access to a luxury hotel program).

Luxury Card Travel also includes special discounts and benefits with rental car agencies, cruise lines, and dining programs.

“Priceless” access

Privileged access to exclusive events and insider opportunities. These benefits are also pretty standard as many other premium cards offer special access to similar events.

Priceless Cities

“Celebrate the world’s greatest cities and enjoy unique excursions, privileged access to exclusive events and insider opportunities.”

Priceless Golf

“Access exclusive golf offers and experiences with the PGA Tour.”

Priceless Surprises!“

You never know where, when or who we will surprise next!”

Final word

Overall, the Mastercard Black Card is not my favorite rewards card because there are much more practical alternatives that provide you with the same benefits (or better) and often for much cheaper.

Instead, this card is for someone who is drawn to the prestige of the Black Card brand and is looking to impress while earning some decent rewards on everyday spend and enjoying some nice benefits.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.