Some credit cards are designed for super fans and the Marvel MasterCard certainly fits that bill. It’s an interesting credit card with some unique perks but is it actually worth pursuing?

In this article, I will take a detailed look at the Marvel MasterCard and breakdown all of its rewards and benefits, such as its bonus earning and discounts. I will also talk about what types of credit scores are needed to have good approval odds when you’re ready to apply.

Table of Contents

Sign up Bonus (not too special)

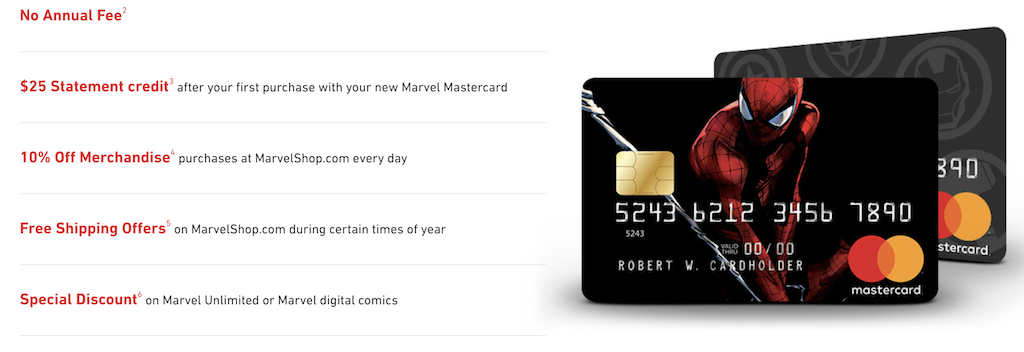

The sign up bonus for this credit card can vary but it usually is not anything special. For example, as of December 2019, the sign up bonus consisted of a $25 statement credit that was activated after your first purchase.

Considering that it is very easy to find credit cards offering $100 or $150 dollars as a sign-up bonus for small amounts of purchases such as $500 dollars this is not a very exciting offer. If you are interested in finding cards with much more value you can check out my list of top credit cards.

However, if you are interested in the Marvel MasterCard you are probably not picking it up for the statement credit. Instead, you are probably more interested in the bonus categories and special Marvel perks. Keep reading below to find out what those are.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Bonus categories

One of the most important things to look at when choosing a credit card is what type of bonus categories that it offers. The reason is because that is where all of the value is going to be for the long-term in many cases.

The Marvel MasterCard actually offers some pretty decent bonus categories. It earns the following rates:

- 3% cashback on dining

- 3% cashback on select entertainment purchases

- 3% cashback at Marvel.com and Marvel’s Official Merchandise Booths

- 1% cashback on all other purchases

Let’s break down all of these categories.

3% back on dining

Over the past couple of years we have seen an explosion in cards offering cashback for dining purchases. For example, we have seen cards like the Capital One Savor Cash Rewards Credit Card which earns 4% back on dining.

Then there are the cards that earn flexible points like the American Express Gold Card which earns 4X on dining and also the Citi Prestige which earns 5X on dining. Those cards allow you to transfer your points out to transfer partners which means that you can get much higher than 4% back in value. In fact the value could be closer to 10% in some cases!

So compared to all of those options 3% cashback on dining is okay but not extremely competitive. The good news is that this card has no annual fee so earning 3% back on dining is still pretty good.

What counts as dining?

If you are wondering what will register as a dining purchase, that is going to come down to the MCC code. An MCC is a four-digit classification code that is assigned to a merchant by the merchant’s payment card network or merchant processor. Neither Marvel nor Synchrony Bank assigns or has responsibility for the assignment of MCCs.

It usually just comes down to what the “predominant business activity” is for that particular merchant. So if you were to visit a café located inside of a grocery store it is possible that the café would not code as dining and instead may code as groceries. So that’s just something to consider.

3% back on entertainment

The Marvel MasterCard will also earn a 3% cashback on select entertainment purchases. Getting 3% back on entertainment purchases is actually pretty good. A lot of popular cards don’t offer entertainment as a bonus category. So if you spend a substantial amount of money on entertainment purchases each year this card is not a bad option at all.

But you might be wondering what exactly is defined as entertainment purchases.

Select entertainment categories include:

- Movie Theatres

- Video Rental and Game Stores

- Theatrical and Concert Promoters

- Amusement Parks

- Digital Entertainment

- Games and Software

- Music

- Books and Newsstands

- Toys and Hobby Stores

Synchrony supplies some definitions for these different categories so you can have an idea of what to expect.

Movie Theatres:

- Establishments that sell tickets and refreshments for movie productions.

Video Rental and Game Stores:

- Merchants that rent DVDs and/or games and related equipment for consumer use, including online video rentals.

Theatrical and Concert Promoters:

- Merchants that operate live theatrical productions or concerts, and include ticketing agencies.

Amusement parks (including zoos, circuses and aquariums):

- Establishments that operate parks or carnivals and offer mechanical rides and games and/or live animal shows.

Digital Entertainment, Games, and Software:

- Merchants that provide digital games and content for computers and mobile devices.

Music:

- Establishments that sell CDs and related items, including online records and digital music.

Books and Newsstands:

- Establishments selling reading material both digital and physical formats (includes comic stores).

Toys and Hobby Stores:

- Establishments selling toys and games, including video games.

One thing to consider is that the the Capital One Savor Cash Rewards Credit Card earns 4% back on entertainment. So if you want to optimize your cash back for dining and entertainment, that might be a better option for you.

3% back at Marvel.com and Marvel’s Official Merchandise Booths

When shopping at Marvel.com you will earn 3% cashback, which is pretty simple. Here are what the terms and conditions have to say about what falls in this category:

Purchases made with your card solely via:

- (a) the following Marvel digital and/or online storefronts:

- (i) Marvel Digital Comics Shop

- (ii) Marvelshop.com

- (iii) Marvel Unlimited

- (iv) Marvel Print Subscriptions

- (b) Marvel’s official merchandise booths at designated comic conventions

- (c) any other Marvel-branded digital or physical stores designated by Marvel.

Marvel.com registration may be required in order to purchase at Marvel.com. Purchases on third-party websites linked to from the Marvel.com website or apps (e.g., sites operated by third-party advertisers) are not eligible purchases at Marvel.com

1% cashback on all other purchases

If you are not spending on one of the categories above you will earn a straight 1% cashback with this credit card.

There are several no annual fee credit cards that can earn you much more than 1% back. For example, there is the Freedom Unlimited which earns 1.5% cashback on all purchases and there is the Citi Double Cash which earns 2% back on all purchases.

Thus if you were trying to maximize cashback on everyday purchases you probably want to consider an additional option to at least supplement this card.

Other perks

This card also has some additional benefits you could take advantage of.

10% Off

You will be able to get 10% Off Merchandise purchases at MarvelShop.com every day. Here are some of the key terms for this benefit:

- Must use your Marvel Mastercard to receive discounts.

- The discount is valid on phone orders and orders placed online at MarvelShop.com and does not apply to shipping and handling charges, gift wrap or gift boxes, gift cards, publications, memberships, media, games and accessories, electronics, Sideshow Collectibles, Limited Edition merchandise, personalization, and items not in stock.

- Cannot be combined with any other promotional offers, except shipping, unless otherwise stated. Can be applied to already discounted items on MarvelShop.com.

Free Shipping

You can also get Free Shipping Offers on MarvelShop.com during certain times of year. Free shipping applies to standard delivery anywhere in the U.S. or its territories.

Special Discount

Another nice perk is the special discount on Marvel Unlimited or Marvel digital comics. Marvel Unlimited (MU) is a digital comics subscription service that gives you instant access to over 25,000 Marvel comics on your mobile device and PC.

Cardholders who are current MU members will be sent, via email, an opportunity to redeem Marvel digital comics chosen by Marvel at its sole discretion.

If you are not an MU member you will be sent, via email, an offer redeemable for three free months of a monthly MU membership.

Marvel Avengers S.T.A.T.I.O.N.

This card also offers a special perk when visiting the Marvel Avengers Station in Las Vegas Nevada. That is an interactive exhibit that has proven to be a hit for many Avengers fans where you can “delve into the history, science, engineering, genetics, technology and profiles of Captain America, Hulk, Thor and Iron Man.”

If you are interested in visiting the Marvel Avengers Station, you can get 20% off your admission and also 10% off merchandise.

However there are some key terms with this benefit that you should know about.

Limited to four tickets

First, the ticket purchases are limited to four tickets per cardholder (and you must use your Marvel MasterCard in order to get the discount).

Five dollar service fee

There is also a five dollar service fee that applies to each ticket so that cuts into your savings.

The current ticket rates are $34 for adults and $24 for children. However, with all of the additional fees an adult ticket actually comes out to $44.52. I am assuming that they apply the 20% discount to the base $34 price for admission. And in that case you would be saving about seven bucks with this discount.

That would bring the price of admission down to $27 but you would still have to pay the five dollar service fee and whatever other possible fees are tacked on that original amount.

Purchase tickets from the box office

You also must purchase your tickets from the box office. The discount is not eligible for online purchases. That means that you may have to bother with waiting in line in Las Vegas which could take a while. Losing out on the convenience of purchasing your tickets online may not be worth it to many people.

Different Marvel card designs

When you get it approved for the Marvel MasterCard you can choose from several different types of design options for your credit card. For big time Marvel fans this is probably one of the coolest perks of the credit card because who doesn’t like whipping out a card with their favorite super hero?

No annual fee

This credit card comes with no annual fee. That is a pretty significant feature given that this card earns 3% back on dining and entertainment. I think this is definitely one of the better no annual fee credit cards.

Who issues the Marvel MasterCard

The Marvel Master card is issued by Synchrony Bank.

Marvel MasterCard Approval odds

You might be wondering what type of credit score is needed to have good approval odds for the Marvel MasterCard. While Synchrony is known for offering a lot of cards that are easy to get approved for, the Marvel MasterCard is one of their better known cards and seems to have higher standards for approval.

Note: Synchrony will often look at your TransUnion credit score to determine your approval odds (read how credit pulls work here).

If you have a credit score 700 or above you probably have decent odds although every individual case can be different.

For example, there are data points of people getting approved for this card with a credit score in the 670s to 690s. If you have an established credit history then you probably will have better odds if your credit score is on the lower side, but I would still try to get that credit score into the 700s, preferably at 720 or above.

When do you get your cashback?

Cashback earned during a billing cycle will be calculated at the end of your billing cycle and issued as a statement credit to your Account within two billing cycles.

Final Word

The Marvel MasterCard is not a bad credit card option if you are a Marvel fan. While it leaves a lot to be desired in the sign-up bonus department, it actually has some pretty decent bonus categories for a card that comes with no annual fee. Also, if you spend a lot at Marvel stores or events it’s possible that this card could actually save you a lot as well.

I would not use this card for a daily driver for every day spend since it only earns a flat 1% cashback on everyday purchases but it could definitely find a valuable place in a wallet if you had other cards to supplement it.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.