If you are like millions of people then at some point you will probably need to send off a check in the mail (even in 2021).

Unlike cash, sending off a check in the mail is much safer and acceptable. But that doesn’t mean that you should not take certain precautions to ensure that your check arrives safely.

Below are some different tips to help you mail your check safely. I’ll also offer some alternatives that you can take instead of sending a check.

Table of Contents

Get the check fundamentals down

Understand the parts of a check

Because checks are sent so often, it’s easy to forget the importance that your check contains a lot of your sensitive personal information such as your bank account number and address.

One worry is that someone could steal your mail and have access to that information but sometimes you may not even want to share that information with the individual you are sending the check to (I will discuss some ways to get around that below).

So make sure you are versed in what information is displayed on a check before you send one out. If you need a refresher on the different parts of a check, click here.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Fill out the check properly

You need to make sure that you properly fill out your check before sending it off.

I know this sounds obvious but if you do not properly fill out certain fields on the check, sending out a check could be as risky as sending cash in the mail!

For example, if you wrote out “Pay to the Order of: Cash,” your check could be cashed or deposited by anybody.

It would be just like sending over a wad of cash in the mail.

You also want to take a step to avoid your check getting “washed” which is when someone alters/removes the ink and changes elements on the check such as the name and amount.

One easy way to do this is to use an indelible pen which is essentially a writing pen that has ink that cannot be removed.

You can also increase the security of your check by writing “for deposit only to account of payee” on the back of the check (in the endorsement section).

This will prevent the check from being signed over to another individual which means that it will just be one step harder for someone to cash it if they are not the named recipient on the check.

That’s probably one of the most vital tips for sending a check securely through the mail.

Use the right envelope(s)

The best practice for sending off a check in the mail is to use an inconspicuous envelope that does not allow other people to see inside.

It’s not the best idea to send a check in an envelope that could easily be identified as some sort of special occasion envelope.

For example, let’s say you were sending off a birthday check to a family member and you are sending it in a bright orange envelope.

That is going to call extra attention to your mail and so you would typically want to avoid that.

You also want to avoid thin envelopes where a light could be shined through, exposing the contents. A cheap, basic white envelope is typically not a good choice for mailing a check.

I would recommend using some sort of business envelope that gives the contents of your mail a bit of privacy. You can find a large pack of these on Amazon for around $20. You’ll probably want the standard size number 10.

These envelopes come in different types but generally they have some type of security tint on the interior of the envelope that makes it much more difficult to detect what type of documents are inside.

If you want to take the security step even further you could also purchase a thick envelope like some sort of bubble mailer. These can help make it more difficult to discover what is on the inside and they can also weatherproof your check.

Wrap up the check

Regardless of the type of envelope that you sent off your check with, you probably want to consider placing the check inside a folded letter of some sort.

This could be a blank piece of printer paper or it could be something like a cover letter but it is good practice to not send a check as the only item in an envelope because it could make it easier to detect.

Drop your check off

Anytime you are sending something valuable through the mail, especially something like a check, it’s a good idea to drop the check off at the post office or in a post office collection box.

You could also use USPS collection boxes that you find in various parts of your local town but those may not always be as reliable as the ones located in or at a post office.

If you do use one of those collection boxes then try to put your letter in them just before pick up and avoid dropping your letter off in the evenings or on weekends when the collection boxes may not be served.

It really is a good idea to go to the post office if you live in an area where anybody could access your mailbox.

If you are worried about someone stealing your mail and for some reason you were not able to make it to the post office, consider waiting for the mailman to arrive and walking your mail to him/her personally.

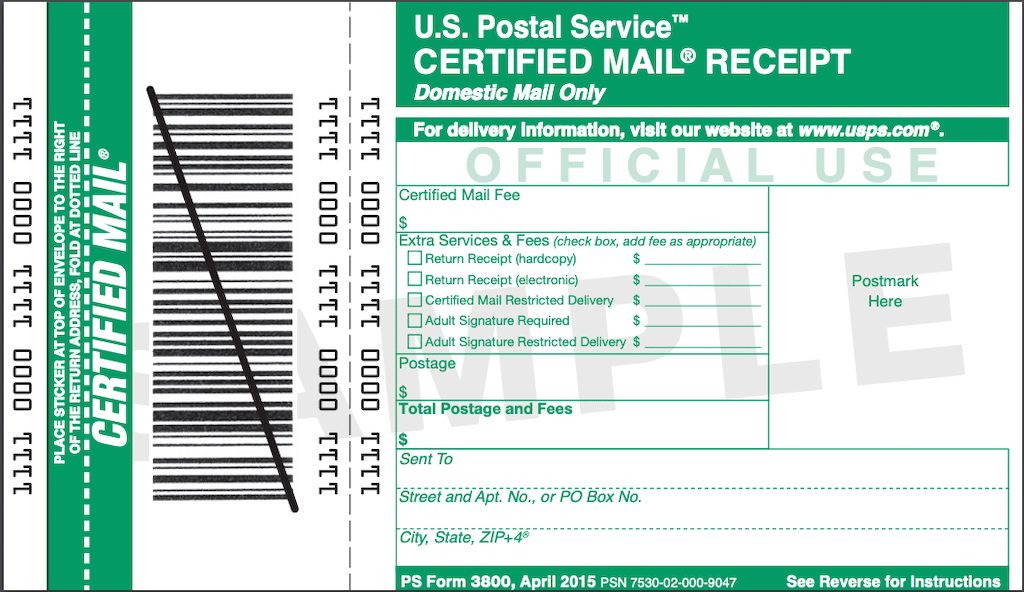

Send via certified mail

If you need verification that the recipient received your check then you might want to consider sending off your check via certified mail.

Certified mail provides the sender with a mailing receipt and electronic verification that an article was delivered or that a delivery attempt was made.

This is a very smart option whenever you are dealing with something like a deadline because you can verify when the check was delivered/received.

Tip: If you combine sending off a letter certified with bubble mailer and a security envelope along with the measures above such as indelible ink and additional endorsement information, you will be sending a check off about as securely as you can.

You may not need to do that for every check you send off but if the check is particularly important or you are extra nervous those can be good steps to take.

If the check never arrives

If for some reason your check never arrives then you will need to contact your bank and make a stop payment on the check.

Simply explain to the bank that you sent a check in the mail and that it never was received by the recipient and the bank should be able to handle the rest.

Sometimes these type of situations can drag out so be prepared to devote some time to resolving it if you run into trouble.

You need to keep in mind that your check has your bank account number on it so if a check ever goes missing, then somebody out there may have your bank account details.

This means that you will want to proactively monitor your bank account and any other associated accounts to ensure that nothing is happening.

If you are truly worried about someone hacking into your account then you might be able to talk to your bank about getting a new account number based on the fact that your bank number was potentially exposed.

Alternatives

While sending a check in the mail is not that risky especially if you take the steps above, you still might want to consider other payment methods that offer better privacy and security.

Money orders

Money orders are often a solid alternative to sending a check.

Typically, you have to pay a small fee to get them issued but that is generally around $1.50 so it’s not a huge inconvenience.

You can purchase money orders from the post office but you can also purchase them from other places such as grocery stores or even Walmart.

Money orders require identification to be cashed but money orders have an advantage over checks in that they will not have all of your personal information.

So even if someone did steal your mail containing a money order, they would not have access to your bank account number. In addition, it’s possible to track the money order to ensure that it has been cashed.

Cashier’s Checks

Cashiers checks are very similar to money orders but there are some key differences.

Money orders usually are for smaller amounts while cashier’s checks can be for much bigger amounts. (Someone once purchased a vehicle from me with a cashiers check for $20,000.) Some people might even close on a home with a cashiers’ check.

Cashier’s checks are also issued by a bank. So if you were to send one, your bank will either hold or remove the funds from your account and back the check.

And because they are issued by a bank that means you will need to have a bank account.

Cashier’s checks will also cost more money although you can still get them for only a few dollars.

Ultimately, cashier’s checks will often be needed when the recipient of the funds desires an extra level of guarantee or security. But they can be a great way to transact with large amounts of money without having to walk around with a lot of cash.

Consider electronic payments

Nowadays, it is easier than ever to send money electronically. There are so many different apps you can choose to use like PayPal, Venmo, Cash App, etc.

If you want to send money to a friend or family member I would highly suggest you look into one of the electronic options.

Also, if you want to send a payment through the mail in the form of a check but would like to use a credit card to authorize that payment in order to earn valuable credit card points, consider using a service like Plastiq.

Finally, if you are sending a large sum of money then you might want to consider doing a wire transfer. There will usually be a fee to make a wire transfer but sometimes the fee is waived if you are sending over a certain threshold such as $5,000.

FAQ

Yes, it is perfectly acceptable to send a check in the mail but you should attempt to do so securely.

– Use an indelible pen

– Write “for deposit only to account of payee” on the back of the check

– Use an envelope with security tint on the interior and/or bubble mailers

– Drop the check off at the post office and send it via certified mail

You can send your check via UPS or FedEx but it will be a little bit more costly than it would if you sent a check with USPS.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.