A very common question that I see come in often is: how long do hard inquiries stay on your credit?

It’s an important question and understanding both the short-term and the long-term impact of a hard inquiry is very important.

Here’s a rundown of everything you need to know about hard inquiries, including how long they remain on your credit report.

Table of Contents

Credit score basics

Most lenders use the FICO model, so that what I’ll use in this article.

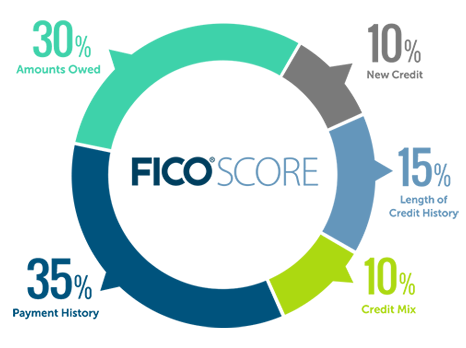

Your FICO score is determined based on the following categories:

- Payment History (35%)

- Utilization (30%)

- Credit History (15%)

- New Credit (10%)

- Mixed Credit (10%)

You can find out more about how your credit score is determined here.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

The “New Credit” category

As you can tell by the breakdown above, payment history is the #1 factor that affects your credit score. Second is credit card utilization (which is how much of your current credit limits you are using).

So where do hard inquiries fall?

Hard inquiries fall into the “New Credit” category which accounts for 10% of your score. Other factors that are considered in this category are:

- How many new accounts you have

- How long it’s been since you opened your last account

So it’s important to remember that hard inquiries only affect a portion of 10% of your total credit score.

That’s not a lot but that doesn’t mean that you should disregard the impact of hard inquiries.

While the numerical impact may be minimal, having too many of these on your credit report can make getting approved for credit and good interest rates very difficult.

So it is vital that you properly manage the pace at which you incur hard inquiries.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How long do hard inquiries stay on your credit report?

Hard inquiries will remain on your credit report for two years.

On occasion, hard inquiries will not drop off your credit report or they may take extra long to drop off. If for some reason you see a hard inquiry on your credit report that is over two years old you should dispute/report it as inaccurate ASAP.

How much do hard inquiries affect your credit score?

Overall, a hard inquiry will usually drop a credit score by 2 to 5 points.

There are some additional things to consider about this.

Good credit scores are affected less

The more established your score is the less the impact a hard credit inquiry will have.

Let’s say that you’ve got a credit report with 100% payment history and multiple established credit lines with ages over 10 years.

In that case, a hard inquiry will have a minimal impact on your score of maybe only a couple of points.

Some even say you can even get away with no damage to your score at times.

Still, I would generally expect there to be some type of dip in your credit score after getting a hard inquiry even if you have a superb credit report.

Bad credit scores are affected more

Let’s say you have a very weak credit profile. Maybe you have a low credit score and little to no credit history.

If that’s the case, then the overall impact from the hard inquiry may be much worse.

It’s possible that your score could drop 10 points or more. This can be very discouraging to people trying to build up their credit score but as shown below the negative impact is only temporary.

Lots of new inquiries will make it worse

Finally, let’s say that you’ve just opened up a hand full of credit cards over the past few months.

In that case, you would have several back-to-back hard inquiries.

When you get an additional hard pull, you’ll probably feel the sting of that hard pull much worse than someone else with fewer inquiries.

And it makes sense that this would be the case.

If you are aggressively applying for credit lines there is a good chance that you are in a tough financial position. Credit card enthusiast aside, most people don’t go around applying for multiple credit lines when everything is gravy.

Therefore, banks will be more worried about lending to you and that is why the credit score drops.

How long do hard inquiries affect your credit score?

The short-term

Hard inquiries begin to lose much of their negative impact after about 60 to 90 days.

This is why some people wait 90 days in-between applying for multiple credit cards.

If you are trying to apply for a number of credit cards in order to maximize your rewards, then I would recommend to wait 90 days between applications.

The long-term

Hard inquiries will only affect your FICO credit score for 12 months.

FICO discounts hard pulls entirely after 12 months, so if you find your credit score lower than you think it should be, you can rule out hard pulls as the cause after one year from your latest hard pull.

Banks still looks at these

One extremely important thing to know is what while FICO may not factor in your inquiries that are over a year old, banks will.

Many banks are interested in seeing how many new accounts and how many new inquiries you have over the past two years.

If you’re applying for a credit card, you might have to try to explain why you have so many credit inquires.

The reason is that there are statistics that show that people with many inquiries might be less responsible and more prone to bankruptcy.

So just because hard pulls will lose their affect on your FICO score after 12 months, that does not mean that you’re in the clear with every financial institution.

Can I avoid hard pulls when applying for a credit card?

It is possible to avoid hard pulls when applying for credit cards. Once upon a time you could utilize some thing called the shopping cart trick but that doesn’t seem to be as reliable as I once was.

Some issuers such as American Express will not always perform a hard pull so by applying for their credit cards you can sometimes avoid the hard inquiry.

If you are concerned about hard inquiries then you can always do a little bit of research to see what credit bureaus are pulled by banks when you apply for credit cards.

By knowing which credit bureaus are pulled, you can strategically apply for credit cards while minimizing the impact from the hard inquiries.

FAQs

A hard inquiry will generally drop a credit score by 2 to 5 points. However, if you have a weak credit profile or have multiple recent inquiries the negative impact could be much worse such as over 10 points.

Hard inquiries begin to lose much of their negative impact after about 60 to 90 days. However, they will only affect your FICO credit score for 12 months.

Hard inquiries will remain on your FICO credit report for two years. However, they will only affect your FICO credit score for 12 months.

Final word

Hard inquiries stay on your credit report for two years but lose their impact after 12 months. But you still need to be mindful of how these hard inquiries will make lending institutions view you as a credit applicant.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.