The average amount of credit cards that people with at least one credit card have is just under 4. But is that number optimal or should you have more or fewer credit cards? In this article, I will break down how many credit cards you really need depending on your goals and preferences.

Table of Contents

How many credit cards do you really need?

The amount of credit cards that you need depends a lot on your goals and preferences.

I would divide people into four camps.

- Moderately interested in savings: Someone interested in earning savings mostly through spend and not that interested in chasing welcome bonuses

- Traveler moderately interested in savings: A light traveler interested in basic travel perks and earning savings mostly through spend and not that interested in chasing welcome bonuses

- Seriously interested in savings: Someone interested in optimizing savings through spend but also through earning some welcome bonuses

- Traveler seriously interested in savings: A more frequent traveler interested in optimizing several travel perks and savings through spend but also through earning some welcome bonuses

Depending on your travel and savings goals, here’s what I would recommend (give or take a card or two):

- Moderately interested in savings: ~4+ cards

- Traveler moderately interested in savings: ~6+ cards

- Seriously interested in savings: ~8+ cards

- Traveler seriously interested in savings: ~14+ cards

I’ll explain where these totals come from based on different scenarios below.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Credit score boosters

- Moderately interested in savings: 2+ cards

- Traveler moderately interested in savings: 2+ cards

- Seriously interested in savings: 2+ cards

- Traveler seriously interested in savings: 2+ cards

Credit score boosters are credit cards that you maintain for the primary purpose of benefiting your credit score. These cards are your oldest cards and they might offer some rewards but even if they don’t, they are worth keeping for the benefits to your credit.

In most cases you want to hold onto them in order to build payment history, provide financial breathing room, and increase the average age of your accounts (AAoA).

Here’s what I mean:

- Even if your payment history is 100% it’s better to have two or more accounts with 100% than one

- Having extra credit lines means it’s easier to keep your utilization lower

- AAoA is a very important factor for your credit history which accounts for 15% of your credit score.

Many times when it comes to rewards these cards will be border-line worthless like old store cards you opened while in college but there are some that can also earn good rewards.

The Chase Freedom Unlimited is a great example (1.5X on all purchases) and it is actually my oldest credit card that I hold onto to boost my average age of accounts. The Blue Cash EveryDay is another great no annual fee option that earns solid rewards (3% at U.S. supermarkets (on up to $6,000 per year) and 2% on gas and department stores).

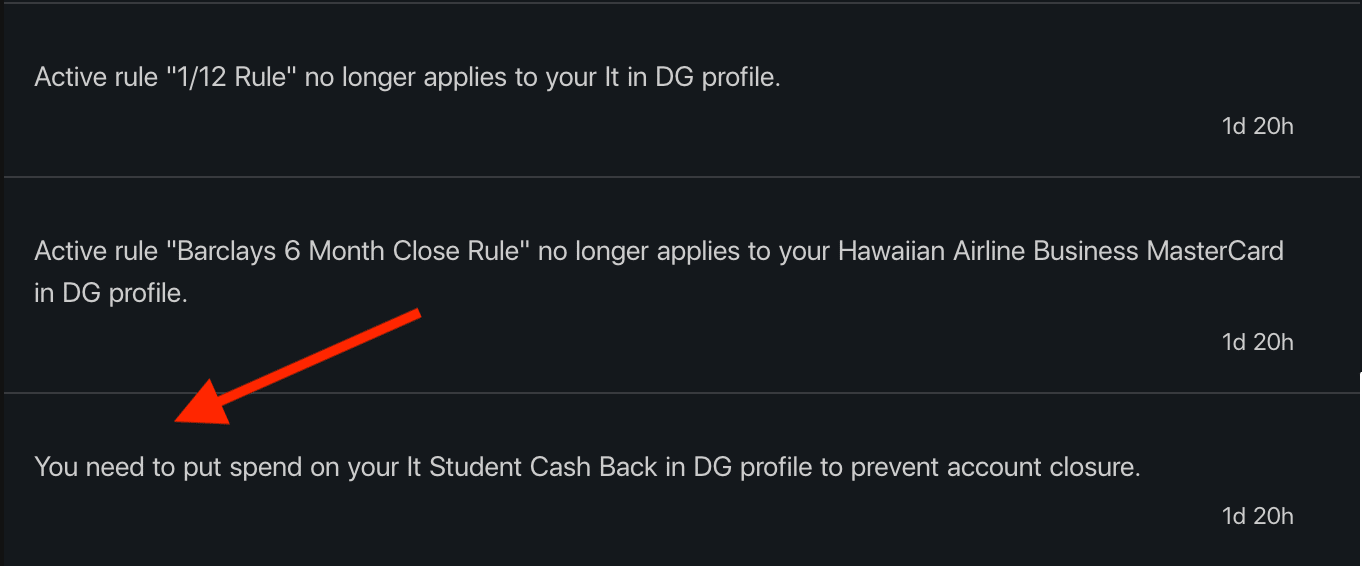

The key with these cards is to remember to put spend on them so that they do not get automatically closed by the banks. (You can get reminders to do this with WalletFlo.)

You may only want one of these booster cards but having two or more is a great way to further boost your payment history and mitigate damage done by canceling other cards.

Bonus spend maximizers

- Moderately interested in savings: 2 cards

- Traveler moderately interested in savings: 2 cards

- Seriously interested in savings: 3 cards

- Traveler seriously interested in savings: 5+ cards

If you are not using at least one card that earns bonus categories on your spend you are likely missing out on lots of value/savings each year.

Let’s say you spend $10,000 on dining and groceries in one year.

If you were using a basic card and earning 1% back you would earn a total of $100 back in rewards but if you were using a card like the Gold Card that earns 4X Membership Rewards, you would be earning 7% back or $700 back in value (at a valuation of 1.75 cents per point).

That is a huge difference of $600 in savings and that is just using one card as an example.

The amount of cards that you need to maximize your bonus spend just depends on your level of commitment to savings.

I think the sweet spot for the average Joe seriously interested in savings is three credit cards.

Three credit cards can cover a broad range of expenses and it is not that difficult to keep tabs of three cards and what categories that they earn points in.

Three is also a good number because you can get a card optimized for all purchases and two cards that cover various categories you spend a lot of money in.

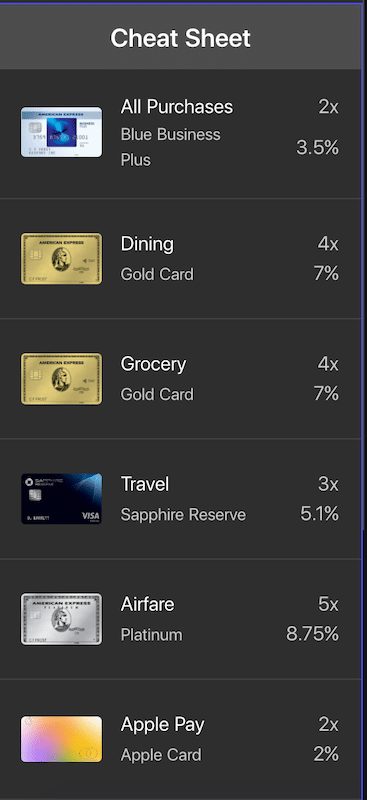

Your lineup could look like:

- Gold Card (4X at restaurants and US Supermarkets)

- Sapphire Reserve (3X Travel)

- Amex Blue Business Plus (2X All purchases)

If you are more serious about maximizing your bonus points and savings (especially for travel), then you probably will have 4 to 5 cards that you use on a regular basis.

In that case your cards might look like the following:

- Gold Card (4X Dining and Groceries)

- Sapphire Reserve (3X Travel)

- Amex Blue Business Plus (2X all purchases)

- Platinum Card (5X airfare and some hotels)

- Chase Ink Business Cash (5X internet, cable, phone, gas)

Just adding one card like the Chase Ink Business Cash could make a huge difference in savings. For example, we pay around $600 each month for all of our internet, cable, and phone bills. So earning 5X on that each month amounts to 8.65% back, which comes out to $622 worth of savings! And remember the Chase Ink Business Cash has no annual fee so that is pure savings.

Finding out which category you earn your most points in is something that WalletFlo will help you accomplish. There will be a cheat sheet and also a breakdown of all of your bonus categories with the top earners ranked at the top so you’ll always know your top cards.

Hotel and airline cards

- Moderately interested in savings: 0+ cards

- Traveler moderately interested in savings: 2 cards

- Seriously interested in savings: 0+ cards

- Traveler seriously interested in savings: 3+ cards

If you never travel, then obviously your need for a hotel or airline card is probably nonexistent even if you are seriously interested in savings.

But if you are a traveler interested in savings, then you probably should have at least one hotel and one airline credit card.

If you travel just a couple of times a year, you can save by taking advantage of perks like free checked bags. With just three roundtrips a year, you could save $180 on baggage fees every year. A card like the United Explorer card would be a perfect example.

Having a hotel card with a major hotel program is a major help as well because you can earn a lot of points on those hotel stays but also receive perks like free breakfast and possibly things like late check out.

If you valued free breakfast at $30 for two people per morning and late check-out at $50 then a card offering those perks when staying just five nights per year could net you $200 worth of perks.

The Hilton Surpass is a fantastic card for people looking for valuable elite benefits that come automatically with the card.

Annual fees for hotel credit cards can be very easy to offset with the free nights that they offer on an anniversary basis. A free night could easily net you $200 or more in value in many places so it’s easy to cancel out the annual fee and still save plenty.

If you are a frequent traveler, then you can easily double up or triple up on hotel and airline credit cards. Since you will be making several hotel stays, you can use those anniversary free nights every year without issue.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Balance transfer needs

- Moderately interested in savings: 0 to 1+ cards

- Traveler moderately interested in savings: 0 to 1+ cards

- Seriously interested in savings: 0 to 1+ cards

- Traveler seriously interested in savings: 0 to 1+ cards

A lot of people need balance transfers when they have ran up too high of a balance on a credit card.

The Capital One Quicksilver Cash Rewards Credit Card is a great option for balance transfers. It is great because it has a 0% APR period of 15 months for your balance transfers and the transfer fee is only 3%. Plus, you can earn some cash back on top of your balance transfer savings which makes this a very attractive option for balance transfers.

Welcome bonus cards

- Moderately interested in savings: 0 cards

- Traveler moderately interested in savings: 0 cards

- Seriously interested in savings: 1+ cards

- Traveler seriously interested in savings: 1+ cards

At any given time, someone seriously interested in credit card rewards and savings will likely have a welcome bonus card. This is a card that you are focused on getting up front value with and you will decide what to do with it after your one year anniversary. Maybe you upgrade, maybe you downgrade but your primary focus in the beginning is earning more rewards.

For example, you may not know if you really want to keep the American Express Platinum Card but you know that the welcome bonus of 60,000 points is very valuable so you decide to jump on board and make your decision on whether or not to keep it after you have experimented with the card for one year.

There is a lot of overlap with these cards and cards that are offer great bonus categories, small business cards, and hotel and airline cards, so this often won’t add a huge amount to your total. But occasionally, you might pick up a card that doesn’t necessarily fit right into your travel plans and that could add to your total.

Small business cards

- Moderately interested in savings: 0 cards

- Traveler moderately interested in savings: 0 cards

- Seriously interested in savings: 2+ cards

- Traveler seriously interested in savings: 3+ cards

Small business cards are very helpful because they can minimize the impact on your credit score by not bringing down your average age of accounts and also can allow you to stay or get under 5/24. This can allow you to pursue many more welcome bonuses and earn a lot more savings.

For this reason, I think that anybody serious about earning constant rewards should have a business card or two open at various times. Some people might even stick exclusively to small business cards for a while. And it makes sense, especially since some come with such high bonus offers like the Chase Ink Business Preferred and Chase Ink Business Cash.

But if you are not all about credit card rewards and are not familiar with setting up a business, then you likely will not have any small business credit cards at all and that is totally understandable.

Purchase and travel protections

- Moderately interested in savings: 0 additional cards

- Traveler moderately interested in savings: 0 additional cards

- Seriously interested in savings: 0 additional cards

- Traveler seriously interested in savings: 0 additional cards

One of the biggest advantages to using credit cards for your purchases is the ability to take advantage of special purchase and travel protections.

Luckily, some of the best cards that offer travel protections and purchase protections also offer great bonus category spend. For example, with the Amex Gold and the Sapphire Reserve, I get great bonus categories and travel and purchase protections. So you don’t have to pursue additional cards to obtain these valuable protections in many cases.

Final word

Once again, here’s what I would recommend based on your goals and savings preferences.

- Moderately interested in savings: ~4+ cards

- Traveler moderately interested in savings: ~6+

- Seriously interested in savings: ~8+ cards

- Traveler seriously interested in savings: ~14+ cards

That might sound like a lot to manage at the top end but that is one reason I developed WalletFlo — to make keeping tabs on all of your cards easier via automation.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Currently active/open personal+biz cards:

Me = 34

Player 2 (10yrs younger) = 19

Over 2 million points & miles accumulated — without ever taking a flight or booking a hotel outside our home state. When we’re able to travel more, we’ll have a few options at least.

Myself, I see long term value in 15 of the 34 cards I have. 4 more kept around purely for avg account age. The only accounts that get closed are those that offer poor value — which is on the card issuer.

Wow 34. You are up there! You might crash WalletFlo if you use it. 😉 That’s about the same percentage I usually find for cards were keeping — about half.