Goodwill letters to creditors are the first line of defense for many trying to rebuild their credit by getting negative remarks like late payments removed. Goodwill letters are simple letters that just about anyone can author but their success is also very hard to predict. Still, because they are so easy to create and send out it’s often worth giving goodwill letters a shot.

What is a goodwill letter to a creditor?

A goodwill letter is your opportunity to send in a short and sweet letter to request for your lender (or sometimes collection agency) to remove late payments from your credit report. The reasoning for the request is based on reasons that have nothing to do with any mistake made by the lender. Instead, you are requesting for negative information to be removed based on the “goodwill” of the lender.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What goodwill letters are not meant for

Goodwill letters are typically not effective for certain types of derogatory marks, such as bankruptcies, liens, and judgments and are mostly used to remove late payments. Also, you generally do not want to send in a goodwill letter for late payments or charge offs that are not paid in full.

As you could imagine, a lender is not going to be feeling very gracious when you haven’t even paid your outstanding balance. If you’ve settled an account you might still give it a try but goodwill letters are best used on late payments for accounts paid in full.

What needs to be in a goodwill letter?

Goodwill letters do not need to be long but they do need to include some specific information in order to maximize your chances of getting negative remarks removed.

Include your identifying information

You want to make the lender’s job as easy as possible when sending in these letters. Start by properly formatting your letter to include your name, address, telephone number, and all of your account details for that lender.

If you have multiple late payments, be sure to identify the exact months and years that were late and by how many days they were late. It’s often helpful if you can print out a portion of your credit report to show them how the late payments are showing on your credit report, although this is not necessary.

Explain your situation

Your goodwill adjustment letter is your chance to show a lender why they should remove the late payments from your credit report.

This is usually done by explaining the circumstances around why your payments were late. For example, if you experienced hard times (a death in the family, loss of job, medical condition, etc.), you will want to bring up this information. You can also add information as to why it’s so important for the late payment to be removed (maybe you’re trying to buy a home, a vehicle for work, etc.).

When including personal details about your situation, disclose all of the pertinent details to build your case but try not to be overly dramatic so that you can retain credibility with whoever is reading your letter.

If you have a long track record of making payments on time with this lender then you absolutely want to highlight this by showing them how responsible you’ve been in the past. Let them see you as a valuable customer who simply had an anomalous slip-up that won’t happen again.

Sometimes you can express your willingness to do things like signing up for auto payment to show the lender how sincere you are about responsibly managing your account.

Strike the right tone

Try to make yourself sound likeable and reasonable (hopefully this isn’t too hard).

Go for a pleasant and apologetic tone. Avoid trying to “sound smart” by using an unnecessary amount of big words and don’t word your letter too sternly. That last thing you want to do is sound like a know-it-all, entitled, or like you’re taking your anger and frustration out on the lender.

Keep your goodwill adjustment letter short

You also want to just keep these goodwill letters short. Lenders see these letters all the time and sending in an entire dissertation on why your late payments should be removed is only going to increase their load and not your chances of removal. As a rule of thumb, keep these letters to a few paragraphs and at a maximum one page.

Manage your expectations

When sending goodwill letters, it’s important to not keep your expectations too high. Lenders are obligated to report late payments to the credit bureaus and are under no obligation to remove your negative information unless there is some type of error with the reporting. So give it a try, hope for the best, and consider it a surprise if it works in your favor.

Drawbacks

There aren’t many drawbacks to sending in a goodwill letter but there are a few potential negative outcomes that could happen. These drawbacks are pretty rare but it’s still a good idea to be aware of the potential negative aspects of sending in such a letter just in case you have bad luck.

Admitting responsibility (on the record)

If you think there might be any grounds for disputing the late payments as inaccurate, you want to be careful about taking responsibility for the late payment. Sometimes lenders will use your goodwill letter against you as an admission of fault for a late payment. In the case of student loans where you might have ground to argue that a deferment or forbearance was not processed properly, this is something to be aware of.

Negative corrections to your report

If your negative mark is only reporting to one credit bureau it’s possible that the lender will see this when receiving your report and actually decide to “update” your report so that all three credit bureaus will show the negative remark. Or perhaps there were other late payments that the lender didn’t report but will discover upon reviewing your file.

Account deletion

It’s even possible that a lender could delete your entire account after processing your goodwill letter (this is more common with accounts that are already closed). If this happens, the removal might boost your score but you could lose the benefits of having the older account on your credit report.

Comment on credit report

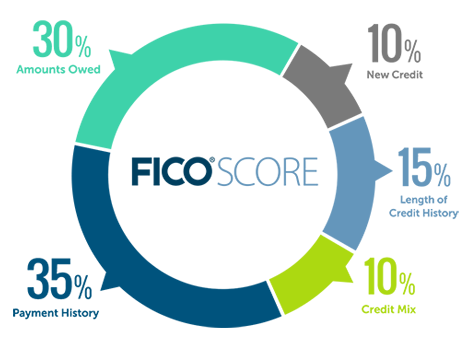

There’s also a small chance that your goodwill letter could lead to a dispute comment on your credit report. Sometimes these comments can force FICO to treat your accounts a little differently. For example, FICO might ignore an account while it’s disputed and that could affect things like your utilization. Also, if you’re seeking a mortgage, these types of comments can sometimes cause lenders to deny you.

Send the goodwill letter

You can send your goodwill letter via mail, email, fax, online log-in portal communication, or even call in and speak to someone.

Sending a letter via mail is probably the standard procedure for sending goodwill letters. Some like to send their letters via certified mail but sometimes this can appear like you’re gearing up for a legal confrontation and could cause someone to respond defensively toward your letter.

I would personally prefer to mail my letter (non-certified), fax my letter, or send it in via email just to send out the right vibes.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Who to address the letter to

When you send the letter to a lender you can send it to many different addresses.

Many start by sending their goodwill letters to the address found on their bills or an address for things like “card member services” but these letters will often be processed by entry level agents who many not have authority to handle your issue. You can also use the creditor’s address found on your credit report. However, many people are increasingly addressing their letters to corporate recipients.

To do this you can search a company’s corporate website for contact information and look for a “contact us” section or similar where you can find both mailing and email addresses. Feel free to take down all of the relevant email addresses you find on a corporate website and address separate emails to all of them. You never know who may or may not respond.

You can also use corporate directories like www.consumerist.com, www.lead411.com, www.hoovers.com, and others to find contact information. Some of these might not always be updated so you’ll need to follow up.

On the company corporate websites you can sometimes find information for departments like card services. If you can’t find an individual to send your letter to then sending it addressed to a relevant department in the executive offices is still a good option. The key is to continue to try different departments and personnel until you get a response. Eventually someone will likely respond.

Some people also have luck with other methods like email guessing which you can read more about here.

The response

Sometimes you will never get a response from the lender. Instead, you’ll need to monitor your credit report to see if any changes are made to your credit report.

Goodwill letter sample

There are hundreds of sample goodwill letter online. I recommend searching for a specific type of goodwill letter that relates to your unique situation. If you can’t find one then simply customize a sample letter by including the details of your situation. Here’s a good resource for letter samples.

Avoid drafting a cookie-cutter, cut and pasted letter that an executive will see right through. Put some originality into it along with a personal touch to make it more effective.

Final word on goodwill forgiveness removal letter

Overall, there’s never a guarantee that these goodwill letters will work but it’s usually always worth giving them a try because of how easy they are to write and the low risk of something going wrong.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

This is an excellent post… Thank you !