Getting approved for a small business credit card is not nearly as difficult as many think. As long as you have a decent credit score and some form of a business, then you’ll be eligible to apply for some of the best business credit cards. In this article I’m going to discuss some tips and tricks for how to get a business credit card and then give you a few of my top recommendations.

Why do you need a business credit card?

One of the biggest reasons that people seek out business credit cards is to segregate their business expenses from their personal expenses. This is often a necessity for accounting and tax purposes and it’s also good for general record-keeping.

But business credit cards also come with special bonus categories that are often ideally suited for small businesses and start-ups. These are bonus categories like advertising, travel, shipping, gas, and telecommunications. By picking the perfect business credit card, you’ll be able to earn cash back or earn valuable rewards that you can use to travel more often (or more comfortably like in Qatar first class).

How to get a business credit card

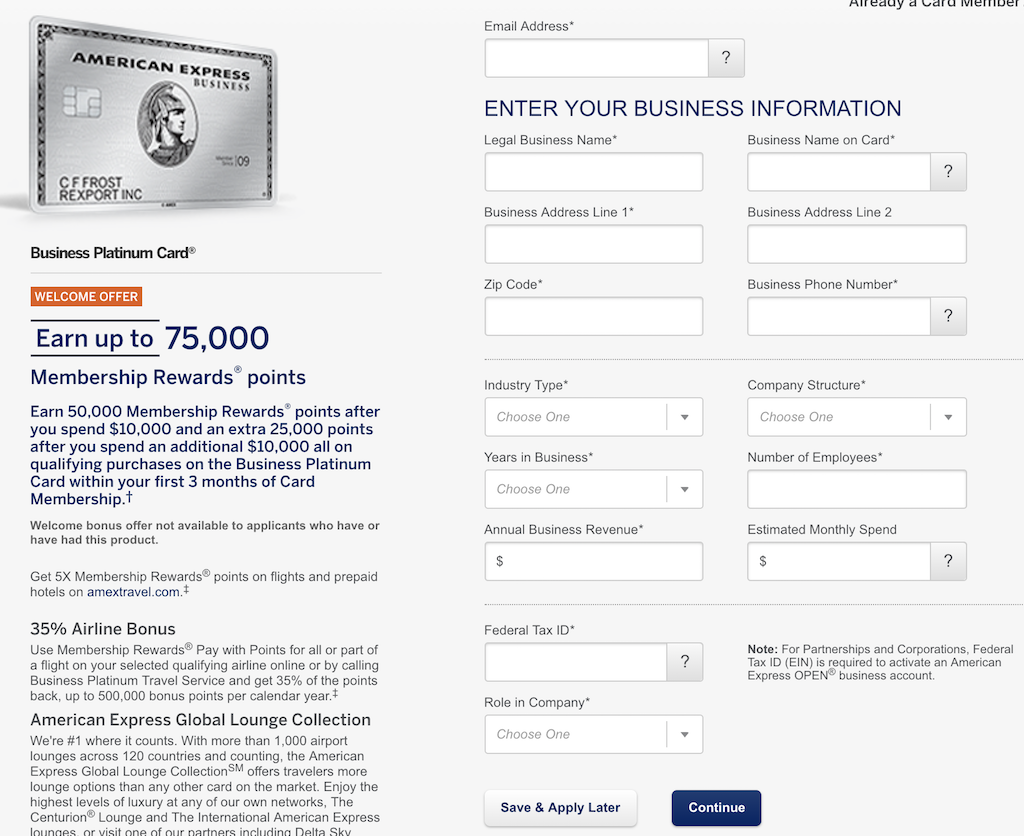

Getting a business credit card is a lot easier than you probably think. The application process usually works almost the exact same way as applying for a personal credit card. The only difference is that you need to supply additional details about your business.

What additional details you need depends on which bank you’re applying for. Some banks only ask for a couple of extra details but others will ask you to get much more in depth about the nature of your business.

Potential questions you might see on a business card application include:

- Legal business name

- Business address

- Industry type

- Company structure

- Age of business

- Number of employees

- Annual revenue

- Estimated monthly spend

Again, different banks ask different questions so I suggest that you round up all of the relevant details for your business before you apply. Or you can simply look up the application online to see what fields you’ll be required to fill out.

How to get approved for a business credit card

The different banks vary in how they approve applicants for business credit cards but there are a few things you can do to improve your approval odds.

Have a good personal credit score

A lot of people don’t know this but there are separate credit scores for your business and your personal profile. However, it’s your personal credit score that will usually dictate whether or not you are approved for a business card (especially for your first business card). Remember, you are personally liable for debts incurred on these business credit cards, so the banks want to make sure that you are financially responsible.

A good credit score for business credit cards is generally going to be around 720+ but you you can still get approved for business cards with lower scores (even in the 600s). In my personal experience, Amex business credit cards can be some of the easiest to get approved for but your situation could differ.

If you’re not very confident about your credit score you can do a couple of things to improves your approval odds.

Open a business bank account

You can open up a business bank account with your prospective credit card issuer. This shows them that you are serious about your business and could lend credibility to your revenue numbers.

In order to open a business bank account you might need documentation for an LLC, d/b/a, etc. D/b/a documents are generally easy and cheap to get and you can check with your local state or county court for requirements.

Open up a personal credit card

You could also just open up a personal credit card with that bank to establish a relationship with them. For example, if you wanted the Chase Ink Business Preferred you could apply for the Chase Sapphire Preferred or even the Chase Freedom and then wait a few months to go for the Ink.

- Read about my tips for getting for getting approved the Chase Ink for more specific tips.

Know how to handle a recon call

This is very important, especially if you every plan on applying for Chase business cards like the Ink. If you’re not instantly approved for a business credit card there’s a good chance that you’ll have to call in to “reconsideration.”

This is a phone call where you’ll be asked a lot of very specific questions about your business, such as your revenue, size, profit, etc. This is why it’s a good idea to make a cheat sheet with all of the important details of your business so that the information on your application will be accurate.

I highly suggest for you to read my Tips for a Chase Reconsideration Call article.

Have a business

This should be obvious but you’ll need a business to apply for a business credit card. You don’t always need a traditional LLC, corporation, partnership, etc. If you don’t currently have a money-making business (or any business at all) there’s still hope for you.

How to get a business credit card for a new business

If you have a new business that just started or even a business that has not brought in any revenue, you can still get approved for a business credit card. Some people have been approved for business credit cards with zero revenue but sometimes that lack of revenue can result in your denial.

If you have an accurate method for projecting your revenue over the next year you could always provide a good-faith estimate for your revenue. Keep in mind that sometimes these applications can end up in financial review so always have some reasonable basis for your projected revenue.

And if it’s your first business card, some people recommend combining your personal income with your business revenue since your personal credit report is purely what that approval will be based on.

How to get a business credit card without a business

If you don’t have a business at all then you need to start one. The good news is that it’s incredibly easy to start a business. If you do any type of selling or reselling, whether on eBay, Amazon, Craig’s List, etc., that can definitely qualify as a business.

Or maybe you do some type of consulting or tutoring on the side? That can also serve as a business. Again, you never want to be untruthful on a credit card application. Especially when it only takes a small amount of initiative to start a side hustle.

When you do start something like your own re-selling business, the name of your business will typically be something like “First Name Last Name, Consulting” or “First Name Last Name, Contracting.”

Do I need an EIN for a small business credit card?

If you are creating your own small business by reselling items or consulting, it’s possible to form that business without ever creating an Employer Identification Number (“EIN.”)

In this case, you would select “Sole Proprietorship” as your company structure on your credit card application. If you only see a field on the application for an EIN or Tax ID Number, you should be able to just put your social security number in that field.

How to get a business credit card without using your social security number

If you’d rather not use your social security number, you can easily create an EIN in a matter of minutes. Simply go to the official IRS website and you’ll be able to create an EIN very quickly.

Things to Know about business credit cards

Many business credit cards like those from Chase, Amex, and Citi do not report to your personal credit report. This means that they won’t show up as new accounts which will help mitigate the damage done to your credit report.

Also, any balance you keep on those non-reporting credit cards will not show up on your personal credit report. That’s why some business credit cards like the American Express Blue Business Plus are ideal for balance transfers. You can basically lower your utilization in an instant and improve your credit score.

My favorite business credit cards

There are a ton of great business credit cards offered nowadays. But below a few of my favorites. I like these mostly because of their great bonus categories which are perfect for many small businesses, especially if you spend money on advertising and travel. They also earn some solid rewards.

The Chase Ink Business Preferred

The Ink Preferred comes with one of the best sign-up bonuses at 80,000 Ultimate Rewards after spending $5,000 in the first 3 months! At a valuation of 2 cents per point, that’s $1,600 worth of rewards. Even if you only redeemed these for a statement credit, that’s still an $800 rebate!

The Ink Preferred also earns 3X on the first $150,000 spent in combined purchases on:

- Travel

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases with social media sites and search engines

- You can click HERE to learn more about this card and compare it others.

American Express Blue Business Plus Credit Card

The American Express Blue Business Plus Credit Card is one of my top business credit cards because it earns a whopping 2X on all purchases up to $50,000 per year. Since I value Membership Rewards close to 2 cents per point, that’s 3.5-4% back on all purchases (up to $50,000 per year) in the form of Membership Rewards!

And this card comes with an intro 0% APR period. So if you need to make a big purchase, you can make that purchase and pay it off over time without any interest and without it reporting to your personal credit report. It’s a great way to handle big purchases if you don’t want to affect your personal credit score.

The Business Gold Rewards Card

The Business Gold Rewards Card from American Express OPEN is great because it allows you to choose one category to earn 3X the points on. You can choose from any of the following categories to earn 3X on:

- Airfare purchased directly from airlines

- U.S. purchases for advertising in select media

- U.S. purchases at gas stations

- U.S. purchases for shipping

- U.S. computer hardware, software, and cloud purchases from select providers

This card also comes with a high welcome offer of 50,000 Membership Rewards points after you spend $5,000 in the first 3 months. This was my first business credit card and I recall earning a lot of Membership Rewards from this card over the course of a year with the great bonus spending categories.

Capital One Spark Cash for Business

The Capital One Spark Cash Visa is a very simple cash back credit card that earns 2% back on all purchases. This small business credit card is a great option for anybody looking for a simplified rewards structure. The Capital One Spark also comes with a hefty early spending bonus of $500 after you spend $4,500 on purchases within the first 3 months of being approved. And the annual fee is waived the first year!

Southwest Rapid Rewards Business Credit Card

The Southwest Rapid Rewards Business Credit Card is one of the most-prized credit cards right now. Chase recently prevented applicants from picking up two personal Southwest credit cards which made obtaining the coveted Southwest Companion Pass more difficult. But with this business card’s all-time high 60,000 point sign-up bonus you’ll be on your way to earning the Companion Pass in a hurry!

How to get a business credit card with bad personal credit

If you have a bad personal credit score you might struggle to get approved for some business cards. But there are still some options out there like the Applied Bank® Visa® Business Card which are easier to get approved for.

Final word

As you can probably tell, it’s not very difficult to get approved for a small business credit card as long as you have a decent credit score and some form of a business to your name. However, it’s still a good idea to read up on what to expect when applying for certain cards and to consider additional ways to improves your approval adds like opening up a business checking account.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

After I read your article I just realized that No wonder every time I check for credit cards Amex offers me pre-approve business credit cards and I never paid attention so if I take a chance to apply for one of them I probably be approved, I just wondering, is good to know more about credit