Discover pre-approval offers can give you some extra assurance when applying for Discover cards.

But how exactly do you get these offers and what do they mean for your approval odds?

This article will take a close look at what you need for Discover pre-approval offers and show you how to check for them. I’ll also provide you with some specific credit scores that pulled up pre-approval offers in the past.

Interested in finding out the hottest travel credit cards for this month? Click here to check them out!

Table of Contents

What are Discover credit card pre-approval offers?

Discover pre-approval offers are special offers that can be pulled up for applicants who have a high chance of getting approved for various Discover credit cards. However, they do not guarantee approval.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What Discover credit cards can I get pre-approved for?

Below is a list of Discover credit cards you might want to try to get pre-approval offers for.

- Discover it Secured (example)

- Discover it Cash Back

- Discover it Student Cash Back

- Discover it Student Gas & Restaurants

- Discover it Balance Transfer (example)

- Discover it Miles

- Discover it Chrome

The Discover it Cash Back is a terrific no-annual fee credit card that allows you to earn 5% back on quarterly categories. You’ll earn 1% back on all other purchases.

And at the end of the year, cash back earnings are doubled the first year so it equals to 2% back on all purchases and up to 10% back on your quarterly categories (and you get a free FICO score).

Here’s a historical look at what the Discover it quarterly categories have been over the past five years.

2017

- Q1: Gas Stations, Ground Transportation, and Wholesale Clubs

- Q2: Home Improvement Stores & Wholesale Clubs

- Q3: Restaurants

- Q4: Amazon.com & Target

2016

Q1: Gas & Ground Transportation (including car rental)

Q2: Restaurants & movies

Q3: Home Improvement Stores & Amazon.com

Q4: Department Stores, Amazon.com, Sam’s Club

2015

Q1: Gas & Ground Transportation (Car Rental, Taxi, Limo, Public Transport)

Q2: Restaurant & Movies

Q3: Home Improvement Stores, Department Stores, and Amazon.com

Q4: Amazon, Department Stores, Clothing Stores

2014

Q1: Restaurants and Movies

Q2: Home Improvement Stores, Furniture Stores, Bed Bath Beyond

Q3: Gas stations

Q4: Online Purchases, Department Stores

2013

Q1: Restaurants, Movies

Q2: Spring Style (shows a picture of a flower) Clothing and home improvement

Q3: Summer Fun (shows a picture of a gas pump handle) Gas stations

Q4: Holiday Shopping (shows a picture of a gift bow) Department stores, Amazon.com

H/T: My FICO

How to check for Discover credit card pre-approval offers

You can find Discover pre-approval offers here.

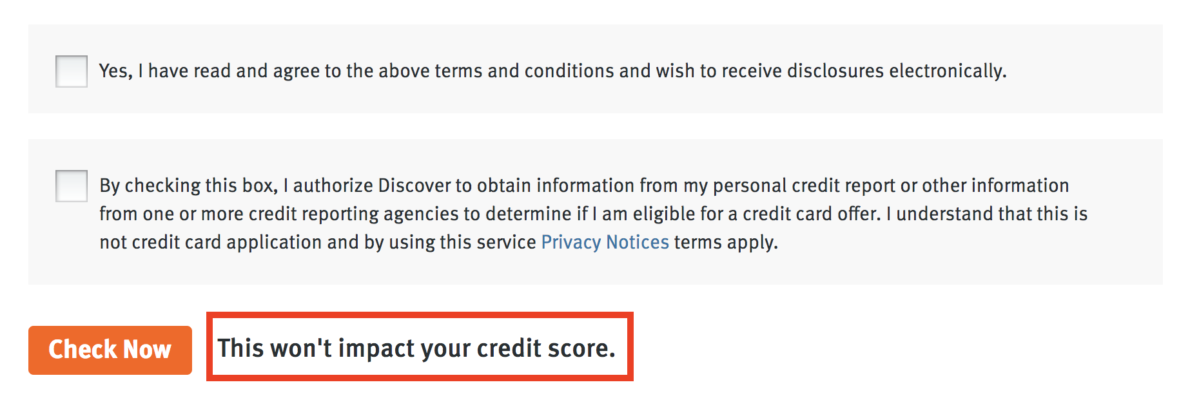

Does checking for Discover pre-qualified offers affect my credit?

Rest assured, filling out the pre-approval form will not impact your credit score — the websites even states “This won’t impact your credit score.”

This is because Discover will not perform a “hard pull” when applying for pre-approval offers. Instead, it’s more of a “soft pull” that won’t bring down your credit score. You can read more about how credit inquiries affect your credit score.

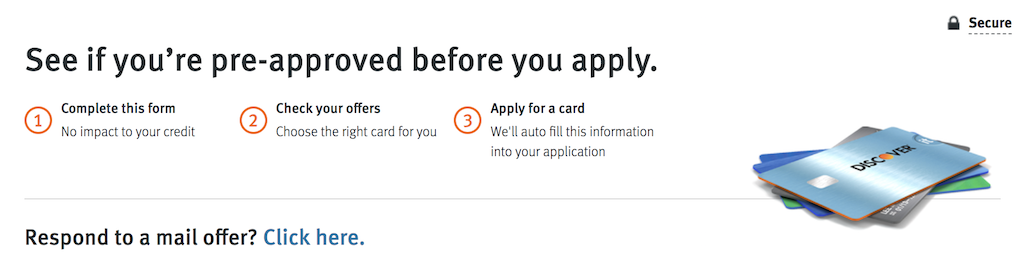

How to pull up the offers (Discover pre-approval tool)

The online Discover pre-approval page requires you to input more data than most pre-approval pages.

In fact, you might think that it’s a full-on credit card application since it requires your full social security number along with income and other information.

So to get your pre-approval complete the following:

- Step 1: Go to the pre-approval page

- Step 2: Enter in your personal information:

- Name

- Address

- Student status

- Total Annual Gross Income

- Monthly Housing/Rent Payment

- Housing Status

- All nine digits of your social security number (SSN)

- Checking or Debit Account

- Savings, IRA, or Money Market Account

- What card benefit is most important to you

- Step 3: Check the boxes and click “Check Now”

Income

If you are 21 or older, you can include income that is reasonably accessible to you.

So for example, you would (typically) be able to include your spouse’s income when reporting your total annual gross income.

What credit score is needed for Discover pre-approvals (approval odds)?

I did some research on approval odds and found pre-approved offers for the following credit scores:

The bolded are self-reported approvals.

Of course, the lower that your credit score is, the higher that your interest rate will likely be and the lower your credit limit will be as well. Also, if your credit score is low (lower 600s), you might only get approved for the secured credit cards.

My advice would be to try to get into at least the mid 600s to go for pre-approvals but obviously the closer you get to the 700s, the better.

- Related reading: Discover it vs Discover it Chrome

Can you be denied for pre-approvals?

Just like with other major issuers, it’s possible to be denied for a Discover card even when you received a pre-approval offer.

Be aware there are some offers you might receive that probably don’t mean anything special for your approval odds, such as the offer found here on myFICO shown below:

Here’s The Card We Found For You

The Discover it card is changing the game.

Your Offer

- No Annual Fee*

- 0% Intro Purchase APR* for 14 months and then 10.99%– 22.99% Standard Variable Purchase APR.

- 0% Intro Balance Transfer APR* for 14 months from date of first transfer, for transfers under this offer that post to your account by July 10, 2014 and then 10.99% – 22.99%Standard Variable Purchase APR.*

- 3% of the amount of each transfer .

* See rates, rewards and other info

Notice there’s no specific language about being “pre-qualified.” Also, the interests rates can be telling.

Fixed APR or APR range

Like some other issuers, many remark that your approval odds are better when you’re shown a fixed APR versus a range of an APR.

So for example, if you were shown an APR of 15.4% your odds might be better than if you were shown an APR range of “18.2% to 20.3%.”

- Related reading: Discover it vs Discover it Student

Pre-approvals and hard pulls

One cool thing about some pre-approvals is that when you get approved, you might not incur a hard pull on your credit report.

I’m not sure how to predict when this happens, though, and I would generally expect to receive a hard pull so you’re not caught by surprise.

What credit bureau does Discover pull?

Discover will likely pull your Experian credit report but it’s possible that they might pull your credit reports from TransUnion and Equifax. You can read more about which banks pull which credit bureaus here.

Discover credit card application rules

You can only hold a maximum of two total Discover credit cards. But keep in mind that your first account needs to open for a year before your second card can be opened.

You are also limited to one student card. To automate your credit card eligibility be sure to check out the free app WalletFlo.

Discover Reconsideration Line

If you’re denied for a credit card from Discover then you can always call their reconsideration line phone number at: 888-676-3695 or 1-800-DISCOVER.

Read my article on tips for the Chase Reconsideration line here to learn how to handle a recon call. While that article is for Chase, many of the same tips would apply for the Discover it.

Discover Deals

Update: No longer available.

Don’t forget that if you get approved for a Discover credit card, you’ll get access to Discover Deals.

This allows you to earn great cash back rates at major stores like Walmart, Target, and many others. You can also find discounts at stores like BestBuy.

When using tools like Cash Back Monitor and EvReward to monitor the cash back rates, you’ll notice that Discover Deals is often at the top of the earnings, so it’s truly a valuable program.

Other pre-approval links

Other major issuers also offer pre-approval/pre-qualified offers.

Some of them have unique quirks and I write about them in the articles below so you can know what to expect.

Amex pre-qualified offers

Citi pre-qualified offers

Chase pre-qualified offers

Final word

If you’re interested in a good cash back credit card then you should think about trying to go for a Discover pre-approval. It’s pretty easy to check for your offers and if you get lucky, you might even get approved without a hard pull.

And lastly, you can get pre-approved offers with credit scores in the mid-to-low 600s, so many people could potentially qualify.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.