The Discover it and Discover it Student are two very popular cash back credit cards. They are very similar credit cards but there are some key differences between the two cards which are worth pointing out. Here’s a close look at the Discover it vs Discover it Student.

Update: Some offers are no longer available — click here for the latest deals!

Sign-up bonus

One of the drawbacks to the Discover it Cash Back and Discover it Student Cash Back is that they don’t come with sign-up bonuses. For example, some cards mat offer you something like $150 back after you spend $1,000 in the first three months after account opening.

This means that with both Discover it cards, you’re going to be missing out on up-front value compared to other options.

But that’s not a major blow considering how lucrative the rewards can be with these cards and I’ll show what you what I mean.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Bonus earnings

The bonus earning structure is the same for both of these cards.

They each earn 5% back on special quarterly categories which change each year. This means that every three months there will be a new special bonus category like dining or gas that you can spend on in order to earn 5% cash back.

Here’s a look at what the categories have been in the past.

2017

- Q1: Gas Stations, Ground Transportation, and Wholesale Clubs

- Q2: Home Improvement Stores & Wholesale Clubs

- Q3: Restaurants

- Q4: Amazon.com & Target

2016

Q1: Gas & Ground Transportation (including car rental)

Q2: Restaurants & movies

Q3: Home Improvement Stores & Amazon.com

Q4: Department Stores, Amazon.com, Sam’s Club

2015

Q1: Gas & Ground Transportation (Car Rental, Taxi, Limo, Public Transport)

Q2: Restaurant & Movies

Q3: Home Improvement Stores, Department Stores, and Amazon.com

Q4: Amazon, Department Stores, Clothing Stores

2014

Q1: Restaurants and Movies

Q2: Home Improvement Stores, Furniture Stores, Bed Bath Beyond

Q3: Gas stations

Q4: Online Purchases, Department Stores

2013

Q1: Restaurants, Movies

Q2: Spring Style (shows a picture of a flower) Clothing and home improvement

Q3: Summer Fun (shows a picture of a gas pump handle) Gas stations

Q4: Holiday Shopping (shows a picture of a gift bow) Department stores, Amazon.com

H/T: My FICO

As you can see, it’s pretty common to see Amazon, restaurants, gas, and department stores. These are categories that fit the profile of the average spender and fit well with the spending of college students, too. This is important since it means you won’t have to go out of your way to earn rewards with your credit card spend.

Another great feature about the Discover it cash back calendar is that Discover is really good about revealing their schedule in advance which allows you to plan out your spending better to capitalize on rewards.

Doubled cash back

What makes both the Discover it Cash Back and Discover it Student Cash Back stick out is that Discover will double the rewards earned with each card at the end of the year.

This is an exceptional earning opportunity for two reasons.

10% back on quarterly categories

You’ll be earning 10% back on all of the quarterly categories for the first year. That’s a fantastic return which means that you can earn a total of $600 cash back just via the bonus categories alone.

This is why the lack of a sign-up bonus for either of these cards is not a big deal. You can still net more in rewards over time than those other cards with sign-up bonuses.

For example, assume you only spent $6,000 and you maxed out the 5% categories on the both the Chase Freedom and the Discover it.

For the first year you’d earn $450 with the Chase Freedom when factoring in the $150 sign-up bonus plus the $300 in cash back. But with the Discover it, you’d earn $600 back since your $300 cash back would be doubled at the end of the year.

But that’s not all.

2% back on all purchases

Even your non-bonused spend will be doubled the first year. This means that you’ll be earning 2% back on all purchases for a year, which is a great return on par with the Citi DoubleCash.

So in total you’ll earn 10% back on rotating categories and 2% on all purchases. That’s potential for some extremely valuable rewards that many other other cards can’t compete with.

It’s true that your rewards are only doubled for the first year but that’s still a great offer to be able to maximize rewards like that in your first year, especially for students.

Good grade bonus

The Discover it Student Cash Back will provide you with a $20 statement credit each school year your GPA is 3.0 or higher for up to five years. So that’s another $20 you can add into the rewards bucket each year assuming you can a least average a B.

If your school does something funky with GPAs, you’ll just need to earn the equivalent of the 3.0 and this $20 will be provided in the form of a statement credit. You’ll be allowed this once per year (not per semester). (This perk is also available for the Discover it Chrome card.)

This is a great incentive to keep up your grades even though the pay out isn’t huge — who doesn’t like free money?

0% Intro APR

Discover it Student Cash Back

- 0% Intro APR for 6 months on purchases

Discover it Cash Back

The Discover it Cash Back offers the better 0% APR and balance transfer opportunities since the intro APR period is over twice the length offered by the student version and there’s no 0% APR available for balance transfers on the Discover it Student.

So if you’re trying to get serious about balance transfers or want a long period of time to pay down a balance, the Discover it Student Cash Back is not the way that you want to go.

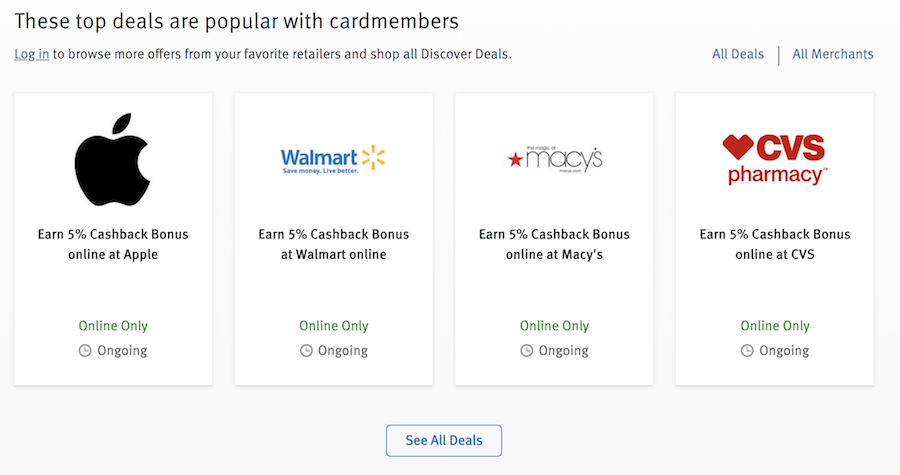

Discover Deals

Both of these cards will give you access to Discover Deals which is a shopping portal that will allow you to maximize your cash back rewards with every day online shopping.

Read more about that amazing shopping portal here.

Foreign transaction fees

Both cards do not have foreign transaction fees.

This is great for a no annual fee credit card but I wouldn’t want a Discover card to be my primary card to be used when traveling abroad. Instead, I’d want to also have a Visa or even a MasterCard or Amex.

In some parts of the world Discover’s acceptance is growing but this is something to consider when thinking about using these cards abroad. If you’re worried about this you can check this map for international Discover acceptance.

Annual fee

Both cards do not have an annual fee.

FICO Score

Both cards allow you to view your FICO score for free which is based on the TransUnion score.

Freeze it

Account Freeze Freeze it which allows you to instantly prevent new purchases, cash advances and balance transfers on your account if you misplace your card.

Discover Identity Alerts

Discover Identity Alerts are offered by Discover Bank at no cost and provide:

- (a) daily monitoring of your Experian credit report and an alert when a new account is listed on your report;

- (b) daily monitoring of thousands of risky websites known for revealing personal information and an alert if your Social Security number is found on such a website.

It’s always nice to know that you have some sort of system looking out for you since you never know who or what might try to access your data so these are nice perks both cards offer.

Credit scores needed

Both cards are known for being some of the easier cards to get approved for. I’ve read that the minimum credit score for the Discover it is 650 and assuming that’s true, that still leaves you some breathing room for getting approved if your credit score is under 700.

The Discover it Student is going to be easier to get approved for especially if you have limited credit history. I would expect the credit limits on the Discover it Student to be more modest compared to the Discover it but if you’re just trying to build credit as a student, credit limits shouldn’t be a major concern.

Plus, you can always try for a credit limit increase at a later date but that will likely be subject to a hard pull.

If your score is really low you can look into the Discover it Secured cards which will allow just about everyone to get approved (though you’ll need to put down a deposit).

Discover it vs Discover it Student

These two cards are nearly identical but there are some key differences.

Discover it

- Much better 0% APR intro period and balance transfer options

- Higher credit limits

Discover it Student

- $20 annual statement credit for good grades

- Easier to get approved for

Final word

Both cards are lucrative rewards cards for the first year. I think that the Discover it Student card is probably one of the best credit cards for students and the option that I would recommend to most students looking to get into credit card rewards. But both of these cards can be some of the most valuable cash back rewards cards, especially when you’re focused on first-year earnings.

Cover photo by barnyz.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

k