Requesting a credit line increase from Discover is a pretty easy task. The hard part is predicting what the outcome of your request will be, though.

In this article, I’ll break down how to request a Discover credit line increase and also provide you with some data points I found showing you how much of an increase you can expect and what type of credit score you may want to have before applying for an increase.

Table of Contents

How to request a Discover credit line increase

You can request a Discover credit line increase in four easy steps:

- Step one: Log-in to your Discover account

- Step two: Click on the “manage” tab on the top menu (on the right)

- Step three: Click on “credit line increase”

- Step four: Update your income and other details

You can also call 800-347-2683 and request a credit line increase although I would recommend doing it online.

Tip: Use the app WalletFlo to give you auto-reminders of when to request credit limit increases!

Log into your Discover account

- You can easily login on the main Discover page here.

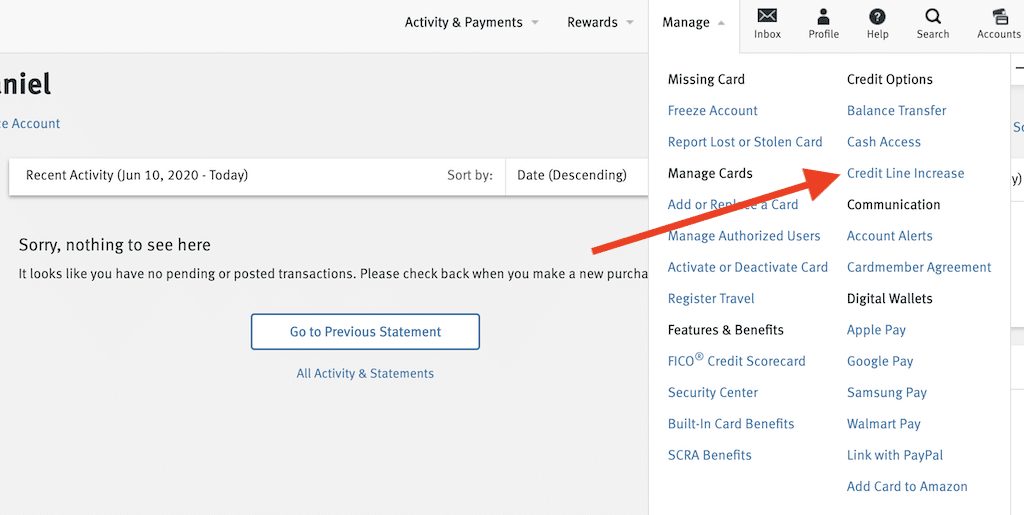

Click on the manage tab

Once you are logged into your account, just click on the “Manage” tab that is found on the top menu bar.

Click on “credit line increase”

Under “Credit Options,” you will see the “Credit Line Increase” button. Click that to proceed.

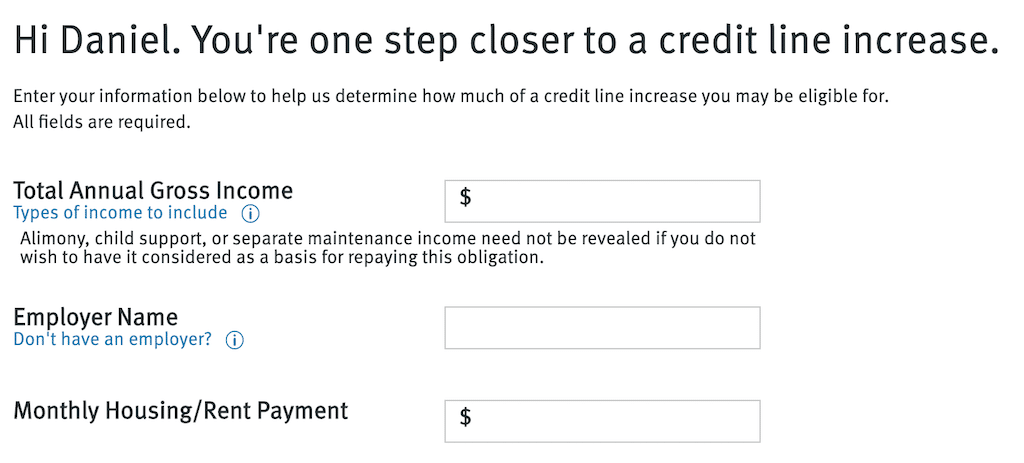

Update your income and other details

You will now be on the main credit line application page and you just need to fill in the details which I explained below.

Discover credit line increase application

The credit line application form will ask you to fill out the following information:

- Total Annual Gross Income

- Employer Name

- Monthly Housing/Rent Payment

Total Annual Gross Income

Your total annual gross income includes “current or reasonably expected salary, wages, bonus pay, tips, commissions, internships, living expenses, scholarships or grants, and income from investments.”

So add up all of your income streams and that will be your annual gross income.

Something to be aware of is that if you are 21 years or older, you can include income that you have “reasonable access” to. This is known as “accessible income” and you can read more about it here.

Your income is really important when it comes to establishing credit lines so be sure to update it if you ever have an increase because that will increase your odds of getting a credit line increase.

Related: Does Income Affect Your Credit Score?

Employer Name

This field is straightforward. Simply enter in the name of your employer. If you do not have an employer or would prefer not to answer just enter “other.”

Why does Discover ask for this?

Some people think it’s because it deters people from lying about their income since they are providing a way for Discover to potentially verify their income.

But when it comes to banks verifying your income for credit, that is an extremely rare event and I don’t think you need to worry about dealing with that. Plus, if you are telling the truth you have nothing to worry about.

Monthly Housing/Rent Payment

Your monthly mortgage or rent payment is extremely relevant to getting approved for a credit line increase. That’s because this payment cuts down on your discretionary income which is super relevant when it comes to determining your ability to pay off your bills.

Hard pull or soft pull?

Discover is one of the issuers that sometimes performs a soft pull while other times it performs a hard pull on your credit.

The application form states:

After reviewing your application, we may need to pull a credit bureau report, which may affect your credit score. In these cases, we will proceed with the application only with your consent.

This means that your credit line increase could result in a hard pull which could bring down your credit score.

Often if you are approved for the credit line increase amount you initially request that will be a soft pull. But sometimes Discover will not accept your request and instead will offer you a counter offer for an increase. Sometimes when you process this request it can result in a hard pull.

How bad would a hard pull affect your credit?

Typically, a hard pull will only bring down your score around 3 to 5 points but it could bring your score down much more if you have a less established credit profile or have recently applied for a lot of credit.

Eventually, after a few months, your credit score should come back up and if you were approved for a credit line increase, it will probably jump higher than where it was before.

Related: Credit Pulls Database Guide: Experian, TransUnion, or Equifax?

Can you be instantly approved for a credit line increase?

Many people will be instantly approved for a credit line increase with Discover.

But on other occasions your request might go to a manual review process.

In that case, you might see a message like, “”We’re reviewing your request and will let you know in 2 days.” It’s not clear what that means for your approval odds but many people have been approved for credit line increases after receiving the message.

What cards can I get a credit line increase for?

You should not be limited with respect to the type of card you can get a credit line increase for. Here’s some of the popular Discover cards that you might increase a credit line for:

- Discover it Secured

- Discover it Cash Back

- Discover it Student Cash Back

- Discover it Student Gas & Restaurants

- Discover it Balance Transfer

- Discover it Miles

- Discover it Chrome

How much of a credit line increase to request?

How much of a credit increase you should request depends a lot on your starting limit.

If your starting credit line is $10,000, then requesting a 100% increase could be too aggressive. However, if your credit limit is $500 then requesting a 100% increase could make a lot of sense.

Discover is tricky because the process is a true black box and outcomes are unpredictable. I’ve seen reports of people getting several thousand dollars in increases while many others are limited to only $500 increases.

My one bit of advice would be to start off small and be patient. I think requesting a 25% increase is generally a conservative approach.

Here are some self-reported examples for Discover credit line increases. Below, I’ve listed the amount of the increase and if enough information was given, the percentage that the credit line increased.

- $500 (17%)

- $700 (23%), $2,000 (40%), $3,000 (38%)

- $700 (26%), $1,500 (36%), $2,200 (23%)

- $900 (100%)

- $1,300

- $1,500

- $1,500

- $4,000 (58%), $1,500 (18%), $4,200 (33%), $7,000 (36%)

Automatic credit line increases

Like many other banks, Discover will sometimes grant you an automatic credit line increase.

For example, here’s someone who got an automatic increase from $1,800 to $2,200.

It’s very hard to predict when an automatic credit line increase will happen so your best bet is to use your card often and never miss a payment and just cross your fingers.

Tips for a Discover credit limit increase

If you want to increase your odds of being eligible for a Discover credit line increase, there are certain things that you can try.

Spend big on your card

A lot of banks don’t like to extend credit to people who don’t use their cards. That’s because they are unprofitable customers. It costs them money to keep your accounts alive and active and if you are never using your card, you are not generating revenue for them in the form of interest fees or interchange fees.

Discover seems to be one of those banks that puts extra value on using their cards. So try to use your card a few times a month at least in the months leading up to your credit line increase request.

You may also consider cycling your credit limit. Sometimes if you spend close to your credit limit and then pay off that amount multiple times a month, that can be an indicator to your bank that you need more access to credit.

Pay off a high balance

You want your utilization to be in check before you apply for a credit line increase.

If Discover sees that you have a maxed out credit card or multiple maxed out credit cards they will feel less good about extending you additional credit because you may just max out that line and become a credit risk.

So make sure that you your balance is paid down and in some cases this may require you to pay off your entire balance before your statement closes. That will prevent your outstanding balances from appearing very high and could improve your credit score tremendously.

Credit line increases with other issuers

You might also be interested in reading about getting credit limit increases with other issuers.

Discover credit line increase (FAQ)

It’s often advisable to wait 3 to 6 months between credit line increases although some people have had success when waiting shorter amounts of time.

If Discover accepts your initial request for a credit line increase it will likely be a soft pull. But if it is not approved, your later request could result in a hard pull.

Data points suggest that having a credit score in the mid to upper 600s can be good enough for a credit line increase.

Here are some self-reported data points.

696 Experian, 717 TransUnion, 717 Equifax (Denied)

695 (Approved)

708 Equifax FICO 8 and 689 Experian FICO 8 (Approved)

Equifax 671 Fico 8, TransUnion 684 Fico 8, Experian 696 Fico 8 (Approved)

Final word

Overall, discover is pretty unpredictable when it comes to credit line increases. There are a lot of conflicting data points out there and the amounts for increases can be sporadic. I would just focus on using your Discover card as much as possible and trying more than once if you were not successful.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.