A Citi credit limit increase can be a great way to increase your spending power and to improve your credit score. These requests are also very simple to make and sometimes the results can be instant. Here’s everything you need to know about Citi credit limit increases, including how often to request these and whether you can expect for Citi to make a hard pull or soft pull on your credit profile.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

What is a Citi credit limit increase?

A Citi credit limit increase is a request that you can make with Citibank for them to increase the credit limit for your credit card.

How do you request a Citi credit limit increase?

There are two different ways that you can request/apply for a Citi credit limit increase.

Tip: Use the app WalletFlo to give you auto-reminders of when to request credit limit increases!

Request online

You can request a Citi credit limit increase by logging on and going here.

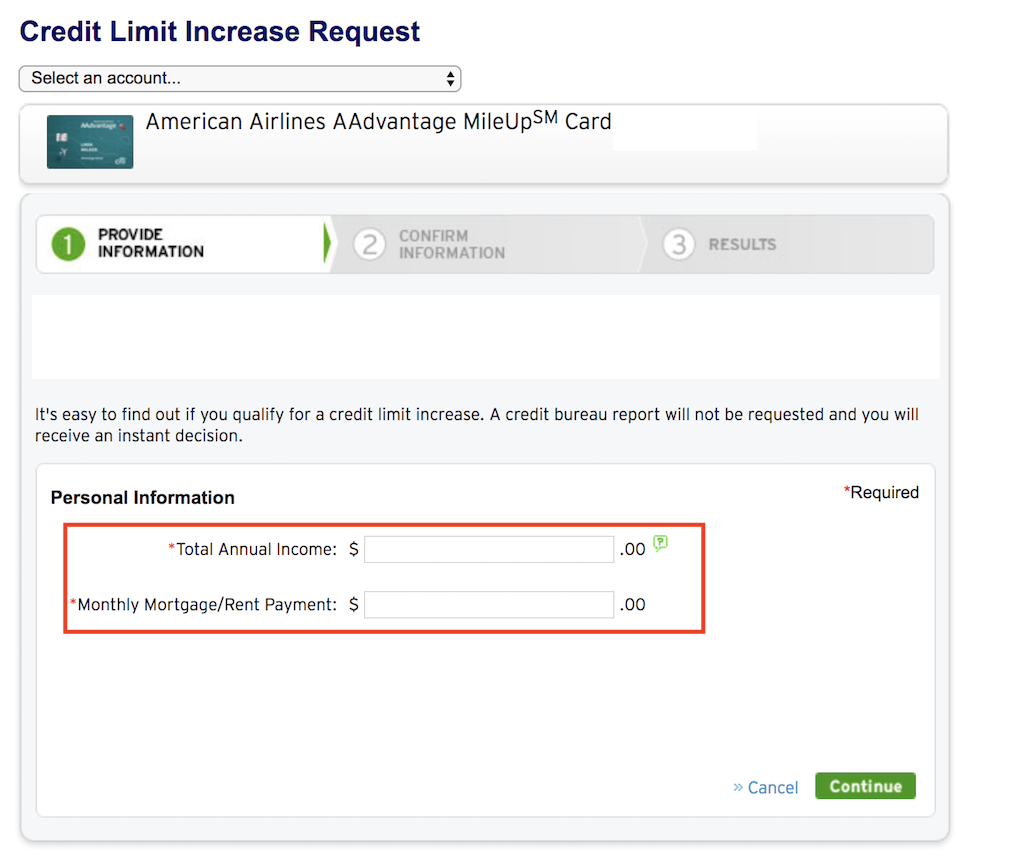

Once you log-in to that page, you’ll be able to select which card you want to apply for the credit limit increase for. You can also log-in and go to “Services” and then click on “Request a credit limit increase.”

You’ll then be taken to a screen where you’ll be asked to enter your monthly rent or mortgage and also to input your income. Remember, if you are 21 or older you can include all income that you have reasonable access to.

Once you verify your details, you’ll be notified immediately if you’ve been approved for a credit limit increase. At that point, you’ll get the chance to request for an additional credit limit increase if you’d like.

Request by phone

You can request a credit limit increase by calling Citi at the following phone number: 1-800-950-5114. You can also try calling the phone number on the back of your Citi credit card.

How much of an increase should I ask for?

If you are interested in asking for an additional increase for your credit limit, you might be wondering how much additional credit you should ask for.

The amount that you request for your credit limit increase is really up to you. It’s usually pretty reasonable to request for your credit limit to be increased by 50% to 100%, depending on how high your starting credit limit is. However, you can request for increases that are way higher than that.

There are reports of people starting with credit limits at $1,200 and then receiving increases all they way up to $20,000. Another report shows someone getting an $11,000 increase from a $3,750 credit line.

Citi is known to offer you a counter offer if your request is too high so that’s why a lot of people will request for increases which are much higher than their current credit limits.

Note: Once you start requesting for additional credit limit increases beyond what is initially granted to your, that’s when the hard pulls start to become a factor (read more on that below).

Related: Citi ThankYou Premier Review

How often can you request a credit limit increase?

As soon as you receive and activate your credit card you can request a credit limit increase.

But note that often banks don’t approve you for a credit limit increase until after you’ve used their cards for several months. So I personally would wait 3 to 6 months before requesting a credit limit increase from the time of opening a new credit card account or from the time of my last credit limit increase request.

It’s also not just about days waited.

You typically want to wait until your credit score is in better shape before applying for an increase, especially if you were denied an increase before.

Remember that opening up a new credit card can temporarily drop your credit score because of the hard inquiry and also the new account bringing down your average age of accounts. So it’s often a good idea to wait until that negative effect has gone away before requesting your credit limit increase.

As a general rule of thumb, try to get your credit score as close to 720 or higher as you can for the best odds of getting approved for a credit limit increase.

What cards are eligible for credit limit increases?

You’ll be able to see exactly which of your cards are eligible for a credit limit increase when you log-in to your account with the above link.

However, I don’t think that Citi limits these requests to certain cards so I think virtually any Citi card should be eligible for a credit limit increase including:

- Citi® Double Cash Card

- Citi® Diamond Preferred® Card

- Citi Simplicity® Card

- Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard®

- CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

- American Airlines AAdvantage MileUp℠ Card

- Citi® / AAdvantage® Executive World Elite™ Mastercard®

- Citi ThankYou® Preferred Card

- Citi PremierSM Card

- Citi ThankYou® Preferred Card For College Students

- EXPEDIA®+ CARD From Citi

- Costco Anywhere Visa® Card By Citi

Why would you want a credit limit increase?

A Citi credit limit increase could benefit you in a couple of ways.

More spending power

The first is that if you need to make a big purchase or put more spend on your credit card then a credit limit increase is going to allow you to increase your spending without maxing out or going over your credit limit.

Obviously, you need to make sure that you’re ready to take on a higher credit limit so that you don’t end up paying interest on your purchases (though many Citi cards offer interest free periods).

Boost your credit score

The second is that increasing your credit limit will decrease your credit card utilization and allow your credit score to increase. Utilization is the second most important factor for your FICO credit score, making up 30% of your overall score (payment history is #1 at 35%). So if you can get the utilization down then your score will go up.

Ideally, you want your utilization to be somewhere between 5% and 10% but no higher than 30%. So if you currently have a $5,000 credit line and you’re using $3,000 of it and you get a credit limit increase to $10,000 then your utilization will go down to 30% which should increase your credit score by at least a few points.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Is the credit limit increase a soft pull or hard pull?

Generally, getting a Citi credit limit increase should only result in a soft pull as Citi states, “A credit bureau report will not be requested and you will receive an instant decision.”

Soft pulls

A soft pull is a form of credit check that does not result in a ding on your credit score. That’s very different from a hard pull which will have a negative effect on your credit score.

Hard pulls

The effect of a hard pull on your credit score depends on a few factors, such as how established your credit profile is. If you have a very new credit profile then a hard inquiry could drop your credit score by a dozen or so points.

However, if you have a more established credit profile you may not even notice a drop in your score. For most people, they will fall somewhere in-between and will likely experience a drop of 2 to 5 points in their credit score after a hard pull is made.

The good news is that hard pulls will not impact your credit score for forever. After two years they fall off your credit report and after one year they no longer affect your credit score. But even after about 90 days you should start to notice that their impact is starting to get diminished.

Warning: If you request an even higher credit limit as discussed above, then Citi will perform a hard pull on your credit so keep that in mind.

If you are worried about incurring a hard pull then I highly suggest that you make your request over the phone so that you can verify whether or not a hard pull will be made on a recorded line, just in case anything unexpected happens.

What credit bureau will Citi pull from for the credit limit increase?

Citi will often pull from Experian but it does depend on your location. Click here to find out more about which banks pull which credit bureaus.

Automatic Citi credit limit increases

Citi will perform a soft pull on your credit profile sometimes (some say every six months) and it’s possible to receive an automatic credit limit increase.

Usually, you’ll need to be a very active spender and have your utilization under control along with a flawless payment history to be eligible for the automatic credit limit increase. The more that Citi sees that you’re going to be a profitable customer, the more likely they are to offer you an automatic increase.

If you ever get a pay increase make sure to update your income in your personal file because that can make a huge difference when it comes to getting automatic increases.

Credit line increases with other issuers

You might also be interested in reading about getting credit limit increases with other issuers.

Final word

Getting a credit limit increase with Citi is a pretty straightforward process and in some instances it can take only seconds to complete. Don’t be afraid to shoot for the moon with Citi because even if they don’t honor your original request you still stand a good chance of receiving a solid credit limit.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

How to check on replacement card that you said had been mailed but we haven’t received it yet!