The Citi AAdvantage Platinum Select World Elite is one of those great travel credit cards that is a must-get in my opinion due its high welcome bonus and other perks. In this review article, I will break down all of the main features of the Citi AAdvantage Platinum Select, covering things like welcome bonuses, bonus earning, and other perks like free checked bags and preferred boarding.

Table of Contents

Welcome bonus

The Citi AAdvantage Platinum Select is known for having a bonus that changes all the time. For example, I have seen this card offer 30,000 miles and also offer 65,000 miles for its bonus, which is obviously a huge difference.

This means that you really want to try to time your application for this card so that your application coincides with one of the higher bonuses offered. Personally, I wouldn’t settle for anything under 60,000 miles.

Lastly, this is one of those cards where it is not uncommon to see several links out for that card at the same time. So you might see a 50,000 point offer and a 60,000 point offer out at the same exact time. Don’t believe me? Just look here and here.

So it’s not just about making sure the timing is right, you also want to make sure you are looking at the best offer currently available to the public.

The spend requirement will usually be $2,500 to $3,000 but keep in mind the Barclays Aviator Red card offers AA miles after just a single purchase.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How far can you get with these miles?

American Airlines will be implementing a new dynamic pricing system for their miles soon. This means that there will not be a set price for redemptions between certain destinations. Instead, the price will fluctuate similar to how a cash price fluctuates for a plane ticket.

But you can still get a great value for your AA miles right now. I would highly suggest that you read my article on AA sweet spots as it highlights some of the best uses for American Airlines miles.

You’ll see how 50,000 to 60,000 miles can get you some pretty solid redemptions including things like a roundtrip in domestic first class.

Matching?

In the past, if you did not jump on one of the best offers you could call in and request the agent to match you to a higher offer. So let’s say you applied for a 50,000 mile offer but a week later you found a link for a 60,000 mile offer. In that case, you would be able to call in and get your offer matched to that higher offer.

I have seen recent reports where matching was not honored so this is something that is not always guaranteed but it is still worth giving it a shot in my opinion because you don’t have anything to lose.

Rules

Citi has some complicated application rules (which by the way is something that WalletFlo will help you have to not worry about in the future).

In addition to Citi application rules, once you pick up this card, you can’t get its bonus again for 48 months, as the rules state:

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Platinum Select® account in the past 48 months.

This means that you can get other cards, such as the business version without violating this rule. Also, I should point out that sometimes targeted mailers go out without this language so be on the lookout for those.

Credit card strategy tip

I’d be sure to hit up the best Chase cards first like the Chase Sapphire Preferred which offers 60,000 points after spending $4,000 in the first three months. As long as you haven’t opened up five accounts in the past 24 months, the Chase Sapphire Preferred or Chase Sapphire Reserve are going to be better options to go with first.

Bonus earning

The Citi AAdvantage Platinum Select earns the following rates:

- 2X on purchases on American Airlines

- 2X at restaurants (including cafes, bars, lounges, and fast food restaurants)

- 2X at gas stations

This card is a little unique because American Airlines is not a direct transfer partner of the major banks like American Express, Chase, or Citibank. Unlike other legacy carriers such as United Airlines or Delta, you can’t just transfer your points earned from great cards like the Amex Gold Card or Sapphire Preferred so it’s harder to rack up miles.

This means that you might have to rely more on your American Airlines credit card to earn you miles. In this case, being able to earn 2X at restaurants and gas stations is not too bad. However, I would much rather earn Membership Rewards or Chase Ultimate Rewards on categories like dining and travel.

If you want to earn a lot of AA miles, the best route is to look into stacking AA cards like the Platinum Select, Platinum Select business card, and Barclays Aviator. Getting those three cards could score you over 150,000 AA miles in a hurry.

Flight discount

One of the new perks with this card is that you can get a $125 dollars flight discount (after you spend $20,000 or more in purchases during your card membership year and renew your card). Getting $125 dollars back after spending $20,000 dollars is not very good in my opinion.

I would much rather put $20,000 dollars worth of spend on a different card like a Hilton card and earn a free night that could be worth way more than $125. However, that is just me.

Something that I think is cool about this discount is that it is also redeemable for air travel on any oneworld carrier or American Airlines codeshare flight.

First checked bag free

When you fly on domestic American Airlines itineraries you can get free checked luggage for you and up to four companions. This is a great way to save a couple hundred bucks on a round trip and this benefit alone could easily offset the entire $95 annual fee.

The catch is that it only works on domestic flights. Meanwhile, the United Explorer card also offers this benefit for international flights (but not for as many companions).

If you want to take advantage of this perk your card needs to be open at least seven days prior to your travels and the reservation must include the primary credit cardmember’s American Airlines AAdvantage number. (If your card gets closed you cannot use these benefits.)

All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. And in order for the companions to get free luggage they must all be on your itinerary as well.

Unlike the United Explorer Card, the terms do not require you to use your Platinum Select on the airfare to get this benefit.

Preferred boarding on American Airlines flights

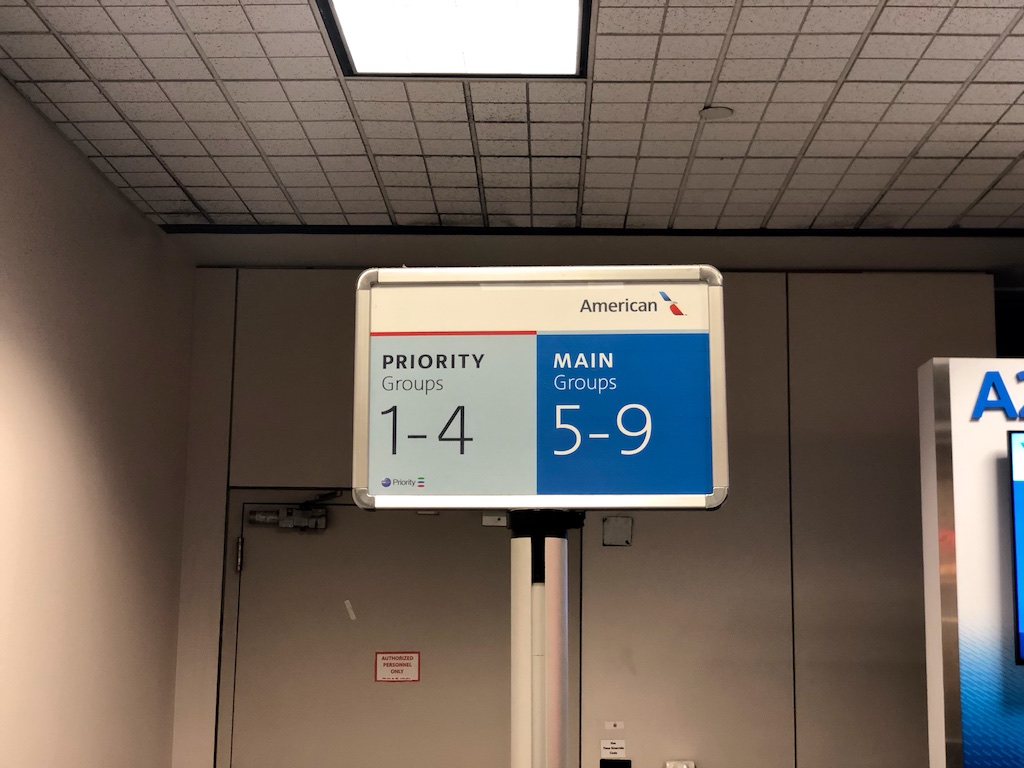

With this card you’ll get “Preferred Boarding” on American Airlines flights for up to four companions traveling with you and listed in the same reservation. You should note that this is different from priority boarding. Basically with this perk you get to board with Group Five.

This is still a nice perk because it means you will likely have more access to the overhead storage bin space. To find out more about the American Airline boarding groups click here.

In case you’re wondering, here are all of the other eligible cards that will get you preferred boarding:

- CitiBusiness / AAdvantage Platinum Select World Elite Mastercard

- Citi / AAdvantage Platinum Select American Express Card

- Citi / AAdvantage Platinum Select Visa Signature

- AAdvantage Aviator Silver Mastercard

- AAdvantage Aviator Red Mastercard

- AAdvantage Aviator Business Mastercard

The terms do not require you to use your Platinum Select on the airfare to get this benefit.

25% savings

With this card, you can get a 25% discount on in-flight food and beverages. These savings do not apply to any other inflight purchases, such as wireless internet access. Also, this benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by certain airlines. Note that if you’re flying Main Cabin Extra, you can get some drinks for free.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

No foreign transaction fees

This card has no foreign transaction fees which is pretty standard for a major airline cobranded credit card.

Annual fee

The annual fee for this card is $99. Typically, this fee is waived for the first year. This is in contrast to the American Airlines card issued by Barclays that forces you to pay the annual fee the first year.

Benefits and protections

Just in case you have not heard, Citibank dropped pretty much every major travel benefits and protection from their cards as of September 22, 2019. Some of the benefits and protections that were dropped consisted of:

- Worldwide Car Rental Insurance

- Trip Cancellation & Interruption Protection

- Worldwide Travel Accident Insurance

- Citi Price Rewind

- Trip Delay Protection

- Baggage Delay Protection

- Lost Baggage Protection

- Roadside Assistance Dispatch Service

For this reason, you don’t want to use this card for purchases that you really need or want built-in travel insurance/protections for. So when it comes to purchasing flights and prepaid hotels, you would be much better off with a card like the Chase Sapphire Preferred which provides you with much better protections.

While this was a major blow to the Platinum Select, I still am big on this card for its high welcome bonus.

Final word

Overall, I am a pretty big fan of this card. There are so many great partners that you can use American Airlines miles on that it is always tempting to get this card but you really need to make sure you’re jumping on a great offer since the offers can fluctuate over time.

And while I was sad to see some benefits go, it’s worth noting that you don’t have to use your Platinum Select card on your airfare purchases to get the perks like free checked bags and preferred boarding.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

WOW ! Great card strategy ! I’m still under the Chase 5/24 rule with 3 more slots for Chase cards. In addition, I need about an estimated 6 more months of Chase credit history before applying for my first sapphire preferred card. My CFU is only 5 months old. LOL! So, thanks for your inside. This AA credit probably should wait.

Yeah, you got it — I definitely would not use a 5/24 slot for this card!