Purchase protection is rock solid for the Chase Sapphire Reserve. It’s one of the benefits that could end up saving you hundreds or even thousands of dollars in unexpected situations, so you definitely want to know how to utilize it.

In this article, I’ll explain the basics of the protection and how to file a claim. I’ll also give you some tips on how to deal with the claims process.

Table of Contents

What is Chase Sapphire Reserve purchase protection?

Chase Sapphire Reserve purchase protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per year. So if you purchase a new fancy electronically and it went to poop within 3 to 4 months of purchasing it, you could get coverage for that purchase.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Is coverage different for the Reserve vs the Preferred?

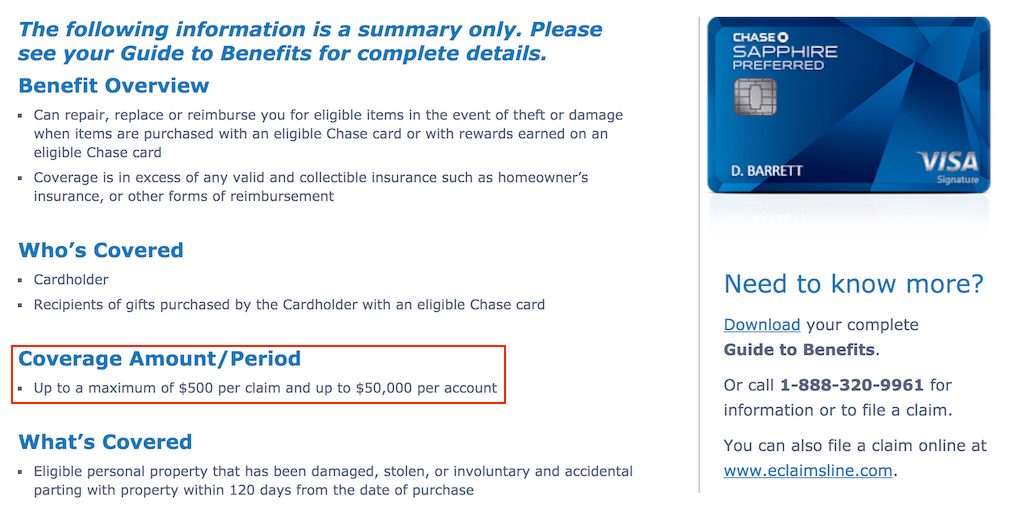

The Chase Sapphire Reserve and the Chase Sapphire Preferred have very different purchase protection limits.

The Chase Sapphire Preferred (full review here) only gets coverage up to a maximum of $500 per claim and up to $50,000 per account while the Sapphire Reserve gets up to $10,000 per claim. The Chase Freedom and the Chase Freedom Unlimited also both have this $500 per claim limitation.

The $500 limit compared to the $10,000 limit is a very dramatic difference.

It is also the reason why I choose to put large purchases on my Sapphire Reserve and NOT my Freedom Unlimited even though the Freedom Unlimited would earn me more points since it earns 1.5% back on all purchases.

If you are curious as to how this protection stacks up to some of the competition, take a look at the chart below which breaks down the purchase protection for several different cards:

| Card | Claim limit | Annual limit | Time covered from purchase |

|---|---|---|---|

| Amex Gold Card | $10,000 | $50,000 | 120 Days |

| Amex Platinum Card | $10,000 | $50,000 | 120 Days |

| Citi Prestige | $10,000 | $50,000 | 90 Days |

| Chase Sapphire Preferred | $500 | $50,000 | 120 Days |

| Chase Sapphire Reserve | $10,000 | $50,000 | 120 Days |

| United Explorer Card | $10,000 | $50,000 | 120 Days |

| Bank of America Premium Rewards Credit Card | $10,000 | ? | 90 Days |

I thought Chase did away with this benefit?

Effective 08/26/18, Price Protection and Return Protection were discontinued. Price protection kicked in when a price dropped shortly after you purchased it and return protection would help if you out in some scenarios if the store would not allow you to return your item.

Both of these protections are different from purchase protection, which focuses on the purchase being damaged or stolen.

What loss is covered by the purchase protection?

The purchase protection will cover theft, damage, or involuntary and accidental parting with property within 120 days from the date of your purchase.

According to Chase, “[i]nvoluntary and accidental parting with property” means the “unintended separation from an item of personal property in which the item’s location is known but recovery is impractical to complete.”

This phrasing is a bit vague but it can be interpreted to mean that items that are truly lost are not covered since you wouldn’t know the location of a lost item.

However, sometimes lost items do get covered at times.

In some situations, it might be the case that you could describe an item as both lost and stolen.

For example, if you left a phone on a plane and it never turned up you might say it was lost. But if someone deliberately saw it under your seat, grabbed it, and didn’t turn it in, that could be considered theft.

So the distinction between lost and stolen isn’t always crystal clear. It will be up to you to decide how to represent the facts of your situation but anytime that true theft is involved, generally there needs to be some sort of police report filed so keep that in mind.

What is the limit for purchase protection?

Purchase protection will replace, repair, or reimburse you up to a maximum of $10,000 for each claim and up to $50,000 for each year. However, you should note that the limit for coverage will be the amount showing on the receipt of your purchase if that number is below $10,000.

$10,000 is one of the higher limits for purchase protection so this is definitely a solid perk.

Do I get a repair or replacement?

The decision to replace, repair, or reimburse you will be made at the Benefit Administrator’s discretion.

You will only be reimbursed up to the dollar amount to replace or repair the item or the program limit, whichever is less.

Note to be eligible for coverage, you must charge some portion of the price of the purchased item to your Account.

Who is eligible?

You as the cardholder will be covered and also whoever receives gifts purchased with your Chase credit card account.

A lot of people don’t realize that gift recipients receive coverage as well.

What is not covered?

Credit card companies like to exclude certain types of purchases from protections like this. There are a lot of different types of exclusions but typically they involve items that you don’t purchase from a retail store.

Here is a list of what’s not covered:

- Animals and living plants

- Antiques and collectible items

- Boats, aircraft, automobiles, and any other motorized vehicles and their motors, equipment or accessories, including trailers and other items that can be towed by or attached to any motorized vehicle

- Computer software

- Items purchased for resale, professional, or commercial use

- Items that mysteriously disappear. “Mysterious disappearance” means the vanishing of an item in an unexplained manner when there is an absence of evidence of a wrongful act by a person or persons.

- Items under the care and control of a common carrier (including U.S. Postal Service, airplanes, or delivery service)

- Items including but not limited to, jewelry and watches from your baggage unless it is hand-carried and under your personal supervision, or under the supervision of your traveling companion who is previously known to you.

- Losses resulting from:

- abuse

- fraud

- hostilities of any kind (including, but not limited to, war, invasion, rebellion, insurrection, or terrorist activities)

- confiscation by the authorities

- risks of contraband

- illegal activities

- normal wear and tear

- flood

- earthquake

- radioactive contamination

- or damage from inherent product defects

- Losses resulting from mis-delivery or voluntary parting with property

- Medical equipment

- Perishables, consumables, including but not limited to perfumes, cosmetics, and limited-life items such as rechargeable batteries

- Traveler’s checks, cash, tickets, credit or debit cards, and any other negotiable instruments • Used or pre-owned items

How do I file a purchase protection claim?

Call the Benefit Administrator within 90 days after the loss, damage, or theft.

You can file a claim by calling1-800-874-7702 or you can do it online at www.eclaimsline.com.

I would advise to initially call the Benefit Administrator to clear up any questions you might have and then to just file your claim online, since it’s much easier to track the process that way.

Also there are two important deadlines you don’t want to forget about:

If you do not contact the Benefit Administrator within 90 days of the loss, your claim may be denied.

Also, be sure to provide all of the information requested and return the information within 120 days from the date of loss, theft, or damage.

What documents do I need to submit with my claim?

Do your best to keep records of all receipts and any claim or incident reports. These are vital if you need to prove the loss of an item and without them all you have is your word that your item disappeared, which will probably not be enough.

These are all of the documents that Chase lists that you might have to submit with your claim.

- Your completed and signed claim form

- A copy of your card receipt

- A copy of the itemized store receipt

- if more than one method of payment was used, documentation linking the purchase back to the Account must be included

- A copy of the police report (made within 48 hours of the occurrence in the case of theft), fire report, insurance claim, loss report or other report sufficient to determine your eligibility for Purchase Protection

- A copy of your insurance declaration page, when applicable

- Documentation (if available) of any other settlement of the loss

- Any other documentation deemed necessary, in the Benefit Administrator’s sole discretion, to substantiate the claim

If the claim is for a damaged item:

To substantiate your claim, you may be asked to send the damaged item to the Benefit Administrator (at your expense). Therefore, it is always a good idea to hold on to the damaged item just in case you need to send it in.

Do I have to file a claim with my insurance company?

Yes.

If you have personal insurance, like homeowner’s, renter’s, or automobile insurance, you are required to file a claim with your insurance company and to submit a copy of any claims settlement from your insurance company along with your claim form.

At the discretion of the Benefit Administrator, a copy of your personal declaration page may be sufficient when the claim amount is within your personal insurance deductible.

Coverage is excess

Purchase Protection provides coverage on an “excess” coverage basis.

That means it does not duplicate, but pays in excess of, valid and collectible insurance or indemnity (including, but not limited to, homeowner, renter, automobile, or employer insurance policies).

After all insurance or indemnity has been exhausted, Purchase Protection will cover the loss up to the amount charged to your Account, and subject to the terms, exclusions, and limits of liability of the benefit.

This is why it’s not always a good idea to split large purchases because it can make utilizing benefits like this a headache and complicate the process.

Purchase Protection will also pay for the outstanding deductible portion of your insurance or indemnity for eligible claims.

Damages to part of a set of goods

Chase states:

Where a protected item is part of a pair or set, you will receive no more than the value (as described herein) of the particular part or parts, stolen or damaged, regardless of any special value that the item may have as part of such a pair or set, nor more than the proportionate part of an aggregate purchase price of such pair or set.

This sounds like it means that if you lose one item of a three part set (say some sort of fancy cookware), then you may be limited to 1/3 the price of the set.

That could pose a problem if you lost the most valuable part of a set so that might be something you can work out with them.

Purchase Protection is not “contributing” insurance, and this “non-contribution” provision shall take precedence over “non-contribution” provisions found in insurance or indemnity descriptions, policies, or contracts.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Additional Provisions for Purchase Protection

There are a few additional provisions that you might want to be aware of.

Due diligence

You shall use due diligence and do all things reasonable to avoid or diminish any loss or damage to property protected by this benefit.

Fraudulent claims

If you make any claim knowing it to be false or fraudulent in any respect including, but not limited to, the cost of repair services, no coverage shall exist for such claim and your benefits may be canceled.

Any and all relevant provisions shall be void in any case of fraud, intentional concealment, or misrepresentation of material fact by the Cardholder.

Claim file will be open for 6 months

Once you report an occurrence, a claim file will be opened and shall remain open for six months from the date of the damage or theft.

Claims must be substantiated within 6 months

No payment will be made on a claim that is not completely substantiated in the manner required by the Benefit Administrator within six months of the date of damage or theft.

You must give the Benefit Administrator all assistance as may reasonably be required to secure all rights and remedies.

Legal action

If you plan on taking legal action against them for your claims, there are a few requirements for that:

- No legal action for a claim may be brought against the Provider until sixty (60) days after the Provider receives proof of loss.

- No legal action against the Provider may be brought more than two (2) years after the time for giving proof of loss.

- Further, no legal action may be brought against the Provider unless all the terms of this Guide to Benefit have been complied with fully.

How will I be reimbursed?

At its discretion and depending on the nature and circumstances of the incident, the Benefit Administrator may choose to address your claim in one of two ways:

Repaired or replaced

A damaged item may be repaired, rebuilt, or replaced wholly or in part. A stolen item may be replaced.

You will be notified of the decision to repair, rebuild, or replace your item within fifteen (15) days following receipt of the required proof-of-theft/damage documentation.

Reimbursed

You may be reimbursed for the covered item.

The reimbursement will be for no more than the original purchase price of the covered item as shown on your Account receipt, less shipping and handling charges, up to a maximum of $10,000 dollars per claim and $50,000 per year.

You will only be reimbursed up to the amount charged to your Account or the program limit whichever is less.

Under normal circumstances, reimbursement will take place within five business days of receipt and approval of all required documents.

You can read more from the official terms and conditions here.

4 tips for dealing with benefit claims

1. Prepare to be patient

If you’ve never dealt with a benefits administrator, you should know that things can move very slowly.

It’s not uncommon for these things to go on for several weeks or even months to get resolution. While patience will help you get through the process, don’t be afraid to call up and check on the status of your claim to make sure things are moving along.

2. Don’t be afraid to hound them

You will likely have to be the one to follow up on your claim because the agents will often not contact you to keep you in the loop.

3. It can be frustrating, stay calm

Sometimes they do things that are very annoying/frustrating like send requests for more information you’ve already sent to them.

This happened to me a couple of times on one of my claims and it was driving me crazy. Do your best to stay calm. For the most part, the phone agents were pretty professional and usually sounded like they were interested in helping.

4. Stay organized

It’s very important to keep track of all of your documents and a record of everything you’ve sent them.

You should be able to view all of the documents you’ve submitted online, which is why I don’t recommend mailing in forms. But if you do, then you just need to keep even better records.

Final word

The Sapphire purchase protections for the Reserve are very strong. Make sure you get familiar with how these perks work so you don’t miss out on any value in the future. You might also be interested in learning more about the rental car insurance for the Reserve.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Chase eclaimline? This company is a total ripoff and a total waste of your time. They will string you along asking for the same documentation over and over again. I have submitted everything they have asked for and they started asking for the same things again.

Chase uses them for their “purchase protection”. SHAME ON YOU CHASE for using a company that is a total scam.

i agree with the comment above. Amex with their FREE cards is far superior in their damage or loss coverage than Chase. For a $550/yr chase, it’s a joke. I filed a claim for a $15 charging cable my cat chewed.. they wanted me to go to a repair shop across town to get an estimate for a USB cable. when i pushed back at the absurdity of that.. they approved the claim. i’ve been waiting 4 months so far for another claim on trip cancelation.. they’re asking for the same docs over and over.. which have all been provided. no response for 2 months.