The Chase Sapphire Preferred is once again one of the hottest travel rewards credit cards. This is due in large part to the industry-leading welcome bonus that was recently increased to 100,000 points but it also is due to the additional enhancements to the card. One of these enhancements was a new $50 hotel credit.

But how exactly do you use this credit and is it actually a good deal?

In this article, I will break down how you can use this credit and some pros and cons that might make you think twice about the value of the credit.

Table of Contents

What is the $50 annual Ultimate Rewards hotel credit?

The $50 hotel credit is a credit issued every year that can go towards a hotel booking made via the Chase Travel Portal.

If you were approved for the Chase Sapphire Preferred on or after August 16, 2021 you will instantly be able to use the credit once your account is open. However, if you had the card opened before that date you will have to wait until your account anniversary to use the credit. After that, you will receive the $50 credit every account anniversary.

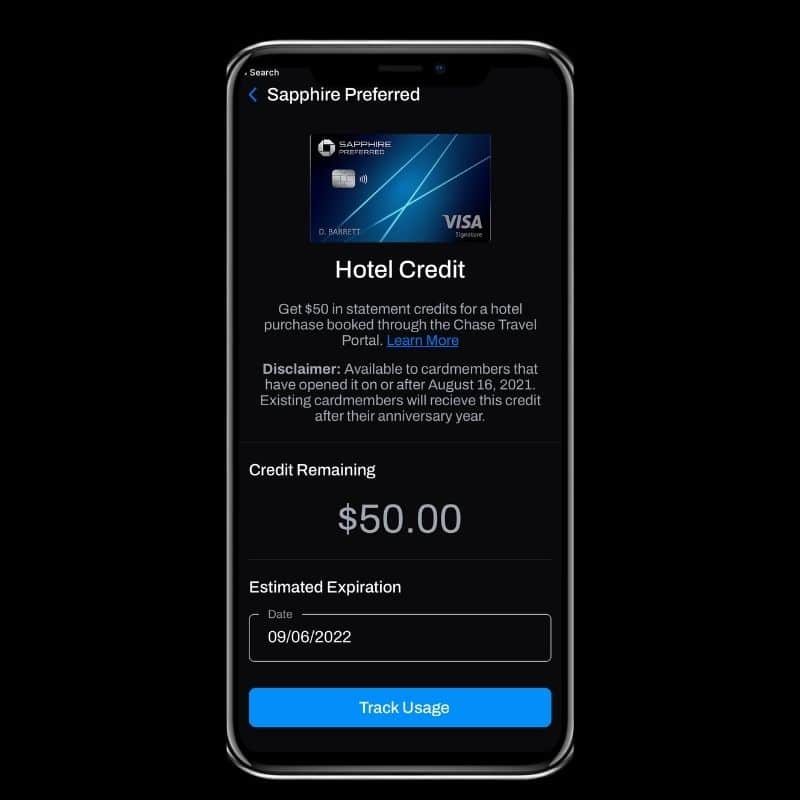

Tip: You can easily keep track of your credit card perks like the $50 hotel credit with the free app WalletFlo. It will also keep you up-to-date on all of the latest promos and credit card offers. So be sure to check it out!

How to use the $50 hotel credit

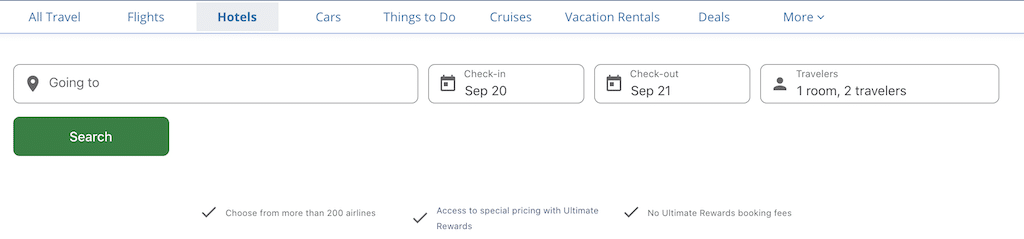

To use the credit, you need to log into the Chase Travel Portal at ultimaterewards.com.

If you have multiple Chase cards you will be asked to select your card and make sure that you select your Chase Sapphire Preferred card.

Once you are logged in, navigate to the travel screen. On desktop, you simply click on the three bars in the left hand corner and then scroll down to “Travel” and click on that.

Next, navigate to “Hotels” and then simply go through your search and booking process as you normally would. You should be able to use your credit on any of the hotels you find in the search results so feel free to book any property you’d like.

After you make your hotel booking, the statement credit should automatically post to your account within two days of your purchase posting to your account. It should then appear on your monthly billing statement within 1 to 2 billing cycles.

In my experience, Chase has been pretty solid with posting credits quickly. But in the event you do not see your credit after a week or two, you can always call the number on the back of your card and inquire about it.

Is it worth it?

So now that you know how the credit works, a big question is whether or not the credit is worth it?

In other words, in light of the $95 annual fee that the Chase Sapphire Preferred has, does this credit provide sufficient value to make the card a keeper?

The answer to that question is that it depends.

The biggest knock against the $50 hotel credit is that you have to use it on a hotel booked through the Chase Travel Portal, which is powered by none other than Expedia.

This means that you will miss out on hotel elite perks for your stay. For example, you will almost assuredly not get any type of elite night credits for your stay or earn loyalty points for the respective elite program.

There is still hope for your elite status benefits such as upgrades, free breakfast, late check-out, etc. In order to maximize your odds of receiving those benefits, you should call or email the hotel ahead of time and ask them to add your loyalty number to your reservation.

You can also do this when you arrive at the property but I find it better to do it ahead of time before you actually arrive at the property/check-in desk.

I have booked a number of hotel stays through online travel agencies over the past few years and have had a tremendous amount of success with receiving elite status benefits with Hilton, Marriott, and Hyatt.

Because you can still receive some of your elite status perks (albeit with a little bit of extra work and luck), I think the $50 hotel credit still holds a lot of value for many travelers.

Tip: Because you lose out on other elite benefits, credits like this are often good for non-chain hotel bookings. So if you can find a cozy cabin located off the grid in the Chase Travel Portal, you might get more value on a stay like that.

It’s worth pointing out that the Chase Sapphire Preferred offers some other solid perks.

There is the $60 Peloton credit that is good for digital memberships and all access memberships. Together with the $50 hotel credit, you could actually turn a small profit with this card!

Other major benefits include:

- 25% bonus when using points in the Chase Travel Portal

- 12 months of DashPass

- Primary rental car coverage

- 10% anniversary points

And then you have the solid bonus categories like 3X on dining, streaming, and online groceries. So just make sure you’re aware that there are major value opportunities beyond the $50 hotel credit, since some of these perks could offset the $95 annual fee by themselves.

FAQ

No, if you do not use the $50 credit, you will not be able to utilize it in the next year.

The credit is automatically applied to your card when you make a hotel booking through the Chase Travel Portal. It does not require activation.

The $50 hotel credit is issued every anniversary year.

No, you do not earn additional bonus points on the $50 portion of your hotel purchase.

Final word

The Chase Sapphire Preferred is no doubt one of the most popular credit cards for travelers right now. The $50 hotel credit makes it a lot easier to offset the already relatively low annual fee of $95. However, you do lose out on some potentially valuable perks when utilizing this credit and that is something that everyone should be aware of.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.