The Chase Sapphire Preferred is one of the flagship credit cards offered by Chase. The card has a lot going for it including a great welcome bonus, decent bonus categories, and a lot of amazing travel protections. In this article, I’ll break down all of the benefits and show you just how valuable this card can be.

Table of Contents

Chase Sapphire Preferred intro

Card highlights

- 2X on Dining

- 2X on Travel

- 5X on Lyft

- DashPass

- Strong travel protections

- No foreign transaction fees

- $95 annual fee

The Chase Sapphire Preferred is arguably the most popular travel rewards credit card. It appeals to a broad range of consumers because of its low annual fee, superb travel protections, and ability to rack up valuable travel points that can be transferred out to some great partners. It’s easily one of the top travel cards for a beginner and that’s why I put it at my number one spot.

Welcome bonus

For the longest time the welcome bonus for the Sapphire Preferred was stuck at 50,000 Ultimate Rewards after spending $4,000 in the first three months.

That wasn’t a bad bonus at all but Chase eventually upgraded the welcome bonus to 60,000 Ultimate Rewards after spending $4,000 in the first three months which was much more attractive and even higher than the Chase Sapphire Reserve’s bonus.

60,000 Ultimate Rewards can get you very far.

Just how far? I’ll give you some examples.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Cashback

If you just redeemed your 60,000 point bonus for straight cashback, the baseline value is $600 which is actually very good.

Some banks with valuable transferable points don’t allow you to cash in at one cent per point so this is actually very competitive.

But you can do much better.

Chase Travel Portal 25% bonus

If you redeemed your Ultimate Rewards in the Chase Travel Portal, you’ll be able to book things like airfare, hotels, car rentals, and cruises at a rate of 1.25 cents per point which would put the value of your 60,000 points at $750.

But it’s not even all about the monetary value.

Using the Chase Travel Portal means that you don’t have to deal with award inventory or deal with black-out dates.

So there is a huge convenience factor here.

For people who like simplicity in their travel rewards, the travel portal is the way to go.

Just keep in mind that if you had the Chase Sapphire Reserve, you could redeem your points at a rate of 1.5 cents per point towards travel.

Chase travel partners

Things get even sweeter when you start to transfer your points out to travel partners.

Here are all of the current Chase transfer partners:

- Aer Lingus

- British Airways Executive Club

- Emirates

- JetBlue

- Flying Blue (Air France/KLM)

- Iberia Airways

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- Hyatt

- Marriott

- IHG

You can transfer your points to all of these partners at a 1:1 ratio.

For someone looking to do a lot of flying around the US, Chase Ultimate Rewards can be extremely valuable. You can often find Southwest Wanna Get Away flights on the cheap so transferring your points to Southwest is often a good move.

This is especially the case if you have the Southwest Companion Pass which allows a companion to fly for free with you for up to two calendar years.

United Airlines can also be a great option for flying around the US but don’t forget that you can use United miles on some great partners like EVA and Lufthansa.

I recently used United miles to fly first class on Lufthansa and it was a pretty amazing flight there are many other amazing business class and first class redemption possibilities with Ultimate Rewards.

60,000 Ultimate Rewards transferred to United wont be quite enough for a long-haul premium flight with partners like EVA and Lufthansa but it will set you up nicely to get there with perhaps some additional spending or another Chase card.

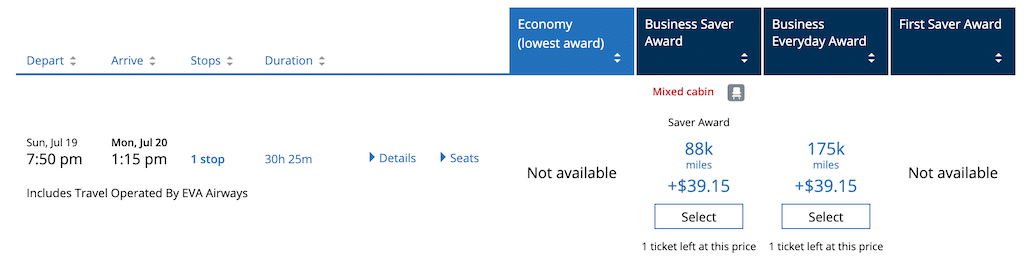

For example, you could fly one-way business class between Taipei and the US for 88,000 United miles plus ~$40 in fees.

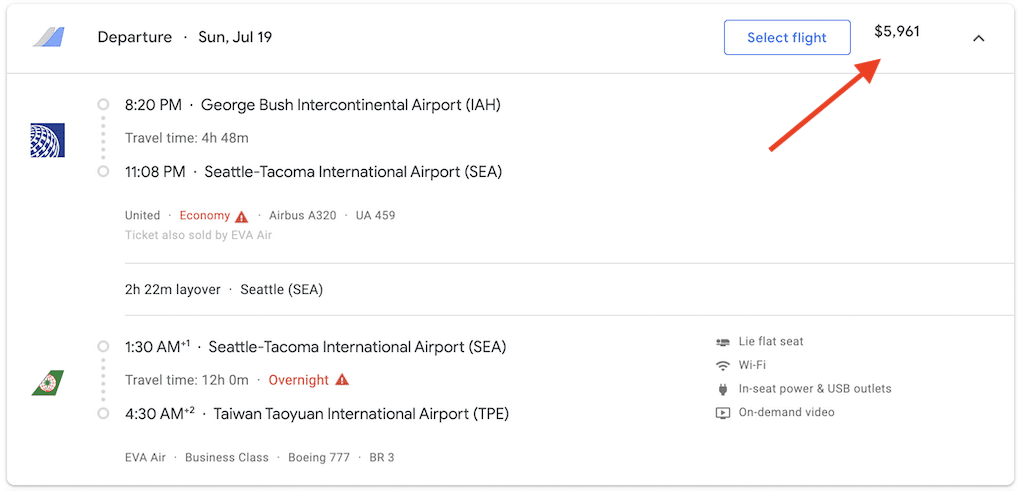

According to Google Flights this would be a $5,961 flight. So if you use your 60,000 Ultimate Rewards towards this redemption, the total value you would be getting from your 60,000 points would be approximately: $4,037!

That just goes to show the potential for outsized value with some of these transfer partners.

If you want to check out some more examples of some amazing premium cabins that you can book with Chase points, be sure to check these out here:

- First Class on the new Singapore Airlines A380

- Upper Class on the Virgin Atlantic 787

- First Class on the British Airways 747

Chase also has the best lineup of hotel partners, especially with Hyatt. If you transfer your welcome bonus over to Hyatt, 60,000 Hyatt points could get you two nights at a category 7 property which could amount to value close to $2,000!

So as you can see, transferring your points is the way to go for outsized value.

Eligibility

The Chase Sapphire Preferred is subject to the Chase credit card application rules including the Chase 5/24 rule and the dreaded Sapphire 48-month rule, not to mention the 2/30 rule.

Instead of trying to keep up with calculating all of these rules yourself, I highly recommend that you sign up for the free app WalletFlo which will automate your eligibility for all of these credit card rules.

You can also set up notifications so that you are reminded when you are finally eligible along with keeping tabs on your annual fees, upgrade history, etc.

Related: Chase Credit Card Application Status Guide

Bonus categories

- 2X on Dining

- 2X on Travel

- 5X on Lyft

2X on Travel

One of the great things about the Sapphire Preferred is that it earns 2X on a broad travel category.

Chase states that travel includes “airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.”

I’ve actually had quite a few tours and even excursions like scuba diving count as travel in the past.

2X on Dining

Dining is also pretty broad and includes primary businesses with “sit-down or eat-in dining, including fast food restaurants and fine dining establishments.”

Earning 2X on dining in travel is respectable.

Using a WalletFlo valuation of 1.73 cents per point, that comes out to 3.46% back. That’s not bad but many people believe that the Chase Sapphire Preferred is overdue for some changes in the bonus category department.

(Personally, I think it would be nice to see the addition of grocery store bonus spend.)

The thing about Chase is that you have some great options for earning more points. For example, the Chase Freedom offers 5% back on rotating categories and there is also the Chase Freedom Unlimited with its 1.5% back on all purchases.

5X on Lyft

Earning 5X on Lyft is a pretty big deal if you use that rideshare service.

Using the valuation above, 5X comes out to 8.65% back.

That’s very good but again some people may prefer to use a different service like Uber or they may not even use rideshares at all. Note that this benefit is currently only running through 03/31/2022.

DashPass Subscription

As a cardmember you will get a complimentary one-year DashPass membership, which is DoorDash’s subscription service that provides unlimited restaurant deliveries with a $0 delivery fee and reduced service fees on orders over $12.

Normally, this membership would cost you $9.99 per month, so that’s a high potential for savings over the span of one year.

Travel and purchase protections

One of the reasons why the Chase Sapphire Preferred is such a great travel rewards credit card is that it has fantastic travel protections, especially for a card with low annual fee.

Here’s a breakdown of the travel and purchase protections you’ll get with this card.

Primary rental car coverage

When you book a rental car on the Chase Sapphire Preferred, you should refuse collision damage waiver coverage because you have built-in rental car coverage with your card.

The best part about this protection is that the coverage is primary unlike so many other cars which only offer secondary rental car coverage.

Trip Cancellation/Trip Interruption

You can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses. These expenses include things like airline tickets, hotel stays, and tours, which is why I consider this card to be one of the best to use for hotel bookings.

This protection is one of the biggest reasons to get this card and why it makes sense to put most of your trip itineraries on this card. Unless your trip costs significantly more than $10,000, you often can avoid purchasing trip insurance with these perks.

Baggage Delay

The baggage delay protection will reimburse you up to $100 a day for up to five days for essentials such as toiletries and clothing when your baggage has been delayed over six hours.

The six hour threshold and $100 a day limit for coverage is very competitive making this once again a great card to use for airline travel.

Purchase Protection

The purchase protection benefit will cover you for new purchases for 120 days and you will be protected against damage or theft up to $500 per claim and $50,000 per account.

This benefit is definitely not one of the most competitive because other rewards cards offer purchase protection up to $10,000 per claim. So when it comes to your “big balla” purchases, you may want to put those on a different card.

Extended Warranty Protection

If you put a purchase on this card, a U.S. manufacturer’s warranty will be extended by an additional year, on eligible warranties of three years or less.

This is a pretty decent extended warranty protection but because the purchase protection limit is so low, I personally rarely rely on this.

Trip Delay Reimbursement

If your common carrier travel is delayed longer than 12 hours or if it requires an overnight stay, you and your family can be reimbursed for unreimbursed expenses including meals and lodging up to $500 per ticket.

This is a great perk because many common carriers such as airlines don’t have to provide compensation when your flight is substantially delayed for reasons like bad weather.

And when they do provide compensation or lodging it could be at a specific hotel but if you have this benefit you can go out and stay at a hotel of your choice while getting reimbursed for your dining expenses.

The only drawback is that it requires a delay of 12 hours versus six hours which is what is offered by other cards like the Sapphire Reserve.

Travel Accident Insurance

Hopefully you’ll never have to use this but if you pay for your air, bus, train or cruise transportation with your card, you can receive coverage of up to $500,000 for accidental death or dismemberment.

Travel and Emergency Assistance

If you get yourself into a situation while traveling and need assistance finding legal or medical referrals or some other type of emergency assistance, you can contact the Benefit Administrator.

Just to be aware that you will be responsible for any services that you accept.

Events and experiences

You can get exclusive access to some pretty cool events in different industries like music, sports, and entertainment. These include some high profile events like the Sundance Film Festival.

Direct access to customer service

One of the most convenient perks offered by this card is direct access to a customer service agent. All you have to do is call the number on the back of your card and you will be instantly connected to a customer service representative.

(You may have to verify the last few digits of your card first.)

This greatly cuts down on your waiting time and is a huge perk.

Foreign transaction fees

The Chase Sapphire Preferred has no foreign transaction fees.

Annual fee

The annual fee for the Chase Sapphire Preferred is $95.

Chase Sapphire Preferred FAQ

If you receive a 60,000 point bonus, you could be getting anywhere from $600 to over $4,000 worth of value. It all depends on how you choose to redeem your points.

The annual fee for the Chase Sapphire Preferred is not currently waived for most offers.

Primary rental car coverage

Trip Cancellation

Trip Interruption

Baggage Delay

Trip Delay Reimbursement

Travel Accident Insurance

Travel and Emergency Assistance Services

Yes, you can get pre-approved for the Chase Sapphire Preferred. Read more about how to do that here.

It’s recommended to have a great credit score of around 720 or higher to get approved. However, plenty of people have been approved for the card with credit scores that are lower than that. I would generally try to get my score as close to 700 as possible before applying though. Read more about approval odds.

Chase might pull from multiple bureaus when you apply. In my case, Chase will usually pull from Experian and Equifax but it could differ based on your location. Read more about credit pulls here.

Yes, after you have had the card for one year, you can look into upgrading to the Chase Sapphire Reserve which comes with a higher annual fee but many more benefits.

You are not allowed to get both of these cards based on the application rules found in the terms and conditions. You will need to wait 24 months from receiving a bonus from one of the cards and/or cancel one of them if you currently hold one in order to get approved for an additional Sapphire card. To automate your eligibility for these rules, I suggest using WalletFlo.

You get “roadside dispatch” which helps you get the roadside assistance that you need. However, this service is not complimentary and you will be billed for whatever services you accept.

Yes, after you have had the card for one year you may inquire about downgrade opportunities.

Many people choose to downgrade the Sapphire Preferred to the Chase Freedom or the Chase Freedom Unlimited, both of which have no annual fee but still offer great rewards. You can also downgrade to the no annual fee version of the Chase Sapphire.

Yes, it is possible to get a credit limit increase. There are several tips I have and I recommend that you read up on those in order to improve your odds of getting an increased credit limit.

No, the Chase Sapphire Preferred does not come with Global Entry. However, you can get this benefit with the Chase Sapphire Reserve. Find out more about Global Entry here.

No, the Chase Sapphire Preferred does not come with airport lounge access. Once again, you can get airport lounge access with the Chase Sapphire Reserve via Priority Pass Select.

Yes, the Chase Sapphire Preferred is partially metal. It’s not as heavy as some other metal cards like the Amex Platinum Card but it is more durable than a standard plastic credit card.

Because the card is partially metal, you may have trouble disposing of it (unlike a typical credit card that you can just cut up). Chase allows you to send in your card with a prepaid envelope for proper disposal if you would like.

No, as long as your card is active your points will not expire.

Chase may not require you to set up a travel notification on your Sapphire Preferred but this could depend on your travel and spending habits with Chase. If in doubt, you should try to set one up and you can find out how to do that here.

Final word

The Chase Sapphire Preferred has an amazing welcome bonus and decent bonus earning potential but it also comes with some amazing travel protections that make it a great choice for a go-to travel rewards credit card.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.