Are you trying to check your Barclays credit card application status?

Well, you’re in luck as Barclays makes it easy to check your status with a simple application status checker.

In this article, I will show you how to check your Barclays credit card application status online or over the phone. Then I will give you some handy reconsideration tips that have worked for me when Barclays has denied me.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

How to check your Barclays credit card application status

You can check your application status by accessing Barclay’s application status checker or by calling Barclays customer support. I prefer checking online as it’s less cumbersome than calling.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Check your Barclays credit card application status online

The type of credit card you are applying for will determine which application status checker you can choose to check your Barclays credit card application status.

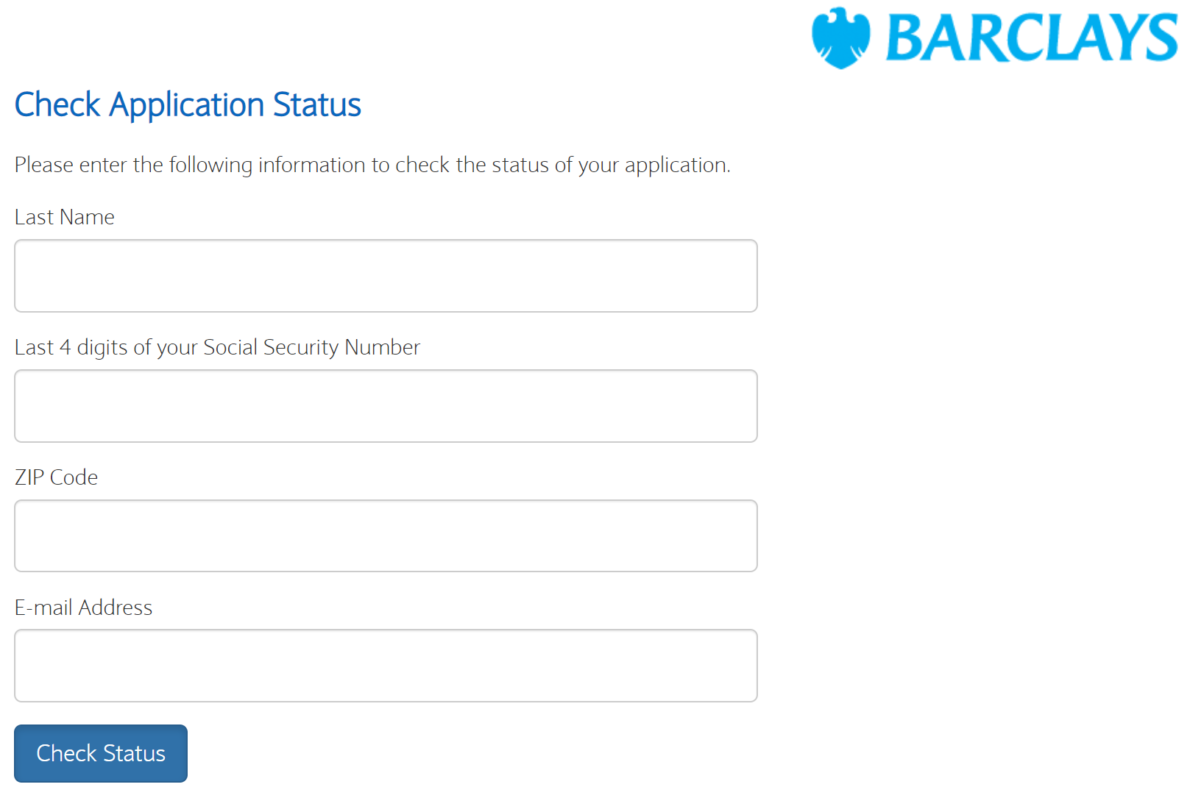

You won’t need an application number, but you will need the following to check the status:

- Last name

- Last four digits of your Social Security Number (SSN)

- ZIP code

- E-mail address

(Remember, it must match the information you gave during the application process.)

After filling the blanks with your information, you’ll be able to view the status of your credit card application.

You will only see the most recent credit card application status dating up to 90 days from the application submission. It’s not like Amex application status checker which allows you to look at all past applications.

You will see three messages when checking the status of your Barclays credit card.

- Denied

- Reviewing (pending)

- Approved

Application status: “denied”

If your status says that you’re denied, then you’ll probably want to call the reconsideration line phone number found below.

Reasons for your denial will usually be related to the number of inquiries, the number of new accounts, debt-to-income ratio, or not following the Barclays credit card rules.

Application status: “reviewing” or “pending”

If your application is being reviewed, then you may just need to wait a few days because Barclays is processing your app. Sometimes calling into the reconsideration line will expedite this but other times you must simply wait it out.

An application being reviewed will usually be because someone has to review your credit report and determine if you are too risky or not profitable.

Application status: “approved”

Congratulations, you have been approved! You won’t need to do anything else besides waiting up to 10 business days for your credit card to arrive at the billing address.

Check your Barclays credit card application status by phone

You can check your Barclays credit card application status via phone by calling the following numbers:

- +1-877-523-0478

- +1-888-232-0780

Stay on the line until you can say or select the option to “check on an application.” Make sure you have your information ready.

If you need, they can also direct you to a credit analyst for reconsideration.

What Barclays credit cards can I check my application status for?

You should be able to check your status for any Barclay personal or business credit card including:

- AAdvantage® Aviator® Business Mastercard®

- Diamond Resorts World Mastercard®

- Choice Privileges® Visa Signature® Card

- Carnival® World Mastercard®

- Miles & More® World Elite Mastercard®

- AAdvantage® Aviator® Red World Elite Mastercard®

- Holland America Line Rewards Visa® Card

- JetBlue Plus Card

- Barnes & Noble Mastercard®

- Hawaiian Airlines® Business Mastercard®

- FRONTIER Airlines World Mastercard®

- Hawaiian Airlines® World Elite Mastercard®

- JetBlue Business Card

- JetBlue Card

- NFL Extra Points Credit Card

- Priceline Rewards™ Visa® Card

- Princess Cruises Rewards Visa® Card

- RCI® Elite Rewards® Mastercard®

- Uber Visa Card

- Upromise® Mastercard®

- Wyndham Rewards® Visa® Card

How long does approval take?

If your credit card approval is not instant, it could take up to 10 business days to process the application manually.

If you suspect things are lingering too long then check with the reconsideration line number below.

On another note, Barclays is known to make applications go into review. Don’t worry too much if your application is being reviewed as it’s common with people that have high or low credit scores.

How long does it take to receive a Barclays credit card?

Barclays claims you will receive your credit card within 10 business days of your application being approved. At the time of approval, Barclays will also quote the number of days it will take for you to receive your card, usually up to 10 business days.

In my experience, it usually took no longer than seven business days to receive my new Barclays credit card. Barclays will expedite cards for a fee.

Can I check for credit limit increase approval?

Barclays doesn’t have a tool to check the status for your credit line increase online.

So, the only way for you to check is to call Barclays and talk to a credit analyst. They will give you the status and might request more information from you or perhaps give you reasons why you were denied a credit line increase.

You can call a Barclays credit analyst for personal cards with this phone number:

- +1-866-408-4064

For business cards:

- +1-866-710-2688

Barclays credit card rules

Barclays has a few rules for new applicants restricting credit card sign-ups. These rules aren’t exclusive to Barclays as other bank issuers will also have rules.

No limit to the number of cards

Barclays doesn’t have a limit to the number of Barclays credit cards you hold. That means you can hold as many cards you want with Barclays, but only if you get approved. Still, it might be a good idea to keep it to a reasonable number.

90 days for minimum spend

You have 90 days from when you applied for your Barclays card to meet your minimum spend. Therefore, you start counting the 90 days once you applied for the card, not when you received it.

Barclays doesn’t have any hard rules

Surprisingly, Barclays doesn’t have many hard rules across all their cards. While some claim they have rules regarding the number of cards you can apply within 24 months (6/24), Barclays doesn’t put anything in writing and doesn’t always enforce these rules.

Some soft rules like waiting 6 months to apply for a new Barclays credit card are true for some people. Yet, there are data points out there showing how it’s not the same for every person.

Barclays actually focuses on the credit report more than anything else. So, if your score is not above 700, you will have a harder time getting a Barclays credit card approved.

Barclays credit card reconsideration line

If you’re not approved, or even having an application under review, you will want to call up a Barclays credit analyst. They will be able to review your application and give you feedback or request more information from you and perhaps get you approved for a credit card.

Barclays reconsideration phone number and hours for personal cards

The phone number for personal card applications is:

- +1-866-408-4064

You can also try:

- +1-800-308-6008

And the operating hours:

- 8am to 12am EST (midnight) seven days a week

Barclays reconsideration phone number and hours for business cards

The phone number for personal card applications is:

- +1-866-710-2688

And the operating hours:

- 8am to 8pm EST seven days a week

What to say in a reconsideration call

Handling a reconsideration call isn’t very difficult, but there are a few things you should consider.

The first is that you need to have a good reason for why you’re seeking a card.

Here are some excellent reasons for seeking new credit cards:

- You need the credit card(s) to help segregate your expenses for some purpose (e.g., starting multiple businesses)

- You’re switching or trying to build up a relationship with a specific airline like American Airlines (only works if you’re getting that particular co-branded card)

- You don’t want to pay foreign transaction fees, or you are attracted to some other benefit (e.g., primary rental car insurance)

- You prefer one interest rate (APR) over another (especially when dealing with balance transfers)

- Prefer pin and chip over sign and chip

- You want to utilize the benefits and gain awards by using the card for everyday spend (everyday spend shows profitability towards Barclays)

Generally, it’s not a good idea to tell the phone reps that you’re just going after a card because you think it has a “great sign-up bonus.” That will make you look like an unprofitable customer, or even worse, a “gamer” which any bank has come to despise.

Don’t be nervous when calling Barclays. The credit analysts have the power to change your application denial to an approval. Plus, if you are calm and cool and not trying to game the agent, they will be more willing to help you out.

Barclays credit pulls

Barclays is known to pull from the TransUnion credit bureau.

This is great as TransUnion is pulled from the least compared to the other credit bureaus, so you can give your credit report a rest in many cases.

If you got denied by Barclays, you would still have a hard pull on your credit report. Hard pulls will stay on your credit report for two years but should lose their effect for FICO scores after one year.

Barclays referrals

While Barclays doesn’t have an official refer-a-friend program like Amex, it does sometimes target current cardholders giving targeted cardholders referrals to hand out.

Unfortunately, the targeted referrals from Barclays aren’t frequent and come in waves lasting a limited amount of time. So, if you can take advantage of referring someone to get some kickback, you should do it and call yourself lucky.

Final word

Don’t be worried if your application is pending as Barclays is known to take their time to review applications. If you did end up getting denied, call that retention line as those credit analysts do have the power to approve you.

I hope you found this article helpful. Remember we aren’t Barclays, so we cannot guarantee anything, but if you have any questions, drop them down in the comments below.

This article was originally published by Steve Smith.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

What if there is no record of my application? I applied today for JetBlue Plus Biz and there is no info when I check online or the phone?

You might have to wait until a weekday to get an answer. If you don’t see your status appear on Monday, something might be up and you should call in.

Have you found odds to be pretty good for getting approved when calling the reconsideration line? I applied for the AA Barclay business and just checked my status and was denied. Should I wait for my letter or call tomorrow?

Just called the reconsideration number listed in the article and was told to call 800-308-6008

Thanks for the update!

I was approved on October 5, 2021 and it said i should receive my credit card in 10 days today is October 27, 2021 and still no credit card i have called 4 different number , spoke with several customer service rep for them to tell me my info isn’t in the system but yet when i check the statis it says approved and been on hold for longer than an hour

No one can seem to help me and give me an answer

Blessings

Joyce

Is it true that with a Barclays credit card application you have to declare you have lived in another country and they then do a credit check on you in that country?