The Amex International Airline Program might be one of the best kept secrets of the Amex Platinum Card. It offers opportunities to save hundreds or even thousands on premium airfare, making it one of the most valuable perks of the Platinum Card.

However, there are some restrictions on this program that you should know about.

This review article will discuss everything you need to know about the Amex International Airline Program, including how to book your tickets and what kinds of discounts you can expect to receive.

Update: Some offers are no longer available — click here for the latest deals!

Table of Contents

What is the Amex International Airline Program (IAP)?

The Amex International Airline Program is a special program available to Platinum cardholders and Centurion cardholders that allows you to receive special discounts on up to eight first class, business class, and premium economy fares when booking through Amex. (Noticeably missing from eligibility is the Corporate Amex Platinum Card.)

Of course, the Platinum Card offers other solid benefits like 5X on airfare, lounge access, and many others that help to offset the card’s annual fee.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What about the American Express Platinum Companion Fare?

The Amex International Airline Program used to allow you to purchase a 2-for-1 business class fare and so it functioned as a sort of premium companion pass. One of the big drawbacks to this program was that you were forced to purchase a full-fare business class ticket.

This perk had limited value to many people because full fare business class tickets can be very pricey and so the amount saved was often minimal. For example, you might be charged close to 2X the price for a full fare business class ticket versus a discounted rate.

There was a small subset of folks who likely benefited from booking these full fares for work and who were reimbursed but with a companion fare to go along with them. But this group of people was not very large, which made the International Airline Program one of the least interesting features of the Platinum Card.

Well, in the summer of 2017, Amex revamped the Amex International Airline Program. This program is much more useful and practical for cardholders and in my opinion adds a tremendous amount of value to the Platinum Card.

The Amex International Airline Program rules

While this program has the potential to save you a lot of cash on your first class, business class, and premium economy tickets, there are some rules that you need to be aware of in order to take advantage of the savings.

Refundable or non-refundable fares

This is a very welcomed change. With the new program you can purchase either refundable or non-refundable fares and still receive your discount.

First class, business class, and premium economy

As stated, the deals apply to first class, business class, and premium economy fares.

Flights must originate in the US

Travel must originate in and return to U.S. gateway (may exclude certain overseas territories) and select Canadian gateways. One-way travel permitted on some airlines where routing originates in U.S. or select Canadian Gateways

Ticket service fee

There is a $39 per ticket service fee per booking, so make sure to factor in that fee for your savings. Also, if you need to make any changes or rebook your flight, you will likely have to pay the $39 fee each time.

This service fee is waived for Amex Centurion members.

Membership Rewards can be used

Membership Rewards can be used to cover the cost of the ticket via Pay with Points. You’ll need to redeem a minimum redemption of 5,000 points. Your card will first be charged with the full price of the ticket and then Amex will reimburse you based on the value of your Membership Rewards.

Remember that if you book with the Business Platinum Card you’ll be able to get 35% Membership Rewards points back after you use points for all or part of an eligible flight booked with Amex Travel, up to 500,000 points back per calendar year. So using points with the Business Platinum Card allows for even more lucrative redemptions.

If you choose to pay with points, you will still be able to earn your frequent flyer miles so it’s a sweet deal.

You can find the official terms and conditions here.

How to book the Amex International Airline Program

To take advantage of these special fares, you no longer need to call American Express Travel speak with an agent. You can now search and book flights online here.

If you still want to book over the phone, there are two phone numbers for the International Airline Program, depending on whether you have a personal card or a business card. Here are the hone numbers:

- 1-800-525-3355 for Platinum Travel Service

- 1-800-553-9497 for Business Platinum Travel Service

One of the great features of this program is that they allow you to put a flight on hold free of charge for up to 48 hours. Once you’ve found your potential itinerary, you should also be able to have the itinerary sent to your email address for your review and reference.

If you do put a booking on hold you should verify with the rep that the pricing will remain the same and be sure to closely monitor the price at all times since there are reports of the pricing fluctuating on some cardmembers.

Book via Amex chat

Amex also recently made a change so that you can now book your flights via chat! Simply log-in to your account and open up a chat and after verifying your details, you’ll be able to make your search request.

What kind of discounts can you get with the Amex International Airline Program?

The big question about this program is what kind of discounts are you able to get through it to make it worth it or not. Generally, when you find a deal, you’re probably going to be looking at discounts around 5 to 15% off but you can certainly find discounted fares that will offer even more off than that.

For example, you can find reports of people receiving discounts of close to 50% off on certain flights. Those awesome deals are going to be less common but there’s an insane amount of value to capture if you can snag one of those fares.

I recommend checking out the Flyertalk thread/Wiki on this to get a sense of the discounts found on different airlines.

Note that you should never take it for granted that these rates will be cheaper than publicly available rates and should always compare pricing since sometimes these discounts leave a bit to be desired and sometimes there are no discounted rates offered (compared to what the airlines are offering). I recommend a simply price search with Google Flights for easy comparisons.

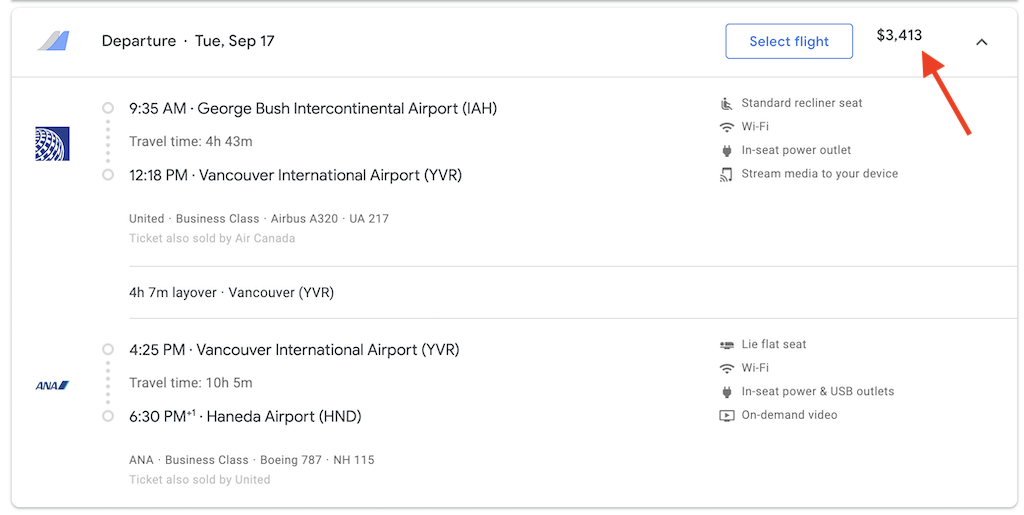

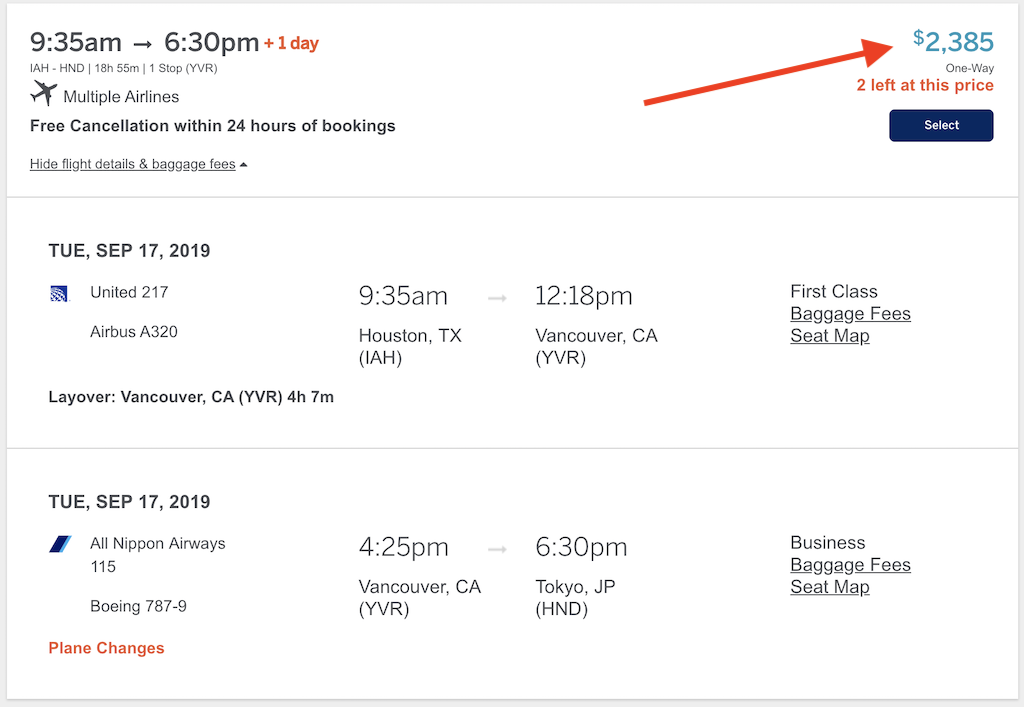

You can see the price comparison between Google Flights $3,413 and Amex IAP $2,385 below on a one-way flight to Tokyo– a difference of over $1,000 or 30% off!

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What airlines participate?

Not every airline participates in the program. Currently, here is the list of airlines that participate:

- AeroMexico

- Air China

- Air France

- Air New Zealand

- Alitalia

- ANA

- Asiana Airlines

- Austrian

- British Airways

- Brussels Airlines

- Cathay Pacific

- China Airlines

- Delta

- Emirates

- Etihad Airways

- Iberia

- Japan Airlines

- KLM

- LATAM

- Lufthansa

- Qantas

- Qatar

- Singapore

- South African Airways

- Swiss

- Virgin Atlantic

You’ll notice that notably absent are domestic carriers United and American.

Can you earn 5x with the International Airline Program?

Both the personal Platinum Card and the Business Platinum Card will earn 5X the points when booking flights with Amex Travel.

The personal Platinum Card earns 5X with the International Airline Program but the Business Platinum Card does not according to Amex reps.

Keep in mind that the Business Platinum Card only earns 5X through the Amex Travel portal while the personal Platinum Card earns 5X on airfare purchased directly with the airlines. Amex chat reps state that the Business Platinum does earn 5X with the IAP but I haven’t been able to personally verify that.

5X the points is a lot of points. If you value Membership Rewards at 1.8 cents per point then that’s like earning just under 10% back on your purchase. So that’s an additional discount that you want to factor into your analysis if you’re using a Platinum Card to pay for your airfare.

The 5X on airfare is only one of the key benefits to the Platinum Card. Here’s a quick rundown of some of the major Platinum benefits.

- $200 annual airline credit

- $200 annual Uber credit

- $100 Saks credit

- $179 CLEAR credit

- $200 Hotel credit

- $300 Equinox credit

- $240 Entertainment credit

- Priority Pass access for you and two guests

- Centurion lounges access for you and two guests

- Delta Sky Club access when flying with Delta

- Hilton Honors Gold elite status

- Marriott Gold

- 5X on airfare and 5X on hotels booked through the Amex Travel portal

- TSA Pre-Check/Global Entry $100 credit (read about these programs here)

- Annual fee: $695 (NOT waived first year)

YouTube

Amex International Airline Program FAQ

Yes, you will earn 5X Membership Rewards when you use your Platinum Card for the International Airline Program. But, the Business Platinum Card will not earn 5X.

Yes, you can use Membership Rewards to pay for your flight. You’ll need to redeem a minimum redemption of 5,000 points.

Yes, you will still earn your frequent flyer miles when you book with the International Airline Program.

Yes, you can book either refundable or nonrefundable fares with the IAP.

Yes, your booking will be subject to a $39 ticket service fee.

Final word

The International Airline Program has the potential to be the most valuable benefit offered by the Platinum Card if it’s one that you would normally put to use. With just one booking you could potentially save hundreds or thousands of dollars which would instantly offset the high annual fee (which is already pretty easy to offset).

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Hey Daniel, quick question that you may get A LOT.

If you could only choose one card between the Amex Platinum & the Sapphire Reserve, Which would you choose based on not having any other amex/chase cards to balance and play with, and why?

Appreciate what you do and all the info you put out.

-Devon

I would go with the CSR. That’s because id still earn a lot on dining and travel and get all of the better travel protections. Lounge access wouldn’t be as good but I’d rather have long term earning potential, an easy $300 travel credit, and ability to save with DoorDash or use the Chase travel portal at 1.5 cent per point. I don’t use programs like this IAP or FHR enough to stick with just the Platinum. But if I did, and really wanted Centurion club access, I might go with the Plat.