Offers contained within this article maybe expired.

Are you trying to check your Amex credit card application status?

Luckily, Amex makes it very easy to check your status.

This article will show you how to check your status online or over the phone.

I’ll also show you some tips if your credit card application is denied that might allow you get it changed to approved when calling into the reconsideration line.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

How to check your Amex credit card application status

You can check your application status online or you can do it over the phone. I personally recommend that you do it online because that’s going to be the quickest and easiest route for many.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Check your Amex application status online

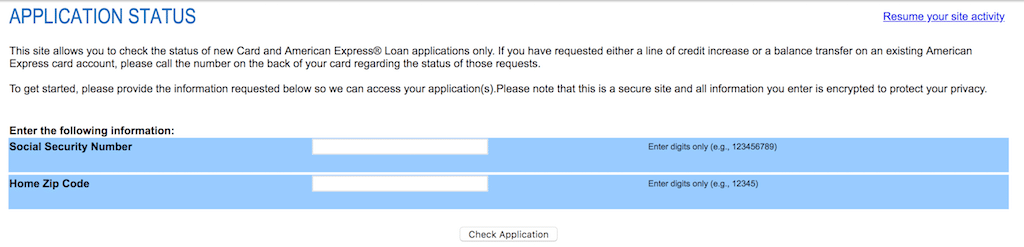

You can check your credit card application status here. (You can also check on the status of loans as well).

Simply do the following:

- Enter your (full) social security number (SSN)

- Enter your home zip code (the one you used on the application)

- Click “Check Application”

Be sure to only include digits when entering your social and ZIP Code.

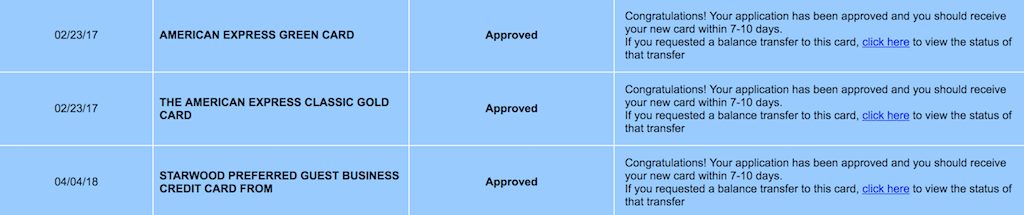

Once you input your personal information, you’ll be able to view the status of your credit card application.

You should also see the status of prior credit card applications as well (both personal and business credit cards should show up).

As you can see, mine show “Approved” below but other messages you might see are:

- Denied

- In Progress

- Cancelled

Application status: “Denied”

If your status says that you’ve been denied then you’ll probably want to call the reconsideration line phone number found below. Keep reading for more tips on that.

Application status: “In Progress”

If your application is in progress you may just need to wait a few days because Amex is processing your app. Sometimes calling in to the reconsideration line will expedite this but other times you must simply wait it out.

Application status: “Cancelled”

If you see that it’s been cancelled you should call Amex immediately to inquire about what happened (there could have been some sort of verification issue).

For all of these, you don’t want to wait too long to act because if you wait longer than say, 30 days, your application may no longer be considered active and you might have to reapply for a card.

Check your Amex application status by phone

You can also check your American Express application status via phone.

You can try the following phone numbers:

- 1-866-314-0237

- 800-567-1083

You’ll probably be asked to enter the last four digits of your SSN and zip code when you call.

Related: What Does Amex’s “Member Since” Date Really Mean?

What Amex cards can I check my application status for?

You should be able to check your status for any personal credit card or business credit card including:

- Platinum Card from American Express

- Amex Gold Card

- Amex Green Card

- Blue Business Plus Credit Card

- Blue Cash Preferred® from American Express

- Blue Cash Everyday® from American Express

- Blue Delta SkyMiles® Credit Card

- Business Green Rewards Card

- Gold Delta SkyMiles® Credit Card

- Platinum Delta SkyMiles® Credit Card

- Delta Reserve® Credit Card from American Express

- Delta Reserve® for Business Credit Card from American Express

- Hilton Honors American Express Card

- Hilton Honors American Express Surpass Card

- Hilton Honors American Express Aspire Card

- Amex EveryDay® Card

- Amex EveryDay® Preferred Card

- The Business Gold Rewards Card

- The Plum Card®

- Gold Delta Skymiles® Business Credit Card

- Platinum Delta Skymiles® Business Credit Card

- The Business Platinum Card®

- Lowe’s Business Rewards Card from American Express

- SimplyCash® Plus Business Credit Card

Related: American Express Travel Notifications Guide: Are They Needed?

How long does approval take?

If your credit card approval is not instant it could take a couple of days for your application to process. In my personal experience, I’ve never had to wait longer than a handful of business days.

If you suspect things are lingering too long then check with the reconsideration line number below.

How long does it take to receive an Amex card?

You should receive your card within 7 to 10 day business days. However, for some cards like the Platinum Card Amex will allow you to receive it with expedited shipping so the delivery time could be much quicker.

Once you are approved, you should immediately request expedited shipping or else it might be too late.

Can I check for credit limit increase approval?

Note that the above website is not where you you’ll see the status of a credit limit increase request or a balance transfer.

If you have requested either a line of credit increase or a balance transfer on an existing American Express card account, call the number on the back of your card regarding the status of those requests.

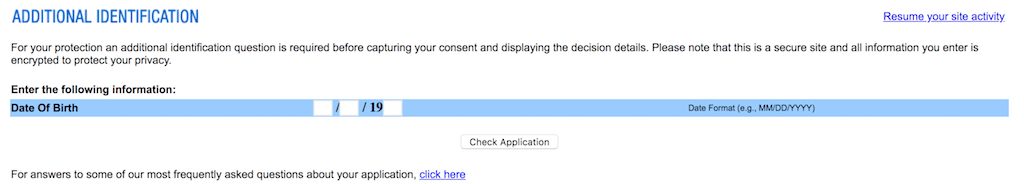

However, if you requested a balance transfer for your new credit card, you should be see a link taking you to a screen where you can check on that.

It will state:

If you requested a balance transfer to this card, click here to view the status of that transfer

You’ll then be taken to a new screen where you might have to verify your date of birth to proceed.

Amex credit card rules

Amex, like many other major credit card issuers, has a few specific rules you need to take into consideration when applying for their credit cards. By the way, if you find all of these credit card rules a little complex and confusing, be sure to check out the free app WalletFlo that will automate the calculations for all of these.

The Amex 2/90 day rule

The Amex 2/90 rule does not allow for you to be approved for more than two credit cards within any 90 day period.

Remember, this rule applies to credit cards, not charge cards.

Some applicants are lucky enough to get around this rule and get 3 credit cards in 90 days, but generally they are the exception to the rule.

Things are different when it comes to charge cards, though.

There is no strict limitation on charge cards. However, I would limit charge card applications to about 2 per 90 day period just to be on the safe side.

One credit card application per day

American Express application rules typically (though not always) limits you to one Amex credit card approval per 5 business days.

Again, this does not apply to charge cards but only credit cards. Also, some people have been able to get around this rule in the past.

Five Amex credit cards total

American Express used to limit consumer to four total credit cards but now they allow usually allow you to hold five credit cards at a maximum.

Once again, this rule does not apply to charge cards and there are people who have found ways to get around this rule.

Bonuses are once per lifetime

One of the most important American Express application rules to know about is the once per lifetime bonus rule.

This means that once you open up a specific card, you can never earn the bonus for that card ever again even if you cancel your card and reapply.

There’s no distinction between charge cards and credit cards with this rule, either.

Crack down on gaming

American Express has cracked down on gaming and has decided to start denying welcome bonuses to those who they believe are trying to game the system.

Now, Amex will tell you if you are not eligible for a welcome offer before they ever run your credit.

For more on these rules, I suggest that you read my primer on applying for American Express credit cards.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Amex credit card reconsideration line

If you’re not approved for your credit card then you’ll probably want to call up to the Amex reconsideration line. This phone line gives you the chance to plead your case and show why you should be approved for a card.

Amex reconsideration phone number and hours

Here are the phone numbers and hours for the Amex reconsideration line.

- For new customers: 877-399-3083

- For current customers: 866-314-0237

Here are the hours of operation:

- Monday to Friday: 8am to 12am

- Saturday: 10am to 6:30pm

- Sunday: Closed

What to say in a reconsideration call

Handling a reconsideration call isn’t very difficult but there are a few things you should consider.

The first is that you need to have a good reason for why you’re seeking a card.

Here are some good reasons for seeking new credit cards:

- You need the credit card(s) to help segregate your expenses for some reason (e.g., starting multiple businesses)

- You’re switching or trying to build up a relationship with a certain airline like Delta

- You don’t want to pay foreign transaction fees or you are attracted to some other benefit (e.g., primary rental car insurance)

- You prefer one interest rate (APR) over another (especially when dealing with balance transfers)

Generally, it’s not a good idea to tell the phone reps that you’re just going after a card because you think it has a great sign-up bonus. That will make you look like an unprofitable customer, or even worse, a “gamer” which Amex has come to despise.

Amex credit pulls

American Express is known to pull from the credit bureau Experian.

But one cool thing about Amex is that they don’t always perform a hard pull on your credit card application.

If you’re a current customer then Amex will often only perform a soft-pull if they reject your credit card application. And sometimes Amex will even perform a soft pull when they approve your application.

I don’t think anybody knows exactly how to predict which type of credit pull will be done by Amex but it’s good to be aware of these.

There also might be some link between soft pulls and applying for Amex pre-qualified credit card offers.

Amex Refer a Friend

Amex has a program called Amex Refer a Friend which allows you to send your referral application links to friends and family and if they are approved then you’ll get a nice cut of points or miles.

There is no way to check on the approval status of other people who have used your links though, so you’ll often have to personally verify that they used your link and were accepted. You can read more about the Amex Refer a Friend program here.

Final word

American Express makes it very easy to check on the status of your credit card and loan applications. It’s a good idea to review all of the different Amex application rules so that you have a good idea of what to expect when it comes to the outcome of your credit card application.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.