Offers contained within this article maybe expired.

Food delivery services such as Uber Eats and GrubHub have exploded in popularity over the last few years. They make finding and ordering food much more convenient in many areas of the country.

The drawback is that they come with a lot of fees including delivery fees which can be quite pricey.

Luckily, there are ways to avoid these delivery fees with memberships like Uber Eats Pass.

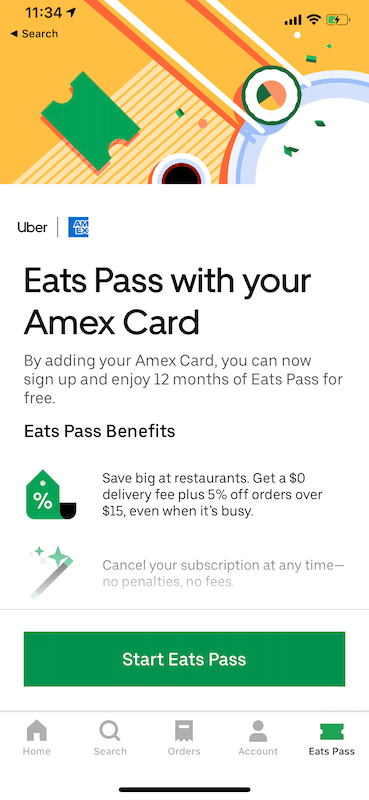

And now it’s possible to get a free Uber Eats Pass membership with certain American Express cards.

In this article, I’ll tell you everything you need to know about Amex Uber Eats Pass including how to enroll and what to expect.

Table of Contents

What is Uber Eats?

Uber Eats is a food delivery service app that allows users to order meals from various restaurants and have the meals delivered directly to their home or another desired location.

What is the Eats Pass Membership?

The Eats Pass Membership is a monthly subscription through Uber Eats that offers various benefits including $0 delivery fees, 5% off restaurant orders over $15, and $0 delivery fees on grocery deliveries over $30 in select markets.

Typically, this membership would cost $9.99 per month or $119 per year.

For a regular Uber Eats user, this perk can result in some pretty massive savings.

The delivery fees will change based on when and where you order your food from but it’s not uncommon to have to pay a few bucks per order.

If you order Uber eats once a week, it’s very possible that the waived delivery fees could save you over $200 in a year alone.

And when you also factor in the savings on restaurant orders over $15 and grocery delivery orders over $30, those savings can add up even higher.

So for people who are already using Uber Eats, this is really a fantastic saving opportunity.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What is the American Express Eats Pass membership?

If you have an eligible American Express card, you can get the Uber Eats Pass for free for up to 12 months!

The stipulation is that you must enroll by December 31, 2021.

Tip: Since this benefit is offered in a 12 month timeframe, you don’t want to activate the subscription until you are confident that you will actually be using it.

What American Express cards get the Eats Pass membership benefit?

You can receive the Uber Eats Pass if you have one of the following consumer American Express cards:

How to enroll in the benefit

To enroll in the Uber Eats Pass offer, first make sure that you have downloaded or updated to the latest version of the Uber Eats app.

Once you are in the app, add your eligible American Express card to your wallet.

After you have added your card, you should be able to see a prompt to enroll in Uber Eats Pass.

If you have already added your eligible card, then all you have to do is claim your complimentary Uber Eats Pass within the app and confirm your enrollment.

You will see a tab for Eats Pass in the bottom right corner of the app and once you click on that you will see a call to action button that says “Start Eats Pass.” Simply tap on that to enroll.

If your card has been added you should see a slide up window that indicates when your billing will begin and that you qualify for 12 months free. Remember that this will auto renew when your 12 months are up.

You can find out more about how to enroll here.

Note: Some people including myself have experienced a glitch where the membership was only activated for six months. If this happens to you, you can try re-adding your eligible American Express card and if that does not work contact Uber Eats.

New change

In order to receive your Uber Eats Pass benefits you must use an eligible Amex card for payment. In some cases, this may mean you’ll have to miss out on bonus points (e.g., using the Platinum instead of the Chase Sapphire Reserve).

Monthly discount

A new discount will be applied to Uber Eats Pass members for Uber rides. You’ll be able to save 10% on your first 3 eligible rides of every month. Only UberX, UberXL, Uber Green, and Uber Comfort rides are eligible for the 10% rides discount. Only Uber Black rides are eligible for the 15% rides discount.

Other Uber benefits

You can save on Uber if you have an American Express Platinum Card or Gold Card with special monthly credits that are issued.

The Platinum Card receives a $15 monthly credit on Uber that comes in the form of Uber Cash ($30 for the month of December). This means that you can use this credit on Uber rides or on Uber Eats.

And starting early next year, the American Express Gold Card will provide card members with $10 monthly credits in Uber Cash which can also be used on Uber rides or Uber Eats.

Tip: If this is a lot for you to keep track of, I would recommend you use the free app WalletFlo to help you keep track of all of your credits.

American Express Uber Eats Pass FAQ

After you have used your membership for 12 months, you will be automatically charged $9.99 or the current pass rate.

This means that you need to remember to cancel your Eats Pass in order to avoid the fees.

If you would like to know the exact day that your pass ends, simply click on the Eats Pass tab and scroll down under “learn more” and you will see the exact date the offer ends.

You must enroll in this benefit before December 31, 2021. You will have the benefit for 12 consecutive months from the date that you enroll.

Generally, yes it is a good idea to tip your Uber eats delivery driver. You can read more about the tip or not to tip a debate here.

If you are already enrolled, simply select the Eats Pass icon to enroll in a complimentary membership through American Express.

Once you enroll, your membership will become complimentary at the start of your next billing cycle.

Yes, Uber will auto-bill you for Uber Eats Pass starting 12 months from the initial enrollment in the benefit.

Final word

This is a fantastic way to save for someone already using Uber Eats.

If you are new to Uber Eats then it can also be a great way to save but you need to factor in that sometimes you have to pay other fees such as service fees or sometimes even deal with marked up prices.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I no longer have a physical card as I thought I had cancelled this card. ow can I cancel it if it is not in my possession?