When it comes to finding your security code for your American Express card, things aren’t always so straightforward, especially if you are used to other cards like those from MasterCard and Visa. That’s because American Express does things a little bit differently when it comes to credit card numbers and security codes.

In this article, I’ll break down the difference between an American Express security code and other codes you might find on cards like a Visa or MasterCard.

Table of Contents

What is the American Express CID (CVV) code?

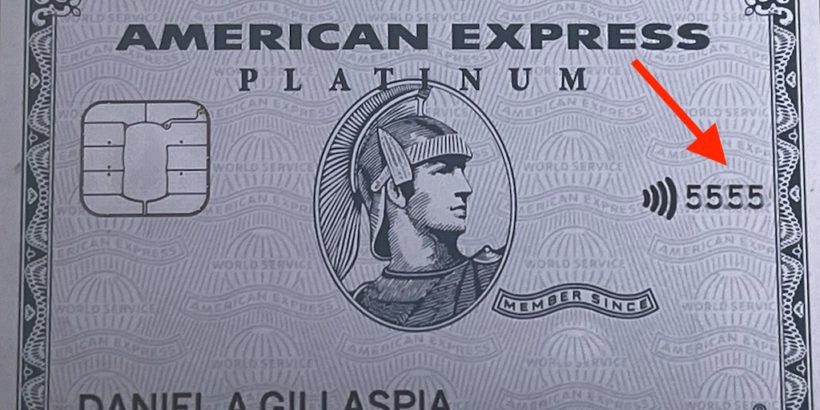

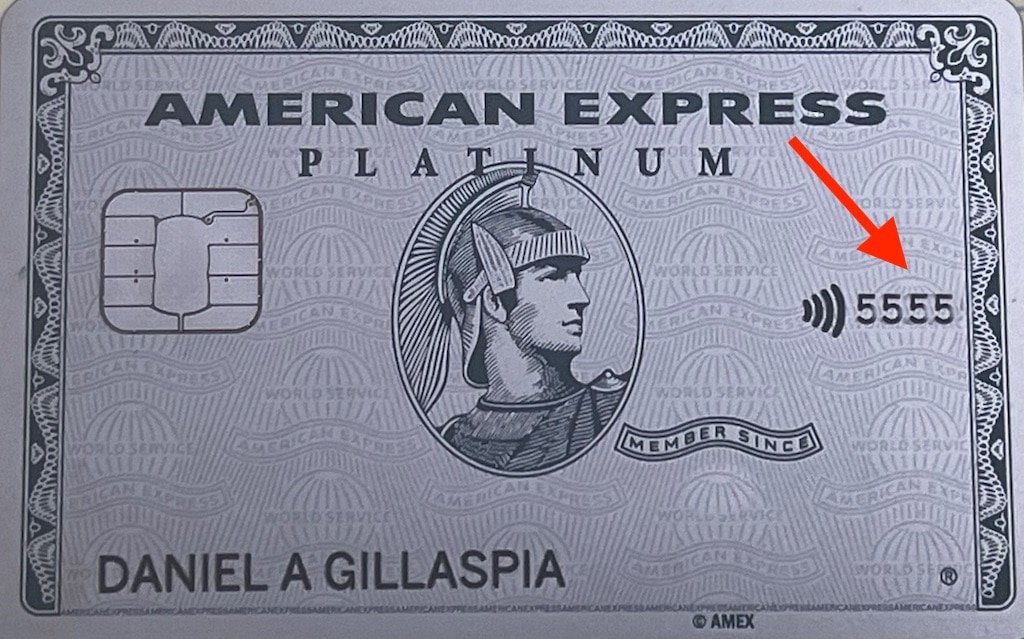

The CID (card identification number) is the four digit number located on the front of your American Express card.

Tip: Check out the free app WalletFlo so that you can optimize your credit card spend by seeing the best card to use! You can also track credits, annual fees, and get notifications when you’re eligible for the best cards!

CVV codes overview

CID/CVV codes actually started out in the UK and they were initially an 11 character alpha numeric code. Eventually, the concept was adopted by the UK Association for Payment Clearing Services and they streamlined the code into the three digit code we are familiar with today. MasterCard started to use them in 1997, American Express in 1999, and Visa in 2001.

You might be wondering what exactly is the point of a credit card security code?

These codes can serve a few different purposes.

The main purpose is that these codes confirm with the merchant that you are actually in possession of the card. This is especially important for online purchases where you cannot supply a signature, pin, or any other type of in-person verification.

It’s possible that somebody could take an imprint of your credit card or obtain your credit card number through some other type of means and attempt to fraudulently use your card to purchase something.

If the fraudulent actor is required to supply the security code but they don’t have your card to get the number, then this enhanced security measure can help prevent fraud.

This can work well for a few reasons.

First, your CID is not stored on your EMV chip or magnetic strip. This means that merchants cannot obtain your CID simply by swiping your card, which helps cut down on credit card fraud.

Furthermore, your CID cannot be stored by a merchant when making an online purchase. (This is one reason why you are sometimes required to input your CID when auto populating your credit card account number.)

Since merchants can’t store your security code, in the event of a data breach you don’t have to worry about your security code being taken.

So these numbers can help heighten the security of your account.

Unfortunately, with the prevalence of phishing scams, a lot of fraudsters have been able to obtain CIDs so they are not quite as effective at preventing fraud as they used to be.

Also, not all merchants require CIDs and some fraudsters can simply guess the three or four digit code so these security numbers aren’t fool proof.

Where are the credit card security codes located?

The credit card security code on your credit card could be located in a different place depending on the type of credit card that you have.

For American Express cards, as mentioned, the CID is a four digit code found on the front of the card, usually on the right side.

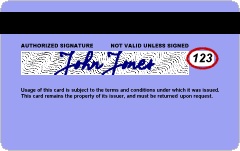

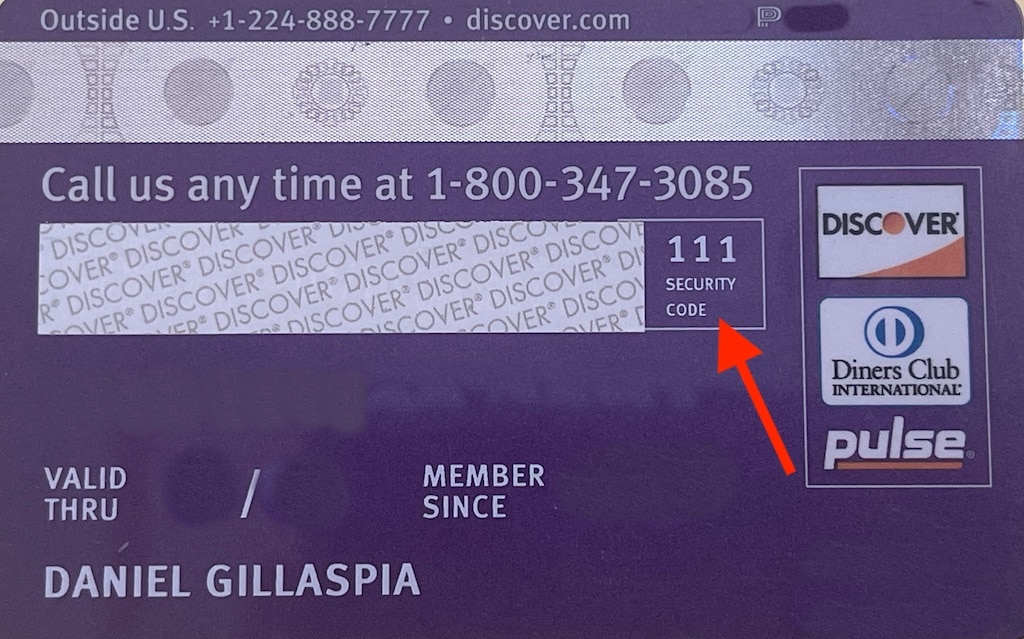

But for other types of credit card issuers, typically you will find the security code on the back of the credit card where you find other details like the expiration date.

In a lot of cases, the security code will be directly to the right of where you would supply your signature and on some cards the three digit code will actually be inside the signature box/signature panel.

Sometimes the credit card will actually spell out the words “security code” so that you know you are looking at your security code number but in other cases you may simply find a three digit code.

The security digits should not be embossed like your credit card number or name and expiration date. This is to prevent people from obtaining your security code if they are able to take an impression of your card.

Three digit code for American Express cards

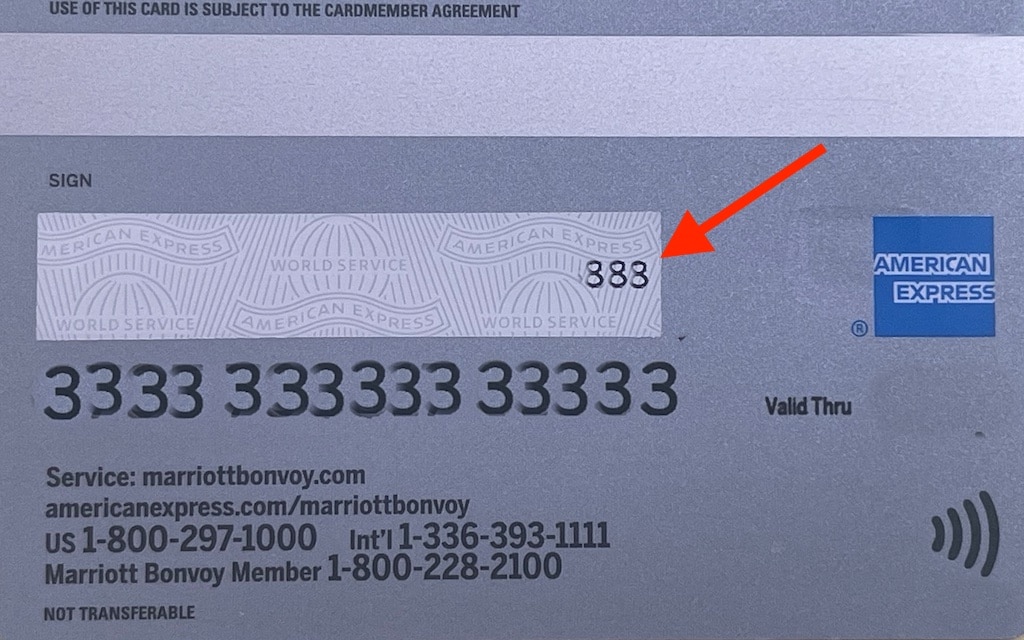

One area of confusion that comes in with American Express is what the three digit code on the back of those cards is.

American Express takes extra steps to secure your credit cards by providing you with the security code on the front which is a four digit code and an additional security code on the back which is a three digit code.

When you are asked to provide your CID/CVV (or main security code) for your card, you will input the four digit number on the front of the card.

But other situations will arise when you need to provide the three digit code on the back of an American Express card. Typically, you will only have to do this when dealing with American Express.

For example, if you are trying to redeem points, American Express may ask you to supply the three digit number on the back of your card.

Different types of security codes

In case you didn’t know, there are a few different types of names for the security codes associated with your credit card.

Here are some of the more well-known security codes that you might encounter:

- CVV Number (card verification value)

- CSC (card security code)

- CAV (card authentication value)

- CVD (card verification data)

- CID (card identification number)

- CVC or CVC2 (card verification code)

- CVV2 (card verification value code, 2nd generation)

Some payment networks like to use specific types of names. For example, American Express refers to the four digit code as the CID and Discover may do the same.

But other payment networks may go with different types of names. For example, MasterCard will refer to it as the CVC and Visa may refer to it as the CVV.

Just remember that when it comes to American Express, anytime you see something mentioned about a security code related to a purchase, it’s almost always asking you about the four digits on the front of your card.

Final word

If you ever need your security code to confirm a purchase for your American Express card, simply use the four digit number on the front of your Amex card.

But be prepared to use the three digit code on the back of the card if you are ever dealing with American Express as they may use that for an additional security feature.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.