The Marriott Bonvoy Boundless credit card is one of the most popular travel rewards credit cards. It often comes with a pretty sweet welcome bonus and offers some perks that make this card worth holding onto in the long term.

In this review article, I’ll break down everything you need to know about the Marriott Bonvoy Boundless Credit Card.

Table of Contents

Marriott Bonvoy Boundless overview

- 6X Bonvoy points on Marriott

- 2X Bonvoy points on all other purchases

- Annual Free Night Award

- Automatic Silver Elite Status

- Get Gold Status when you spend $35,000 on purchases each account year.

- 15 Elite Night Credits each calendar year

- $95 annual fee

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Welcome bonus

Like many other co-branded hotel credit cards, the welcome bonus for the Marriott Bonvoy Boundless card changes on a regular basis.

A couple of the recent offers we have seen include:

- Earn 100,000 Marriott points after you spend $5,000 on purchases in the first 3 months.

- Earn 75,000 Marriott points after you spend $3,000 on purchases in your first 3 months

I’m a big fan of the Marriott Bonvoy Boundless Credit Card when it offers 100,000 points because of all of the redemption possibilities.

With 100K Marriott points, you could cover a couple of nights at Marriott brands like the Autograph Collection, JW Marriott, Le Meridien, Luxury Collection, and even at some Ritz-Carlton, St. Regis, and W hotels.

Here’s a look at the award chart:

| Category | Off Peak | Standard | Peak |

|---|---|---|---|

| 1 | 5,000 | 7,500 | 10,000 |

| 2 | 10,000 | 12,500 | 15,000 |

| 3 | 15,000 | 17,500 | 20,000 |

| 4 | 20,000 | 25,000 | 30,000 |

| 5 | 30,000 | 35,000 | 40,000 |

| 6 | 40,000 | 50,000 | 60,000 |

| 7 | 50,000 | 60,000 | 70,000 |

| 8 | 70,000 | 85,000 | 100,000 |

So you could definitely get over $800 worth of value at nice properties from a 100K bonus.

Or you could stretch your points on Category 1 properties and cover up to 20 free nights!

And finally, you could convert your points into airline miles at a 3:1 ratio and a 5,000-mile bonus for every 60,000 Marriott points you transfer. So in this case your 100K points could be worth 38,000 airline miles for just about any major program.

Related: The Best All-Inclusive Marriott Properties

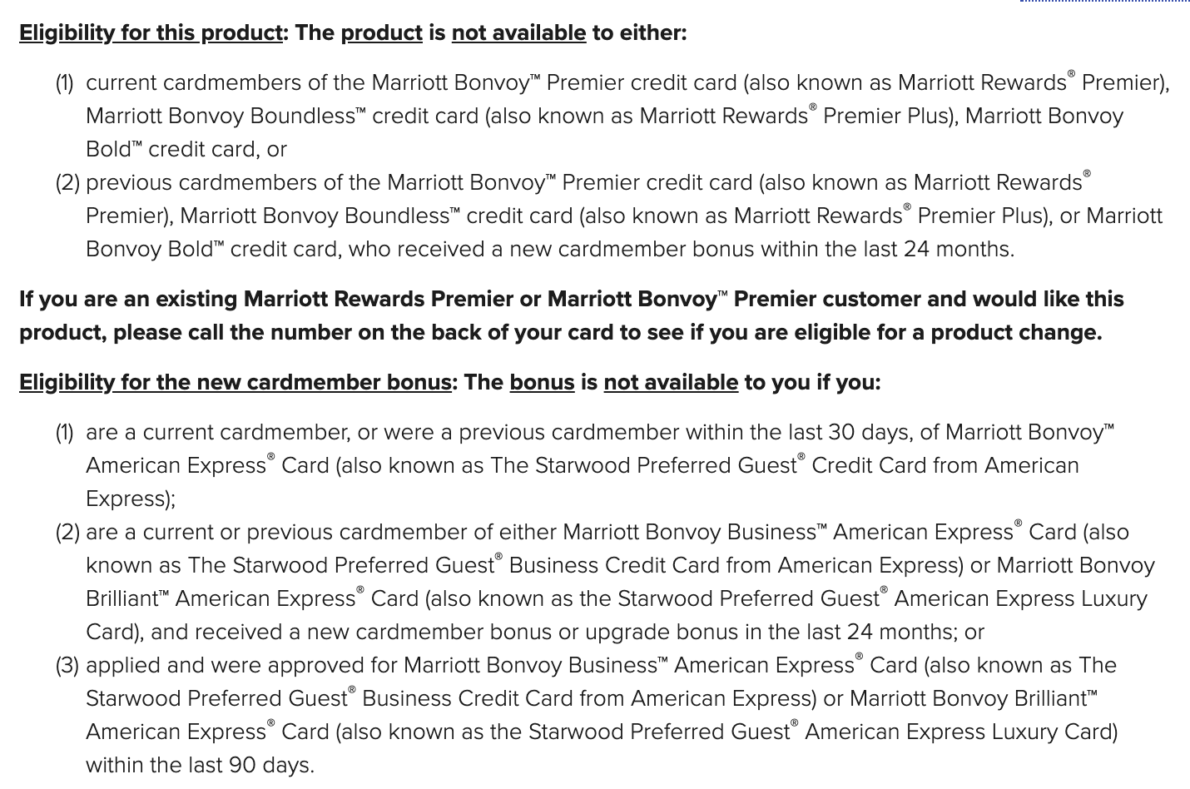

Eligibility

The eligibility rules for the Marriott credit cards are pretty complex and a little confusing.

You can find the text for these rules below but remember that WalletFlo automates your eligibility for these rules!

Bonus categories

The Marriott Bonvoy Boundless Card offers the following bonus earning rates:

- 6X Bonvoy points on Marriott

- 2X Bonvoy points on all other purchases

6X on Marriott

6X on Marriott is okay for Marriott properties.

Using a WalletFlo valuation of .77 cents per point, 6X comes out to 4.6% back.

That’s not terrible but if you use a card like the Chase Sapphire Reserve on your Marriott purchases, you could earn 3X Ultimate Rewards which many people would value more than 4.6% back.

2X Marriott points

Earning 2X (1.5%) on all other purchases is okay but it’s a little bit disappointing that this card does not have other bonus spend categories like many of the best hotel credit cards.

Tip: To maximize bonus earnings on categories like groceries and dining, consider the Amex Gold Card.

Free anniversary night

Every year on your account anniversary, you’ll get a free night that can be used on properties costing up to 35,000 points per night.

There are some great properties you can find in this range and you should check out our article on the best Marriott Category 5 properties.

For many people, this perk is crucial in justifying the $95 annual fee.

It’s pretty easy to get much more than $95 of value from a category five property. In fact, I often get over $200 in value when utilizing my anniversary night.

So for a lot of cardholders, this free night makes it worth holding onto this card in the long run and paying the annual fee each year.

- Related reading: Which Hotel Credit Card Has the Best Free Night Certificate?

Elite status

The Marriott Bonvoy Boundless offers automatic Marriott Silver status. Silver status is the bottom level elite status with the Bonvoy program.

It honestly doesn’t offer a whole lot of benefits but they include:

- 10% bonus on points

- Late check-out

- Free wifi

The good news is that you can work your way up to Marriott Gold status by spending $35,000 on your card in a given calendar year.

Marriott Gold will get you benefits like:

- 25% Bonus on points

- Late check-out

- Upgrades

- Enhanced internet

- Welcome gift

Tip: If you really want to get Marriott Gold status instantly, you should look into getting the Amex Platinum which will get you automatic Gold status among many other valuable travel benefits.

You’ll notice that neither Silver or Gold status provide you with free breakfast.

If you are interested in getting free breakfast for your hotel stays, a good elite status to go for is Hilton Gold which you can also get automatically with the Amex Platinum or Hilton Surpass.

Elite night credits

Each year, you will be issued 15 elite night credits that will help you obtain elite status quicker.

Here are the requirements for Marriott elite status.

- Silver: 10 to 24 nights

- Gold: 25 to 49 nights

- Platinum: 50 to 74 nights

- Titanium: 75 to 99 nights

- Ambassador: 100 nights + $20,000 U.S. dollars in qualified annual spend

So 15 qualifying elite nights would get you only 10 nights away from Gold status.

You might be wondering if you can combine elite qualifying nights from other credit cards in order to climb up the elite status levels. Unfortunately, the answer to that question is no because Marriott states:

A maximum of 15 Elite Night credits will be awarded through this benefit per Marriott Bonvoy program member account even if the member has more than one Credit Card linked to their Marriott Bonvoy account.

The exception to this is if you have a small business and personal credit card. In that case, you can earn a total of 30 nights.

- Related reading: What’s The Best Top Hotel Elite Status?

Marriott Bonvoy Boundless protections

Baggage Delay Insurance

The baggage delay protection is very solid. It kicks in after only six hours which is really competitive and provides $100 a day for up to five days while other cards may only cover you for up to three days.

Lost Luggage Reimbursement

If you or an immediate family member have check or carry on luggage that is damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

Trip Delay Reimbursement

The trip delay reimbursement is pretty good and covers you up to $500 per ticket, but I would rather go with a card that has a delay requirement of only six hours instead of 12 hours.

Purchase Protection

Purchase protection covers your new purchases for 120 days against damage or theft up to $500 per claim.

It’s a great benefit but the $500 limit per claim on this card is on the lower side. I utilize purchase protection on cards like the Sapphire Reserve to get coverage up to $10,000 per claim.

Marriott Bonvoy Boundless FAQ

Yes, the Marriott Bonvoy Boundless card comes with a free anniversary night.

You can use the free night on properties that cost up to 35,000 points per night. These may include brands like the Autograph Collection, JW Marriott, Le Meridien, Luxury Collection, and even some Ritz-Carlton, St. Regis, and W hotels.

Check out our article here for recommendations on what properties to use the free night at.

Yes, the Marriott Bonvoy Boundless comes with automatic Marriott Silver status.

Each year, you will also be issued 15 elite night credits.

The Marriott Bonvoy Boundless offers Marriott Silver status and upgrades are not an official benefit of that level of elite status. However, it’s still possible that you could get an upgrade at the right property.

The Marriott Brilliant card is issued by American Express and it is a premium card loaded with travel benefits and a much higher annual fee.

Meanwhile, the Boundless card is a lower annual fee hotel credit card meant to appeal to a wider audience.

No, you cannot upgrade the Boundless to the Brilliant because the Brilliant card is issued by American Express and the Boundless card is issued by Chase.

Your eligibility depends on when you opened up or closed your other Marriott credit cards. The easiest way to figure out if you are eligible is to use the free app WalletFlo.

No, the Marriott Bonvoy Boundless card does not have foreign transaction fees.

The annual fee is $95.

No, the annual fee is not usually waived.

Yes, the Marriott Bonvoy Boundless is subject to the Chase 5/24 rule. The easiest way to figure out if you are eligible is to use the free app WalletFlo.

No, it does not come with primary rental car coverage. If you want that protection, you should look into a card like the Chase Sapphire Preferred.

Final word

Overall, the Marriott Bonvoy Boundless credit card is a good hotel credit card. I really like the free anniversary night that it comes with and the fact that you get 15 elite night credits as well.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.