Offers contained within this article maybe expired.

If you hold a corporate card from American Express you should definitely look into the Corporate Advantage Program (CAP) as it can save you a good deal of money on annual fees for your personal cards. That’s right, I said personal cards.

The problem with this program is that many elements of it are very YMMV. Still, if you are willing to put in a minor amount of work on an occasional basis you might be able to save yourself a few hundred bucks a year!

Below, I will go into detail about how much money you can save with the Amex Corporate Advantage Program.

Table of Contents

What is the Amex Corporate Advantage Program?

The Corporate Advantage Program (CAP) is a program that allows Amex corporate cardmembers to save money on annual fees for their personal cards. Your annual statement credit that you receive may be as high as $150 but it depends on the type of personal card that you have.

Here are the rates that you can expect for the respective cards:

- Amex Platinum Card: $150

- Amex Gold Card: $100

- Amex Green Card: $75

- Amex Blue Cash Preferred Card: $50

This means that your effective annual fees will come out to the following after the discount is factored in:

- Amex Platinum Card: $400

- Amex Gold Card: $150

- Amex Green Card: $75

- Amex Blue Cash Preferred Card: $45

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

A few quick things to note:

- In the past this benefit has been extended to some people with non-vanilla Platinum cards (e.g., Schwab Platinum). However, some reports have indicated that partner Platinum and Gold products have been excluded so YMMV.

- If you are denied the discount for one of your cards then my suggestion would be to try to wait a few days/weeks and contact American Express again.

- You might be able to enroll multiple cards into this program so that you receive the discount for every eligible card you have. However, some customers have been limited to just one discount.

Ultimately, as you can probably tell, this benefit seems to be very YMMV so maximizing it may be a bit hit or miss at times.

How to check your eligibility

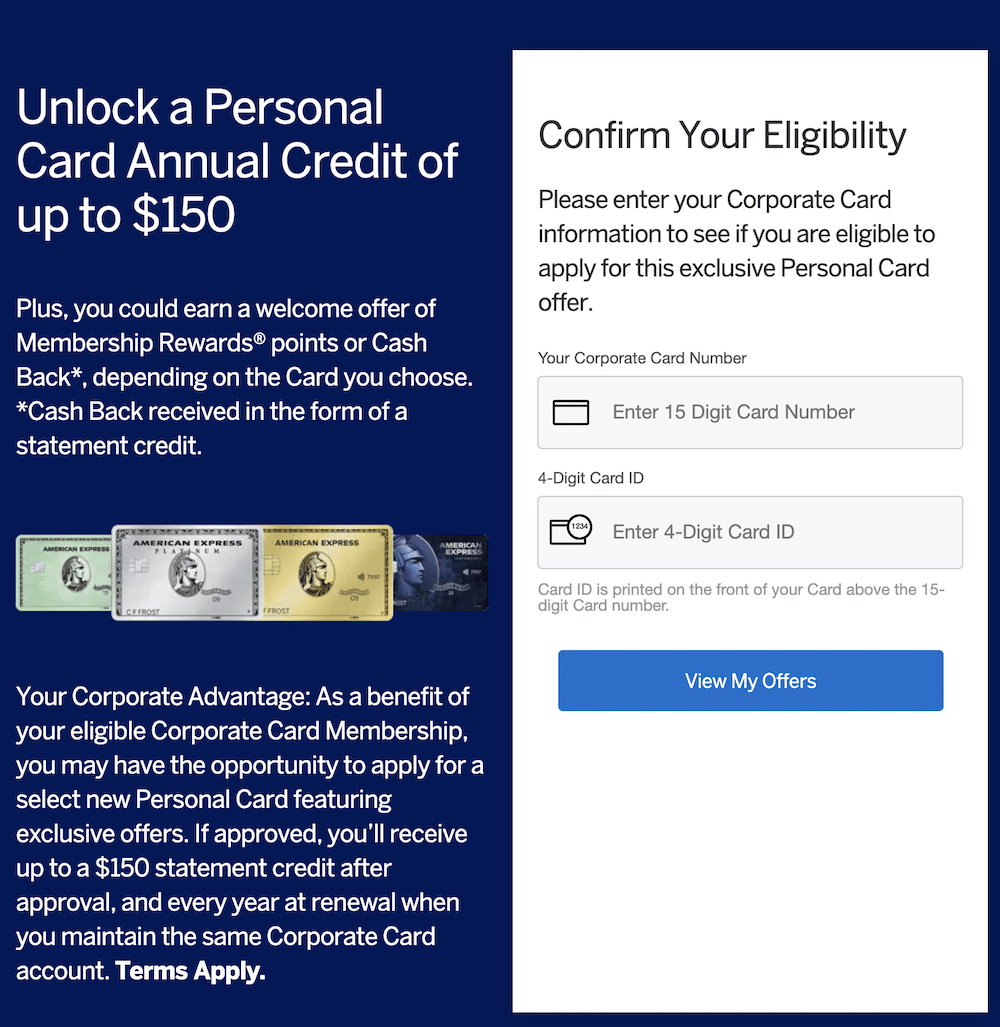

If you would like to confirm your eligibility for the Amex Corporate Advantage Program, simply follow this link.

You will need to enter your 15 digit corporate card number along with your card ID. This is the four digit number found on the front of your card above the 15 digit number.

If you currently have one of the eligible cards above and you have not received a discount on your annual fee then you should contact American Express and inquire about the discount.

You can do this by calling the number on the back of your corporate card and some people have even had luck doing this over chat. Sometimes your enrollment may take only a few minutes via chat and other times you might be given a phone number to call so once again YMMV.

Targeted welcome bonuses

In addition to getting the annual statement credits that help offset the annual fee, you can also simultaneously earn a welcome bonus when joining the program by applying for a new card.

The issue here is that the welcome bonuses that this program shows you may not always be the best available to you.

This is why some people will apply for their personal card via a separate link with a higher welcome bonus. After they are approved they will then join the Amex Corporate Advantage Program, so that they can take advantage of the annual statement credit.

I have heard some reports of people having issues joining the corporate program when they go this route but others have had success.

I personally have not attempted this route so I can’t attest to it from my own experience but I would definitely at least attempt to go the route of earning a higher welcome bonus and then enrolling in the Amex Corporate Advantage Program later on.

Receiving the credit

Like many other aspects of this credit, receiving the credit can vary.

Upon chatting or calling in to American Express, some individuals have been given their credit manually the next day.

Others have had to wait a couple of months for the credit to appear.

Meanwhile, some have been forced to wait one year after enrollment to receive the annual statement credit.

(If you apply for the card outside of the program then it seems your odds of having to wait one year for the statement credit to hit may increase.)

Every year, you should receive the credit within 8 to 12 weeks after your account anniversary.

Note: Many people report that renewals do not always happen automatically so you may have to monitor this and contact American Express if you come across any issues.

This is definitely a perk you need to keep your eye on every year. That is a little bit of a burden but if a short phone call can save you a few hundred bucks I would say it is worth it.

Approval odds

Some data points indicate that you might have better approval odds for the personal cards when you apply through this program. There are some anecdotal reports about people getting approved for these cards with very low credit scores.

Some even go as far as to say that if offers appear for you when you check your eligibility you are virtually guaranteed approval.

It’s not clear to me if this is legitimate or not (I doubt it) but if you have a corporate card and your personal credit score is bad this might be a way for you to get on board with American Express personal cards.

Amex Corporate Advantage Program FAQ

Individuals with an Amex corporate card are eligible to apply for the Amex Corporate Advantage Program.

You should receive the statement credit every year as long as your corporate card remains open.

You may be limited to one personal card for the program. However, some people have had success enrolling multiple cards.

The annual statement credit should be posted to your account within 8 to 12 weeks after your account is approved or within 8 to 12 weeks of the anniversary date of your personal card.

No, it does not appear that you can avoid the limitations of the once per lifetime language rule by applying through this program.

It is quite common for people to not receive their credits especially upon renewal. If you don’t see your credit within 12 weeks of your account anniversary, call American Express or inquire via chat.

Final word

The program is a great way to save a nice chunk of change on your annual fees. It’s very easy to enroll so I would always give it a shot. However, I would definitely try to earn a higher welcome bonus first and then enroll my card later so that I don’t lose out on a lot of Membership Rewards.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.