Offers contained within this article maybe expired.

American Express has some pretty specific rules and requirements when it comes to upgrading and downgrading your credit cards and charge cards. Some of these restrictions are pretty intuitive while others are not as obvious and could cost you a lot of rewards if you don’t know what you’re doing.

In this article, I will cover everything you need to know about product changing with American Express including upgrades and downgrades.

Table of Contents

Product changes explained

Product changes are when you change from one credit card product to another (e.g., changing from the Green Card to the Platinum Card). Typically, when you product change with Amex you will be either upgrading or downgrading.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How to product change

The process for product changing your Amex card is very simple.

You can product change your American Express card by calling the number on the back of your card. When you get a hold of an agent, simply tell them that you want to product change your card and they should be able to help you or transfer you to someone who can.

It’s possible they might ask you some questions about why you want to product change so it’s a good idea to have a your reasoning already decided.

Common reasons for product changing might include:

- Change in spend habits

- Change in benefit use

- Wanting to avoid a higher annual fee

Sometimes you can make product changes via chat but at other times that possibility has been taken away.

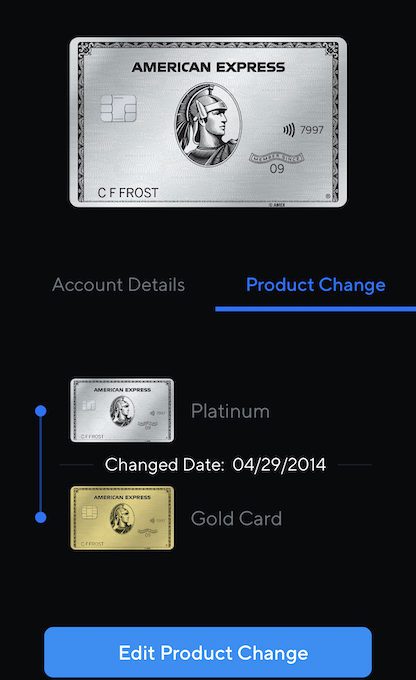

If you are looking for an easy way to keep track of all of your product changes, then I would highly recommend you use the app WalletFlo.

With just a couple of clicks, you can select your product change details and always have it on hand when needed. Plus, it tracks your eligibility for bonuses which is something I talk about below.

Bonus eligibility

One of the biggest considerations for choosing to upgrade or downgrade a card with American Express is your future welcome bonus eligibility.

Typically, when you product change to a new card you are disqualifying yourself for a future bonus for that card. This is the result of the “once per lifetime rule” which states that you can only receive a welcome bonus for a card once per lifetime.

You would think that the rule only applies when you open a new card but this is simply how American Express does it.

So let’s say that you have the American Express Green Card and you are going to product change it to the Gold Card. Once your Green Card is converted to the Gold Card, you lose eligibility for the Gold Card’s bonus.

If you have the ability to hit the minimum spend for something like a 60,000 point bonus, you could be costing yourself over $1,000 in rewards by choosing to product change!

This is typically why people only recommend product changes when you have previously opened the card you’re product changing to.

The big thing to note here is that you can receive special upgrade bonus offers. Targeted upgrade offers can come via email, snail mail, or could potentially just show up elsewhere (perhaps Amex Offers).

In some cases, these upgrade offers will not contain the once per lifetime language which means you may have a shot at earning the bonus again.

Retention offers

Another factor in the mix is the possibility of getting a retention offer.

A retention offer is a special offer made by the bank to keep you from closing your account or in some cases just switching to another product.

If you were thinking about product changing, I would always inquire about possible retention offers before doing so. If you are not offered a retention offer or if they offer you a retention offer that you think is subpar, I would call back and speak to at least one other agent.

What counts as a good or bad retention offer is all based on your circumstances.

A lot of times the best retention offers go to those putting a lot of spend on their cards but you don’t always have to put a lot of spend on a card to get a decent offer.

Also, sometimes these retention offers require you to put spend on your card to earn the bonus while other times you will be instantly given bonus points. So it’s not always the amount of the retention offer that matters but the process you have to go through to get it.

Charge cards and credit cards

American Express does not allow you to cross pollinate between charge cards and credit cards. So for example, you cannot product change an American Express Platinum card to an Amex EveryDay card.

However, based on some online reports, you can try to change a credit card to a charge card if you pay off the entire balance of the credit card. (I’ve personally never attempted this before so I can’t verify if it still works.)

Different product lines

The other thing to be aware of is that you cannot product change between different lines of product. So for example, you could not product change the Marriott Brilliant Card to a Hilton Aspire. (The good thing is that with co-branded cards, American Express has a lot of no-fee options).

This also means that you cannot change from a card that earns Amex Membership Rewards to a card that earns cash back.

Business to personal

You cannot product change an American Express business card to a personal card or vice versa.

You also cannot change the name of your business on your credit card in many cases such as if you have a new EIN with the new business.

Keeping your points alive

Another thing to consider if cancelling a card is on the table is that you want to always make sure you are keeping your Membership Rewards alive.

In order to keep your Membership Rewards alive, you must always have at least one active Membership Rewards earning card. A lot of people recommend the Amex EveryDay card because it is a no annual fee card and that’s an easy way to park your points and keep them open.

So don’t ever cancel a Membership Rewards card without having a way to save your points.

Length of account history

A big factor to consider before requesting a product change is how long your account has been open.

The CARD Act of 2009 prevents banks from raising the annual fee of a credit card within the first 12 months of account opening. This means that you will not be allowed to upgrade from something like the Gold Card to the Platinum Card until you have had the Gold Card for 12 months or longer (some wait until the 13th month).

If you are product changing your card to something with a lower annual fee then I don’t believe you have to wait 12 months to do so. I have seen reports of agents telling customers that they need to wait one year before product changing so this could be YMMV.

If you do downgrade prior to your one year anniversary, you can get the annual fee refunded on a prorated basis.

But be careful of trying to downgrade to a product with a lower annual fee too quickly.

If you just received a bonus for an American Express card and decided to quickly downgrade that card, that might raise red flags for American Express and it could affect your relationship with them.

This is made clear by their anti-gaming rules:

“If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome offer in any way or that you intend to do so (for example, […] if you cancel or downgrade your account within 12 months after acquiring it; […]), we may not credit the Statement Credit to, we may freeze the Statement Credit credited to, or we may take away Statement Credit from your account. We may also cancel this Card account and other Card accounts you may have with us.”

Good standing

American Express wants your card to be in good standing when you request your product change. If you have had issues with payments or any other similar account issues, your request for a product change may be denied.

New accounts

If you product change to a new American Express card, this should not reflect as a new account on your credit report and there should be no hard pull involved.

One of the motivating factors for product changing is that you don’t have to worry about getting a ding on your credit report. And the ding I am talking about is from a new account showing up on your credit report.

Often, if you already have an American Express card and you apply for a new card, you will not be subject to a hard pull on your credit report.

Tip: For people trying to stay under 5/24, product changing allows them to take advantage of new products without violating the 5/24 rule.

Card numbers

When you product change, your card number should remain the same. However, the card will likely have a new security code and expiration date. Other details for your account such as your credit limit/spending power and your APR should also remain the same.

FAQs

You can initiate a product change by calling the phone number on the back of your card. You can also try to use chat.

No, product changing with American Express will not affect your credit score.

No, you cannot product change between personal and business cards.

Yes, both the Platinum Card and the Gold Card are charge cards so you can change between the two.

If you are product changing to a card with a higher annual fee you will need to wait one year.

Final word

Navigating product changes successfully with American Express is not as difficult as it might sound. The key thing is just to make sure you are not limiting yourself when it comes to eligibility for bonuses.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.