[Offers contained within this article may no longer be available]

The Citi Prestige and the American Express Platinum cards offer some of the best travel benefits in the credit card game. However, with those valuable benefits come high annual fees. With such high fees, a lot of people struggle to decide which card to apply for. So here’s a comparison of the two cards with a final verdict at the end.

July 25, 2016 UPDATE: Big changes have just been announced to the Citi Prestige and this article has been modified to reflect those changes.

Charge card vs Credit Card

First, don’t forget that the Citi Prestige is a credit card the American Express Platinum is a “charge card.” A charge card must be paid off in full each month or else you face a hefty monthly fee. The benefit to a charge card like the Platinum is that you’re not restricted to a credit limit and so you have a little more flexibility — you just need to be able to keep yourself in check to make sure you’ll pay off your balance in full each month.

Transfer Partners

The American Express Platinum earns Membership Rewards, which transfer out to several partners. Here are the transfer partners of Membership Rewards.

Airlines

- Delta Skymiles

- Club Premier AeroMexico

- Aeroplan Air Canada

- Flying Blue Air France/KLM

- MilleMigilia Club Alitalia

- ANA

- Asia Miles

- Avios British Airways

- Emirates Skyrewards

- Etihad Guest

- Hawaiian Airlines

- Iberia Plus

- JetBlue

- KrisFlyer Singapore Airlines

- Virgin America

- Virgin Atlantic

Hotels

- Best Western Rewards

- Choice Privileges

- Hilton HHonors

- SPG (Starwood Preferred Guest)

Citi Thankyou Points

The Citi Prestige earns Thankyou Points and Citi has fairly recently added a lot of new travel partners. These partners are:

Airlines

- Asia Miles (Cathay Pacific)

- EVA Air

- Eithad Guest

- Flying Blue (Air France, KLM)

- Garuda Indonesia Frequent Flyer

- Malaysia Airlines Enrich

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Thai Airways Royal Orchid Plus

- Virgin America Elevate (Get 500 Elevate points for 1,000 pts)

- Virgin Atlantic Flying Club

Hotels

- Hilton HHonors (Get 1,500 HHonors Bonus Points for 1,000 pts)

Typically, the transfer partners are one of my first considerations when considering a travel rewards card but with two cards like these, which are heavy in the benefits department, more weight should probably go to which benefits will fit better into your travel lifestyle.

Still, although I’d give more consideration to the benefits, I would have to say that Membership Rewards edges out Thankyou Points here since at the very least they boast the better hotel selection and offer better airline transfer options. And for someone like me who lives near a United hub, it’s great having both ANA and Aeroplan (along with Singapore Krisflyer) to transfer to and book Star Alliance flights with.

Redeeming Points for Travel

Membership Rewards can be redeemed in the following ways:

- Between .5 and 1.0 cent per point for gift cards

- 0.6 cent per point for a statement credit/charge

- 1.0 cent per point on air fare

- 0.7 cent per point on hotels, cruises, and vacation packages.

Thankyou Points can be redeemed for cash back and gift cards at one cent per point but you can get more for air travel. With the Prestige, Thankyou Points can be redeemed at a rate of 1.33 cents per point for airlines and 1.6 on American Airlines. With the new changes, Thankyou points will be able to be redeemed for 1.25 cents on all airlines.

Sign-up Bonus

AMEX Platinum

- 40K to 100K (currently 40K) when you spend $3,000 in the first 3 months.

The 40K offer is the standard offer available to the public, and the 100K offer comes around in three forms but there’s no guarantee that you will ever get it. The three forms it comes in are:

- 1) Targeted mailings (if you’re already an Amex cardholder your chances of getting this offer in the mail are slim to none).

- 2) Pre-approval links: Some sites (including the Amex site) that allow you to view your pre-approved credit card offers will show this offer.

- 3) Incognito/Private browser windows sometimes show this offer (rare)

Tip: When applying for bonuses with Amex cards always remember that bonuses for personal cards are only given once a lifetime (although not 100% enforced).

Citi Prestige

- 40K to 100K (currently 40K) when you spend $4,000 in the first 3 months.

Most value Membership Rewards more than Thankyou Points so with an even bonus of 40,000, the Platinum likely is offering you more value when you consider the value of cents per point.

There’s really no telling when the higher 100K offers will (if ever) return. Amex sometimes sends out targeted 100K offers and a couple of times those offers have leaked to the public. However, your odds of receiving (or taking advantage of a leaked offer) are probably not very high. Also, Citi’s recent trend towards eliminating or reducing sign-up offers makes it feel like the Prestige 100K offer isn’t coming back any time soon.

So, unless you get a little lucky, you’ll probably be stuck with 40K offers for the time being in which case, I’d give the Platinum the edge.

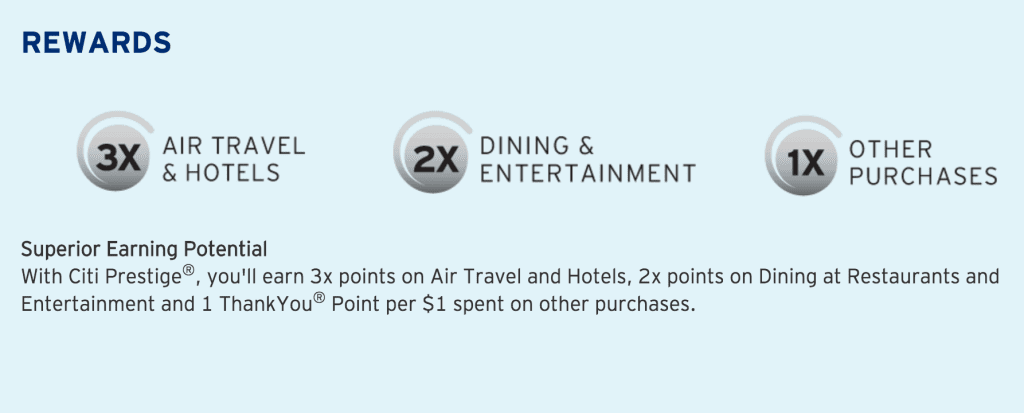

Bonus Categories

AMEX Platinum

- 1X on all purchases

- 5X on airfare purchased directly with the airline

Citi Prestige

- 3X on air travel and hotels

- 2X on dining and entertainment

- 1X on all other purchases

One of the biggest knocks against the Platinum is that it doesn’t have any bonus categories for spending. While the Amex PRG and the Everyday Preferred cards can assist with earning MR points, the Citi Prestige has earning capability built in and won’t require you to pay an annual fee for an additional Citi card just to be able to earn more points.

Benefits

AMEX Platinum

Here’s a breakdown of my favorite benefits of the Platinum, but in a nutshell this card confers a host of benefits to you making it worth it including:

- Priority Pass airport lounge access (worth $400 per year)

- Centurion Lounge Access/Delta Lounge Access (when you fly with them)

- $200 annual airline credit (essentially reducing the annual fee to $250)

- $100 statement credit for Global Entry/TSA Pre-Check (a Godsend that’s good for 5 years!)

- Add up to 3 authorized users for only $175 per year (for all 3)

- Gold status with Hilton and Starwood

- Free Boingo Wifi subscription (worth $120 per year)

- Rental car benefits like express check-in, free upgrades, and discounts with status.

- Concierge service

Also, while not exclusive to the Platinum, Amex Offers (which are special discounts and rebates given to Amex cardholders) can add up quickly if used efficiently and can certainly act as a considerable benefit to having the Platinum.

Citi Prestige

- $250 airline credit (which can be used for broader expenses, such as airline tickets)

- Priority Pass Select airport lounge access for you and up to two guests for free (the Platinum requires that you pay $27 per guest for this benefit)

Complimentary access with two guests to American Airlines Admirals Club® lounges (when you fly with them)- Complimentary night at any hotel of your choice after a minimum 4-consecutive-night booking (now calculated on an average nightly rate basis and taxes are not included)

- $100 Global Entry credit

3 free rounds of golf through GolfSwitch- Rental car benefits like express check-in, free upgrades, and discounts with status.

- Add authorized users for $50 each.

- Concierge service

With the recent changes to the Citi Prestige, the contest between these two cards is a lot closer. The Prestige does offer more valuable Priority Pass lounge access but it doesn’t offer anything above that now. With the Platinum, you get Centurion lounge access, which are some of the best airline lounges in the U.S. (and you can bring up to two guests for free). You also get Delta SkyClub lounge access when you fly with them. Thus, if you regularly fly Delta or fly in and out of airports with Centurion lounges, the lounge benefits offered by the Platinum begin to surpass those offered by the Prestige.

However, the Prestige still has the better airline credit, bonus earning potential, and the fourth night free benefit, so there’s still an edge that can be had with the Prestige.

Protections

Protections for purchases and travel aren’t usually a priority for many but these protections can be extremely valuable when things go wrong. The Amex Platinum has a number of quality protections but not as many as the Citi Prestige. Specifically, the Citi Prestige offers protections on baggage delay, trip delay/cancellation, and price protection.

No Foreign Transaction Fees

Both cards have no foreign transaction fees.

Annual Fee

Citi Prestige

- $450, not waived* (more like $200/year with airline credit)

*If you are a Citigold member, the annual fee should be reduced to $350. In addition, some have had success with getting the $350 annual fee when they apply in-branch.

AMEX Platinum

- $450, not waived (more like $250/year with airline credit)

Highlighting the Differences

So overall, here are some of the key differences between the cards that I would consider when making a decision between the two cards.

The Citi Prestige

- Offers a $250 airline credit that can be used even for airfare tickets

- Earns a very respectable 3X on airfare and hotels, and 2X on dining and entertainment

- Offers a fourth night free when booking hotels

- Allows two guests to visit Priority Pass lounges for free

Citi Prestige offers Admirals Club access to the primary cardholder when flying on American Airlines.- Allows you to add each authorized user for $50.

The American Express Platinum

- Offers a $200 airline credit that is meant to be utilized for fees and incidentals (although there are ways around this)

- Earns no bonus category points

- Offers gold HHonors and SPG status

- Allows no free guests with your Priority Pass and you must pay $27 per guest

- Offers access to Centurion Lounges with free access for up to two guests

- Offers access to Delta SkyClub lounges when you fly with them

- Allows you to add up to three authorized users for $175 total

- Gives you access to Amex Offers

The Verdict

The most widely used benefit conferred by these type of cards is lounge access. Now, with the recent changes, the Platinum Card offers better lounge access to a lot of travelers. Some may still be able to get more value out of the Prestige with its airline credit, 4th night free benefit, and more expansive Priority Pass membership but it all depends on your travel habits and goals. Before, I stated that the Prestige was the clear-cut winner in this comparison but now I have to say it’s much more a of a toss-up and that it really depends on how you’ll be taking advantage of the benefits.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

3 comments

Comments are closed.