There are two new great offers out that are all-time high offers worth taking a serious look at. One is for the Chase Ink Business Cash and the other is for the Chase Ink Business Unlimited.

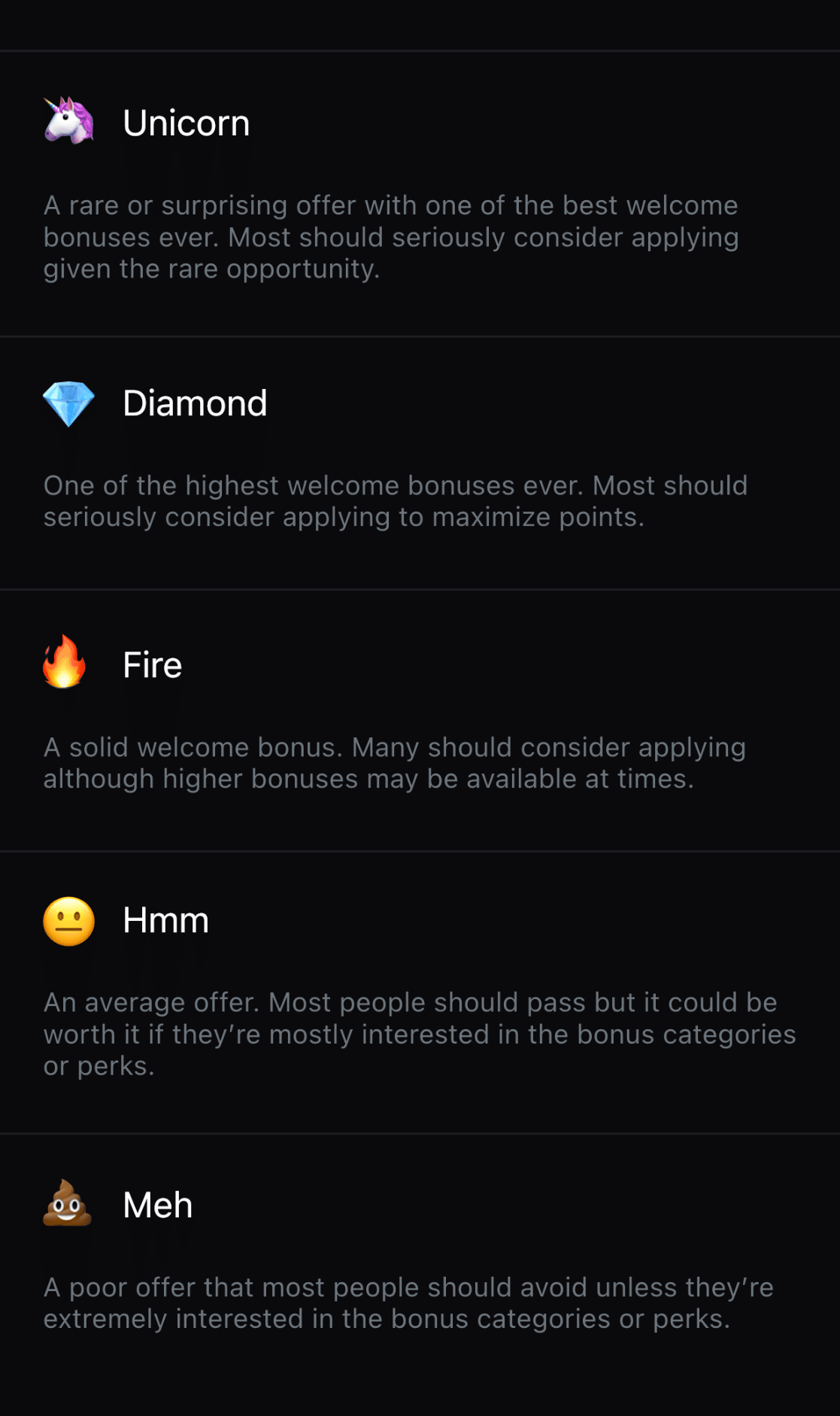

These new offers would fall into the new WalletFlo “Diamond” category which I will explain below!

Diamond ranking

One of the goals with the new WalletFlo mobile app is to allow users to quickly evaluate whether or not an offer is worth applying for.

We don’t want you to have to go digging around through old blog posts or web forms to figure out how great an offer is. So we are introducing a ranking system that will give you make it easy to instantly judge if an offer is worth pursuing.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

The new offers

Here are the two new offers:

- Chase Ink Business Cash is offering $750 cash back (or 75,000 Ultimate Rewards) after spending $7,500 in the first three months.

- Chase Ink Business Unlimited is offering $750 cash back (or 75,000 Ultimate Rewards)after spending $7,500 in the first three months.

The bonuses for both of these cards have been pretty stagnant at $500 cash back/50,000 points for a couple of years.

So it is a pretty rare and exciting increase which would typically put an offer like these in the Unicorn category. However, since the minimum spend requirement made a pretty significant leap from $3,000 to $7,500, that drops it from Unicorn territory down to Diamond.

Diamond offers are those where the welcome bonus is at or near the highest ever available to the public so they are still extremely worthwhile offers.

The major difference between a Unicorn and Diamond offer will often be that the Unicorn offers a better bang for your buck. Also, those Unicorn offers will likely be more rare or offered on a limited time basis.

The thought with these Diamond and Unicorn offers is that if you are eligible (which you can check using the WalletFlo eligibility checker) and you are interested in the points currency, it will be a good move for you to apply.

And since both of these cards are subject to the 5/24 rule, they should be a priority to consider for anyone eligible.

As for what these cards can do for you, here’s a look at the bonus categories:

The Chase Ink Business Cash earns 5% cash back per $1 on the first $25,000 spent in combined purchases in the following categories each account anniversary year:

- Office supplies stores

- Internet, cable and phone services

You can also earn 2% cash back per $1 on the first $25,000 spent in combined purchases in the following categories each account anniversary year:

- Gas stations

- Restaurants

Both of these credit cards come with no annual fee making them some of the most lucrative small business credit cards on the market. They also both offer a 0% APR period for the first 12 months.

Since these are business credit cards, you’ll need to have some type of a business to qualify. Most readers seem to qualify with having a sole proprietorship. These are often people who have side hustles doing things like selling items on eBay or some form of consulting.

A lot of people will apply for the cards with a business name such as “[your name] consulting.”

So I hope the ranking system is making sense.

As we progress with WalletFlo we will incorporate more automated strategy into these rankings but for now the idea is just to save you time on evaluating the value of these offers.

- Chase Ink Business Cash $750 cash back (or 75,000 Ultimate Rewards) after spending $7,500 in the first three months.

- Chase Ink Business Unlimited $750 cash back (or 75,000 Ultimate Rewards)after spending $7,500 in the first three months.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Would you please let me know what cards are available for Canadians.