Since the new year has just rolled around, there are some important things you need to make sure you take care of credit card wise so that you are starting off 2020 the right way. Here are eight helpful tips and reminders that anybody with credit cards should think about as we usher in the new year.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

1. Balance transfers

If you did a little bit of overspending during the holidays that is okay and you are definitely not alone (in fact, 61 percent of Americans dread the holidays because of the overspending).

But you can still avoid accruing interest by going with a good balance transfer credit card. If you are not familiar with balance transfer cards, they are very easy ways to reduce the amount you have to pay on your credit card interest payments.

Once you get approved for the card, you simply transfer debt from one credit card over to a new card but the new card does not charge you interest for a specific time period. For example, you may not get interest charged for 15 months like in the cards shown below.

When you make the transfer, you will be charged a balance transfer fee of usually 3% to 5% or sometimes just a minimum fee of five dollars whichever is higher.

Below are three solid recommendations if you want to have a balance transfer card with great terms and also potential to earn some good rewards. Remember, the welcome bonuses and rewards you are getting with these cards should also factor into your decision for the balance transfer.

Capital One Quicksilver Cash Rewards Credit Card

- Balance transfer fee: 3%

- Balance transfer period: 15 months

A solid option for a balance transfer card is the Capital One Quicksilver Cash Rewards Credit Card, which offers a 0% APR for 15 months as well. If you transferred a $4,000 balance at an APR of 16% to the Capital One Quicksilver Cash Rewards Credit Card, you’d save $680 factoring in the transfer fee!

This card also earns 1.5% cashback on every purchase and has no annual fee and offers a $150 early spend bonus after you spend $500 within 3 months from opening your account. (That $150 bonus completely wipes out the transfer fee on a $5,000 transfer.) Click here to learn how to apply.

Chase Freedom

- Balance transfer fee: $5 or 5% of the amount of each transfer, whichever is greater.

- Balance transfer period: 15 months

There are a lot of options out there but if you are below 5/24, one great option to go with is the Chase Freedom card. It has no annual fee and a 0% intro period for 15 months which is very competitive. Plus you can earn some cash back on quarterly categories and even a little bit back on the welcome bonus.

One reason I really like the Chase Freedom card for balance transfers is that you don’t have to burn up a 5/24 slot to get a balance transfer card and you can always upgrade this card to a more premium option.

Major Tip: If you want to do a balance transfer AND improve your credit score, you could do a balance transfer to a card like the American Express Blue Business Plus which will NOT reflect a balance on your personal credit report.

2. Annual credits

Credits for credit cards are usually issued on either a calendar year or anniversary year basis. Since we just rolled around into the new year, that means that all of your calendar year based credits are now active again!

So don’t forget to choose your airline for your American Express cards that have credits which include cards like the Gold Card, the Platinum Card and now the new Green Card.

And be sure to look into ways to optimize all of your credits (even the ones you don’t think you would normally use). You would be surprised at some of the ways you can use lesser-known credits like the Platinum Card’s Saks credit for example.

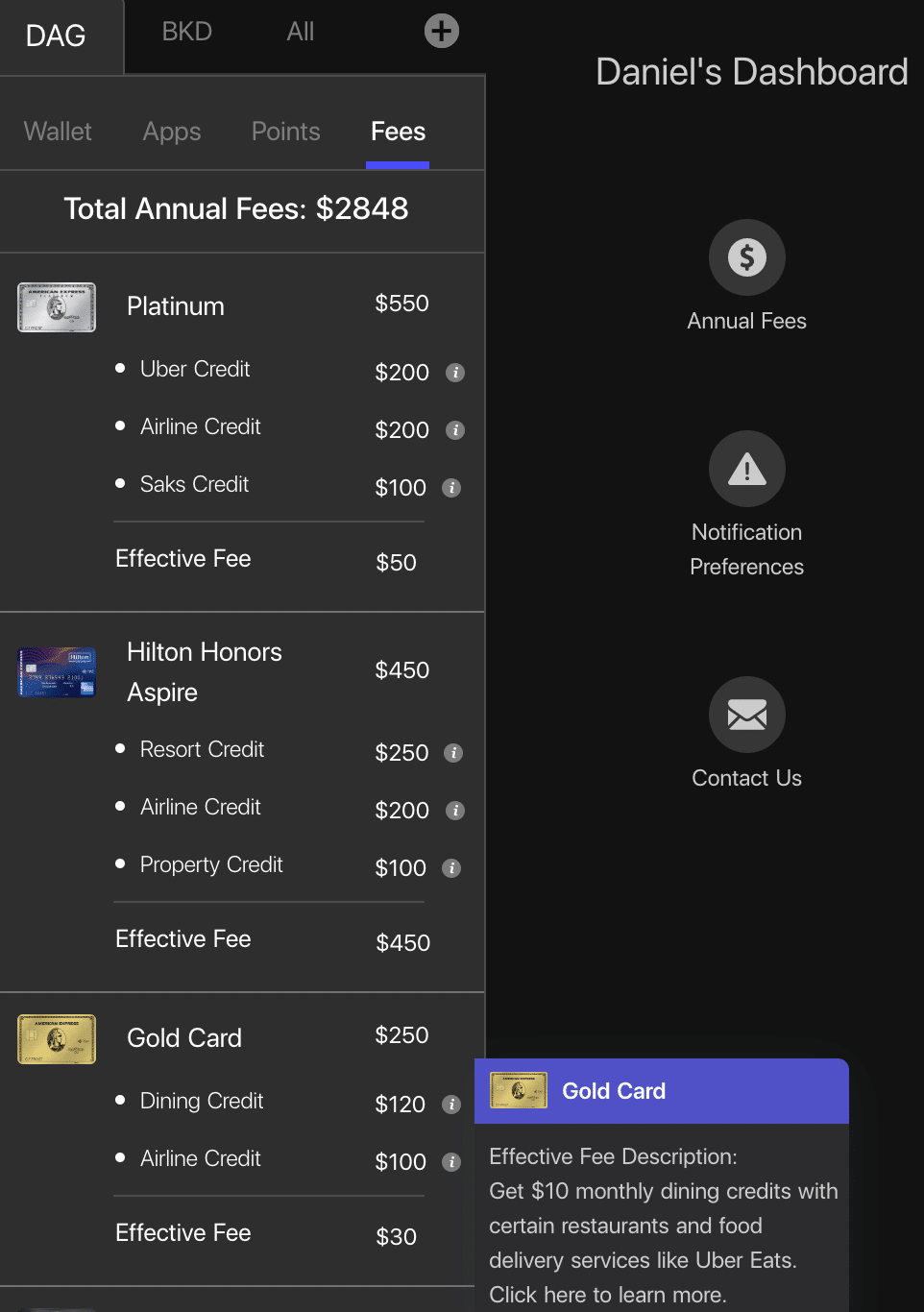

By the way, if you are looking for an easy way to track all of your credits attached to your cards that is something that WalletFlo is designed to do. By simply clicking on one tab, you’ll see an entire breakdown of all of your credits along with a way to find out any details you need to know about the credits.

3. Prepare for tax season with lucrative credit card offers

Paying for taxes is one of the best ways to get tons of miles and points on your credit cards. If you are thinking about putting substantial spend on your credit cards for your tax payments, you should look into applying for a couple of credit cards so that you can earn a welcome bonus or two when you pay for your taxes.

A couple of the most valuable welcome bonuses that you can apply for right now include:

- The Platinum Card — 60,000 points

- Chase Ink Business Preferred — 80,000 points

- Chase Sapphirre Preferred — 60,000 points

- Chase Sapphirre Reserve — 60,000 points

The fees will vary based on what payment service you use to pay your taxes, but you can get the fees down to 1.87%. with Pay1040. They are a legit partner with the IRS and they take the following payment methods:

- Visa

- Master Card

- Discover

- American Express

- STAR

- Pulse

- NYCE

- Visa Checkout

- MasterPass

- Amex Express Checkout

Imagine paying $5,000 in taxes on a card like the the Platinum Card and earning 60,000 Membership Rewards. At a valuation of 1.75 cents per point that would net you $1,050 from the sign-up bonus alone but you would also earn an additional 5,000 Membership Rewards which would be worth an additional $87.

So your total earnings would be worth $1,137. Meanwhile your total amount in fees would be $93.50. Therefore you are looking at a total gain of $1,000.43!

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

4. Take inventory of your free nights

The beginning of the year is a great time to take inventory of all of the free nights offered by your credit cards.

Typically those free nights will be coming available and expiring around the account anniversary date so it’s always a good idea to know when those dates are.

You can plan out some of your trips for the year and rest assured that you will not miss out on your perks.

5. Referrals

Don’t forget — a lot of referrals reset at the beginning of the year so now you should be able to send out more referrals to other people if you had those maxed out in 2019!

6. Take inventory on your annual fees

The start of a new year is a great time to take inventory of all of your annual fees. You should also consider your upgrade and downgrade options for cards you currently have so that you’re not paying for cards you don’t need and you are not under-optimizing your rewards. Now if only there was an app that would automate all of this for you…. 👀

7. Plan out your credit card strategy

The next thing you want to do is plan out your credit card strategy.

A lot of new credit card rules are now in effect and so you need to be more strategic when planning out your credit card applications.

It would not hurt to check your upcoming eligibility for some cards that you plan on getting for the year and think about how you will meet the minimum spend requirements for them.

One thing that is new about 2020 is that the major airlines are now implementing dynamic award prices.

This means that the award prices will fluctuate more than ever this year and you need to be mindful of that when earning points. So be sure to do your research on the dynamic award prices before jumping on a card because prices could be more surprising than they ever were.

8. Hilton promotion

Hilton has a pretty awesome promotion that is running through the beginning of 2019 all the way through May. In some instances, you could earn over 60X so be sure to pay attention to this promo.

9. Don’t be too aggressive

We have seen numerous shut downs in 2019 and banks are only going to get more strict with what they don’t allow people heavily pursuing rewards. Keep this in mind when applying for new cards and don’t push things too far. Avoid applying for cards from random links that are not meant for the public or not targeted for yourself.

Final word

Make 2020 a year of taking control of all aspects of your financial life when it comes to credit cards. Whether that means reducing interest payments or optimizing credits and referrals, there are a lot of opportunities for you to capture additional value with your credit cards by staying on top of things.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.