Chase just revamped the Hyatt Visa Card and released the new World of Hyatt Card. It’s a new card that’s loaded with many more valuable perks and that is definitely one of the top hotel credit cards on the market now. If you value Hyatt points and have an interest in staying at Hyatt properties, then you absolutely want to check out this new card.

Update: Some offers are no longer available — click here for the latest deals!

The World of Hyatt Card

- Sign-up Bonus:

- Earn 40,000 points after you spend $3,000 on purchases within the first 3 months of account opening

- Plus, earn an additional 20,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months of account opening.

- Bonus earning:

- 4X spent with your card at Hyatt hotels, including participating restaurants and spas

- 2X on local transit and commuting, including taxis, mass transit, tolls and ride-share services

- 2X at restaurants, cafes and coffee shops

- 2X on airline tickets purchased directly from the airline

- 2X spent on fitness club and gym memberships

- Free nights:

- Receive one free night at any Category 1-4 Hyatt hotel or resort every year after your cardmember anniversary

- Earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year

- Elite status:

- Receive 5 qualifying night creditstoward your next tier status every yea

- Earn 2 additional qualifying night credits toward your next tier status every time you spend $5,000 on your card

- $95 Annual Fee ($20 higher now)

5/24 Rule

Reports are coming out that this card will eventually be subject to the Chase 5/24 Rule. You can read more about that rule (and others) here.

This means that if you’re interested in this card then you need to act pronto if you’ve over 5/24.

Current cardmembers

If you already hold the Hyatt Visa card you can hold on to that card or you can upgrade (which I’ll be doing very soon).

Note: If you currently hold the Hyatt Visa you cannot get the new card and if you’ve received a Hyatt bonus in the past 24 months, you won’t be eligible either.

The official terms and conditions state:

The product is not available to either (i) current Cardmembers of any Hyatt Credit Card, or (ii) previous Cardmembers of any Hyatt Credit Card who received a new Cardmember bonus within the last 24 months.

Sign-up bonus

- Earn 40,000 points after you spend $3,000 on purchases within the first 3 months of account opening

- Plus, earn an additional 20,000 Bonus Points after you spend $6,000 total on purchases within the first 6 months of account opening

This card takes the 40,000 point sign-up bonus of the previous Hyatt card and adds 20,000 bonus points to it after you spend a total of $6,000 in the first 6 months.

$6,000 is not a huge minimum spend requirement when you have 6 months to complete so this should be very doable for a lot of people.

60,000 Hyatt points can get you pretty far.

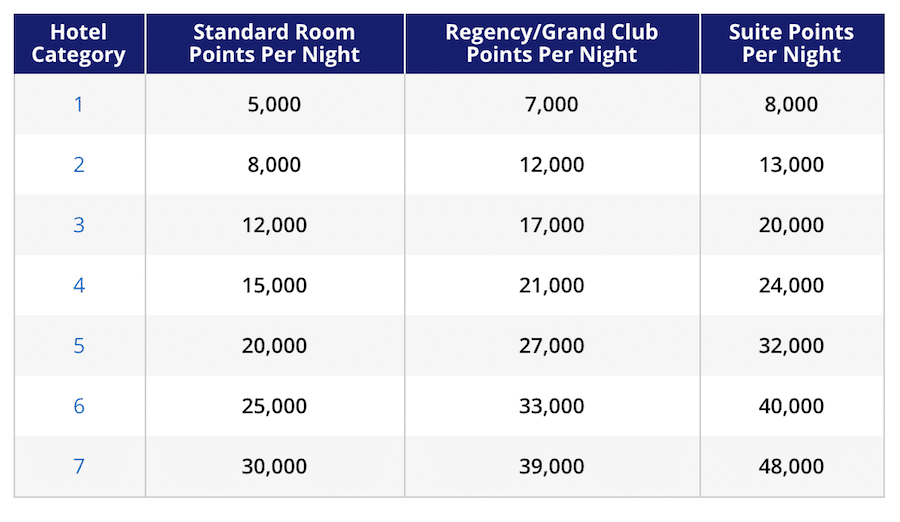

If you go for the lower properties, that can get you 6 to 12 free nights.

However, if you want to stay at the highest Hyatt properties that require 30,000 points per night, you can still get two free nights covered, much like the old sign-up bonus.

The difference is that you have points you can use which are more flexible and don’t expire as quickly, so this is a much-improved sign-up bonus.

Bonus earning

- 4X spent with your card at Hyatt hotels, including participating restaurants and spas

- 2X on local transit and commuting, including taxis, mass transit, tolls and ride-share services

- 2X at restaurants, cafes and coffee shops

- 2X on airline tickets purchased directly from the airline

- 2X spent on fitness club and gym memberships

This card really stepped up the bonus earning.

You used to earn 3X on Hyatt purchases but now you earn 4X. This means that you’re better off using this card than the Sapphire Reserve now for Hyatt purchases.

At a valuation of 1.5 cents per point, that’s 6% back on Hyatt purchases, which is great. This will be in addition to the 5X you’ll earn as a Discoverist elite member. That’s a total of 14.25% back on hotel stays/purchases which makes this card one of the best earning for hotel points out of any hotel credit card.

It also means you’ll be earning 2X or 3% back on all sorts of travel and dining purchases but if you have a card a like the Sapphire Reserve, you’d want to stick to that card since you’d be getting 3X back which transfers out to Hyatt at a 1:1 ratio.

But the 2X on gym memberships is cool because not many other cards off that as a bonus category.

Free nights

- Receive one free night at any Category 1-4 Hyatt hotel or resort every year after your cardmember anniversary

- Earn an extra free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during your cardmember anniversary year

Hyatt adds on to the previously offered annual free night certificate with an additional free night when you spend $15,000, which again is another pretty obtainable goal, especially if you’re already hitting the $6,000 minimum spend requirement.

You can find some decent Hyatt properties in the category 1 to 4 range but I often struggle to find a property I really want to stay at given how small the Hyatt footprint is.

It’s worth noting that the free nights are not available at resorts and properties like Miraval, Hyatt Zilara or Hyatt Ziva resorts or Oasis homes.

Elite status perks

- Receive 5 qualifying night credits toward your next tier status every year

- Earn 2 additional qualifying night credits toward your next tier status every time you spend $5,000 on your card

This card comes with the same Discoverist status as the old card. There’s not much to this status although I’ve been given nice upgrades because of that status at top-tier properties like the Park Hyatt Milan or the Park Hyatt Paris-Vendôme (not my favorite).

But these perks are very valuable to those who value status with Hyatt.

Free nights count toward elite status now, so you’ll have a head start toward hitting your elite status by utilizing your free nights plus 5 qualifying nights from this card.

And for big spenders, this perk is absolutely huge.

You can work your way up to top-tier status simply be spending a lot on your credit card as you’ll earn 2 nights every time you spend $5,000.

By spending between $65,000 and $140,000, you could obtain Explorist or Globalist status depending on if you’re qualifying for the first time or re-qualifying.

That’s a lot of spend but this is still going to attract a lot of people to spend money on this card.

Final word

This new Hyatt card is one of the best hotel credit cards now that it’s beefed up with so many more benefits. The higher sign-up bonus can cover a weekend at the most expensive Park Hyatts and the card now earns better points at Hyatt purchases and on the gym membership category which is rare. The card also makes obtaining elite status much easier with its credits.

Since this card will soon be subject to Chase’s 5/24 Rule, I really many people should jump on it sooner than later just to be on the safe side. If you want to compare this card to the new Marriott credit click here.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I have had the Hyatt card for many years, and still do? Can I get this one also and have two cards?

Good question. Unfortunately, no if you currently hold a Hyatt card you can’t get the new card.