The Chase Freedom Unlimited and the Citi Double Cash are two of the most highly sought after cash back credit cards. They both earn a consistent cash back return on all purchases but their return rates, sign-up bonuses, and other perks are all very different. Each of these cards can outdo the other depending on a person’s needs and goals so here’s a close look at the Chase Freedom Unlimited vs Citi Double Cash.

Update: Some offers are no longer available — click here for the latest deals!

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Sign-up bonus

Chase Freedom Unlimited

The Chase Freedom Unlimited offers $150 cash back after spending $500 in the first 3 months, plus $75 when adding an authorized user. Update: there is a new Chase Freedom Unlimited offer allowing you to earn 3% back on the first $20,000 in purchases each year but does not come with the sign-up bonus.

The total sign-up bonus of $175 is a great offer for a no annual fee credit card.

With the Chase Freedom Unlimited, you’ll earn Ultimate Rewards that can only be redeemed as cash back. But if you have a premium-level card like a Sapphire Preferred or a Sapphire Reserve, then you’ll be able to transfer out your points to several great transfer partners.

Being able to transfer out your points means that you’ll be able to get more value from your points. For example, you might be able to transfer out your points so that you’re getting 2 cents per point at a top-notch Hyatt hotel property.

In that case, that sign-up bonus value just doubled from $175 to $350.

This is why it’s really important to consider the Chase Sapphire cards when thinking about the Freedom. To read more about maximizing Chase Sapphire rewards click here.

Citi Double Cash

The Double Cash offers $100 after spending $500 in the first 3 months.

Unlike the Freedom this is 100% cash back, so the maximum potential for value is a flat $100.

The Citi Double Cash has not always offered a sign-up bonus on a consistent basis so this offer may not always be around. But while it is around, it definitely makes the Double Cash a more competitive option.

Take-a-way

The Chase Freedom has the much stronger sign-up bonus both in terms of its straight cash back value but especially with the value you can get out of it with transfer partners.

Bonus earnings

Chase Freedom Unlimited

The Chase Freedom Unlimited earns unlimited 1.5% back on all purchases. Update: there is a new Chase Freedom Unlimited offer allowing you to earn 3% back on the first $20,000 in purchases each year but does not come with the sign-up bonus.

This is a great earning rate considering these are Ultimate Rewards we are talking about. Again, think about if you’re getting 2 cents per value on redemptions with your Ultimate Rewards. That means you’re earning 3% back on every single purchase which blows the Double Cash out of the water.

This is one reason why the Freedom Unlimited is one of my favorite cards. There’s potential to earn great value on every purchase you put on the card, regardless of what category that purchase falls under.

This 1.5% cash back can also be killer if you can combine with 5% back on the Chase Freedom and/or 3X on dining and travel earned by the Chase Sapphire Reserve.

Citi Double Cash

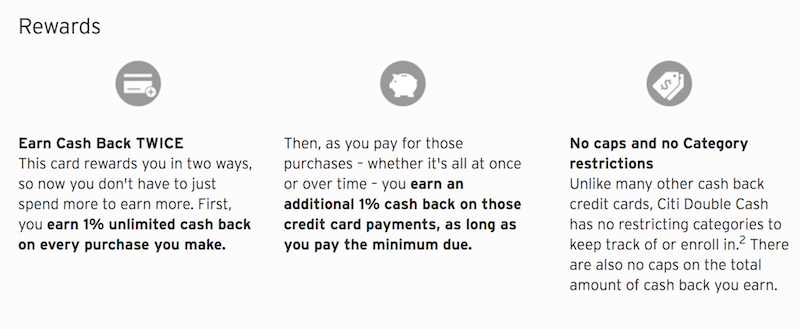

The Citi Double Cash earns 2% back on all purchases but there is a catch. You get 1% back just for making the purchase but only get the additional 2% back when you pay the minimum due.

It’s kind of an odd structure since they only require you to pay the minimum on your credit card but 2% back on all purchases is still fantastic for a no annual fee credit card.

Earnings compared to other cards

Below, I’ll show how much you could net by spending $6,000 on a few different no-annual fee cash back credit cards.

I’ll assume the spend is in the highest earning categories on each card and if there is a cap to them, I’ll just use the non-bonused rate to complete the estimate. I’ll also include the value of the sign-up bonus as well.

Here’s what it looks like:

- Citi Double Cash = $120 + $100 = $220

- Chase Freedom Unlimited = $90 + $175 = $265

- Wells Fargo Cash Wise = $90 + $200 = $290

- Amex Blue Cash EveryDay = .$180 + $150 = 330

- Chase Freedom = $300 + $175 = $475

- Discover it = $600

As you can see, the Chase Freedom Unlimited beats out the Citi Double Cash in year one based on spending of $6,000 and factoring the sign-up bonus.

If you’d like to see how some other card compare you might be interested in these articles:

Long-run analysis

However, in the long-run, the Double Cash will obviously earn more cash back since it earns 2% cash back versus the Freedom Unlimited which only earns 1.5% cash back. But again, it all comes down to how you value/use Ultimate Rewards.

If you’re using your Ultimate Rewards to cover flights and hotels that you’d normally be paying cash for by utilizing transfer partners via the Sapphire cards then the Freedom Unlimited will almost always beat out the Double Cash.

For example, assume you had the Sapphire Reserve and you only used your Ultimate Rewards through the Chase Travel Portal so you were receiving 1.5 cents per point on those redemptions. Well, in that case you’d be earning 2.25% back on every purchase which is better than the Double Cash.

So it comes down to what plans you have for your points.

If it’s just cash back then in the long-term the Citi Double Cash will beat out the Freedom Unlimited.

If you factor in the sign-up bonus which is $75 higher, you’d be getting more cash back with the Double Cash once you spend over $15,000. But again, that assumes you’re only redeeming for cash back.

0% Intro APR

Chase Freedom Unlimited

The Freedom Unlimited has an interesting 0% APR period which allows you to get 0% promotional APR for 6 months from date of purchase on purchases of $399 or more. It’s available anytime and it’s automatic.

This is very different from the Chase Freedom which offers 0% intro APR for 15 months from account opening on purchases and balance transfers. For this reason, I think the Chase Freedom Unlimited is one of the best credit cards for emergencies since you can get 0% APR at any time.

The Freedom Unlimited also offers balance transfers with fees of $5 or 5% of the amount of each transfer, whichever is greater.

Citi Double Cash

The Citi Double Cash has no 0% intro APR. the balance transfer fee is either $5 or 3% of the amount of each transfer

Take-a-way

So the Freedom Unlimited is great for people who think they’ll be occasionally making large purchases of over $399 and might not be able to pay those off immediately. Meanwhile, the Double Cash doesn’t offer anything in the 0% APR department, though it’s balance transfer fee is smaller at 3%.

Refer a friend

Chase has a great Refer a Friend program where you can earn up to 10,000 per referral and up to 50,000 Ultimate Rewards per year on referrals.

This is one of the most under-estimated benefits of Chase cards. If you can tap into these referrals and max them out, that’s at least $500 a year in extra rewards you’re netting with the Chase Freedom Unlimited.

The Citi Double Cash does not have a referral program so you miss out on these benefits.

Chase Shopping Portal

Chase has a tremendous shopping portal which allows you to maximize rewards by earning Ultimate Rewards for everyday purchases on items from an array of online retailers. If you utilize this portal on a regular basis you can add 2% to 5% back on a lot of purchases and really cash in on your savings.

Citi discontinued its shopping portal so there’s no way to maximize rewards with them in this way.

Credit card late fee pass

The Double Cash allows you to get a pass on your first late fee but the Freedom Unlimited does not offer this perk.

Annual fee

Both cards do not have an annual fee.

Chase Freedom Unlimited vs Citi Double Cash

These cards are two very strong cash back credit cards and here are how their strengths compare.

Chase Freedom Unlimited

- Better up-front earnings with higher sign-up bonus

- More ways to cash in on points with shopping portal and referrals

- Better 0% APR options

- Potential for higher earnings with transfer partners

Citi Double Cash

- Better for long-term earnings if you just want cash back

- First late-fee waived

Final word

The Chase Freedom is the more robust credit card out of the two. If you can tap into things like the referrals, shopping portal, 0% APR, and transfer partners, the Freedom Unlimited can absolutely blow the Citi Double Cash out of the water.

However, if you’re just focused on pure cash back earnings and don’t see yourself utilizing things like referrals, then the Citi Double Cash will most likely net you more cash back in the long-run once you hit the $15,000 spend mark.

Cover photo by 401kcalculator.org.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.