Offers contained within this article maybe expired.

American Express has been steadily cracking down on “gaming” and rewards abuse over the past couple of years. They’ve implemented their own “Rewards Abuse Team” known as RAT and have been known to freeze points or outright deny points when they suspect you’ve been up to something.

Well, now American Express just added new extremely vague language to their terms and conditions which is presumably aimed at cracking down even further on rewards abuse.

The new language

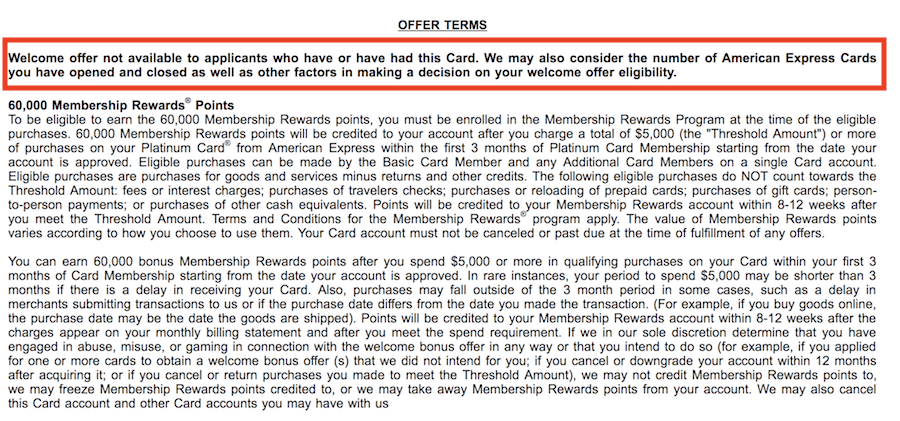

The new language is the bolded text below:

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

You can see the language yourself in the Offer Terms for the Platinum Card.

What does this mean?

What does this mean?

This language is in the same spirit of the gaming language added last summer which states:

If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome bonus offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome bonus offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit Membership Rewards points to, we may freeze Membership Rewards points credited to, or we may take away Membership Rewards points from your account. We may also cancel this Card account and other Card accounts you may have with us

To me, it’s clear that Amex is trying to give itself all the room and fallback language it needs to crack down on those who they view are gaming the system.

But the new language is even more vague than these restrictions previously added.

We don’t know what this means in terms of what will be denied. Will you just be denied the welcome offer points even after you’ve hit the minimum spend? Or will you just be denied for the credit card altogether? If it’s the former, that’s going to be a huge problem.

We also have no idea as to what the threshold is for opening and closing cards.

Are they focusing on all Amex cards opened and closed or more on the opening and closing the cards within the same brand that you’re applying for? Also, how far back in your account history are they going to look to determine if you meet their unacceptable pattern of opening and closing accounts?

And then there’s the “as well as other factors in making a decision on your welcome offer eligibility” language. That’s about as broad and vague as you can possibly get and nobody will know what that means until data points start trickling in.

We might eventually be able to gauge a specific number for account openings and closures to formulate a new credit card rule but I doubt it will be that clear cut.

What should you do?

My advice would be to do what I’ve been suggesting for some time. Play it slow. When I first got into this a few years ago, I had a pedal to the metal mentality. I have no doubt that if I had gone with that mentality today, I wouldn’t last very long.

This is especially the case with Amex. Take things slow and try to avoid cancelling your Amex accounts as much as possible. You could always try to get things in writing via chat stating that you will receive your welcome offer so long as you hit the minimum spend requirement and take a screen shot.

I think that ultimately if you are not pushing things with many new accounts and closed accounts or other fishy activity, you probably don’t have much to worry about but that’s just my hunch. Until we start to see new data points we really don’t know what to expect.

H/T: DOC

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.