The American Express Blue Cash Preferred and the Capital One Venture Rewards Credit Card are two very popular credit cards. If you’re thinking about going for these cards though you should be aware that they are very different types of credit cards in terms of the rewards offered by them.

Here’s a close look at the Blue Cash Preferred vs Capital One Venture with insight into which credit card would be better for you based on your personal spending habits and rewards goals.

Update: Some offers are no longer available — click here for the latest deals!

Welcome Offer

Both cards offer decent sign-up bonuses. The key is to note that the Blue Cash Preferred offers true cash back while the Capital One Venture offers cash back in the form of travel currency.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Blue Cash Preferred

The Blue Cash Preferred comes with a welcome offer of $200 after you spend $1,000 in purchases on your new card in your first 3 months. Keep in mind that the Blue Cash Preferred earns cash back and does not earn Membership Rewards like some other Amex cards.

$200 back is a nice welcome offer and sometimes even higher targeted offers show up.

Capital One Venture

The early spend bonus for the Capital One Venture is for 50,000 miles after you spend $3,000 on purchases within 3 months from account opening. Those 50,000 miles can be redeemed at 1 cent per point which means you get $500 worth of travel.

Travel for the Venture card could include: airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, and taxi cabs. So if you hit the minimum spend, you’ll be able to cover all of those expenses up to $500, which is pretty fantastic.

However, if you redeem your Venture points for cash back, you’ll only get .5 cents per point which means that you’ll receive $250 worth of cash back for non-travel related purchases.

Take-a-way

If you plan on spending money on travel, the Venture card offers more up-front value but if you’d rather have true cash back, the Blue Cash Preferred offers a great return for only $1,000 worth of spend in 3 months.

Bonus categories

Both of these cards offer some good bonus categories but their strengths lie in very different areas.

Blue Cash Preferred

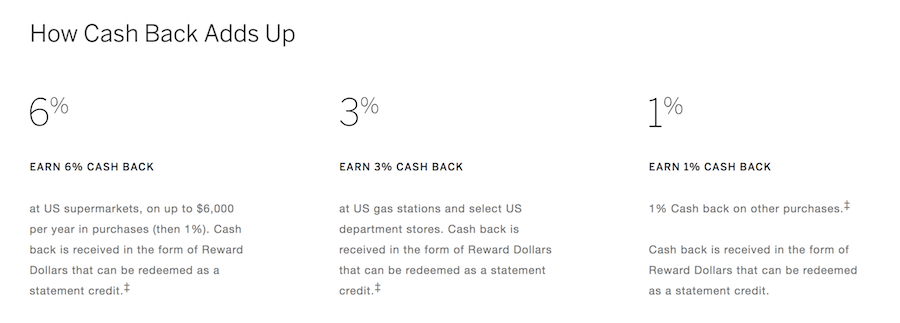

The Blue Cash Preferred earns 6% back at U.S. supermarkets (on up to $6,000 per year in purchases, then 1%) and 3% cash back at U.S. gas stations and at select U.S. department stores.

The supermarkets and gas stations covered by these bonus categories are pretty straight forward. the key thing to note about supermarkets is that warehouse clubs are excluded and for gas stations you won’t earn additional rewards for gas stations that are part of supermarkets or warehouse clubs, such as Target and Wal-Mart.

Department stores include places like: Dillard’s, J.C. Penney (JCP), Kohl’s, Macy’s, Sears, and many others.

These bonus rates make the Blue Cash Preferred one of the best cards for groceries and gas purchases. 6% back at grocery stores is very compelling, although that high bonus rate is limited to $6,000 per year.

Consider this, if you spent $6,000 on groceries you’d get $360 in cash back which wipes out the annual fee of $95 — and that’s without factoring what you’d get back with gas and department stores.

One reason why I like the Blue Cash Preferred so much is that it’s just so easy to offset the annual fee with bonus spend. That makes the card much more of a keeper in my book.

Capital One Venture

The Venture card earns 2% back on all purchases when those points are redeemed towards travel purchases. This is nice because you don’t have to worry about bonus categories and know that you’ll be earning at least 2% back on all purchases.

However, to earn $95 worth of rewards to cancel out the annual fee, you’d need to spend at least $4,750. Compare that to the Blue Cash Preferred which would only require $1,583 worth of groceries to offset the annul fee.

The Venture also earns 10% back at Hotels.com, which is an OTA you can use to book hotel stays. That 10% back stacks on top of the 10% you already get back from Hotels.com so you actually end up with returns around 22% when booking with them.

If you’re interested in a great Capital One cash back card with more traditional bonus categories like dining then consider the Capital One Savor which earns unlimited 3% cash back on dining, 2% on groceries.

Take-a-way

The Blue Cash Preferred is phenomenal for everyday purchases at places like grocery stores and gas stations and you can easily offset your annual fee with those purchases. The Venture is great for Hotels.com purchases and is decent at 2% back on all purchases but you’ll have to spend a lot to cancel the annual fee vis everyday spend.

Annual fee

The Blue Cash Preferred comes with a $95 annual fee that’s not waived the first year. Meanwhile the Venture comes with a $95 annual fee that is waived the first year.

This is something you have to factor into your analysis. If you’re concerned with up-front value the lack of the annual fee means that it’s much easier to come out on top in the short-term but if you’re concerned about the long-term then things start to even out between these two cards.

Amex offers

American Express has Amex Offers where American Express cardholders can earn additional rewards via their everyday spend. These offers can save you money on all sorts of purchases, from restaurants and hotels to gym memberships and phone bills.

If you efficiently utilize your Amex Offers, you could end up saving yourself up to hundreds of dollars each year. So the value attached to this benefit should not underestimated.

Foreign transaction fees

The Blue Cash Preferred comes with a 2.7% foreign transaction fee while the Capital One Venture has no foreign transaction fee.

Considering that the Venture is also a Visa card, the Venture is the much better card to take with you on your international travels.

Blue Cash Preferred vs Capital One Venture

Blue Cash Preferred strengths

- Solid $200 sign-up bonus

- Fantastic bonus categories on groceries and gas

- Good cash back rewards

Capital One Venture strengths

- Fantastic $500 sign-up bonus

- Decent bonus categories

- No foreign transaction fees

Final word

Ultimately, the Venture card has more value potential for the traveler, especially if they are interested in using Hotels.com. With nor foreign transaction fees and up to $500 in travel rewards, it’s really not even close in that department.

But the Blue Cash Preferred is one of the best cash back cards with exceptional earning potential for spend at grocery stores and on gas. If you’re interested in putting cash back in your wallet more than you are about earning travel rewards, then the Blue Cash Preferred is clear front-runner.

In the end, these cards serve very different purposes in terms of their rewards so this is one of those credit card comparisons that are hard to do because these cards are just very different breeds. But they each serve clear purposes and if you’re interested in any of those, they can both be worth picking up.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.