The new Amex Business Platinum 100K offer is getting a lot of attention and hype. 100,000 Membership Rewards is a lot of points but is this offer actually a good deal or is all the hype being created by people trying to sell you this offer? Here’s an honest look at the new Amex Business Platinum 100K offer.

Update: Some offers are no longer available — click here for the latest deals!

A quick look at the Amex Platinum Business Card

First, let’s take a quick look at some of the things to note about the Amex Platinum Business Card.

- 5X on flights and eligible hotels on amextravel.com

- 1.5X per dollar on each eligible purchase of $5,000+

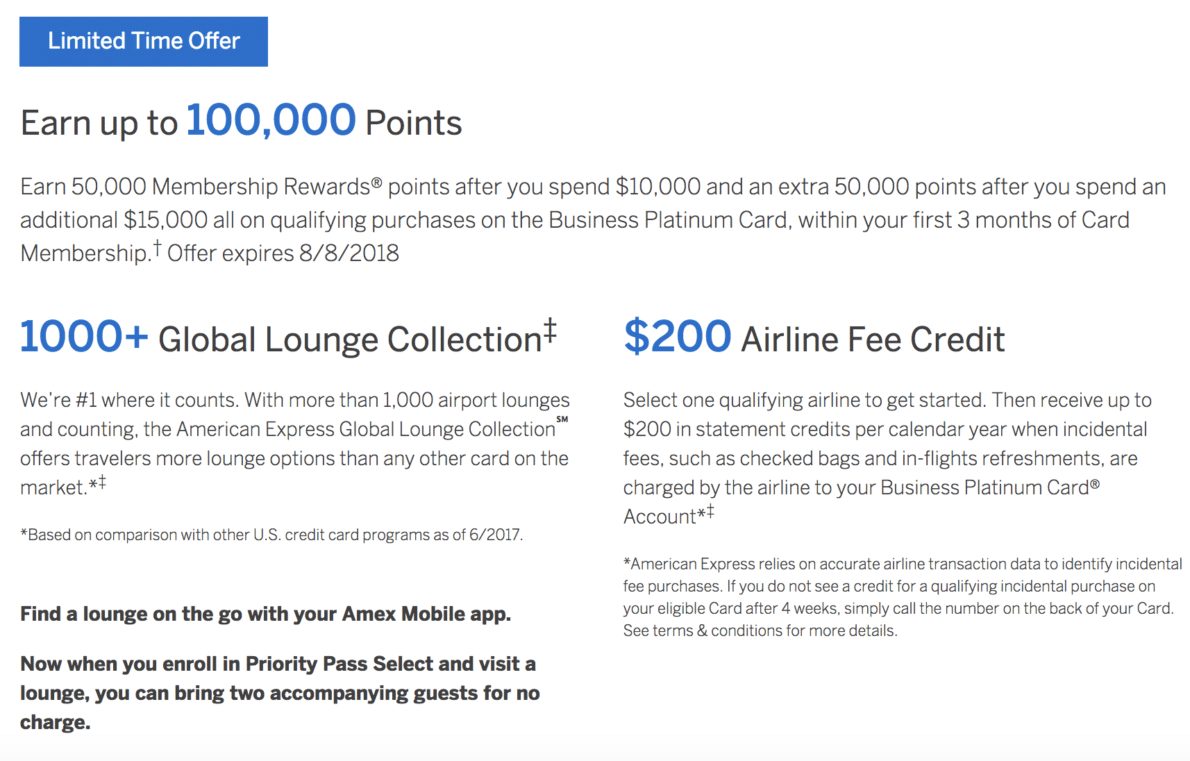

- Centurion lounge access and Priority Pass for you and two guests.

- Does NOT come with the $200 Uber credit.

- Redeem your Membership Rewards at a rate of 1.54 cents per point with premium cabin flights (and one chosen airline)

- $200 airline incidental credit

- Hilton Gold and SPG Gold

- Global Entry ($100) statement credit or one TSA Pre✓® ($85) statement credit every 4 years

- $450 annual fee ($100 lower than the personal version)

- 10 Gogo wifi passes each year

The Amex Business Platinum 100K welcome offer

Offer no longer available — click here for the latest deals!

The welcome offer is tiered so that you earn 50,000 Membership Rewards after spending $10,000 in the first 3 months and then an additional 50,000 Membership Rewards after you spend $15,000 more in the first 3 months.

The previous offer was for up to 75,000 Membership Rewards after you spent a total of $20,000 in the first 3 months, so the minimum spend requirement is “only” $5,000 more than the prior offer but don’t get it twisted: $25,000 is still a giant minimum spend requirement. So if you’re new to credit cards, make sure you’re not getting in over your head chasing this offer.

But assuming hitting the minimum spend is not an issue, you should still consider that higher and more easily obtainable offers for the Business Platinum have gone out from time to time.

Targeted offers

You could sometimes be targeted for some amazing high offers like 150,000 Membership Rewards after spending $10,000 or $20,000. So this 100,000 Amex Business Platinum offer isn’t quite as outrageous as those targeted offers.

It’s just that sometimes it’s hard or even impossible to get targeted for those 150K offers. For example, I’ve never received a targeted Business Platinum offer in the three years I’ve been doing this so having a public offer for 100,000 Membership Rewards is still pretty special.

Amex has some fantastic airline partners and you could put 100,000 points to great use.

For example, you could:

- Transfer your points to Aeroplan and fly business class on SAS to Scandinavia for 55,000 miles and about $12 in fees.

- Transfer them to ANA and fly business class roundtrip to Europe for 88,000 miles and less than $100 in fees on Air Canada.

- Transfer your points to Cathay Pacific and fly roundtrip to Europe for 80,000 miles and less than $100 in fees on Aer Lingus.

- Transfer your points Emirates and fly first class from Milan to New York for 85,000 miles and about $300 in fees.

That’s just the tip of the ice berg.

Once per lifetime rule

The Amex once per lifetime rule is one of the several Amex application rules and states that you can’t receive a welcome bonus for the same product more than once per lifetime. This is something found in their terms and conditions.

Welcome bonus offer not available to applicants who have or have had this product.

However, in practice many have reported that this restriction only lasts for about seven years and after that you can become eligible for bonuses again.

Moreover, targeted offers without this lifetime language regularly come around. For example, there was just a targeted offer for the Business Platinum with no lifetime language for 75,000 points after spending $5,000. I think the offer was just pulled but you can check to see if it still comes up here.

So I wouldn’t necessarily let the once per lifetime rule guide my decision 100% of the time on whether or not to apply. It could definitely make sense to go for a 100K offer if you stand little to no chance of receiving a higher 150K offer.

The personal card as an alternative?

The personal card comes with a welcome offer of 60,000 Membership Rewards after you spend $5,000 within the first three months of account opening. But you can get targeted offers up to 100K so if it’s points you’re after, the personal card is always a solid choice to consider with its many benefits offered.

Would I go for this 100K offer?

Personally, I wouldn’t go for the offer if I had received business mailers from Amex in the recent past. Even though Amex allegedly has stopped sending in physical mailers, targeted offers may still roll through your inbox at any given moment.

If you receive a 150K offer with a smaller spending requirement a month after you apply for this card, you will be kicking yourself. That’s because Amex does not typically match bonuses — they only offer you a small amount of “courtesy” points which are essentially sympathy points.

However, if I’ve never received an Amex targeted mailer (and I’d been opted in to offers for a while), then I might think about going for this.

But first — I’d try to see if I could pull up any alternative offers. For example, I might try to pull up offers in Chrome Incognito. If I couldn’t get any of those to work then I would seriously consider the offer for this card.

Credit score needed

You can find out more about what credit score is needed for the Platinum Card here.

Final word on the Amex Business Platinum 100K

Overall, this offer can worth pursuing if you can hit the minimum spend requirement. However, you should be aware of the more lucrative opportunities that have gone out in the past and possible alternatives that could be worth your while. The offer ends 8/8/18.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.