The Chase IHG® Rewards Club Select Credit Card might be the most valuable hotel credit card to hold over the long-run. While the sign-up bonus can vary over time, Chase IHG Card always offers its free anniversary night which can be extremely valuable when you know how to utilize it. Here’s what you need to know about the IHG credit card.

Update: There is a new Chase IHG credit offer now and the card below is no longer offered. Click here to read about the new IHG credit card.

The Chase IHG Credit Card

- Sign-up bonus ranges from 60,000 to 100,000

- Free anniversary night

- Automatic IHG Platinum Elite status

- 5X per $1 spent at IHG properties

- 2X per $1 spent at gas stations, grocery stores & restaurants

- Automatic 10% point rebate on redemptions

- No foreign transaction fees

- $49 annual (usually waived the first year)

The IHG card is not subject to 5/24

It’s very important to know that the IHG card is not subject to 5/24. This means that this is normally a low-priority card for people.

- If you don’t know about 5/24 or any of the other Chase application rules, then you definitely need to read this.

Chase IHG Card signup bonus

- Current IHG card sign-up bonus: 60,000 bonus points after you spend $1,000 on purchases in the first 3 months of account opening

The standard sign-up bonus is for 60,000 points after spending $1,000 in the first 3 months (sometimes with a $50 statement credit attached).

Many value IHG points around .7 cents per point, so the standard sign-up bonus value could be put around $420. This 60,000 point sign-up bonus isn’t exactly trash but the 80K and 100K IHG offers are obviously more enticing.

How do you get the IHG 80,000 and IHG 100,000 offers?

The answer to this question is: wait around and monitor social media and blogs like this one until it’s announced that an offer has returned.

The 80,000 IHG offer comes and goes and so it’s only a matter of time before it comes back around. The 100,000 IHG offer is a bit more rare, but I think it will come back around soon enough.

Getting the 100,000 IHG Offer

The 100,000 IHG offer is usually targeted but even if you’re not specifically targeted there are a few creative ways to get it. For example, you might have to call into IHG to inquire about signing up for the IHG card. They’ll usually refer you to Chase and that could pull up a higher offer.

In the past, people who applied for the 60,000 and 80,000 offers sent in secured messages to Chase requesting to be matched to the 100,000 offer and they were honored in some cases. If you go that route make sure you send in your secured message within 90 days of account opening and be prepared to be asked to spend an additional $1,000 to meet the minimum spend (assuming you didn’t have to do hit that already).

Note that the 100,000 IHG offer sometimes offers 80,000 points after $2,000 spend and then an additional 20,000 points after $6,000 more in spend. I’m not sure if they would match that offer.

And don’t forget you can tack on an additional 5,000 IHG points for adding an authorized user.

How far will the sign-up bonus take you?

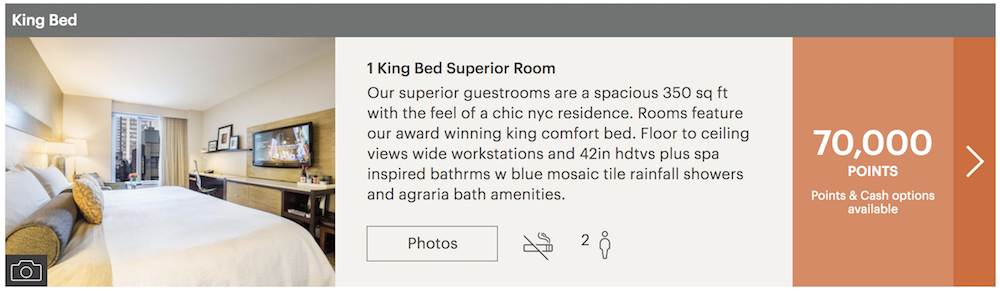

IHG recently implemented another devaluation where the most expensive properties got 10,000 points more expensive and will require 70,000 points.

If you want to stay at a top hotel like the InterContinental in a major city, then you’ll probably be spending 60,000 to 70,000 points per night, though you can find some going for 50,000. For a Crowne Plaza, it will be around 40,000 to 50,000 in a big city. For a mid-tier hotel like the Holiday Inn in a major city, you’re probably looking at the 25,000 to 40,000 range.

When you start looking at smaller cities, it’s much easier to stretch your points, especially if you can take advantage of a Points Break redemption, which range from 5,000 to 15,000 points.

So the answer to how far your IHG points will take you will range dramatically depending on your travel goals.

- You check out the new award prices yourself for many properties here.

Free anniversary night

The Chase IHG Credit Card is one of the most valuable cards to hold on to in the long-run due its very generous free anniversary night.

What’s so special about it?

There’s no restriction for redeeming your free night certificates for certain categories so this is one the most valuable free night certificates available. All you have to do is find standard award availability at your desired property and you can book your free night.

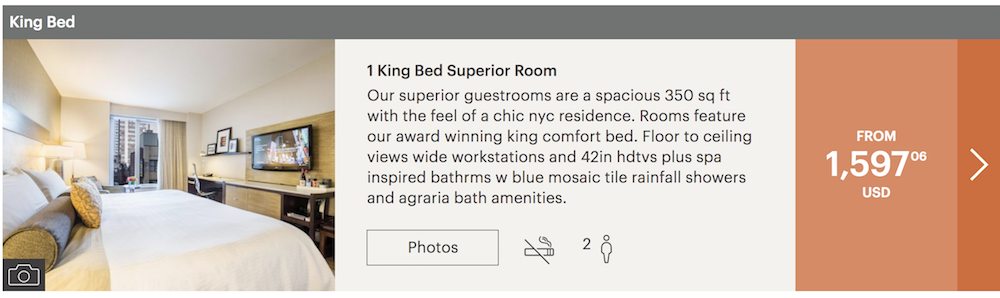

As an example of how ridiculous the value can be, check out the rates for the InterContinental Times Square:

For one night a King Bed Superior Room goes for $1,597. With taxes this comes out to 1,836.13! But if you had your free night certificate, you could stay there for free!

The free night will be available to you to use after you pay your annual fee.

So if you and your spouse picked up this card at the same, then you’d have two free nights hitting your accounts at the same time going forward. This makes the Chase IHG Card perfectly designed for weekend get-a-ways and why it’s one of the top credit cards I recommend for couples who like to travel.

The terms and conditions state that the free night must be redeemed (and the stay must be completed) within 12 months from date of issue. However, in practice as long as you book your hotel before those 12 months are up, you can still use your free night. The catch is that you can’t cancel that night after your pass technically expired. Otherwise, you will forfeit the free night.

Bonus categories

- 5X per $1 spent at IHG properties

- 2X per $1 spent at gas stations, grocery stores & restaurants

These bonus categories are pretty standard for a hotel card. If I were in need of IHG points, the 2X at gas stations and grocery stores might be tempting but given the value of IHG points, I wouldn’t put my spend on those categories just for the sake of earning IHG points.

These earnings would stack on top of what you would earn from staying at IHG properties. For example, you would earn 10 IHG Rewards Club base points per eligible $1 USD spent at most IHG properties including:

- Crowne Plaza Hotels & Resorts

- Hotel Indigo

- Holiday Inn Hotels & Resorts

- Holiday Inn Express hotels

- InterContinental Hotels & Resorts

So as a Platinum Elite member, if you spent $100 with this card on an eligible IHG property you would earn:

- 1,000 base points

- 500 bonus points via elite status

- 500 bonus points vis credit card spend

And you can’t forget that you’ll get an automatic 10% point rebate on redemptions, so in effect, you’re earning 10% more. So $100 would earn you 2,000 IHG points which factoring in the rebate would come out to 2,200. At .07 cents per point, that’s a 15.4% return which is actually pretty good compared to other hotel loyalty programs.

Platinum Elite status

Platinum Elite status is the mid-tier status for IHG and will offer you the following benefits:

- Free Internet Access

- Priority Check-In

- 50% Bonus Earnings on Top of Base Points

- Elite Rollover Nights (if you go over the minimum of nights required for Platinum or Spire elite status, those nights can count toward the next year but will expire after that year)

- Complimentary Room Upgrades (not known for giving the best upgrades)

- Platinum Elite and Spire Elite members are guaranteed one guest room for personal use for reservations made at least 72 hours prior to the date of arrival (exceptions apply)

IHG Platinum status might be the easiest mid-tier status to earn and because of that I believe it’s been a little devalued and doesn’t offer a lot. Unlike Hilton or Marriott mid-tier, there’s no breakfast perk or even lounge access. The 50% bonus on base earnings is really nice but there’s not much else.

IHG doesn’t have a great reputation for offering upgrades for Platinum Elites and it usually just means a nicer room. You can tell this by checking out the terms and conditions, which read:

Platinum Elite and Spire Elite members will be offered a complimentary upgrade, as determined by the hotel, which might include rooms on higher floors, corner rooms, newly renovated rooms, or rooms with preferred views. The upgrade will be offered at time of check-in, based on availability, and will only apply to the member’s personal guest room. The hotel is not required to upgrade members to suites or specialty rooms. Upgrade benefits will not apply to rooms booked as a Reward Night reservation.

It’s a bummer that upgrade benefits don’t officially apply to rooms booked as reward nights, but that doesn’t mean they don’t happen. For example, in Japan at the InterContinental Tokyo Bay, I was upgraded to a Deluxe Corner Room from a standard room on an award stay.

What’s nice about the Platinum status is that you can use it to help you make your way to top-tier Diamond status with Hilton Honors. Read about how I did that here.

Annual fee

This card comes with a low annual fee of $49 and it’s usually waived the first year. This is one of the lowest annual fees for any major hotel card, so that’s a big plus for the card.

No foreign transaction fees

Pretty standard for hotel rewards cards to do away with these now.

Final word on the Chase IHG Card

Overall, the Chase IHG Card is a solid hotel card. What it lacks in elite status perks offered, it makes up for with a valuable free anniversary night, decent to very good sign-up bonus, and a very low annual fee of only $49 that’s waived the first year. For those reasons, I think this card is a keeper that should earn a permanent place in many wallets.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.