In early 2018, Chase made big changes to its main IHG product when it rolled out the IHG Rewards Club Premier Credit Card. The free night benefit underwent a major devaluation, the annual fee went up, but new perks were introduced like the 4th night free and a 20% discount on points purchases. With those changes in mind, here’s a look at the IHG Rewards Club Premier Credit Card and a review of whether or not it’s worth it.

Table of Contents

IHG Rewards Club Premier Credit Card intro

The IHG Rewards Club Premier Credit Card comes with the following features:

- Welcome bonus can range from 80,000 to 140,000 points after meeting the minimum spend

- 10,000 points after you spend $20,000 and make one additional purchase each cardmember year

- 25X for spend at IHG

- 2X at gas stations, grocery stores and restaurants

- Annual free night certificate at an “eligible hotel”

- Automatic Platinum Elite Status

- 20% discount on purchases of IHG points

- 4th night free on award stays

- Global Entry or TSA PreCheck credit of up to $100 every 4 years

- No foreign transaction fees

- $89 annual fee

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Welcome bonus

This is definitely one of those credit cards that you want to try to time for one of the better bonuses.

For this card, we’ve seen bonuses offering 80,000 points after spending $2,000 in the first 3 months and then much higher bonuses offering 140,000 IHG points after you spend $3,000 within the first 3 months.

IHG award redemptions range from 10,000 points per night all the way up to 70,000 points per night. So if you were able to catch this bonus at a higher offer of 140,000 points, you could score 2 nights at a high end property where the value could be in the thousands.

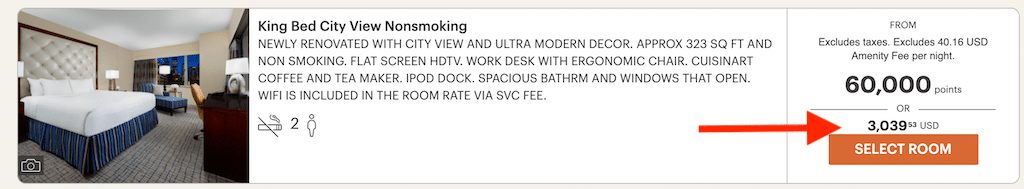

If you want to put your rewards on steroids, you can book something like the Crowne Plaza in Times Square on New Year’s Eve. That would be a 60,000 points redemption per night and the cost for NYE is over $3,000!

One interesting thing about this card is that you can also get an additional bonus of 10,000 points after you spend $20,000 and make one additional purchase each cardmember year.

10,000 points for $20,000 worth of spend and one additional purchase is not something I would be super excited about. This bonus is very similar to other hotel credit cards that offer free nights for hitting spend around $15,000. But 10,000 points will only take you so far with IHG so the extra bonus does not excite me very much.

One thing to be aware of with IHG is that you can take advantage of PointBreaks. These will offer you savings and allow you to stretch your points even further.

So if I were applying for this card, I would try to score a bonus of at least 100,000 points.

Eligibility

The IHG Rewards Club Premier Credit Card is subject to the Chase credit card application rules including the Chase 5/24 rule and the 24-month rule, not to mention the 2/30 rule.

One thing that I like about this card is that if you had the old IHG Rewards Club Select Credit Card, you are not disqualified from eligibility for this card.

The terms only state:

This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.

Instead of trying to keep up with calculating all of these rules yourself, I highly recommend that you sign up for the free app WalletFlo which will automate your eligibility for all of these credit card rules.

You can also set up notifications so that you are reminded when you are finally eligible along with keeping tabs on your annual fees, upgrade history, etc.

Related: Chase Credit Card Application Status Guide

Bonus spending

- 25X for spend at IHG

- 2X at gas stations, grocery stores, and restaurants

- 1X on other purchases

25X at IHG

The 25X at IHG is broken down as follows

- 10X as an IHG Rewards Club Premier Credit Cardmember

- 10X for being an IHG Rewards Club member

- 5X with Platinum Elite Status, a benefit of this card

Using a WalletFlo valuation of .56, that comes out to 14% back which is pretty solid. If you plan on staying a lot at IHG properties, this card can be very rewarding.

2X at gas stations, grocery stores, and restaurants

2X at gas stations, grocery stores, and restaurants is not very strong. This comes out to just over 1% back based on the valuation above. You can do much better than this with travel cards like the Chase Sapphire Preferred which earns much more valuable Ultimate Rewards.

1X on all other purchases

Because of the valuation of .56, this card would be earning just over half a percent on all purchases which is not good at all. You’d be way better off using a card like the Chase Freedom Unlimited which earns 1.5X on all purchases. You could then transfer your points over from the Chase Freedom Unlimited to your IHG account at a 1:1 ratio as well.

Annual free night certificate

The IHG Rewards Club Premier Credit Card provides you with an annual free night certificate that can be used at properties costing up to 40,000 points per night.

The annual free night with the old IHG credit card allowed you to book a free night at any IHG property, including top level InterContinentals. For that reason it was one of my top choices for earning a free hotel night stay.

However, the new IHG card is now more on the level of other cards that have a capped anniversary night like the Marriott and Hyatt cards which both offer free nights in the mid-tier range.

If you want to check out ways to maximize your free night with the IHG Rewards Club Premier Credit Card be sure to read our full guide here.

- Related reading: Which Hotel Credit Card Has the Best Free Night Certificate?

IHG Platinum status

Like the card before it, this card offers IHG Platinum status which is a mid-tier status with IHG.

Here’s a rundown of the benefits that you can expect:

- 50% bonus earnings

- Complimentary Room Upgrades

- Extended Check-Out

- Priority Check-In

- Welcome Amenity

- Elite Rollover Nights

- Guaranteed Room Availability

- Hertz Car Rental: Save and Earn 1,500+ Points

- $30 In-Room Spa Credit

- Earn on IHG Rewards Club Dining, OpenTable & Grubhub

IHG Platinum status is not the most lucrative hotel elite status, but it’s helped us to get upgrades in the past so it’s added at least some value to our travels.

You’ll notice that there is no free breakfast that comes with the status, though. (It is possible to get a free breakfast at some properties though.)

I think the most valuable perk is probably the 50% bonus on earnings since that can really start to add up as you saw above with earning 25X on IHG purchases. If you’re interested in cards that offer more valuable hotel elite status check out the full list here.

20% discount on IHG points

IHG has been offering some great promos on purchased points recently and has even lowered the price of their points.

Combining these point promos with the 20% discount offered by this card has opened up some great opportunities, allowing members to save tons of cash on their stays by simply booking with purchases points instead of paying cash.

If you are a true IHG loyallist, this 20% discount could be very lucrative because you could purchase points whenever a promo takes place (knowing that you will use the points for a hotel stay).

IHG credit card offer 4th night free

This is the biggest new perk offered by this card.

With this card, you’ll be given the 4th night free on award stays. Some other hotel programs offer 5th night free but getting the 4th night free is a major perk because it’s much easier to use.

This perk can also increase the value of point purchases with the 20% discount. If you think about it, you can triple stack discounts if you purchased points at a 20% discount while a promotion was going on and then used the fourth night free.

If you would normally make a 4 night stay at an IHG property with points, then this benefit alone could make it worth getting this credit card.

Global Entry / TSA Pre-Check credit

You’ll get a $100 credit for either Global Entry or TSA Pre-Check every 4 years.

It seems like every card is offering this perk now but it’s always cool to see it offered by a card with an annual fee under $100 because it means that you can come out on top if you’ve never used these programs before.

Global Entry is a program that will grant you expedited entry through customs and immigration and TSA Pre-Check will get you through priority security.

I highly recommend enrolling in Global Entry since it comes with automatic TSA Pre-Check status.

IHG Rewards Club Premier

The IHG Rewards Club Premier Credit Card has some travel and purchase protections to offer but to be honest they are not very strong. If you want to optimize your travel protections for things like trip cancellation or rental car insurance, you will be much better off with something like the Chase Sapphire Preferred.

Trip Cancellation/Trip Interruption Insurance

If your trip is canceled or interrupted because of a covered reason like sickness, severe weather, or some other situation you can be reimbursed up to $5,000 per trip for your pre-paid, non-refundable travel expenses, including “passenger fares, tours, and hotels.”

Other cards like the Sapphire Preferred offer this protection up to $10,000 per trip so you can easily get your coverage doubled by going with a better card.

Lost Luggage Reimbursement

If you or your immediate family members’ checked or carry-on bags are damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

Baggage Delay Insurance

Baggage delay protection will reimburse you for essential purchases like toiletries and clothing when your baggage is delayed over 6 hours by a passenger carrier. You can be reimbursed for up to $100 a day for 3 days.

This is a pretty decent protection here but it only covers three days while other cards will cover you for up to five days.

Purchase Protection

The purchase protection will cover your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account. If you go with a premium card instead, you can get purchase protection up to $10,000 per claim so this is definitely on the weaker side.

Annual fee

The annual fee is $89. If you utilize your annual free night, you should be able to offset this annual fee each year pretty easily. And if you take advantage of any of the perks like the free fourth night or 20% discount on points, it should be even easier to come out way on top with this hotel card.

IHG Rewards Club Premier Credit Card FAQ

No, the IHG Rewards Club Premier does not have foreign transaction fees.

Yes, you will get automatic IHG Platinum elite status. See the IHG Platinum elite status section above for more details.

You can use the free anniversary night at IHG properties that cost up to 40,000 points per night. See the full guide above for more details.

No, you do not get lounge access to airports or to hotels with this card.

Yes, the card is subject to the 5/24 rule along with other application rules.

I would recommend only applying for this card if you have a good credit score, such as a score close to 720. However, it’s possible to get approved for this card even if your credit score is in the (upper) 600s.

Yes, just like with other Chase cards, you can apply for a credit limit increase for this card. Read more about how to do that here.

Final word

The IHG Rewards Club Premier doesn’t offer as much value to everyone as it used to but it actually offers a lot more value to IHG customers and loyalists. If you are interested in staying at IHG properties, you can come out way ahead with a great welcome bonus, strong bonus earning, the fourth night free on awards stays, and a hefty discount on point purchases.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

4 comments

Comments are closed.