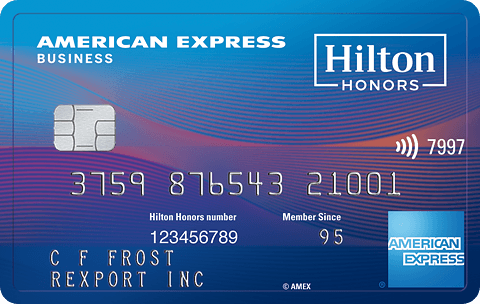

American Express recently released a new suite of Hilton credit cards in January 2018. One of the cards, the Hilton Honors Aspire credit card is one of my favorite new credit cards with all of its new perks. But Amex also introduced the first Hilton business credit card along with these cards and introduced some cool new perks. Here’s a review of what the Hilton Honors American Express Business Card has to offer.

Update: Some offers are no longer available — click here for the latest deals!

Perks of the new Hilton Business Credit Card

The Hilton Honors American Express Business Card offers the following perks:

- 75,000 Hilton Honors points after you spend $3,000 within 3 months of card opening

- 25,000 additional Hilton Honors after you spend an additional $1,000 within 6 months of card opening

- 12X on Hilton purchases

- 6X on select business and air travel purchases

- 3X everywhere else

- Automatic Hilton Honors Gold Status

- Upgrade to Diamond Status by spending $40,000 on eligible purchases on your Card in a calendar year

- Free weekend night after spending $15,000 in a year

- No foreign transaction fees

- $95 annual fee (not waived)

You can read the official terms and conditions here.

Hilton Business Credit Card welcome offer

- 75,000 Hilton Honors points after you spend $3,000

- 25,000 additional Hilton Honors after you spend an additional $1,000

In total this amounts to a 100,000 point welcome offer after spending $4,000.

For a business card minimum spend requirement, $4,000 isn’t too bad, especially since you get 6 months to hit it. 100,000 points isn’t a terrible bonus, either. This bonus is right on par with the Hilton Ascend, which is essentially the personal version of the Hilton Honors business credit card.

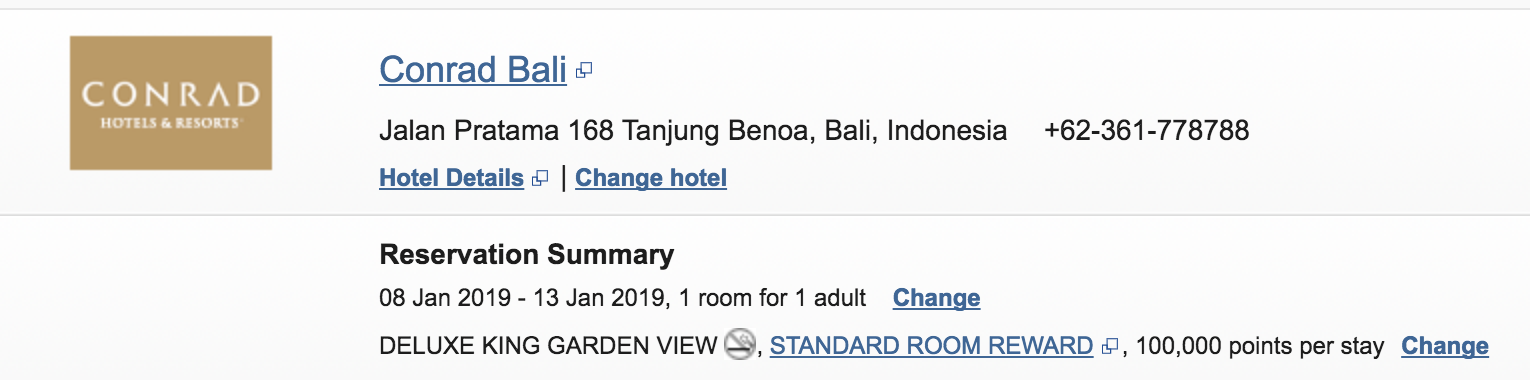

100,000 points will cover 1 to two nights at a solid hotel in a major city most of the time but you can definitely stretch these points in some parts of the world. And by “stretch” I don’t mean staying in crappy properties. For example, I found a Conrad in Bali that went for 20,000 per night. With the 5th night free benefit factored in, you could stay there for five nights for 100,000 points.

Hilton Business Credit Card bonus earning

The Hilton Honors Business credit card earns 12X on Hilton purchases and 6X on “select business and air travel purchases.”

Select business purchases

These business purchases include purchases for:

- U.S. gas stations

- Wireless telephone services purchases directly from U.S. service providers

- U.S. purchases for shipping

If you value Hilton Honors points at .5 cents per point, then that’s a 3% return on gas, phone bills, and shipping. 3% back on gas is pretty competitive compare to other gas credit cards so that’s not a bad a way to use this card. 3% on phone bills and shipping, however, is outdone by a few other business cards offered by Chase and Amex so those don’t excite me as much.

Air travel purchases

The air travel purchases include purchases for:

- U.S. restaurants

- Flights booked directly with airlines or with AmexTravel.com

- Car rentals booked directly from select car rental companies

So again this is a 3% return but for dining, air travel, and car rentals. Not a bad return but you can certainly do better with some other options, including other business cards offered by American Express. Find out more about those options here.

So the bonus earning is very similar to the Hilton Ascend except you get the added bonus of earning points on the business expenses. While these earning rates aren’t exactly “too good to be true,” if you’re just trying to round up Hilton Honors points, this card isn’t a horrible way to go.

Free Weekend Night Reward

- Free Weekend Night Reward from Hilton Honors after you spend $15,000 on eligible purchases on your Card account in a calendar year.

You’ll get one free weekend night which can be used at most Hilton properties after only spending $15,000. That’s a fairly obtainable goal for a lot of people. The second free weekend night after spending $60,000 is not quite as lucrative to me since you could allocate that additional $45K worth of spend somewhere else and come out with many free nights.

- Keep in mind that some properties are excluded from these free nights.

Priority Pass

- 10 Free Priority Pass Visits

Just like the Hilton Ascend, the Hilton business credit card offers 10 free visits to Priority Pass lounges. While guests are now allowed in for free, you can use your 10 passes to allow for entry of guests. For people who have no desire to shell out $450+ for airport lounge access but are interested in experiencing the “lounge life” a hand full of times each year, this type of Priority Pass can make a lot of sense to pursue.

Automatic Hilton Gold status

Just like the personal version, the Hilton Honors business credit card offers you automatic Hilton Honors Gold status. Hilton Gold is a solid mid-tier elite status that will get you free internet, breakfasts, late check-out, and even get you some upgrades and lounge access at times. This is a great perk for this card and you can read more about the Hilton Gold benefits here.

Upgrade to Diamond

- Upgrade to Diamond Status by spending $40,000 on eligible purchases on your Card in a calendar year

Personally, I would much rather achieve Hilton Honors Diamond status via the Hilton Aspire. However, that credit card is a personal card and some folks might be in need of a business credit card so that might not be an option.

Diamond status will get you a number of perks like Executive Lounge access, breakfasts, upgrades to suites, premium internet, and a few others. With that said, I wouldn’t go chasing Diamond status by spending $40K — there are much easier routes. You can read more about the perks of Diamond status here.

Eligible welcome offer

One fantastic thing about the Hilton business credit card is that it is a new product issued by American Express. This means that there won’t be any restrictions for earning the welcome offer like the ones that exist for the Hilton Ascend.

In case you weren’t aware, if you earned the welcome offer for the Hilton Surpass before you’re not supposed to eligible to earn the welcome offer for the Hilton Ascend. Read more about that here.

However, because this is a business card and a new product, you won’t be restricted if you had the Hilton Surpass card. Also, this card won’t report to your personal credit report so it won’t affect your 5/24 status, which is another major plus of the Hilton business credit card.

Final word on the Hilton business credit card

The Hilton Honors American Express Business Card was an extremely welcomed credit card because it offers a new welcome offer to people who were not eligible for the Ascend’s new bonus. It was also the first Hilton business credit card ever offered. I think overall this is a pretty solid business card. Getting 100K points, Gold Status, 10 Priority Pass entries, and decent bonus earning potential for a $95 annual fee is not a bad trade off at all.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.