The Chase Sapphire Reserve is one of the hottest travel rewards credit card available with some of the best benefits around. This is due to its great bonus earning rate of 3X on dining and travel, a 50,000 point sign-up bonus, and its solid travel and purchase protections.

But one feature that really makes this card stand out is the $300 Chase Sapphire Reserve travel credit. In this article, I will tell you everything you need to know about the $300 travel credit.

What is the Chase Sapphire Reserve travel credit?

The Chase Sapphire Reserve comes with an easy-to-use annual $300 travel credit that allows you to get reimbursed for up to $300 worth of various travel purchases.

This credit is in addition to the $60 DoorDash credit which means that you can offset the $550 annual fee down to $190 with these two credits. With lounge access, 3X on dining and travel, and a host of solid travel protections, it is not that difficult to offset the rest of the annual fee, making this card a keeper for many.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What counts as travel?

Chase defines what would be considered “travel” in its terms and conditions:

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.

This means that just about anything can code as travel for the credit. This makes this credit extremely broad and therefore a very easy and practical way to offset $300 worth of the annual fee for many people.

Even if you don’t travel, you can still take advantage of the credit with things like parking expenses and tolls so there is extremely wide use for this credit.

The terms do note some exclusions such as:

in-flight goods and services, on-board cruise line goods and services, sightseeing activities, excursions, tourist attractions, merchants within hotels and airports, and merchants that rent vehicles for the purpose of hauling.

However, in my experience you can often get tourist attractions and excursions to code as travel. For example, I’ve booked scuba diving excursions that activated the travel credit before. You can find a list of specific transactions that counted as travel for the credit here.

How Does the Chase Sapphire Reserve travel credit work?

The $300 travel credit becomes active as soon as you activate your credit card and is automatically triggered when you make an eligible travel purchase.

As soon as you activate your card, you could literally order an Uber ride and pay for it with your card and that would trigger the travel credit — you don’t have to do any extra work.

This means that you don’t have to worry about activation or any tedious requirements like selecting certain airlines. Once again, this makes this credit one of the easiest credits to use out there.

Chase Sapphire Reserve travel credit FAQ

The $300 travel credit will work on small or large purchases. For example, you could use it on 30 $10 purchases or you could use it to take a $300 chunk out of a $1,000 purchase. You could even pay for a $3 parking charge and that should still trigger the credit.

No, even though this card earns 3X on all travel purchases you will not earn those bonus points on your travel credit purchases.

Your travel credit should post to your account the same day your travel category purchase posts to your account. There is usually a very short waiting period to see that statement credit hit your account.

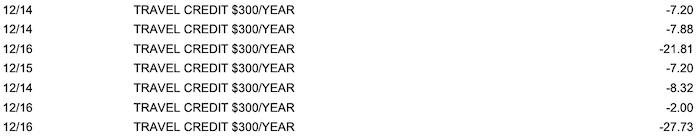

As far as seeing the travel credit on your billing statement, it will appear on your monthly credit card billing statement within 1-2 billing cycles. You may see your credit listed as “TRAVEL CREDIT $300/YEAR”

Authorized users do not get their own travel credit. Instead, the purchases they make will count towards the primary cardmember’s travel credit.

When the Sapphire Reserve first came out, it offered the $300 travel credit on a calendar-year basis. This meant that you could open up a card in June and use your $300 credit and then use it again after the new year. This allowed too many people to take advantage of this perk so Chase changed it to anniversary for new applicants.

Now the Sapphire Reserve travel credit is based on a calendar year or anniversary depending on when you submitted your application.

Anniversary year

If you submitted an application on May 21, 2017 or after, your travel credit will be based on anniversary year.

This means that the year begins with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year.

So if you opened up a card on June 4, 2017 and your first statement closed on July 10, 2017, you’d be able to use your travel credit from June 4, 2017 to when your statement closes in July 2018. At that point in 2018, it would reset.

Calendar year

For applications submitted before May 21, 2017, annual means the year beginning with your account open date through the first December statement date of that same year, and the 12 billing cycles starting after your December statement date through the following December statement date each year.

So if your December statement closes on the 18th, then that means that any purchase after that date will count towards the travel credit for the next year.

Also keep in mind that the annual travel credit will be issued for the year in which the transaction posts to your account. So if you make a purchase at the end of your annual period and it takes a couple of days to post then you risk not being able to use your credit in the annual period that you made the purchase in. I would advise to give yourself least five days of clearance when making these purchases so that you know with confidence that your credit will apply.

Just call in if you’re in doubt

If all of this sounds confusing to you that’s okay. Just call the number on the back of your Reserve card to see when you are eligible for your next $300 Annual Travel Credit. The phone reps are generally pretty good about giving you accurate information. You should also be able to see your reset month when you log-in to your account.

Chase provides you with a tracker for your travel credit. In order to do this, simply log into your Chase account and then click on the Ultimate Rewards section on the main page. This should be found right underneath your credit card accounts.

Once you click on that screen, you should see the travel credit tracker on the right side of the screen. There will be a little circle showing you how much of that credit you have received. In my case below, it shows zero dollars which means that I have the full $300 left to use.![]()

Chase doesn’t determine the merchant codes. Instead, “Merchants who accept Visa/MasterCard credit cards are assigned a merchant code which is determined by the merchant or its processor… based on the kinds of products and services they primarily sell.”

Chase then groups similar merchant codes into categories for determining eligibility. Sometimes the merchants don’t provide a merchant code that falls under a category created by Chase. This is why you may sometimes make a purchase on something that you think should activate the travel credit but it fails to do so.

If you think a purchase should have activated the travel category but it didn’t you can send a secured message to Chase to request them to review it. However, your success will vary and Chase might just refer you to their terms which do not obligate them to honor your request since they aren’t responsible for assigning the merchant codes.

Final word

Overall, the Sapphire Reserve travel credit is among the most valuable travel credits offered by any credit card. It is important to understand the timing of the credit though to make sure you botch your reimbursement and also to understand that merchant codes might not always apply to the travel credit the way you’d like.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

One comment

Comments are closed.