The Chase Hyatt Visa credit card is one of the best hotel credit cards offered by Chase. It offers a very valuable 40,000 point sign-up bonus, elite status, and an annual free night at certain Hyatt properties. The cards is also not subject to Chase’s strict 5/24 application rule. Here’s a look at whether or not the Chase Hyatt Visa credit card worth it.

Update: This card is no longer available — please click here to find out about the new and improved Hyatt credit card.

The Chase Hyatt Visa credit card 40,000 point sign-up bonus

- Get 40,000 bonus points after you spend $2,000 in the first 3 months after account opening.

- Get 5,000 bonus points after you add an authorized user to your account and make a purchase with your card during the first 3 months from account opening

- Plus, 1 free night every year after your cardmember anniversary at any Category 1-4 property

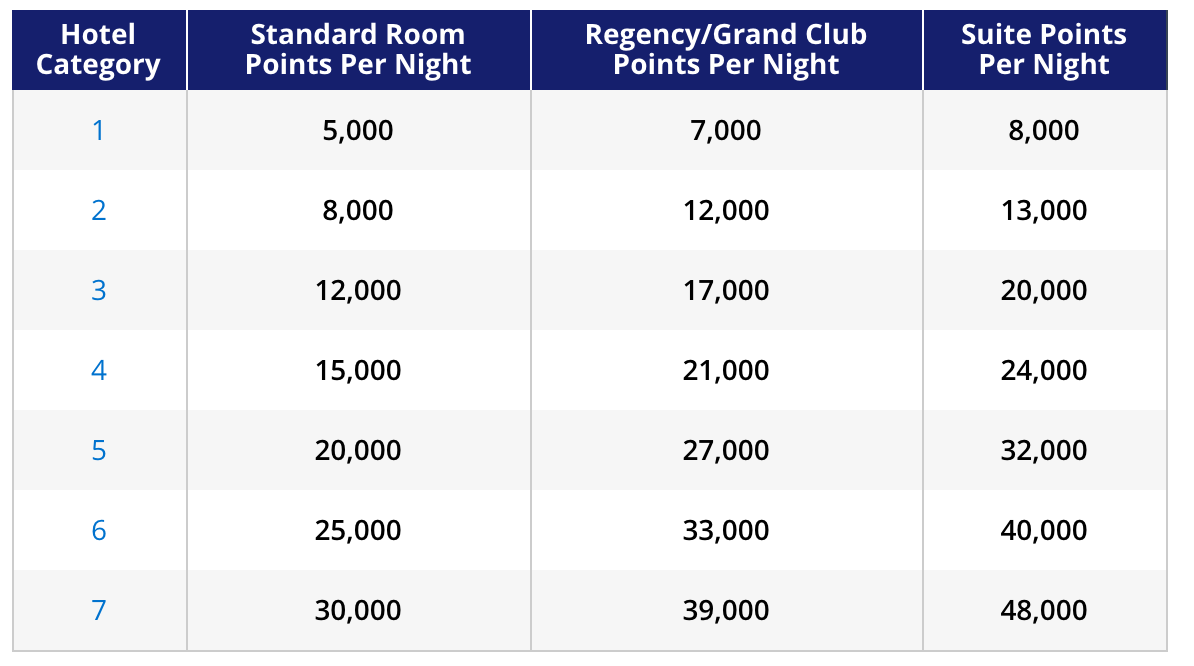

Hyatt points are some of the most valuable hotel points out of all of the major hotel programs. You can easily get over $800 worth of value from this card. For example, I just booked two nights at the Park Hyatt Paris-Vendôme and nights were going for €638 or $778. For 30,000 Hyatt points per night, I received 2.6 cents per point, which means that 40,000 those points gave me $1,040 of value... not a bad trade off for a $75 annual fee.

But Hyatt points can also be extremely valuable for cheaper properties, too. With the sign-up bonus and authorized user bonus you could stretch your points into covering 9 nights a hotel category 1. This is nice because the prior sign-up bonus only provided you with 2 free nights and so it was not possible to stretch your points like this.

Hyatt also has a number of great all-inclusive properties you can use points on. Last summer, I stayed at the all-inclusive Hyatt Ziva Rose Hall in Jamaica and I had an amazing time.

Hyatt also has a number of great all-inclusive properties you can use points on. Last summer, I stayed at the all-inclusive Hyatt Ziva Rose Hall in Jamaica and I had an amazing time.

Finally, Hyatt is also great because it’s a Chase Ultimate Rewards partner. This means that you can supplement your Hyatt points at a 1:1 ratio with Chase Ultimate Rewards points and bolster your Hyatt account balance.

Annual fee

- $75 annual fee (not waived)

With the $75 annual fee and free anniversary night at a category 1-4 Hyatt hotel, this card becomes one of those “keeper cards” that you probably won’t ever have to cancel because there are many possibilities for getting back anywhere from $200 to $400+ worth of value from the free anniversary night.

Keep in mind that the anniversary night must also be used (not booked) “within 12 months from issuance.”

Status

This card comes with Hyatt Discoverist status, which is the lowest elite status tier for Hyatt. Discoverist status is not the most valuable elite status level out there. Its main benefits are late check out at 2pm and free premium internet when available. But it also could get you free hotel room upgrades. I wouldn’t pursue this card purely for the status, but Discoverist status is still a nice addition to have.

Not subject to the Chase 5/24 Rule

The Chase Hyatt Visa credit card is not subject to the Chase 5/24 rule. So if you’ve opened up over 5 credit cards in the past 24 months you can still be approved for this card.

Bonus categories

- 3 points per $1 spent at all Hyatt properties

- 2 points per $1 spent at restaurants, on airline tickets

purchased directly from the airline, and at car rental agencies - 1 point per $1 spent on all other purchases made with your card

I’m not big on most co-branded cards for their bonus category spend potential. The reason is that you can often earn just as good, if not better, rates with other cards that earn flexible reward points that you can transfer out to different programs.

For example, with the Chase Sapphire Reserve you could earn 3X on every dollar spent at Hyatt properties and 3X on dining, car rentals, airlines, etc. You could also transfer those points to Hyatt from Chase Ultimate Rewards if I wanted to. Thus, I wouldn’t make the bonus category earning potential the deciding factor for getting the Chase Hyatt card.

No foreign transaction fees

- This Chase Hyatt card comes with no foreign transaction fees.

Chase Hyatt Visa Protections

The card offers the standard protections you’d probably expect:

- Lost Luggage Reimbursement

- Trip Cancellation/Trip Interruption Insurance

- Auto Rental Collision Damage Waiver

- Extended Warranty Protection

So it the Chase Hyatt Visa credit card worth it?

Getting Discoverist status while picking up an extremely valuable 40,000+5,000 point sign-up bonus with the Chase Hyatt Visa Card is more than enough reason to apply for this card. I also think the annual category 1-4 free night certificate makes the Hyatt Visa a keeper card worth holding on to for the long term. So I would definitely say that the Chase Hyatt Visa is worth it at 40,000 points.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.