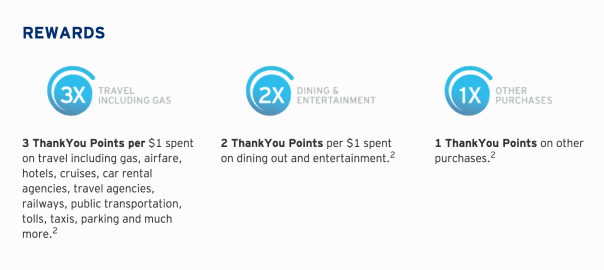

The Citi ThankYou® Premier is one of the best travel credit cards for its bonus category earning potential. The card earns 3X on travel (and gas stations) along with 2X on dining and entertainment and it often comes with a 50,000 point sign-up bonus, making it one of the most competitive bonus category earners in the market.

Update: Some offers are no longer available — click here for the latest deals!

What counts for travel for the Citi Premier?

The travel category is very broad and encompasses a lot of different types of purchses.

Citi defines travel as:

[P]urchases at airlines, hotels, car rental agencies, travel agencies/travel aggregators/tour operators, gas stations, commuter transportation, ferries, commuter railways, subways, taxis/limousines/car services, passenger railways, cruise lines, bridge and road tolls, parking lots/garages, campgrounds and trailer parks, timeshares, bus lines, motor home/recreational vehicle rentals and boat leases and rentals

This travel category covers just about every legitimate travel purchase you will incur, so it makes the Premier one of the best bonus earning credit cards for travel, especially since it offers 3X with only a $95 annual fee (that’s usually waived the first year). Keep in mind that the premium version of this card, the Citi Prestige® Card, only earns 3X on hotels and airfare so unlike the Chase Sapphire cards, the bonus earning is less lucrative with the more expensive card.

Exclusions apply

There are some exclusions to be aware of. The terms explicitly exclude the following from the travel category:

You won’t earn 3X Points for purchases made at recreational camps, insurance companies, auto clubs, fuel used for non-automobile purposes, and real estate agencies

Gas stations are included in the 3X earning category but “[g]as purchases made at warehouse clubs, discount stores, department stores and convenience stores do not qualify for 3X Points.” These terms can make it a guessing game as to which category a vendor will code as. For example, some 7-11s that serve gas will code as a gas station but others may not. The same issue can arise with Wal-Mart and others, so sometimes you may want to test out how local merchants code in order to avoid any future hassle.

How does Citi determine what codes as travel?

Citi doesn’t assign or have any control over merchant codes. Instead, they are chose and assigned by a third party and these categories may change from time to time. When you make a purchase at a merchant, Citi is provided the code for that merchant and if the code matches a category that gives you additional points, you will earn the additional points.

This means that sometimes you’ll run into instances where you might not be earning the points you expected to earn. For example, a restaurant located within a large retail outlet may not be assigned a “restaurant” code, but rather a “retailer” code. This means that you won’t receive additional points for “dining out” with the Premier if you eat at that establishment.

The same thing can work in your favor, however. For example, a restaurant inside of a hotel may code as a hotel purchase which ends up earning you 3X instead of 2X.

What if my Citi Premier purchase doesn’t code correctly?

If you feel like you’re getting robbed because a purchase did not code correctly you can call up the ThankYou Service Center at 1-800-THANKYOU (1-800-842-6596). They might need to open up an “investigation” but they should be able to resolve the issue for you. There’s no guarantee that they’ll credit you with bonus points (especially since they cover this in the terms and conditions), but it could happen so be prepared to explain to the agents why the establishment should’ve coded one way versus another.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.