The Barclaycard Arrival Plus World Elite MasterCard® has had a 50,000 mile sign-up bonus for some time but it might be dropping to 40,000 soon so you might want to consider applying now. I constantly put this credit card in my Top 10 Travel Credit Cards because it offers over $500 worth of travel which is very competitive. It’a a great way to cover random travel expenses or high surcharges on awards tickets but you need to be a little familiar with the card before you go for it.

Update: Some offers are no longer available — click here for the latest deals!

How do the “miles” work?

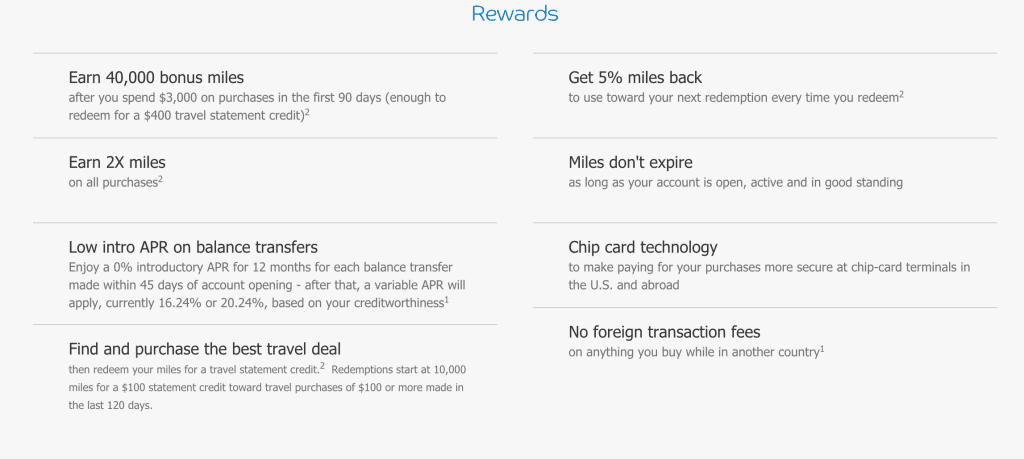

Unlike Chase, Citi, and Amex cards, where you earn points that are transferred to frequent flyer or hotel rewards programs, the Barclaycard Arrival Plus™ works a lot differently. For this card, you earn miles through spending at a rate of 2 miles/per dollar spent. So if you spend $3,000 you earn 6,000 “miles.”

These miles can then be redeemed at one cent per mile but only after you make a qualifying travel purchase. They can also be redeemed for a general statement credit but the value drops down (by 50%) to .5 cent per point which is not a very good redemption rate at all. Thus, I’d definitely stick to travel redemptions for this card.

Redeeming your miles for travel credits is pretty straight forward. You charge your travel expense to your card and then you have 120 days to log into your online Barclaycard account and select the transaction which you would like to credit your miles toward. Once you redeem your miles, you get a 5% rebate and can apply that to another purchase.

The only drawback to this card is that the redemption minimum for miles is 10,000, meaning that the smallest purchase that you can redeem miles for is a $100 transaction. This makes it a lot harder to use this card for travel purchases like taxis and busses.

What constitutes “travel” for the Arrival Plus?

Just like some other cards like the Chase Sapphire Preferred or the Citi Thankyou Premier, the travel category for the Barclaycard Arrival Plus™ is quite broad.

Here are the terms taken straight from Barclays:

Merchants in the travel category include airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, trains, buses, taxis, limousines, and ferries.

The Barclaycard Arrival Plus™ used to also include tourist attractions but it seems that vague category proved to be problematic and Barclaycard removed it. Even without tourist attractions, there’s still a pretty broad amount of expenses that could fall into the travel category, however.

Sign-up bonus

- The current sign-up bonus is for 50,000 miles for spending $3,000 within 3 months but as mentioned it will likely be dropping to 40,000 miles soon.

That means that once you hit the minimum spend you’ll have earned 56,000 miles, the equivalent of $460 worth of statement credit that can be applied against your travel purchases. If you’re a traveling couple and the two of you get the card, it’s an easy way to get close to $1,000 worth of travel purchases covered pretty quickly.

Bonus earning potential

The Barclaycard Arrival Plus™ doesn’t earn extra points for certain categories but it does earn 2X miles on every single purchase. That’s not a bad deal, especially if you can end up spending a lot on this card. (And actually, the bonus earning on this card could be argued to be 2.11X since you get an automatic 5% rebate on your redemption.)

Because there are no bonus categories, this is a great card to use for purchases that don’t fall within the bonus categories of your other cards and would otherwise earn 1X.

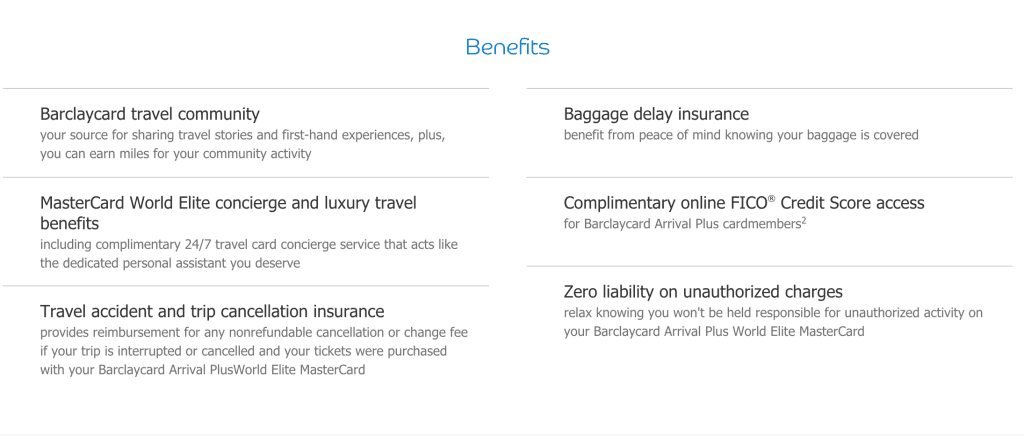

Also, don’t forget about the Barclaycard RewardsBoost. This is a web portal where you can log-in and make purchases with your Barclaycard and earn additional miles on items from a host of different retailers. There’s also the Barclaycard Travel Community, which allows you to earn miles by sharing notes and photos about your travels.

Barclays usually pulls Transunion

One great thing about Barclays is that they almost always pull Transunion for their credit cards. If you pursue Chase, Citi, and Amex cards, you’ll likely get hit pretty hard with hard pulls on your Experian and Equifax credit reports.

Thus, applying for this card can give some of your credit reports a bit of a break when it comes to applying for Chase, Citi, and Amex cards. Moreover, if you’ve got a lot of hardpulls from the aforementioned banks then Barclaycard can always be a good option to go to while you wait for time to distance you from some of your hard pulls.

Note: Barclaycard may sometimes pull from additional bureaus, so YMMV.

Benefits

- No foreign transaction fees

- Travel accident insurance

- Baggage delay insurance

- Free FICO score

- 0% APR for 12 months on balance transfers made within 45 days of opening the account. (Transfer fee is either $5 or 3% of the amount of each transfer, whichever is greater.)

Annual Fee

- $89, waived the first year

The $89 annual fee is not bad at all since it is waived the first year. However, what really makes it great is that you can downgrade or product change this card to a no annual fee card.

Final word

The Arrival Plus is a solid card but it’s worth getting at its current 50,000 sign-up bonus. Otherwise, if you wait until it drops back down to 40,000 points, you might be better off with the Capital One Venture Rewards Credit Card which has lower redemption minimums.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.