The Citi Expedia+ Voyager Credit Card almost never gets any attention. That’s mostly because Citi has many more valuable credit cards offered, and I think a lot of travelers are not interested in Expedia as a loyalty program or online travel agency (for good reasons like utilizing elite perks at hotels, etc.). However, this card could be a valuable tool to supplement your other cards with if you think you might be staying at +VIP properties on any upcoming trips, and here’s why.

Update: Some offers are no longer available — click here for the latest deals!

The features

- 25,000 Expedia points after spending $2,000 in the first 3 months (redeemable for $350 towards VIP hotel stays)

- 4 Expedia+ bonus points per $1 spent on eligible Expedia purchases including flights, hotels, activities and travel packages

- 2 Expedia+ bonus points per $1 spent on purchases for dining out and entertainment, including tickets to concerts, movies and sporting events

- 1 Expedia+ bonus point per $1 spent on other purchases

- $100 Annual Air Travel Fee Statement Credit can be used toward airline incidentals on qualified airlines, Wi-Fi carriers or for either the Global Entry or TSA Pre✓® application fee

- Expedia Gold status

- Anniversary Bonus of 5,000 Expedia+ bonus points after you spend $10,000 in the prior year.

- $95 annual fee

Sign-up bonus

The 25,000 points isn’t the most valuable sign-up bonus available, but $350 worth of travel at select hotels is nothing to scoff at, especially when you consider the $100 travel credit.

$100 statement credit

Right off the bat this statement credit should catch your eye. This is a card with a $95 annual fee offering a $100 statement credit. That means for many people this is essentially a no annual fee credit card although you could even turn a $5 profit on it each year.

The $100 statement credit is per calendar year so that give you the potential to add on another $100 in value to this card.

You should note that there are some limitations:

Airline incidental fees must be separate charges from airline ticket charges and include purchases such as checked bags, inflight entertainment or refreshments, inflight Wi-Fi, or other qualifying purchases that meet the eligibility requirements.

And it only works on qualified airlines.

Qualified airlines include: AirTran Airways, Alaska Airlines, American Airlines, Delta Air Lines, Frontier Airlines, JetBlue Airways, Southwest Airlines, United Airlines, US Airways, and Virgin America Airlines.

So this will be used for domestic airlines but this isn’t even as restrictive at American Express’ airline credit that limits you to a single domestic airline.

Some people online have had success with gift card purchases so consider that. But considering how easy it is to rack up $100 in incidentals for many people, this is an easy way to completely negate the annual fee and a rare find on a $95 card.

How much are Expedia points worth?

Expedia points don’t hold a constant amount and their value depends on what type of travel you’re redeeming for. For example, I’ll take a look at both flight and hotel redemptions.

Flight redemptions

For flights, your points will be worth approximately .62 cents per redemption. So compared to other frequent flyer programs, this is very poor. In addition, there are certain restrictions for using points for airfare, most notably:

- Points must cover the full value of the flight, including taxes and fees

- Flights booked with Expedia+ points can’t be canceled or changed

Keep in mind that you’ll be earning miles on your flights since this still will register as a paid flight, so you could argue that the points are a little bit more valuable.

Hotel redemptions

While Expedia points aren’t so great for airfare, they can get much better value for hotels. For standard hotels, you’ll get about .71 cents per point. This isn’t great although it’s right on par with what you would get for using American Express Membership Rewards for hotels when using their travel portal, so you can’t hate too hard on them for it.

Where the value really is at for Expedia points (and for this card) is +VIP properties.

When you redeem your points for these hotels, you get 1.4 cents per point. That’s almost tied with the Chase Sapphire Reserve’s redemption value in the Chase Travel Portal at 1.5 cents per point.

Bonus category spending

As stated, the Voyager earns:

- 4 Expedia+ bonus points per $1 spent on eligible Expedia purchases including flights, hotels, activities and travel packages (These must be purchased through Expedia and hotels must be pre-paid)

- 2 Expedia+ bonus points per $1 spent on purchases for dining out and entertainment, including tickets to concerts, movies and sporting events

If you’re planning on staying at a +VIP property, then this card is arguably more valuable than the Chase Sapphire Reserve with bonus earning potential on certain categories. And no, I’m not crazy, let me explain.

For example, if you booked a $100 flight through Expedia you’d earn 4 Expedia+ points with the card. However, you’d also earn 1 point per $5 spent on the flight on top of a 30% bonus rate as a Gold member. So that’s 426 points. There’s often promos for using the App to book where you get 2X or 3X the points, so it’s possible your earning could be much higher but let’s just go with 426.

At 1.4 cents per point, that’s about 6% back, which is very competitive to what you’d earn back with the Chase Sapphire Reserve. For example, if you value Ultimate Rewards at 2 cents per point, you’d come out with the same 6% back with the Chase Sapphire Reserve but if you used your Ultimate Rewards in the Chase Travel Portal, you’d only be getting 4.5% back.

Of course, the Reserve also comes with some great travel protections, so you’d always have to factor in what you’d be losing and obviously you’re losing the prospect of transferring points to Ultimate Reward partners.

The point is that the Sapphire Reserve offers some of the best value for a rewards credit card and comes with a $550 annual fee, so the fact that the Expedia+ Voyager card, with essentially no annual fee, could even compete with the earning rate on the Reserve should (in certain scenarios) should be taken into consideration.

Also, I’d have to do some math to determine if it would be worth it for hotel purchases. Since you earn airline miles with airfare purchased through Expedia you don’t lose much, but losing out on hotel points and cash back portal rebates, may be a tougher sell. I’ll update with a closer look later.

The Voyager’s 2X on dining would be inferior to the 3X on the Reserve and likely 2X on other cards like the Sapphire Preferred and Premier Rewards gold Card (unless you were only going to book travel through their respective portals). 2X on entertainment is decent since not many cards offer that except for other Citi cards like the Premier and Prestige.

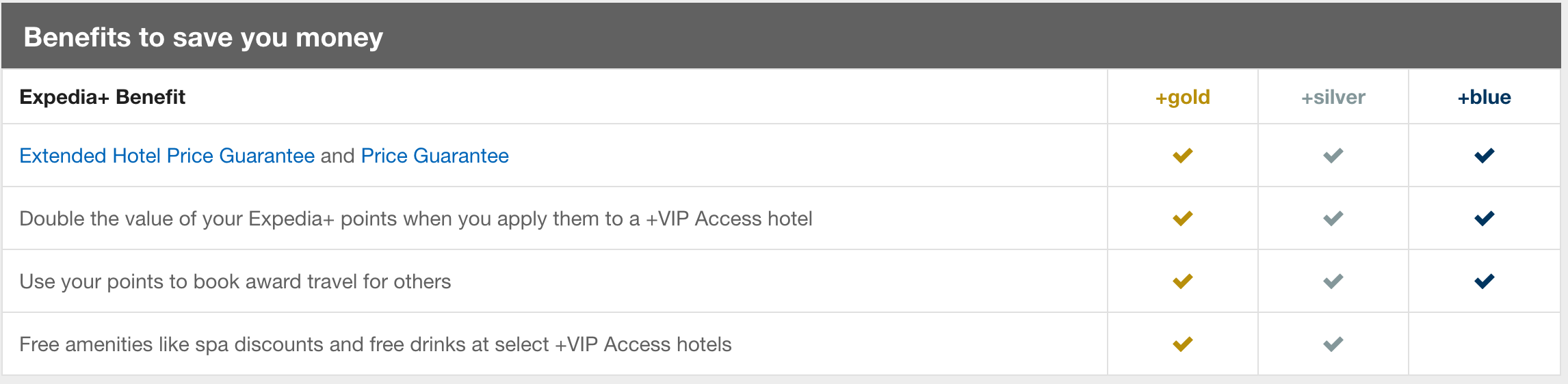

Overall, there’s opportunities to maximize value with this card in certain circumstances and since you can always do a part pay with points on hotels, you don’t have to worry about stranded points.

+VIP properties

The major catch to maximizing value with Expedia is obviously that you’re limited to +VIP properties. But many top properties are +VIP properties. For example, there are many well-known major chain luxury properties that fall into this category including: The Venetian Resort Hotel & Casino in Las Vega and The Cove Atlantis, Autograph Collection, Bahamas

The list could go on. Personally, however, I like to book chain hotels directly with the hotel chain so that I can earn points and stays and enjoy elite perks with my status with the hotel.

So when I choose to use Expedia points to book hotels, they are usually +VIP boutique hotels or hotels that are members of loyalty programs that I know I won’t frequent. You’d be surprised to find out how easy it is to find solid +VIP boutique hotels, too. Just this past summer, I stayed in an all-inclusive property called the Sandos Luxury Resort in Cancun, Mexico that I booked through Expedia and it was a fantastic hotel experience. I didn’t earn any nights or points with a major hotel chain, but I shaved off a lot of the price by redeeming Expedia points at 1.4 cents per point.

If you’re interested in finding more +VIP properties, you can search for more here.

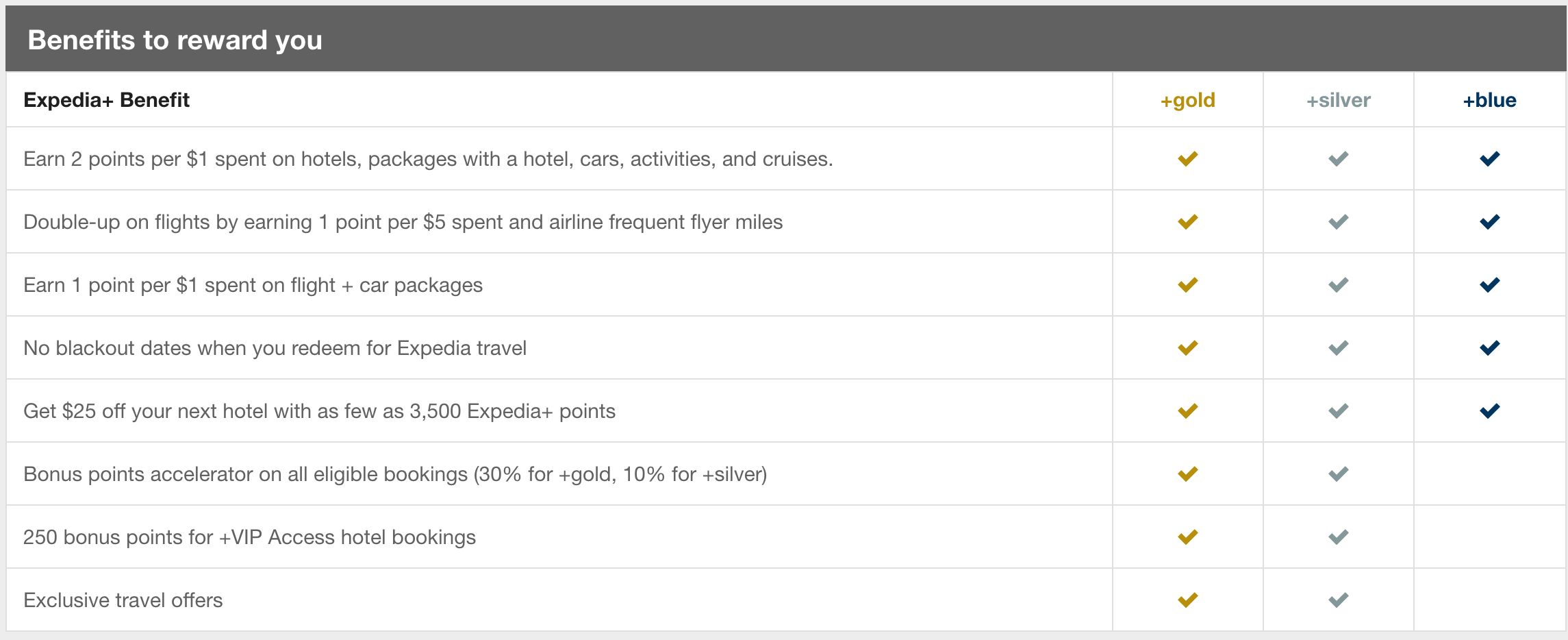

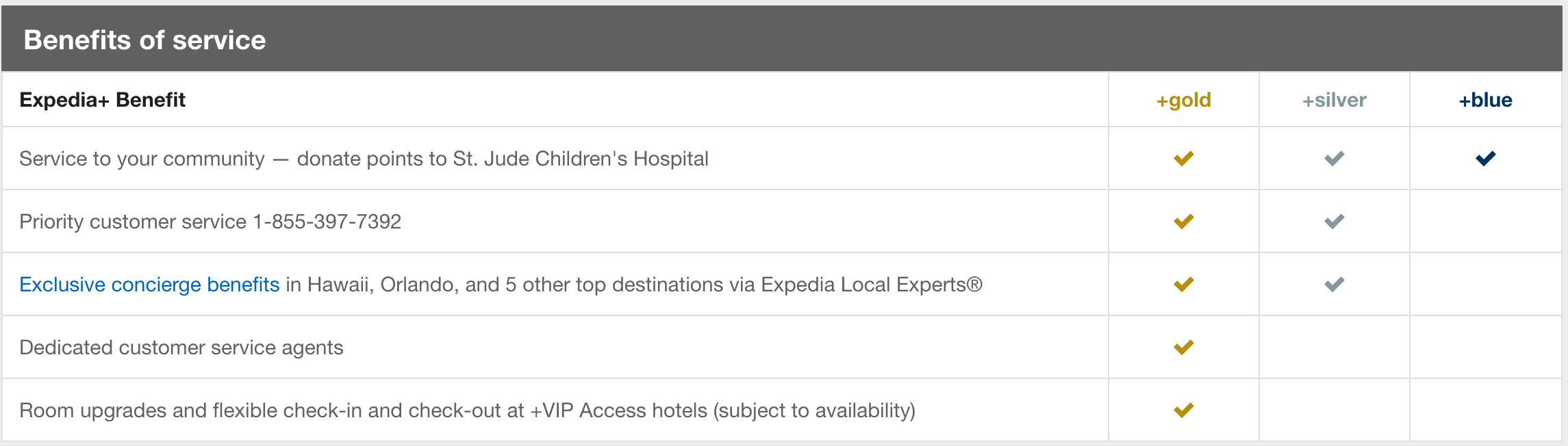

Gold benefits

Expedia is sort of like Hilton Honors in that its points aren’t the most valuable but its always offering a lot of ways to earn bonus points. With Gold status, you’ll earn 30% more points for eligible booking and 250 bonus points for +VIP Access hotel bookings.

Two additional benefits are a dedicated customer service line and room upgrades plus flexible check-in and check-out (which basically means early and late checkout available). The dedicated customer service agent is a major plus here because sometimes Expedia customer service can be brutal with very bad waiting times. It’s nice to have the possibility for upgrades and flexible check-in and check-out, but I’m not sure how often those benefits are honored compared to other loyalty programs.

And finally you can get spa vouchers and free drinks at certain properties. At one of our other stays in the Caribbean at the Grand Roatan Caribbean Resort, we received two rum punches for free due to our Gold status. And on another stay a couple of years ago in Europe, we received a spa certificate.

Final word

Expedia is always a go to for me when I’m not able to find a property to a major chain that I’m loyal to and have status with. Usually this is Marriott, SPG, Hilton, and even IHG. It’s not uncommon in places like the Caribbean to struggle to find those properties so Expedia comes in handy in those situations.

Since the annual fee can be offset so easily for this card I think it’d be worth getting for whenever the time arises to stay at a VIP+ hotel. I probably wouldn’t put my daily spend on this card unless I was working toward a specific goal of staying at a VIP+ hotel, and even then I’d probably only put airline and certain hotel purchases on it, since I’d earn more value on my dining with other cards.

All things considered, though, this card holds at least $450 worth of travel with essentially no annual fee and that makes it a contender in my book.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.