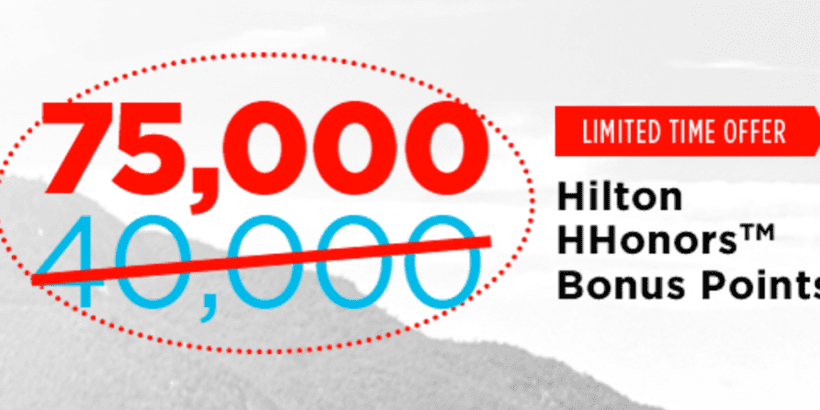

The Citi Hilton HHonors Visa Signature Card offer is back where you can earn 75,000 Honors Points after making $2,000 in purchases within the first 3 months of account opening. Here’s a look at some of the factors you want to consider before choosing to apply.

Update: Some offers are no longer available — click here for the latest deals!

The Offer

- No annual fee

- Earn 75,000 HHonors bonus points after you spend $2,000 in the first 3 months.

- Silver Honors status and fast track to Honors Gold status after four stays within your first 90 days of account opening or when you make $20,000 or more in purchases each calendar year

- Earn an annual loyalty bonus of 10,000 Hilton Honors Bonus Points at the end of each calendar year in which you spend $1,000 or more on stays within the Hilton Portfolio

This card also offers bonus category earning in the following ways:

- Earn 6 HHonors bonus points for every dollar spent within the Hilton Portfolio

- Earn 3 HHonors bonus points for every $1 spent at supermarkets, drugstores andgas stations

- Earn 2 HHonors bonus points for every $1 spent on all other purchases

The Perks

Outside the sign-up bonus of 75,000 Honors points, the perks for this card aren’t too impressive. The fast track to Gold benefit is okay, but I wouldn’t want to put $20,000 on this card just to earn a mid-tier status that can easily be had with the American Express Platinum or a Hilton card with an annual fee.

As for Silver status, you’ll receive the following benefits:

- Automatically receive a 15% bonus on all the HHonors Base Points you earn.

- Guaranteed Discount: A discounted, changeable & refundable rate is exclusively available for Hilton HHonors members

- Silver, Gold and Diamond elite members will receive every 5th night free on Standard Room Reward stays of 5 nights or more.

- Complimentary internet

- Quick reservations and check-ins

- Late Check-out

- Complimentary access to fitness centers and health clubs

- Two complimentary bottles of water per stay at certain Hilton properties

As you can see, nothing too inspiring….

Should You Apply?

A lot of people will ask if they should apply for this offer, since 75,000 Hilton Honors points bonus is a pretty sizable bonus and this card comes with no annual fee, making it even more attractive.

I think the biggest thing that people should consider is that Citi limits you to one sign-up bonus per brand per 24 months. This means that if you applied and got approved for this Citi Hilton card today you would have to wait two years until you could get approved and receive the sign-up bonus for the Citi Hilton Reserve.

The Citi Hilton Reserve comes with a $95 annual fee but offers you two free night certificates, which can present you with the oppurtunity to cash in on much more value in many instances. For example, the Conrad in the Maldives has standard room awards for 95,000 HHonors points per night. Thus, if you used your two weekend nights at this hotel you’d be getting 190,000 HHonors points worth of value out of it. In case you were wondering, the cash value for two nights would be $1,800, so you’re getting a ton in value!

Keep in mind that while the free night certificates from the Hilton Reserve will likely get you more in value, they can only be used on weekends (Fridays, Saturdays, and Sundays) and they expire after one year. Thus, for many people, the flexibility offered by points, makes it worth going after the Citi Hilton HHonors Visa Signature Card.

Thus, you need to ask yourself:

- Do I want to use a two free night certificate (valid only on weekends) at top tier hotels to maximize value? You’ll probably lean more towards the Reserve.

- Do I want more flexibility and/or want to stretch my points and book mid-tier properties for around 30,000 to 40,000 Honors points per night? You’ll probably lean more towards the no annual fee card.

Additional Hilton Card?

Also, worth asking is if you want to apply for an Amex Hilton card instead of a Citi card (or maybe even in addition to the card). Right now, American Express is also offering its no annual fee Hilton card known as the Hilton Honors Card from American Express with a 75,000 point sign-up bonus.

That Amex card comes with similar benefits but offers better bonus category earning potential at the following rates:

- Earn 7X Hilton HHonors Bonus Points for each dollar of eligible purchases charged on your Card directly with a participating hotel or resort within the Hilton Portfolio.

- Earn 5X Hilton HHonors Bonus Points for each dollar of eligible purchases on your Card: at U.S. restaurants, U.S. supermarkets, and at U.S. gas stations

- Earn 3X Hilton HHonors Bonus Points for all other eligible purchases on your Card

So if you applied for both cards you have the potential to net 150,000 Honors points with two cards that won’t even incur you a single annual fee. For reference, 150,000 points could almost get you four nights at a pretty decent hotel in some major urban areas.

For example:

- DoubleTree by Hilton Hotel Chicago – Magnificent Mile (40,000 per night)

- Embassy Suites Orlando – Downtown (40,000 per night)

- Embassy Suites by Hilton Austin Downtown Town Lake (40,000 per night)

However, if you want to stay in one of the nicer hotels you’re probably going to need closer to 60,000 points per night.

Final Word

The co-branded Hilton Honors cards from both American Express and Citi offer some real potential for maximizing value. I would only entertain these cards if I was over 5/24. After that it’s just a matter of figuring out what kind of redemptions you have in mind, and then you should be able to make an informed decision on whether or not you should apply.

H/T: TalkWallet

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

One comment

Comments are closed.