Cathay Pacific just launched its new co-branded credit card that has a lot of people talking (mostly negative). But this offer may not deserve quite as much flack as it’s getting, since depending on your personal circumstances, it can help supplement your earnings for valuable Cathay Pacific or OneWorld flights. Here’s a review of the Cathay Pacific Visa Signature Card.

Update: Some offers are no longer available — click here for the latest deals!

Card at a Glance

- 25,000 Asia miles after spending $2,500

- $95 annual fee that is NOT waived

- 2X on Cathay Pacific purchases

- 1.5X on dining in the US or abroad

- 1.5X on foreign purchases

- 1X on all other domestic purchases

- Complimentary green tier membership in the Marco Polo Club

- Issued by Synchrony

Sign-up Bonus

- 25,000 Asia miles after spending $2,500

A lot of fellow “enthusiasts” aren’t impressed with this bonus since 25,000 miles is on the lower side of airline bonuses and the $2,500 spend requirement is typically attached to higher bonus offers. I tend to agree that the offer isn’t very impressive, although compared to what some other global carriers offer for their co-branded cards (like ANA’s 5,000 miles bonus), this offer isn’t bad.

Annual Fee

The biggest issue with this card is that it comes with a $95 annual fee that is NOT waived. If it weren’t for the non-waived annual fee, then this deal would be a lot easier to entertain for me. But still, it’s like paying for $95 for 25,000 Asia miles, which isn’t a horrible deal.

Bonus Categories

The card earns the following bonus categories:

- 2X on Cathay Pacific purchases

- 1.5X on dining in the US or abroad

- 1.5X on foreign purchases

- 1X on all other domestic purchases

I think the bonus categories of 1.5X on dining abroad and on all foreign purchases are interesting (there are no foreign transaction fees on this card). There aren’t many other cards out there that will give you 1.5X on all foreign purchases, so there’s some value there for those who spend quite a lot of time and money abroad.

However, like with any co-branded card, if you’re going to be putting a significant chunk of your spend on a card to make the earnings worthwhile, you need to have at least tentative plans to use Cathay Pacific or one of its partners. If you have no foreseeable plans of using Asia Miles to fly with a OneWorld partner , I would caution against putting a lot of focus on the bonus categories, since you’ll likely be better off putting spend on Amex or Citi cards.

Other Perks

Complimentary green tier membership in the Marco Polo Club

New members will enjoy a complimentary first year green tier membership in the Marco Polo Club, which is the loyalty program of Cathay Pacific and Cathay Dragon. Of course, this is the lowest level in their loyalty program.

When I looked up the benefits, it looks like this status allows you to use your points for things like lounge access (requiring 9,000 Asia Miles), extra leg-room, extra baggage, etc. It does provide up to two free checked bags when flying economy and up to business (3 for first class) and priority boarding which is nice. You can also renew your status for $100 after a year.

Visa Signature

Visa Signature

You’ll receive all of the Visa Signature benefits (if you get approved for the Signature version)

The Cathay Pacific Asia Miles Program

I think it’s impossible to make a sound decision on this card with out at least knowing a little bit about the Asia Miles Program. So I”m going to touch on some of the major points of the program without getting bogged down in the details.

Transfer partners

Cathay Pacific is one of the few programs that offer transferability from more than one major rewards program. You can transfer points to Asia Miles from both American Express Membership Rewards and Citi ThankYou Points (and SPG). This is a big deal because you could find plenty of other options for earning Asia Miles by shopping around for cards American Express cards and Citi cards and many of those cards will allow you to avoid annual fees, especially during the first year. That reason alone is one reason why many should probably pass on this card.

If you’ve exhausted many of the options with Amex and Citi, however, then it might make more sense to entertain getting this card since it could be a nice way to supplement your earnings if you have a Cathay Pacific or OneWorld booking in mind. So for people like myself, this card could make sense.

OneWorld Alliance

Cathay Pacific is a member of the OneWorld Alliance so you can use Asia Miles to book flights on partners like British Airways, American Airlines, Qatar, etc.

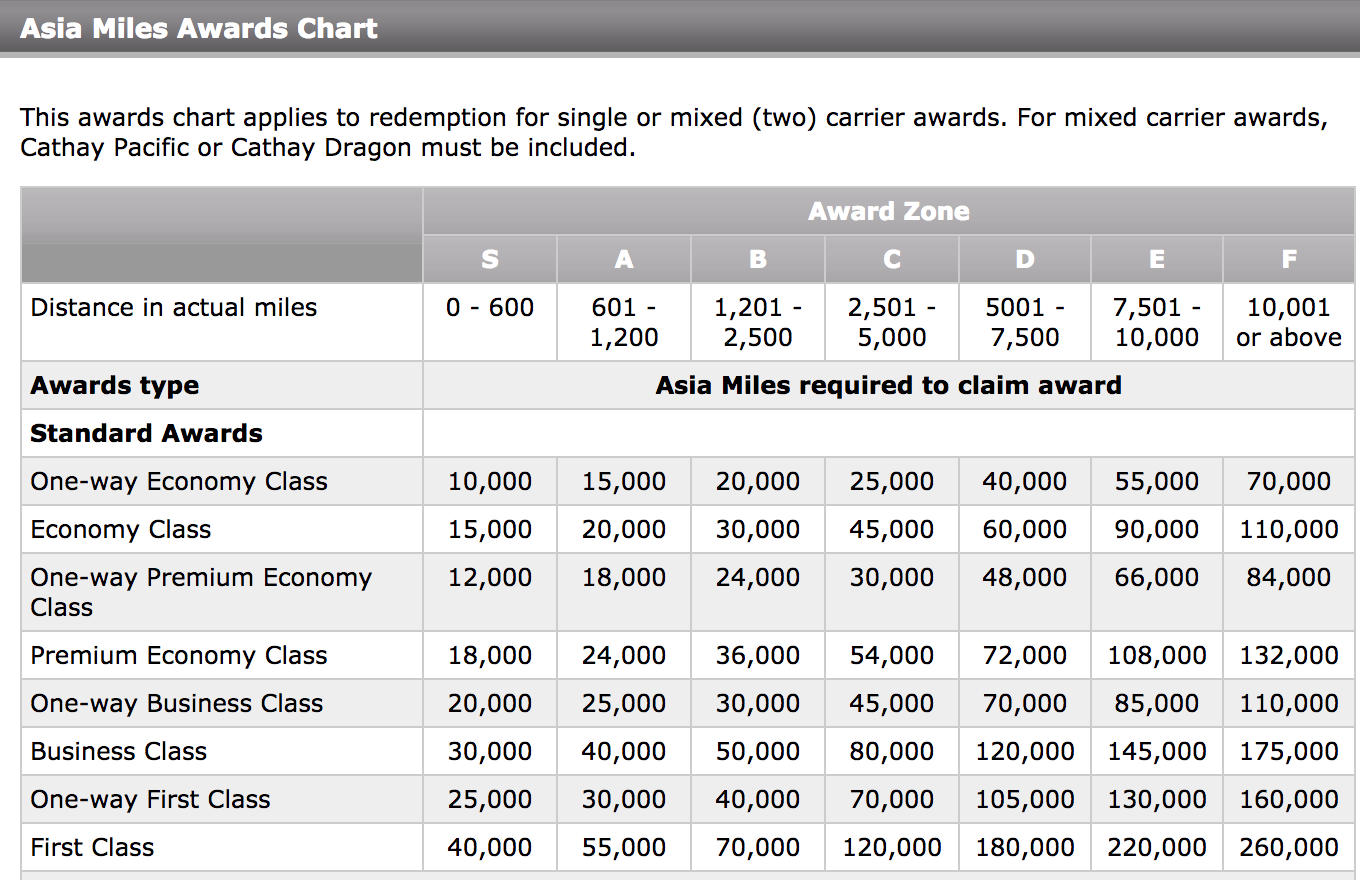

Distance-based award system

Cathay Pacific operates on a distance-based award system (award chart here). They have two separate charts.

One chart called the “Asia Miles Award Chart” is for:

- Cathay Pacific/Dragon flights

- Flights including one OneWorld partner

- Flights including one OneWorld partner and a Cathay Pacific/Dragon flight

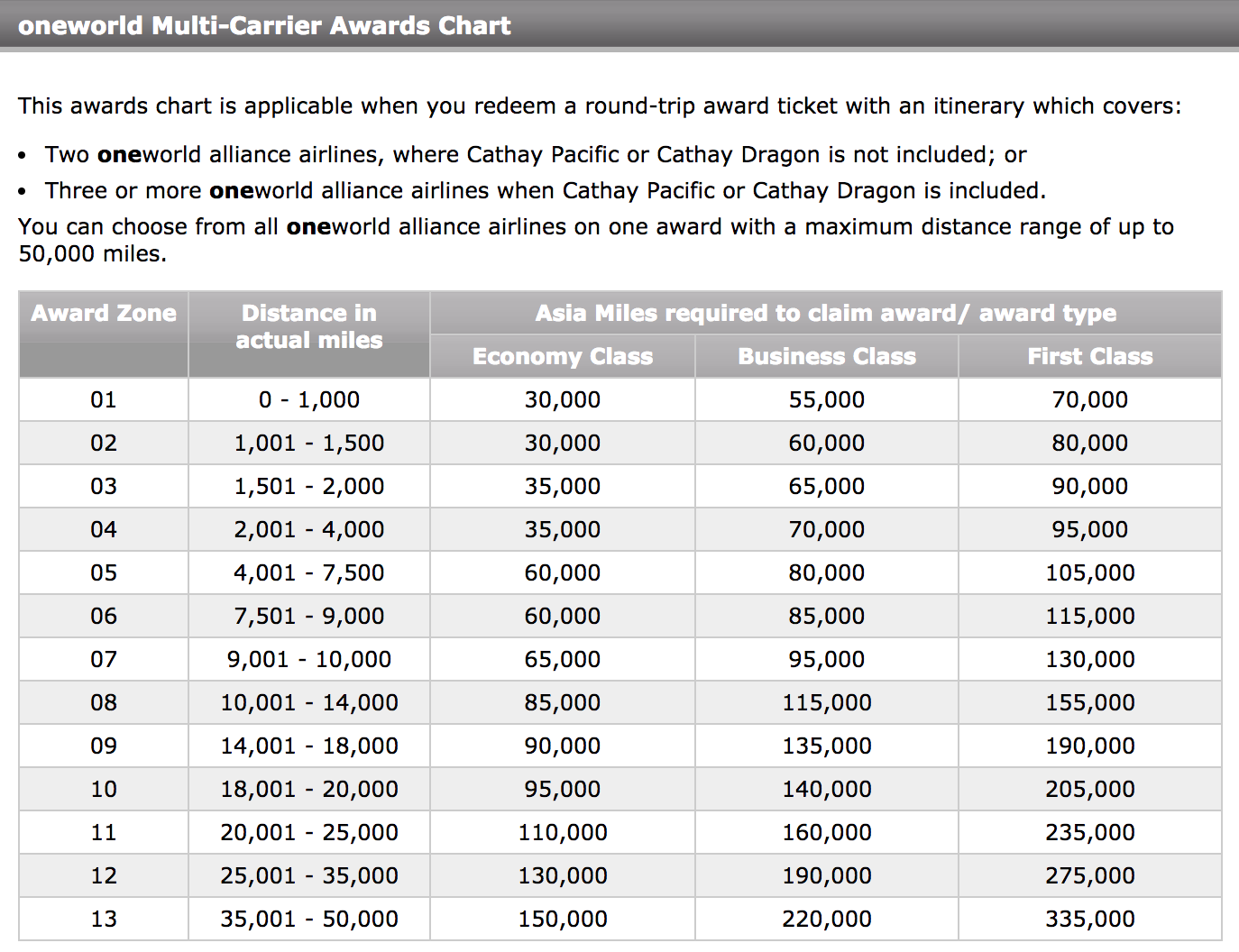

Then there’s another award chart called the “OneWorld Multi-Carrier Awards Chart” for:

- Flights involving two OneWorld partners

- Flights involving Cathay Pacific/Dragon flights and 2 or more OneWorld partners

One Way Awards and stopovers

One of the beauties of this program is that it’s extremely flexible. You can book one way awards using the Asia Miles Award Chart, though you save miles by booking roundtrips. And if you’re booking on the OneWorld award chart, you can have up to five stopovers! Thus, there’s a lot of value to be had with this program if you can take advantage of their lax routing policies.

Sweet Spots

This distance-based award system has a few pretty good sweet spots in it. One great sweet spot is from the east coast to Europe. For example, from JFK to BER it’s only 3,973 miles so that puts you in award zone which is 45,000 miles one way. However, if you book the roundtrip it’s only 80,000 miles, which is one of the best redemption rates (finding availability on Air Berlin is not always easy, though).

There are a few other pretty good redemption rates, many of which are in business class. Check out the article below for more on sweet spots and building round-the-world itineraries with Asia Miles.

Cathay Pacific Surcharges

Cathay Pacific will make you pay fuel surcharges on many airlines. There are some exceptions, such as Air Berlin, American Airlines (on non-Europe routes), Qantas, JAL, etc., and there are very little fees when you fly on Cathay’s own metal, so it’s definitely possible to put together itineraries while avoiding or greatly minimizing surcharges. To read more about these fuel surcharges and about ways to maximize value with Asia Miles award bookings, read this article from Travel is Free.

Finding Award Seats

I usually use the British Airways Avios website to search for Cathay Pacific awards but you may also want to search with Qantas as well.

Expiring Miles

These miles will expire after 3 years — there is no way to reset the clock.

Booking Awards

You can book awards online for Cathay Pacific or you might have to submit an airline award request form to book with a partner. You can read more about the booking process here.

Final Word

This isn’t a horrible deal, it’s just that there are probably going to be options you can seek out that can earn you Asia Miles much more efficiently, since Asia Miles is a partner to multiple major programs. For people like myself, who aren’t left with many earning opportunities with American Express and Citi, however, this deal is worth considering. Especially since Asia Miles can be a valuable program, when you take the time to familiarize yourself with all of the possibilities the program has to offer.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.