[Offers contained within this article may no longer be available]

The new Ritz-Carlton Visa Infinite credit card is considered the same product as the former Visa Signature card but it comes with some revamped benefits that make it more of a legit contender for a go-to benefits card. Here’s a look at the benefits of the new Infinite card and why you may want to consider getting the Ritz-Carlton credit card.

Priority Pass

Typically, the biggest reason to apply and keep a benefits-based credit card is for the lounge access. The new Ritz-Carlton card offers Priority Pass membership in place of the Lounge Club membership it previously offered. The membership tier offered is the level worth $399 a year, which means that you’ll have unlimited lounge access and it will always be complimentary.

Also, one thing to remember is that you’ll need to call in to get your Priority Pass membership benefit processed; it doesn’t happen automatically.

Sign-up bonus

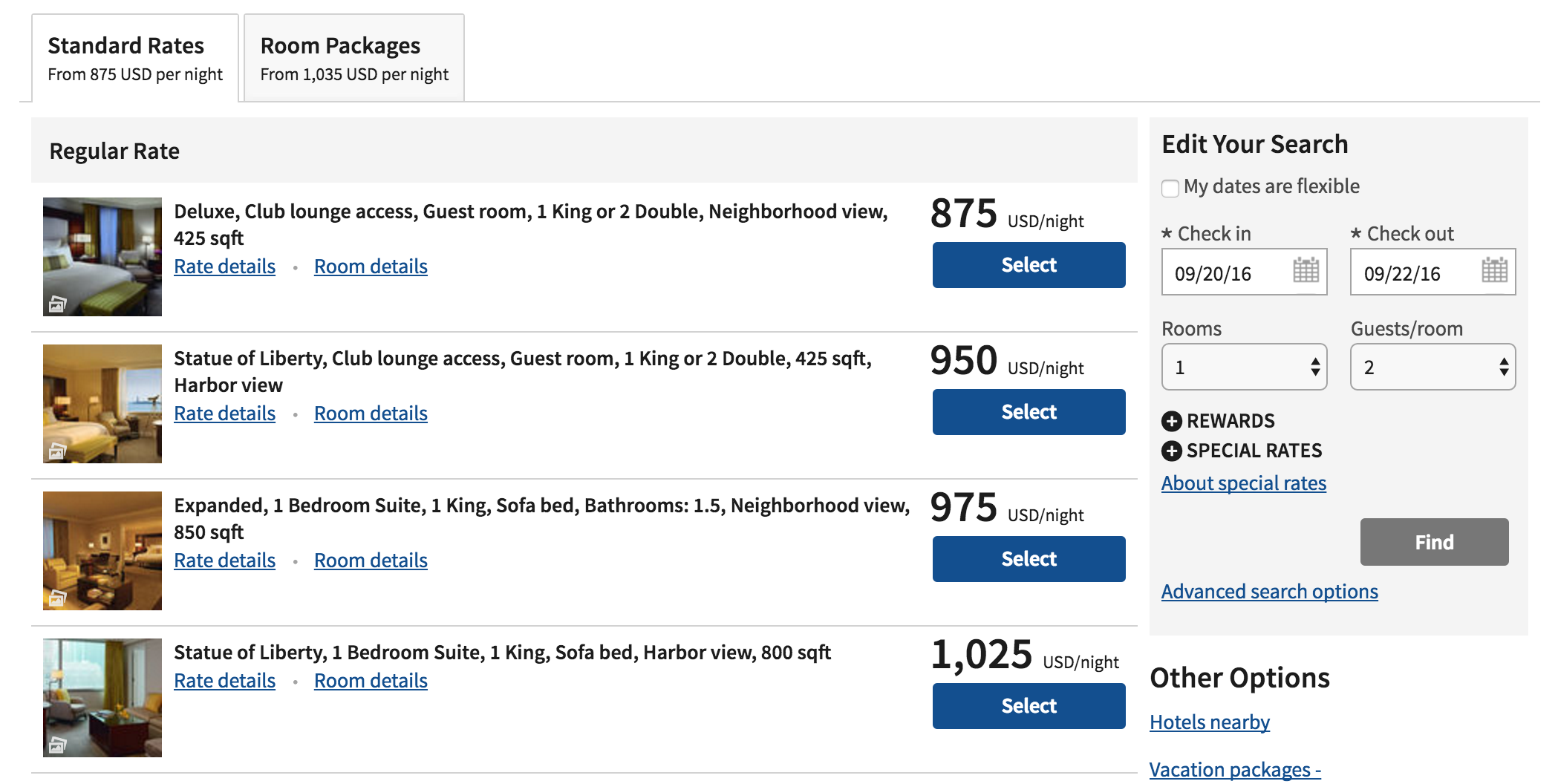

The new sign-up bonus offers three complimentary nights after you spend $5,000 in purchases in the first three months from account opening. The spending requirement went up $1,000 but they are also now offering an additional free night with the sign-up bonus. The catch here is that the nights must be redeemed at category 1-4 hotels, which isn’t really a “catch” considering how expensive category 1-4 hotels can be.

For example, I recently used my free night certificate to book free nights at the Ritz-Carlton Battery Park in New York City, where each night went for just under $900. If you used all three certificates for this night then you’d be netting around $2,700 in free Ritz-Carlton stays.

That’s admittedly a somewhat extreme example, however. More likely, your free night certificate might cover nights worth $300 to $500 a night but even then that’s still a great deal. And the fact that you always have the possibility of using your certificates to cash in for ridiculously expensive Ritz-Carlton rooms is a an exciting perk that’s nice to have on stand-by.

$300 travel credit

The new Ritz card also retains the $300 travel credit. This credit can be used for a variety of things like upgrades, in-flight entertainment and dining, baggage fees, etc. It’s designed to be used for anything that “makes your travel life easier” and although you have to call in to activate it, it’s one of my favorite travel credits to use with airlines like Southwest where I regularly upgrade to Business Select to snag the emergency exit rows with fewer seats. Read more about how to use the benefit here.

$100 airline credit

This is a new benefit offered with the Visa Infinite card. You can save $100 on the total cost airfare when you book tickets for 2 to 5 passengers round-trip on domestic coach. You can choose from most major airlines (but no Southwest :/ ) and make reservations up to 11 months prior to departure. Note: the primary cardholder must be the primary passenger on the itinerary. You can find flights here: visadiscountair.com/ritzcarltoncard.

This benefit is great for weekend warriors you take short-haul economy flights frequently. Frequent Miler proposed the idea of utilizing this benefit to earn or maintain airline elite status. I’m not sure it would be worth it for me but some people might find themselves in an ideal situation where it works out for them.

Annual fee $450

The richer benefits didn’t come without a cost. The former annual fee for the Ritz card was $395 and it’s gone up about $50. Now, I really think that the value from the additional benefits outweigh the additional $50 but it’s always a little sad to see a card get more expensive.

Still, with the $300 statement credit this card can still be essentially a $150 credit card, which isn’t bad at all considering the benefits can be.

Bonus earning potential

- Earn 5 points per $1 spent on Ritz-Carlton properties

- Earn 2 points per $1 spent on travel (airline and car rental) and restaurants

- 10% annual bonus on points earned through purchases

- Earn 10,000 points when you add an authorized user and make a purchase

I don’t typically use my Ritz card to earn Marriott points since my Chase Sapphire Preferred and Premier Rewards Gold Card are my go-to cards for things like travel and dining. However, I will say that it is always fun to use the Ritz-Carlton credit card because it is very heavy (fully metal) and 9 times out of 10 it leaves waiters and cashiers amazed/confused when you whip it out. Once you unbox this card and hold it for the first time, you’ll see what I mean — it’s definitely a unique card and sounds like silverware when it drops. For people strictly concerned about the points that obviously doesn’t factor in, but for the rest of us, it just adds a little excitement to having this card.

Global Entry or TSA Pre-Check credit

According to reps, the Global Entry credit will be available for both the primary cardholders and the authorized users, allowing you to receive separate statement credit for each. Unlike other credit cards, you’ll have to call in to get this benefit honored, however.

Additional benefits

- JP Morgan Concierge service

- No foreign transaction fees

Upgrade certificates

Despite other reports, the new version will still offer the club level upgrade certificates for paid stays. (Hat tip to Travel Codex).

Elite status

- Automatic Gold Elite status

- Maintain your Gold Elite status by spending $10,000 on purchases your first account year and each account year thereafter.

- Achieve Platinum Elite status when you spend $75,000 on purchases each account year.

Comparison to similar cards

I used to consider this card purely a “supplemental benefits credit card,” meaning that I would use other cards like the Platinum or Prestige to obtain lounge benefits and only would use the Ritz for its other benefits and sign-up bonus. However, with recent changes to application rules and the new Ritz benefits, I think this card can be considered a legitimate contender when it comes to credit cards focused on benefits.

Here are three of the top competitors for lounge access benefits:

- The Platinum Card from American Express

- The Citi Prestige

- The Chase Sapphire Reserve (to be released next week)

These three cards offer (or are going to offer) some great value but there are some reasons why it might make sense to at least consider taking the Ritz-Carlton over them. Here are some of those reasons:

- 5/24 Rule: If you’re subject to the Chase 5/24 Rule and not able to pick up any Chase cards like the Sapphire Preferred, Sapphire Reserve, or Ink Plus. In that instance, you won’t be able to even upgrade to the Sapphire Reserve for a while and you might look to the Ritz-Carlton card since data points suggest that it’s not restricted by the 5/24 rule.

- Citi 24 month Rule: If you’ve just been approved for another Citi Thankyou Point card besides the Prestige then you’ll have to wait as much as 24 months to earn a bonus on a new card. If that’s the case, then the Ritz card may be more appealing since a Prestige without a sign-up bonus is a little boring (although still pretty valuable).

- No bonus for Platinum: If you’ve already earned the bonus for the Platinum card and don’t see yourself using Centurion lounges, then the Ritz card has the potential to bring you more overall value, especially if the next factor relates to you.

Perhaps the biggest reason to choose the Ritz….

- Free authorized users: While the Priority Pass with the Ritz doesn’t offer lounge access to guests for free, it does give you the ability to add authorized users for free. And you can add an unlimited amount of authorized users! None of the above competitors allow for that. Thus, if you had a group of family members or friends who wanted lounge access without an additional annual fee to pay, the Ritz could save you some cash. This is especially true if they will be traveling without you.

Final Word

The new benefits are nice to have with the Ritz-Carlton Visa Infinite card. Three free nights at a Ritz category 1-4 can be very valuable and the $300 travel credit along with no fees for authorized users make the deal even sweeter. I think I’d still go with the competitors like the Sapphire Reserve, Prestige, and Platinum Card over the Ritz, but I certainly think the Ritz has more of a place at the table these days given recent changes and shouldn’t be overlooked, even if it’s still only going to serve as a “supplemental benefits credit card.”

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

One comment

Comments are closed.