[Offers contained within this article may no longer be available]

The Chase Sapphire Preferred and the Amex EveryDay Preferred are two popular reward-earning credit cards. The Sapphire Preferred is more of a true “travel credit card,” while the Amex EveryDay Preferred is better described as a credit card great for earning travel rewards. Here’s a comparison of the two cards and a recommendation as to which card would be better off for travelers.

1. Transfer Partners

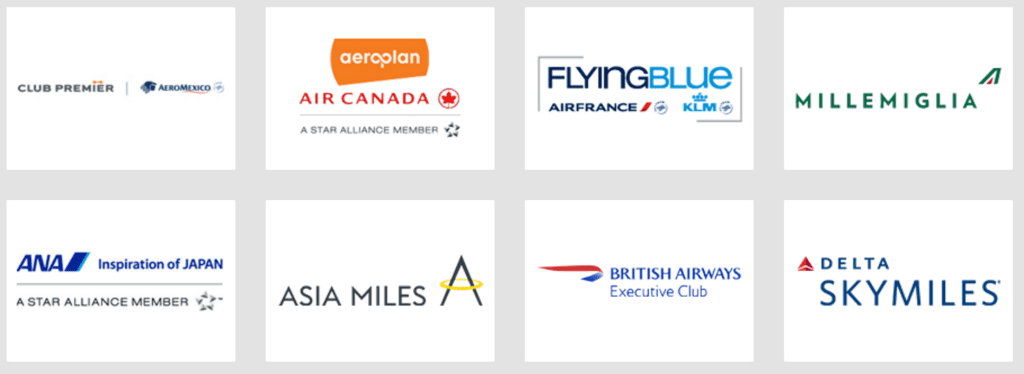

Both of these cards earn flexible points that can be transferred to a number of quality transfer partners. It’s tough to pick which program has the better partners since that often depends on your personal preference and geographical location. However, you should always make sure you’re familiar with airline alliance partners before picking a program because you can often utilize travel partners from both of these programs to book awards through alliances that can serve your needs.

Chase Ultimate Rewards

The Sapphire Preferred earns “Ultimate Rewards” that can be transferred to a variety of travel partners listed below:

Airlines

- British Airways Executive Club

- Korean Air SKYPASS

- Flying Blue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Hotels

- Hyatt Gold Passport

- IHG® Rewards Club

- Marriott Rewards

- The Ritz-Carlton Rewards

Membership Rewards

The Amex EveryDay Preferred will earn you Membership Rewards that can be transferred to a variety of travel partners listed below:

Airlines

These partners do not have all have the same transfer ratios as you can see below:

- Delta Skymiles

- Club Premier AeroMexico

- Aeroplan Air Canada

- Flying Blue (Air France/KLM)

- MilleMigilia Club Alitalia

- ANA

- Asia Miles

- Avios British Airways (250 points = 200 Avios)

- Emirates Skyrewards

- Hawaiin Airlines

- Iberia Plus

- JetBlue

- KrisFlyer Singapore Airlines

- Virgin America (200 points = 100 Elevate points)

- Virgin Atlantic

Hotels

- Best Western Rewards

- Choice Privileges

- Hilton HHonors (1,000 points = 1,500 HHonors points)

- SPG (Starwood Preferred Guest) (1,000 points = 333 Starpoints)

There are a few things to keep in mind about Membership Rewards:

- Bonus transfers are occasionally offered allowing you to transfer your points to partners for higher ratios. Check this thread for a history of these transfer bonuses.

- Your Membership Rewards cannot be freely transferred between you and any friend or family members

- They don’t expire as long as you remain a cardholder

2. Redeeming Points and shopping portals

In addition to transferring points to travel partners you can always redeem your points in different ways, such as for cash back, gift cards, or to book travel.

Membership Rewards

Membership Rewards can be redeemed in the following ways:

- Between .5 and 1.0 cent per point for gift cards

- 0.6 cent per point for a statement credit/charge.

- 1.0 cent per point on air fare

- 0.7 cent per point on hotels, cruises, and vacation packages.

Chase Ultimate Rewards Portal

Ultimate Rewards can be redeemed in the following ways:

- 1.0 cent per point for cash back into your Chase checking or savings account.

- 1.0 cent per point for gift cards

- As a Chase Sapphire Preferred card holder, if you book travel through the Ultimate Rewards Portal you can redeem points as 1.25 cents per point.

For the most part, I would avoid these redemption options, as you will almost certainly get better value with travel partners. However, redemptions through the Chase travel portal at 1.25 cents per point aren’t horrible (just make sure you’re not paying a lot more than you would by booking elsewhere). Thus, if I had to give a preference for redeeming points for these options, I’d give the edge to the Sapphire Preferred.

Shopping Portals

A plus to having the Sapphire Preferred is it grants you access to the Ultimate Rewards Shopping Portal. If you’re unaware, there are many shopping portals that will allow you to earn miles or points when you make purchases online. Read about online shopping portals here if you’re unfamiliar. The Ultimate Rewards Shopping Portal often offers some of the best rates for earning points.

Unfortunately, American Express did away with its shopping portal a couple of years ago. However, they have “Amex Offers.” With Amex Offers, you can score a some great discounts from online retailers and if utilized properly, you can easily end up saving a couple of hundred bucks a year, depending on your spending habits.

3. Sign-up Bonus

Chase Sapphire Preferred

- 40K to 50K (currently 50K) when you spend $4,000 in the first 3 months

- An additional 5K for adding an authorized user.

- Get 15,000 Membership Rewards points after you use your new Card to make $1,000 in purchases in your first 3 months.

- This is the standard public offer

- Get 30,000 Membership Rewards after you use your new Card to make $2,000 in purchases in your first 3 months.

- This offer comes around occasionally, often via Google Chrome Incognito.

- Get 50,000 Membership Rewards after you use your new Card to make $2,000 in purchases in your first 3 months!

- Highly targeted offer that only some have received in the mail.

The standard sign-up bonus for the Sapphire Preferred is obviously much more valuable than the standard offer for the EveryDay Preferred. Even if you’re able to find the “Incognito” offer, you’re still falling short of the Sapphire by about 15 to 25,000 points. Thus, the winner here is definitely the Sapphire Preferred.

4. Bonus category earning potential

Chase Sapphire Preferred

- 2X on Travel (This covers a broad range of expenses from tolls, parking, bus fairs, train tickets, and of course, air line tickets.)

- 2X on Dining

Amex EveryDay Preferred Credit Card

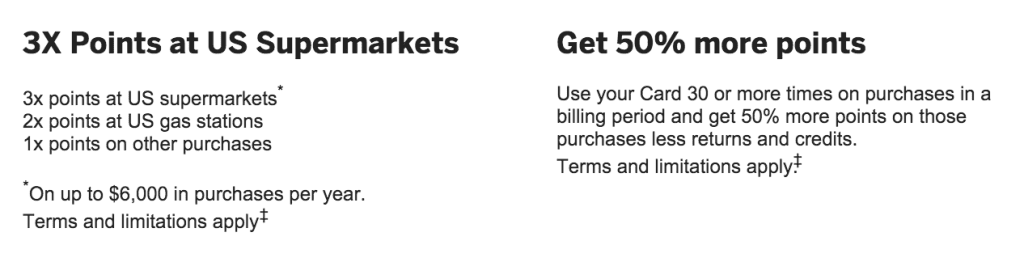

This is where the Amex EveryDay Preferred Credit Card really shines and in my opinion, it might just be the top earning travel rewards credit card, especially if you max out the supermarket categories. Let’s take a look at its bonus earning potential.

- 3x points at US supermarkets (On up to $6,000 in purchases per year)

- 2x points at US gas stations

- 1x points on other purchases

What really makes this card such a high earner is that when you use your card 30 or more times on purchases in a billing period you get 50% more points on those purchases!

Comparing the Earning Potential

The following is an unscientific, estimated breakdown of the main expenditures by American consumer units mostly by using official data over the past couple of years (2012 to 2014) on consumers. I modified some of the figures to make things easy and have added some to the travel category just to make the comparison more relevant to travelers.

(Keep in mind, I’m not factoring in expenses that some people could put on their credit cards like healthcare, car payments, rent, utilities, loan payments, etc.)

Here’s a breakdown of the spending I’m factoring in:

- Gasoline: $2,500

- Parking, tolls, and misc. travel: $1,500

- Entertainment: $2,500

- Food at home (groceries): $6,000

- Dining: $2,700

- Apparel: $1,500

- Phone service: $1,000

- Misc.: $800

- Household expenses and furnishings: $3,000

That comes out to a total of $21,500 of expenses that could be put on your credit cards.

So let’s see how the cards would earn compared to each other:

Chase Sapphire Preferred

- Gasoline: $2,500

- Parking, tolls, and misc. travel: $1,500 (2x)

- Entertainment: $2,500

- Food at home (groceries): $6,000

- Dining: $2,700 (2X)

- Apparel: $1,500

- Phone service: $1,000

- Misc.: $800

- Household expenses and furnishings: $3,000

Year 1 earnings

- 25,700 Ultimate Rewards

Amex EveryDay Preferred

- Gasoline: $2,500 (2X)

- Parking, tolls, and misc. travel: $1,500

- Entertainment: $2,500

- Food at home (groceries): $6,000 (3X)

- Dining: $2,700

- Apparel: $1,500

- Phone service: $1,000

- Misc.: $800

- Household expenses and furnishings: $3,000

We will assume 30 purchases are made each month so you qualify for the 50% bonus.

Year 1 earnings

- 54,000 Membership Rewards

As you can see, the EveryDay Preferred blows the Sapphire Preferred out of the water with these spending habits. In fact, I think that only in a small number of cases the Sapphire Preferred could actually beat out the Everyday Preferred. The 50% monthly bonus in points is simply too good to beat out in most cases.

While the EveryDay Preferred earns more, don’t forget that you don’t have the annual fee waived the first year and will likely earn many more Ultimate Rewards with the sign-up bonus for the Sapphire Preferred. Thus, in the short term, I would give the nod to the Sapphire Preferred but for long-term earning potential, the EveryDay Preferred would have to be the winner.

5. Annual Fees

Chase Sapphire Preferred

- $95, waived the first year

Amex EveryDay Preferred Credit Card

- $95, NOT waived the first year

The $95 fee cuts into the savings of the EveryDay card, making the Sapphire Preferred even more of a valuable option.

6. No interest for the first 15 months

One thing that the EveryDay Preferred has over the Sapphire Preferred is that it has a 0.0% introductory APR for the first 15 months. This is nice to have but if you’re not in the market for a 0.0% introductory APR and more concerned with travel rewards and benefits, then this perk obviously won’t mean much to you.

7. Foreign Transaction Fees

Chase Sapphire Preferred

- No foreign transaction fees

Amex EveryDay Preferred Credit Card

- 2.7% on international transactions

The Sapphire Preferred really starts to outshine the EveryDay Preferred when it comes to travel-related benefits. One of the first ways it does is that the EveryDay card has foreign transaction fees. With so many travel cards offering no foreign transaction fees, it really wouldn’t make sense to use the EveryDay on international trips.

8. Primary rental car insurance

Chase Sapphire Preferred

- The Sapphire Preferred offers primary rental car insurance usually covering the full lost value of the automobile (subject to certain exceptions, of course).

Amex EveryDay Preferred

- Excess rental car insurance (may cover what your insurance company doesn’t cover)

Primary rental car insurance is one of the top benefits of the Sapphire Preferred even though it’s not discussed often. For some, the $95 annual fee would be worth this benefit alone.

9. Travel protections

The Chase Sapphire Preferred really has the EveryDay Preferred beat when it comes to travel protections. The only benefit offered by the EveryDay is for lost or damaged luggage. Here’s how that that benefit compares:

Lost or damaged Luggage

Chase Sapphire Preferred

- For checked or carry-on bags are damaged or lost by the carrier, you’re covered up to $3,000.00 for each Insured Person for each Common Carrier Covered Trip and up to $500.00 for each Insured Person for each Common Carrier Covered Trip for jewelry, watches, cameras, video recorders, and other electronic equipment.

Amex EveryDay Preferred

- Will pay a benefit for the Replacement Cost, up to $1,250, for each Covered Person on a Covered Trip for Loss of carry-on Baggage.

- Will pay a benefit for the Replacement Cost, up to $500, for each Covered Person on a Covered Trip for Loss of checked Baggage

The Sapphire Preferred has many other travel benefits, too. These include:

- Trip Interruption: If your trip is canceled or cut short by covered situations, you can be reimbursed up to $10,000 per trip for your pre-paid, non-refundable travel expenses,

- Trip Delay Reimbursement: If delayed more than 12 hours you are covered for expenses, such as meals and lodging, up to $500 per ticket.

- Baggage Delay Reimbursement: covers up to one hundred ($100.00) dollars per day for a maximum of five (5) days

For the EveryDay, you’d have to purchase travel insurance before your trip to get these benefits. Thus, the Sapphire Preferred is a far superior travel credit card in this regard.

10. Purchase protections

The EveryDay Preferred can definitely hold its own against the Sapphire Preferred with respect to purchase protections, however. Here’s a run down of some of the major benefits.

A) Purchase protections

Chase Sapphire Preferred

- Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.

Amex EveryDay Preferred

- Covers your new purchases for 90 days against damage or theft up to $1,000 per claim and $50,000 per Card Member account per calendar year.

B) Extended Warranty Protection

Chase Sapphire Preferred

- Extends the time period of the original manufacturer’s written U.S. repair warranty by one (1) additional year on eligible warranties of three (3) years or less, up to a maximum of ten thousand ($10,000.00) dollars per claim

Amex EveryDay Preferred

- Provides one additional year if the original manufacturer’s warranty is between one year and five years limited up to a maximum of USD $10,000 per occurrence

C) Price Protection

Chase Sapphire Preferred

- If a card purchase you made in the U.S. is advertised for less in print or online within 90 days, you can be reimbursed the difference up to $500 per item, $2,500 per year.

Amex EveryDay Preferred

- No price protection offered

D) Return Protection

Chase Sapphire Preferred

- You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year.

Amex EveryDay Preferred

- You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $300 per item, $1,000 per year.

Final Word

The Amex EveryDay Preferred card is a fine card for racking up tons of Membership Rewards through spending, and it’s an okay travel card in the sense that you can earn points quickly that you can apply to travel. However, it’s not a good travel credit card in terms of travel benefits and travel perks offered.

Overall, in terms of which card is the better credit card to be used on and while traveling, the Amex EveryDay Preferred can’t compare to the Sapphire Preferred. However, if you’re just wanting a card to earn you tons of points that will help you to be able to redeem trips with travel partners, the Amex EveryDayPreferred is a terrific option with its high bonus earning rates and great purchase protection.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.