[Offers contained within this article may no longer be available]

With Amex rolling out some of the best all-time offers for their Platinum Cards recently, many people may wonder if it would be worth it for them to apply for two Platinum Cards in order to reap the benefits of multiple lucrative sign-up bonuses. Because these cards have such high annual fees, it’s a decision you definitely want to be informed about before taking action. This article will cover whether or not it makes sense to apply for two Platinum Cards assuming you can take advantage of the high sign-up bonuses offered.

Recent Platinum Offers

Let’s take a look at the most recent offers for two of the Platinum Cards that came out.

While one of these offers is no longer active (the 100K offer), this analysis should still be helpful to people in the future when the Platinum 100K and 75K offers come around again.

The two most recent offers are/were:

- 75,000 Membership Rewards after spending $3,000 on the Mercedes-Benz Platinum Card® from American Express

- 100,000 Membership Rewards after spending $3,000 on the (standard) Platinum Card® from American Express

When you factor in the required $3,000 spending for each sign-up bonus, that’s a whopping 181,000 Membership Rewards!

That’s a lot of points and they could get you pretty far.

How far can two Platinums get you?

Take a look at what you could redeem with roughly 180,000 Membership Rewards.

If you transferred to ANA airlines or Aeroplan (remember, both of these programs are part of the Star Alliance, so that means you could book United flights with their miles)

- 7 domestic (contiguous United States/Canada) roundtrips

- 3 round trips in economy to Europe

- 2 round trips in business class to Europe

- 2 round trips in business class to Japan

- 1 round trip in business class to Africa or the Middle East with ANA and you’d have about 75,000 points left over!

If you transferred to Flying Blue you could get:

- 6 roundtrips to Hawaii in economy

- 3 round trips to Europe in economy

- 3 round trips to South America in economy

If you transferred to Delta you could get

- 7 domestic (contiguous United States) roundtrips

You could also do it big and have enough to fly roundtrip in Singapore Suites to various destinations.

These are just a few of the many different examples that you could take advantage of but I wanted to provide you with some concrete examples of just how far the sign-up bonus could take you.

There’s obviously some great potential to book groups of award tickets, so I think these bonuses could be utilized perfectly for people who might be looking to take a large family trip to Hawaii or to anywhere in the United States where they would need to book a handful of tickets.

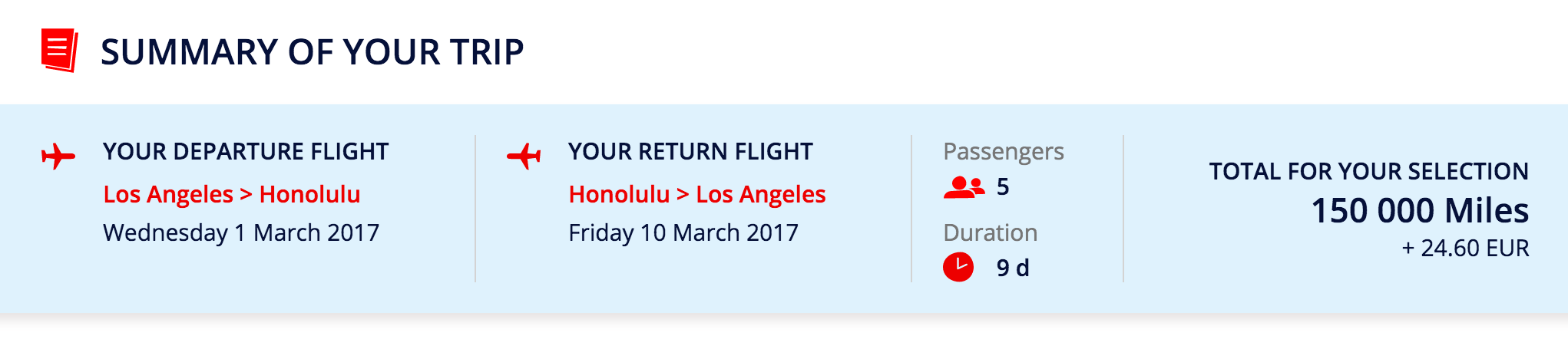

In my experience, finding award availability with Flying Blue has been pretty easy so I think it’s a good choice for families to consider. For example, I just easily found multiple award seats for March 2017 going from LAX to HNL (Honolulu).

**This post assumes the reader is knowledgable about the American Express Platinum benefits — if you are not, please read my article on these benefits and this article will make a lot more sense.

Is it worth the cost?

So it’s clear that you can derive plenty of value from these sign-up bonuses but the question is whether or not it’s worth it since you’ll have to pay two hefty $450+ annual fees up front for a total of $900. So let’s break down the costs.

First, let’s assume that you can make good use of the $200 airline credit offered by both Platinum cards. Whether that’s through the MPX app or by purchasing airline gift cards, let’s just knock $400 off and assume you’re making efficient use of that credit.

So now you’re looking at $525 worth of expenses.

But again, let’s assume that when the new year rolls around (Jan 1, 2017), you make efficient use of those two $200 statement credits from your two Platinum Cards once again.

Note: it’s possible that by the end of the year, users may not be able to utilize things like the MPX app with the airline credits so this example definitely contains some degree of risk if you are planning on going the MPX route.

So now, with the 2017 airline credits hitting you’re looking at being out $125 total in credit card enrollment fees.

Now you haven’t even factored in the up to $100 Global Entry/TSA Pre-Check statement credits AND of course, the very valuable Priority Pass.

With two Platinum cards you get could two $100 Global Entry/TSA Pre-Check statement credits for you and your partner/spouse/mate and just like that, you’re actually still netting $75 in value. And that’s before factoring in the value of the Priority Pass which is at $400 a year!

And, if you paid an extra $175 per year you could also get Global Entry/TSA Pre-Check statement credits for up to three additional people.

So if you were planning to use 150,000 Membership Rewards to get your family of five to Hawaii via Flying Blue, you could go ahead and get your whole crew Global Entry/TSA Pre-Check for an additional $175 to make getting through security a breeze!

Back to the question of value…

With these two cards you have the potential to actually come out on top after the first 12 months without even factoring in the amazing value of the flights you would book.

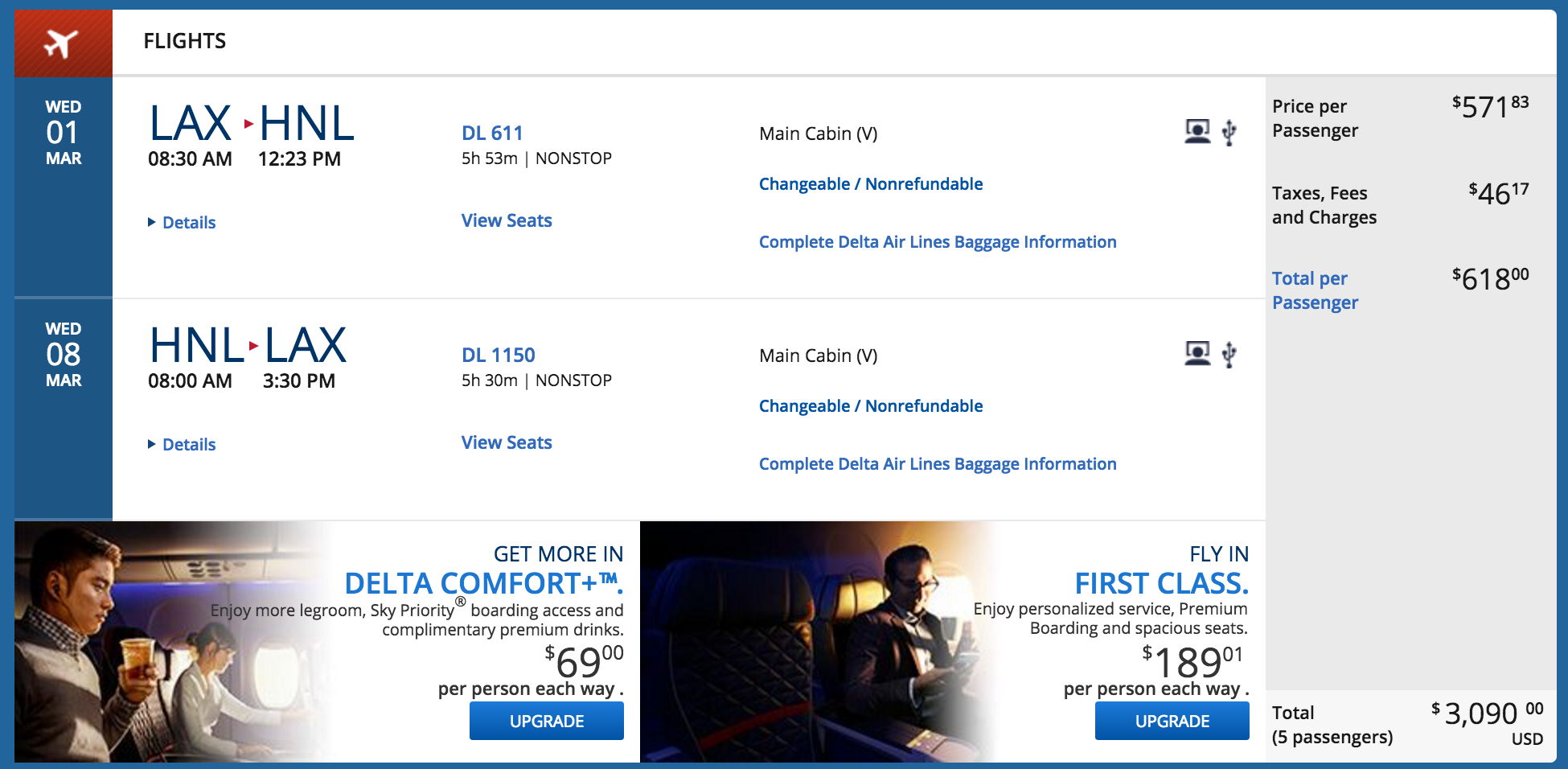

Let’s keep with the example of a family of five going from LAX to Hawaii. Using the cheapest Delta flights (which you would fly using Flying Blue miles since they are both SkyTeam Alliance partners), the total cost for five people would be $3,090.

After subtracting the total fees for the Flying Blue award tickets of $28 the total value of your redemption would be $3,062.

Using 150,000 points for that reward, you’d be redeeming for about 2 cents per point which is pretty standard but think about the value you have gotten from those two Platinum Cards! You’ve just paid $28 for five roundtrip tickets to Hawaii and have netted over $500 in value in benefits from TSA-Pre Check and from Priority Pass (not to mention other benefits like hotel status, rental car status, etc.).

That is truly an exceptional deal in my opinion.

What is the catch?

I don’t think there’s a catch per se but consider the following example to illustrate the full costs involved with getting these cards

Let’s say you earned the 180,000 in bonuses in July 2016, you made use of your total $800 in airline credits by January of 2017, and you went on your family trip to Hawaii in March 2017.

Now, if you’ve played your hand the best you could have with the airline credits, you’ve just gone on a $3,000 trip for $28, so you’re sitting very pretty.

However, when July 2017 rolls around, the annual fees for both cards will be due and they will total $925.

This is when the so-called “catch” comes in.

Having a proper exit strategy

You’ll have to decide how you want to handle your credit card accounts when the annual fee comes due.

You have a few choices:

Cancel both cards

You can cancel both cards and avoid the annual fees altogether.

In this case, you’ll lose all your benefits like Priority Pass and won’t be able to renew hotel status, etc., but you’ll still have Global Entry/TSA Pre-Check. Cancelling both accounts won’t allow these accounts to age and eventually boost your credit score and could dampen your relationship with American Express as well. However, if you’re strictly concerned about the savings and don’t care about lounge access and the other perks, this would be the route to take.

Cancel one card

This is the choice I would prefer.

You get to preserve your account age on at least one account, keep things kosher with American Express (although it’s probably not a huge worry), and you’ll still get to take advantage of the benefits on your card for another year.

Also, when you consider that you were given $3,000 in air fare for your trip to Hawaii, $450 +$28 seems like a pretty small price to pay and you are still coming way out ahead.

Keep both cards

I don’t think most people would need to keep both Platinum Cards.

Unless you just really want to age your accounts or are really adverse to closing credit cards, it makes better sense to close one Platinum Card since the benefits overlap so much between the two.

Even assuming you decided to keep both cards for the next year, at that point, you still would have gotten $3,000 worth of travel for a mere $925 + $28. Again, you’re still coming out ahead.

Coming out ahead not all that matters

I did want to mention that just because you’d be coming out ahead, that doesn’t mean that you’re maximizing your value from sign-up bonuses.

You should always be on the lookout for better deals outside of two platinum cards. For example, the American Express Premier Rewards Gold Card often offers 50,000 Membership Rewards for spending $1,000 and the $195 annual fee is waived the first year! If you already had one 100K Platinum offer, it might make better sense to jump on an offer like that.

However, I just wanted to write this post to show that if you don’t have other options for accumulating a large number of Membership Rewards, jumping on two Platinum Cards can provide you with exceptional value, especially if you know how to utilize the airline credits and have a proper “exit strategy.”

Final Word

There are hundreds or perhaps thousands of ways to utilize 180,000 Membership Rewards points so your outcome in this scenario could obviously vary widely. However, if you’re thinking about applying for two American Express Platinum cards and questioning if it’s worth it, this article hopefully answered that question for you.

Last word – there are at least a couple of data points suggesting that some people have had issues obtaining sign-up bonuses for multiple Platinum Cards. Although cards like the Mercedes-Benz Platinum Card are different from the standard Platinum Cards, there’s always a slight risk you might run into trouble when it comes time to be granted your bonus so keep that in mind.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.