The Chase Sapphire Preferred® and the Chase Ink Plus® are two premier credit cards offered by Chase that offer some of the best sign-up bonuses, earning potential, and benefits that travelers can take advantage of. It can be a little tough to decide which card to apply for over the other so here’s a comparison of the Chase Sapphire Preferred® vs the Chase Ink Plus®.

Key to Transferring Ultimate Rewards

One important thing to know is that the Chase Sapphire Preferred® and the Chase Ink Plus® are the only two cards that allow you to transfer Ultimate Rewards to travel partners. Without having at least one of these cards, you’re restricted to only redeeming your Ultimate Rewards for things like cash back and gift cards.

Getting Approved

Both cards generally require good to excellent credit to get approved. However, the Chase Ink Plus® is known for being a black box and is most often harder to get approved for than the Sapphire Preferred®. In addition, the Ink Plus® is a business card meaning that you need to have some form of a business when applying for it. For those reasons, I tend to give the nod to the Sapphire Preferred® because it is typically going to be the more practical option for most consumers to get approved for.

Tip: Because the Ink Plus® is harder to get approved for, consider applying for the Sapphire Preferred® first and using that card to build up some credit history before going for the Ink. I would shoot for establishing payment history for about 3 to 6 months, is possible. This can be an especially useful credit card application strategy if you have no prior banking or credit card history with Chase.

For more tips, check out my article on tips for getting approved for the Chase Ink Plus®.

Sign-up Bonus

The Sapphire Preferred®

- Earn 50,000 Ultimate Rewards when you spend $4,000 within the first 90 days of opening your account.

- Earn an additional 5,000 for a total of 55,000 Ultimate Rewards when you add an authorized user.

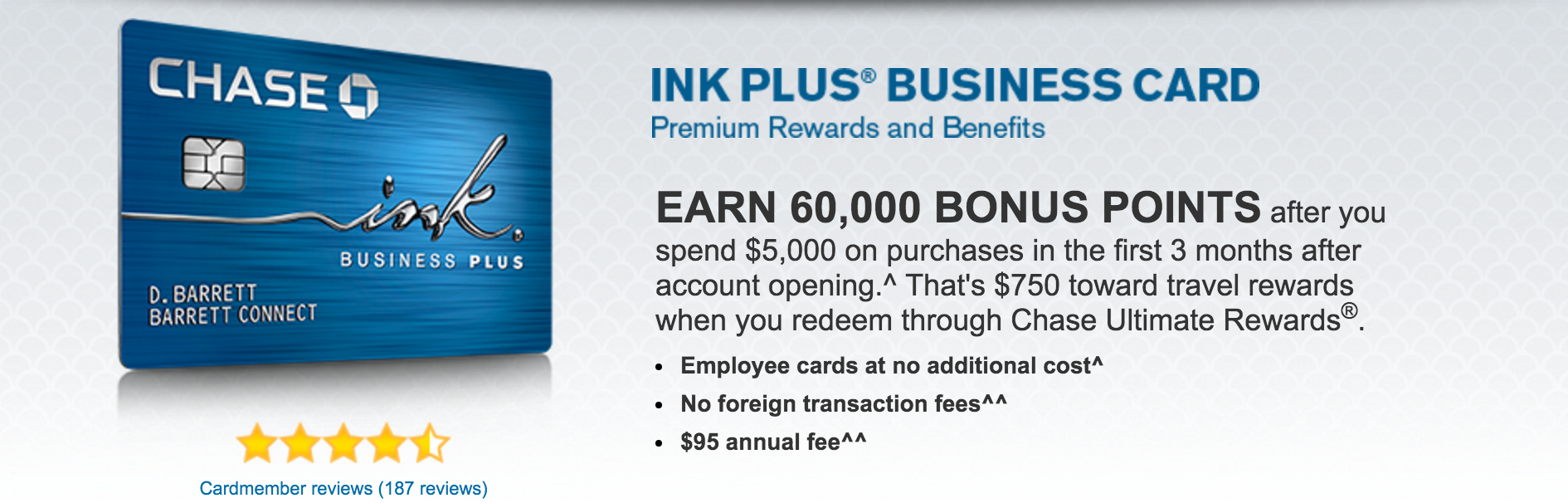

The Ink Plus®

- Earn 60,000 Ultimate Rewards when you spend $5,000 within the first 90 days of opening your account.

The Chase Ink Plus® has the higher offer of 60,000 Ultimate Rewards but it also requires spending an additional $1,000 to obtain the bonus. Also, you don’t get an added 5,000 Ultimate Reward bonus for adding an authorized user, so this bonus is essentially only 5,000 points better.

Another thing to remember is that with this higher offer, the Ink Plus® does not waive the annual fee the first year like the Sapphire Preferred® does. (Sometimes, when you apply for the Ink Plus® in-branch at the bank they will give you the offer with the annual fee waived but if you apply online, chances are you will be stuck with the $95 annual fee the first year).

Thus, when you consider that the Ink will often not waive the annual fee the first year (unless you apply in-branch) and will only net you an additional 5,000 Ultimate Rewards, the better sign-up bonus, in my opinion, will often be the Sapphire Preferred®.

Earning Potential

The Sapphire Preferred®

- 2X on travel

- 2X on dining

- 1X on all other purchases

The Ink Plus®

- 5x on on the first $50,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services

- 2X on the first $50,000 spent in combined purchases at gas stations and hotel accommodations

- 1X on all other purchases

These cards offer very different earning potential. There’s some overlap between them with hotels (which count as travel) but that’s about it (gas doesn’t count as travel for the Sapphire Preferred®). Thus, determining which card will be best for you will depend on you personal spending habits.

If you consistently pay cell phone, internet, and cable bills each month the 5X earning on those expenses, along with the 2X earned on gas, can add up very quickly and make the Ink Plus® the better earner. On the other hand, if you dine out like crazy and spend a lot on things like parking, public transportation, and airfare, you might be better off with the Sapphire Preferred®.

I can’t reiterate enough how great of a combo these cards make in terms of earning potential, so don’t rule out applying for both cards or at least making a plan to eventually obtain both cards. In addition, you should look into applying for one of the Chase Freedom cards to complete the Chase Trifecta and maximize your Ultimate Reward earning potential.

No foreign transaction fees

- Both cards offer no foreign transaction fees

Primary rental car insurance

Both cards offer primary rental car insurance usually covering the full lost value of the automobile (subject to certain exceptions, of course). This can be a tremendous benefit as you don’t have to pay for insurance with the rental car company or risk raising your insurance premium when you would otherwise have to file a claim with them.

Unfortunately, the primary car rental insurance for the Chase Ink Plus® only kicks when you are traveling on business. Therefore, the Sapphire Preferred® provides broader coverage for rental cars.

Protections

Both of these cards have great purchase and travel protection. Below are some of the key protections offered by both cards. They appear to be almost completely identical aside from a difference on the Trip Interruption.

Travel protection

- Lost or damaged Luggage: If you or your immediate family members’ checked or carry-on bags are damaged or lost by the carrier, you’re covered up to $3,000.00 for each Insured Person for each Common Carrier Covered Trip and up to $500.00 for each Insured Person for each Common Carrier Covered Trip for jewelry, watches, cameras, video recorders, and other electronic equipment.

- Trip Interruption: If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.

- The Chase Ink Plus® has a limit of $5,000

- Trip Delay Reimbursement: If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

- Baggage Delay Reimbursement: covers up to one hundred ($100.00) dollars per day for a maximum of five (5) days and is limited to emergency purchases of essential items needed as a result of the delay including but not limited to: clothing, toiletries, and charging cables for cellular telephones,

- Travel and Emergency Assistance: provides a wide range of emergency services available twenty-four (24) hours a day, three hundred and sixty-five (365) days a year

Purchase protection

- Purchase Protection: Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.

- Extended Warranty Protection: Extends the time period of the original manufacturer’s written U.S. repair warranty by one (1) additional year on eligible warranties of three (3) years or less, up to a maximum of ten thousand ($10,000.00) dollars per claim, and

- Price Protection: If a card purchase you made in the U.S. is advertised for less in print or online within 90 days, you can be reimbursed the difference up to $500 per item, $2,500 per year.

- Return Protection: You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $500 per item, $1,000 per year.

Final Word

Both of these cards are top-earning cards for travel rewards. I personally give the edge to the Sapphire Preferred® because it is the easier of the two cards to get approved for. However, you might want to go with the Ink if you think you can get more from the 5X categories and don’t mind losing out a bit on the primary rental insurance for non-business travel.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.